Missouri Company Property Agreement

Description

How to fill out Company Property Agreement?

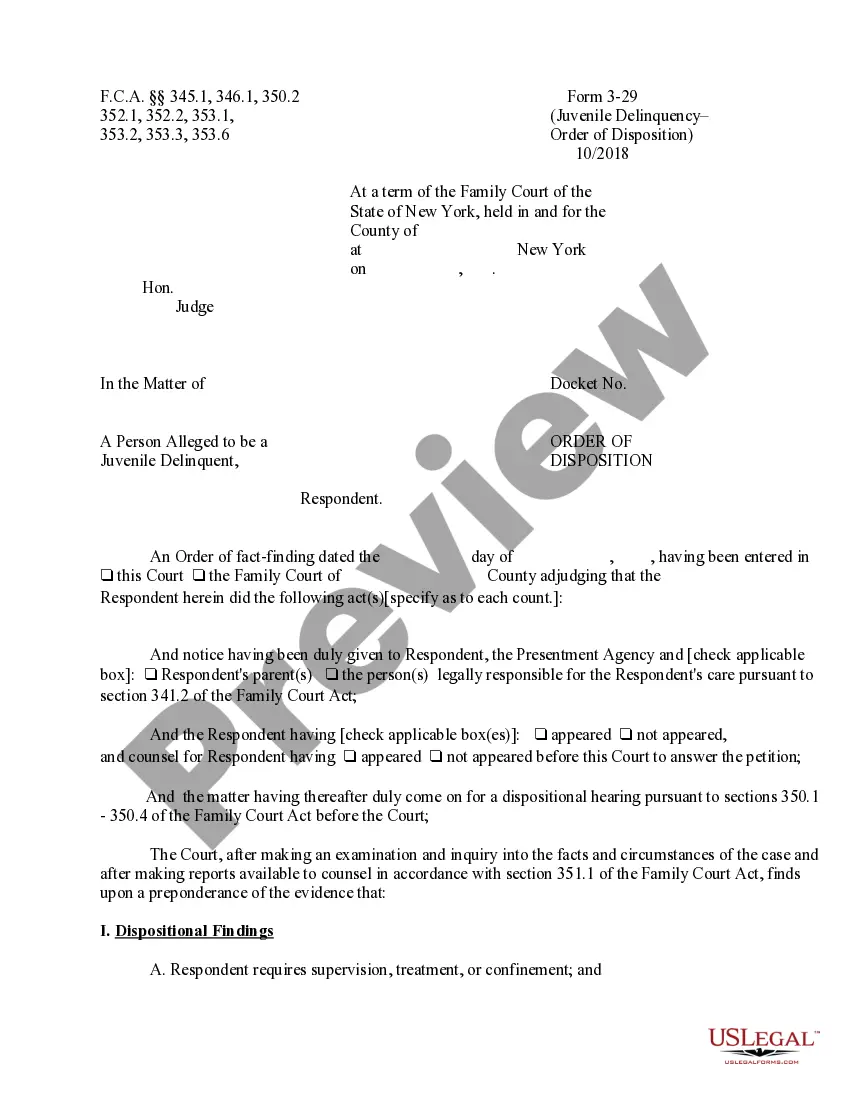

You can dedicate time online searching for the legal document format that meets the federal and state regulations you need.

US Legal Forms offers a vast array of legal forms that can be assessed by experts.

It is easy to download or print the Missouri Company Property Agreement from the service.

Review the form details to make sure you have chosen the correct document. If available, utilize the Review button to search through the format as well. If you want to find another version of your form, use the Search field to locate the template that satisfies your needs and requirements.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, edit, print, or sign the Missouri Company Property Agreement.

- Every legal document format you obtain is your property permanently.

- To get another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct format for the region/city of your choice.

Form popularity

FAQ

The LLC also carries significant tax advantages over the limited partnership. For instance, unless the partner in a limited partnership assumes an active role, his or her losses are considered passive losses and cannot be used as tax deductions to offset active income.

A Missouri LLC operating agreement is a legal document that lets LLC owners outline the conduct of their business and set financial relationships among themselves. Missouri LLC owners can use this agreement to record their ownership percentages, allocate profits and losses, and much more.

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

What are the characteristics of a Limited Liability Company or...It requires the filing of documents with the Secretary of State to be authorized.It may have one or more owners called members.It can be member-managed, or manager-managed.All members have limited liability.More items...

California LLCs are required to have an Operating Agreement. This agreement can be oral or written. If it's written, the agreementsand all amendments to itmust be kept with the company's records. Limited Liability Companies in New York must have a written Operating Agreement.

A Missouri LLC operating agreement is a legal document that lets LLC owners outline the conduct of their business and set financial relationships among themselves. Missouri LLC owners can use this agreement to record their ownership percentages, allocate profits and losses, and much more.

The Missouri Limited Liability Company Act outlines rules and regulations for establishing and operating a limited liability company (LLC) in this state. You should be sure to understand the rules of the Act before you begin the process of forming your LLC.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business.