Missouri Sample Letter for Short Sale Request to Lender

Description

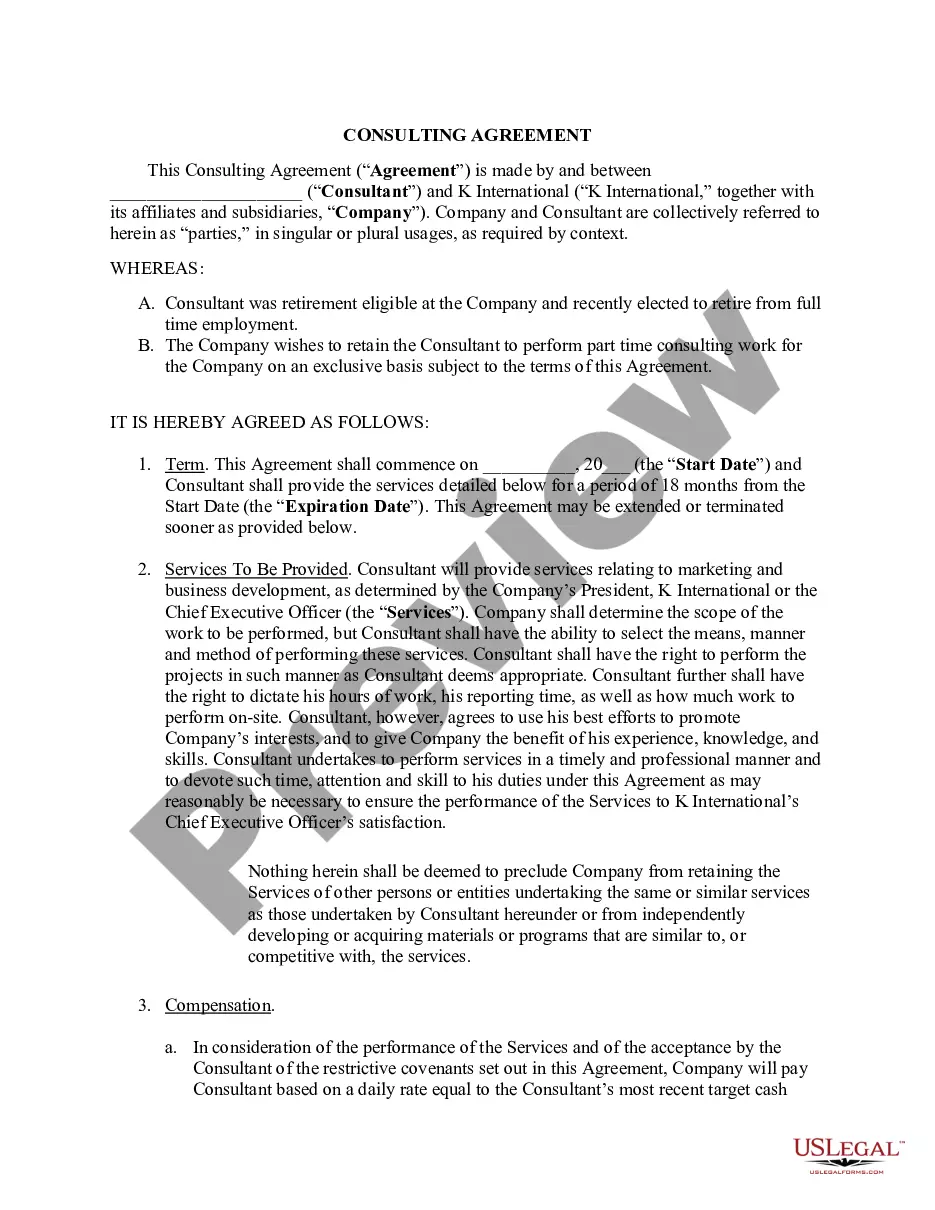

How to fill out Sample Letter For Short Sale Request To Lender?

You might spend hours online searching for the correct legal document template that meets the federal and state requirements you need.

US Legal Forms offers a plethora of legal documents that can be examined by professionals.

You can easily download or print the Missouri Sample Letter for Short Sale Request to Lender from the platform.

If you wish to find another version of the document, use the Search field to find the template that meets your specifications and requirements.

- If you possess a US Legal Forms account, you can Log Into your account and click on the Download button.

- After that, you can complete, modify, print, or sign the Missouri Sample Letter for Short Sale Request to Lender.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased document, navigate to the My documents section and click on the corresponding button.

- If it's your first time using the US Legal Forms website, follow the straightforward instructions below.

- Firstly, verify that you have selected the correct document template for your desired region/city.

- Read the document description to ensure you have selected the right template.

Form popularity

FAQ

Lenders often accept short sales to minimize their losses on a property. When homeowners are unable to keep up with mortgage payments, a short sale can be a more favorable option than foreclosure, which can be lengthy and costly. By accepting a Missouri Sample Letter for Short Sale Request to Lender, homeowners can provide necessary documentation that supports their financial hardship, prompting the lender to consider the request. Ultimately, it allows both parties to move forward without the burden of a prolonged foreclosure process.

Short sale approval refers to the lender's consent to allow the sale of a property for less than the outstanding mortgage balance. This approval is essential before any agreement can be finalized. By utilizing a Missouri Sample Letter for Short Sale Request to Lender, sellers can streamline their communication with lenders, potentially speeding up the approval process. This step is critical for both parties in the transaction.

To write a letter to a mortgage company for hardship, start by clearly stating your name, address, account number, and the purpose of the letter. Explain your financial difficulties in a straightforward manner, and describe any relevant details that contribute to your situation. Conclude by formally requesting assistance, such as approval for a short sale, and consider including a Missouri Sample Letter for Short Sale Request to Lender as an example. This letter serves as a crucial step towards communicating your needs effectively.

To ask for a short sale, begin by contacting your lender to discuss your financial situation. Next, craft a clear and concise Missouri Sample Letter for Short Sale Request to Lender, detailing your hardship and requesting a short sale. Submit this letter along with any required financial documents to support your case, ensuring that you adhere to the lender's submission requirements. This proactive approach can set you on the right path toward resolution.

Short sales can impact your credit score, but the effect may be less severe than a foreclosure. Typically, you may see a decrease of 200 to 300 points, depending on your credit profile. However, this impact is often temporary, and you can build your credit score back over time. Knowing how to use a Missouri Sample Letter for Short Sale Request to Lender may help you navigate this complicated process with greater ease.

To request a short sale, first prepare the necessary documentation, including your financial statements and hardship letter. Next, create a Missouri Sample Letter for Short Sale Request to Lender, clearly stating your request and the reasons behind it. Finally, submit your request to the lender along with any supporting documents, ensuring that you follow their specific submission guidelines. This organized approach increases your chances of a favorable outcome.

To write a letter to a lender, start with a formal greeting and clearly state your purpose. Detail your financial situation using concise language, and make sure to include necessary documentation to support your claims. Utilize the Missouri Sample Letter for Short Sale Request to Lender as a template to help format your letter and ensure that you communicate effectively.

A proof of financial hardship letter is a document that explains your current financial difficulties to your lender. It should outline the reasons for your hardship and provide supporting documentation as evidence. Using resources like the Missouri Sample Letter for Short Sale Request to Lender can streamline this process and guide you in making your case compelling.

In a hardship letter, avoid including emotional appeals or excessive personal details. Stick to factual information about your financial situation, and refrain from making demands without justification. Always maintain a professional tone, and consider utilizing the Missouri Sample Letter for Short Sale Request to Lender to ensure clarity and appropriateness.

To prove hardship for a mortgage, assemble evidence that illustrates your financial challenges. Common documents include income loss statements or increased monthly expenses. Clearly outline your situation in your correspondence, possibly using the Missouri Sample Letter for Short Sale Request to Lender to describe your hardship effectively.