Missouri Petty Cash Form

Description

How to fill out Petty Cash Form?

Are you in a location where you frequently require documents for either business or personal reasons.

There are numerous legal document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers a vast collection of form templates, including the Missouri Petty Cash Form, which can be printed to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Select the payment plan you need, provide the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Missouri Petty Cash Form anytime, if needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Missouri Petty Cash Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

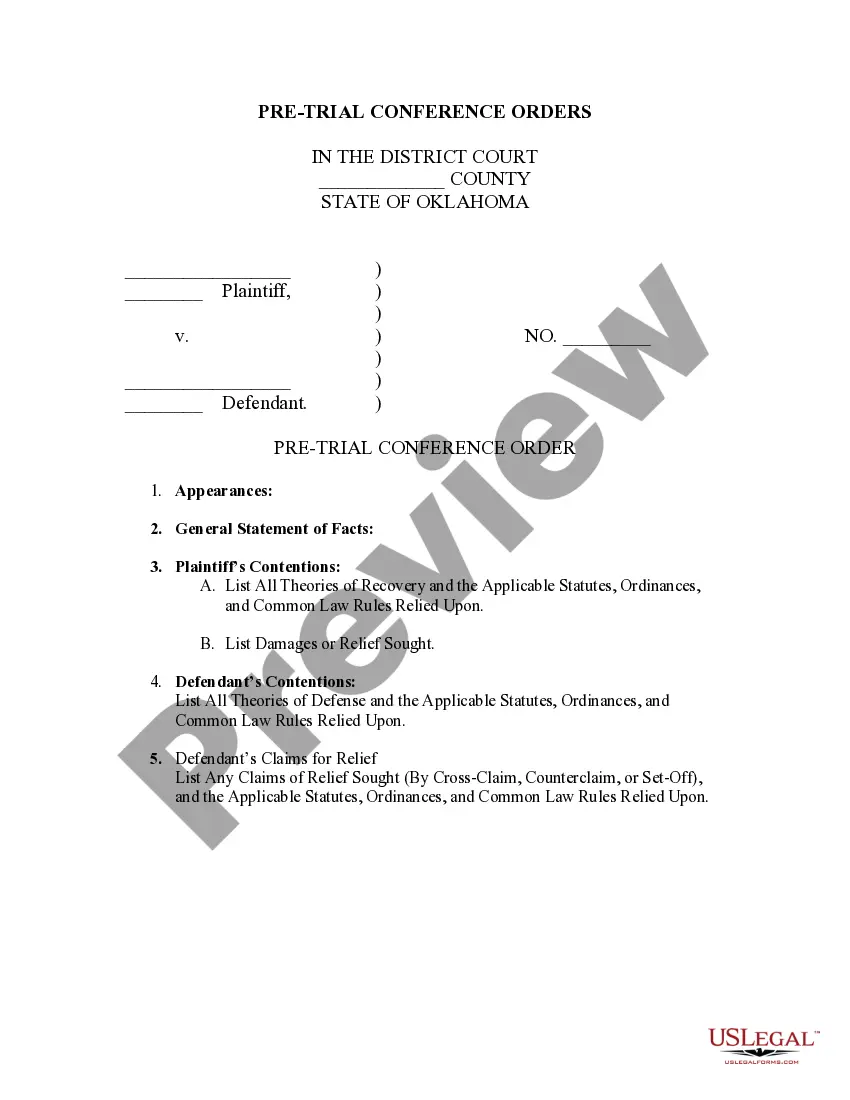

- Use the Review button to examine the form.

- Check the outline to ensure that you have selected the correct form.

- If the form is not what you are looking for, use the Search area to locate the form that meets your needs and requirements.

Form popularity

FAQ

Making an entry in petty cash involves documenting the transaction on your Missouri Petty Cash Form. Record the date, the amount taken, and a brief description of the purpose. It's essential to make these entries consistently, as they provide an accurate overview of cash flow and help prevent mismanagement.

When filling a Missouri Petty Cash Form, start by clearly stating the date and detailing the reason for the cash request. Next, include the name of the recipient and specify the total amount requested. This clarity ensures that everyone understands the nature of the expenditure, fostering efficient processing.

To prepare a petty cash report, first gather all transaction receipts associated with the Missouri Petty Cash Form. Then, summarize the expenses by category, highlighting the total spent during the reporting period. This report helps maintain transparency and can be used for auditing purposes, ensuring your finances stay in order.

Filling out a Missouri Petty Cash Form starts with entering the date and the purpose of the expense. Next, include the name of the person who is requesting the funds and the amount needed. Make sure to attach any receipts that justify the expenditure, as this supports proper record keeping and accountability.

The responsibility for petty cash typically falls to the office manager or a designated financial officer. They must oversee the petty cash fund, diligently manage the Missouri Petty Cash Form, and ensure that all transactions are accounted for. This role is crucial in preventing misuse and maintaining financial integrity within the organization.

Preparing petty cash vouchers involves filling out the Missouri Petty Cash Form accurately. Include key details such as the date, amount, purpose of the expenditure, and attach any relevant receipts. This practice not only keeps your financial records organized but also facilitates smoother audits and reconciliation of the petty cash fund.

A petty cash form is a document used to track and manage small cash expenditures within an organization. The Missouri Petty Cash Form specifically helps businesses document transactions, ensuring funds are used appropriately. It serves as an essential tool for maintaining accountability and transparency in financial operations.

The employee who spends the petty cash is responsible for preparing the petty cash voucher. They should fill out the Missouri Petty Cash Form with details of the transaction, including the date, amount spent, and purpose. This ensures accurate record-keeping and allows for proper reimbursement of the petty cash fund.

To request petty cash via email, simply compose a message that includes the amount needed and the purpose of the funds. Attach the Missouri Petty Cash Form if required. Ensure that you send your request to the designated person responsible for managing petty cash, so they can process it efficiently and provide you with the necessary funds.

Typically, the office manager or a designated employee prepares the petty cash. They ensure that the Missouri Petty Cash Form is filled out correctly and maintains oversight of the cash fund. This responsible individual monitors expenditures and ensures that all transactions are properly documented, protecting the integrity of the petty cash system.