Missouri Hardship Letter to Mortgagor or Lender to Prevent Foreclosure

Description

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Are you currently in the location where you need documents for either professional or personal purposes nearly every day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Missouri Hardship Letter to Mortgagor or Lender to Avoid Foreclosure, which are designed to meet state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally created legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Hardship Letter to Mortgagor or Lender to Avoid Foreclosure template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Preview button to review the document.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that fits your needs and requirements.

- Once you find the correct form, click on Purchase now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Missouri Hardship Letter to Mortgagor or Lender to Avoid Foreclosure at any time if needed. Just click on the required form to download or print the document template.

Form popularity

FAQ

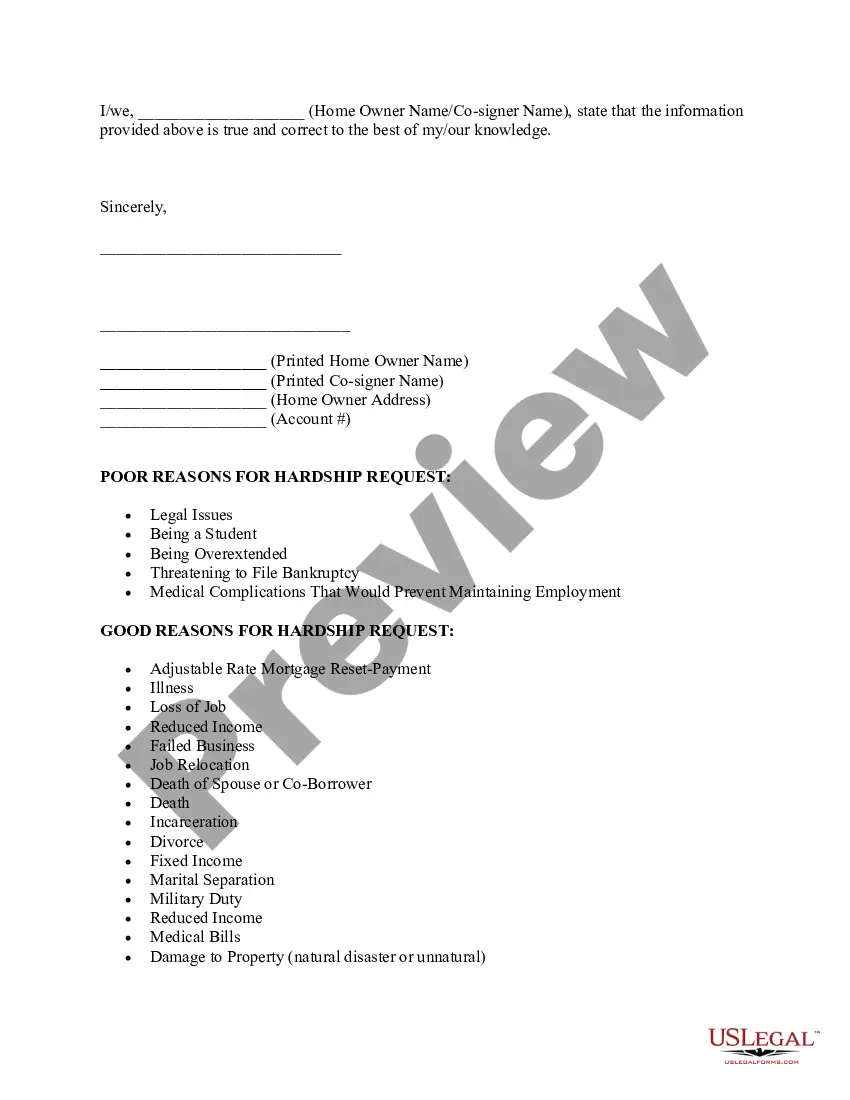

A Missouri Hardship Letter to Mortgagor or Lender to Prevent Foreclosure typically outlines your financial difficulties and explains your situation clearly. For instance, you might describe loss of employment, medical emergencies, or unexpected expenses that have impacted your ability to make mortgage payments. It is important to include specific details about your circumstances and how they have affected your finances. Utilizing platforms like US Legal Forms can help you create a professional hardship letter tailored to your needs.

When writing a hardship letter, avoid including emotional appeals that don't relate to your financial situation. Do not make untrue statements or exaggerate details, as this can damage your credibility. It's also wise to refrain from being overly critical of your lender or their policies. Focus instead on clearly articulating your circumstances and intention to resolve your issues, using a Missouri Hardship Letter to Mortgagor or Lender to Prevent Foreclosure as a guide.

To write a hardship letter aimed at stopping foreclosure, outline your circumstances clearly and honestly, while maintaining a respectful tone. It helps to include specifics that led to your financial difficulties, like unexpected expenses or a change in income. Additionally, express your desire to find a solution and willingness to cooperate with your lender in resolving the matter. A template for a Missouri Hardship Letter to Mortgagor or Lender to Prevent Foreclosure can provide structure.

To write a foreclosure hardship letter, begin with your personal information and the details of your mortgage. Clearly explain your situation, including what caused your financial difficulties. It's vital to express your willingness to collaborate with your lender, emphasizing your goal to keep your home. Utilizing a Missouri Hardship Letter to Mortgagor or Lender to Prevent Foreclosure template can guide you in crafting an effective letter.

To stop foreclosure in Missouri, you can begin by drafting a Missouri Hardship Letter to Mortgagor or Lender to Prevent Foreclosure. This letter explains your financial situation and requests assistance from your lender. It's crucial to communicate openly with your lender about your circumstances. Additionally, consider seeking help from a qualified mortgage counselor or legal advisor who can guide you through the foreclosure process.

A hardship letter explains why a mortgage holder is defaulting on their loan and needs to sell their home for less than what they owe. Hardship may arise from unemployment, reduced income, a death in the family, divorce, military service, incarceration, or other situations.

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

Call 888- 995-4673 or go to . Missouri law provides strong consumer protections against these rescue scams. Under state law, a foreclosure consultant must present a written contract with a three-day right to cancel.

The definition of hardship is adversity, or something difficult or unpleasant that you must endure or overcome. An example of hardship is when you are too poor to afford proper food or shelter and you must try to endure the hard times and deprivation.