Missouri Industrial Contractor Agreement - Self-Employed

Description

How to fill out Industrial Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Missouri Industrial Contractor Agreement - Self-Employed in moments.

If you already possess a subscription, Log In and download the Missouri Industrial Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved Missouri Industrial Contractor Agreement - Self-Employed. Each template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Missouri Industrial Contractor Agreement - Self-Employed with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Examine the form summary to confirm you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The terms self-employed and independent contractor are often interchangeable, but each has its nuances. Self-employed implies a broader range of business ownership, while independent contractor specifically refers to contractual work for clients. When discussing your work in the context of a Missouri Industrial Contractor Agreement - Self-Employed, either term can be used accurately, depending on the emphasis you wish to convey. Ultimately, choose the term that best reflects your business model.

Someone is qualified as self-employed if they own and operate their own business, offering services or goods to clients. Self-employment can include various forms of work, such as independent contracting, freelancing, or running a business. If you decide to enter a Missouri Industrial Contractor Agreement - Self-Employed, you define your role and responsibilities in the business relationship. Understanding self-employment can help you navigate your business journey effectively.

Yes, an independent contractor is synonymous with being self-employed. This status allows you to work for multiple clients while managing your own business operations. Engaging in a Missouri Industrial Contractor Agreement - Self-Employed solidifies your independent status, ensuring clarity in your work arrangements. This distinction is crucial for both legal and financial purposes.

Yes, an independent contractor is considered self-employed. This means you operate your own business and take on projects without being employed by a single company. When you enter into a Missouri Industrial Contractor Agreement - Self-Employed, you outline your terms of service and establish your independence. It's beneficial to understand this distinction as it affects your taxes and business operations.

Yes, a self-employed person can and should have a contract. A well-drafted Missouri Industrial Contractor Agreement - Self-Employed provides legal protection, outlines expectations, and clarifies terms between you and your clients. It is an essential tool for establishing professionalism and trust in your business relationships. Resources such as US Legal Forms can help you create a comprehensive agreement tailored to your needs.

To become an independent contractor in Missouri, start by understanding the necessary licensing and permits for your industry. Once you have your business structure in place, you should draft a Missouri Industrial Contractor Agreement - Self-Employed to formalize your arrangement with clients. Networking and marketing your services are key steps in attracting potential clients. Using resources available on platforms like US Legal Forms can also support your journey.

In Missouri, while the law does not require LLCs to have an operating agreement, it is highly recommended. An operating agreement helps establish how the business operates and outlines members' rights and responsibilities. This is especially important if your LLC has multiple members, but even single-member LLCs benefit from having a clear structure. Consider using a Missouri Industrial Contractor Agreement - Self-Employed to ensure that your business framework is solid.

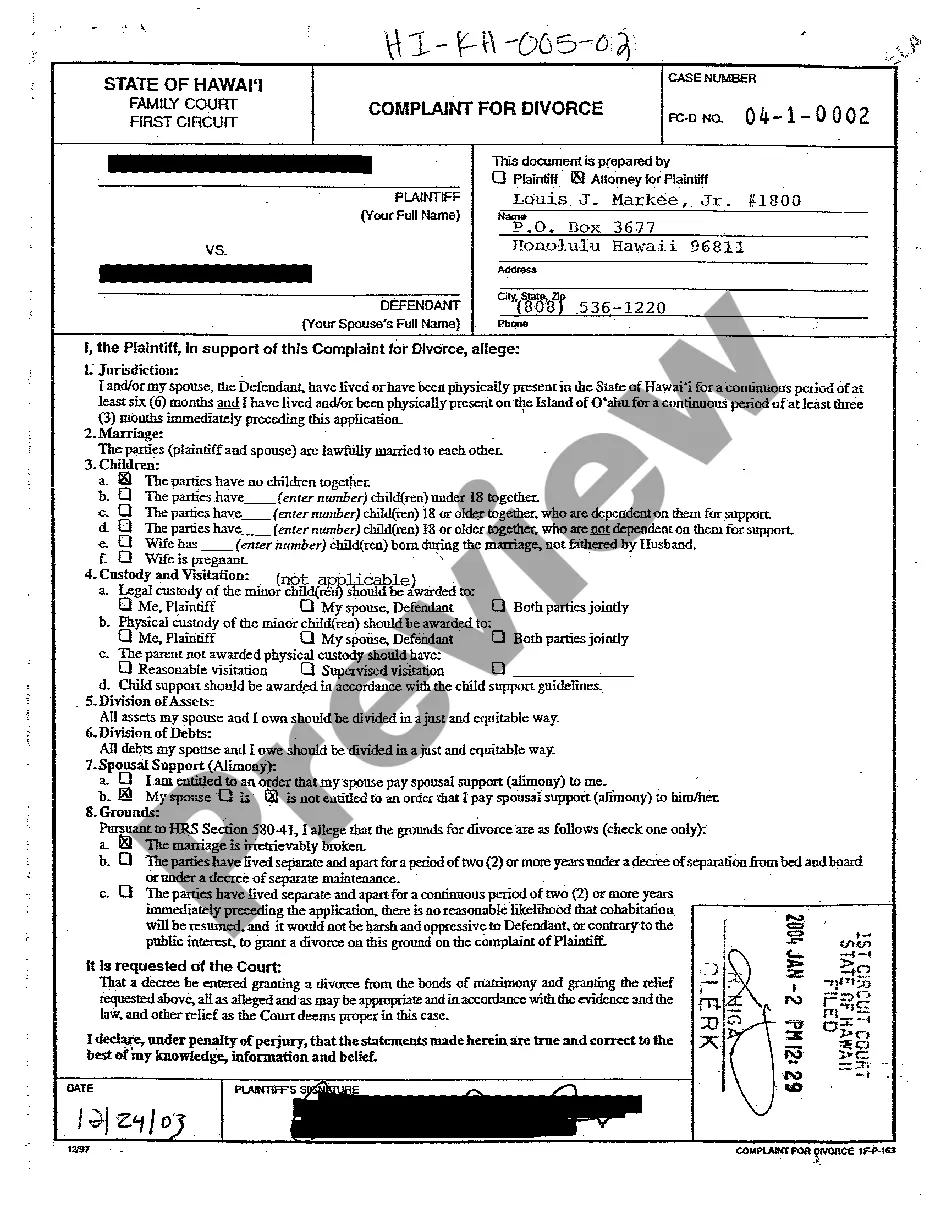

Creating a Missouri Industrial Contractor Agreement - Self-Employed is straightforward. Start by clearly defining the roles and responsibilities of both parties. You should include payment terms, project timelines, and termination clauses. Using templates available on platforms like US Legal Forms can simplify this process, ensuring you have a compliant and professional document.

Writing an independent contractor agreement involves outlining the project details and ensuring legal compliance. Begin with a clear introduction, followed by sections detailing the services, payment schedule, and timelines. It’s crucial to include clauses on termination, liability, and dispute resolution. Platforms like US Legal Forms offer templates to help you create a professional Missouri Industrial Contractor Agreement - Self-Employed efficiently.

employed contract should include essential elements such as the names of both parties, project descriptions, payment details, and deadlines. You should also address the rights and obligations of each party, as well as terms regarding confidentiality, ownership of work, and dispute resolution. A comprehensive Missouri Industrial Contractor Agreement SelfEmployed provides clarity and protects all parties involved.