Missouri Monthly Cash Flow Plan

Description

How to fill out Monthly Cash Flow Plan?

Have you ever been in a situation where you require documents for either business or personal reasons almost all the time.

There are numerous legal document templates available online, but finding forms you can trust is not easy.

US Legal Forms offers a vast selection of form templates, such as the Missouri Monthly Cash Flow Plan, which are designed to meet federal and state requirements.

Once you locate the correct form, click Purchase now.

Choose the pricing plan you would like, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Missouri Monthly Cash Flow Plan template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

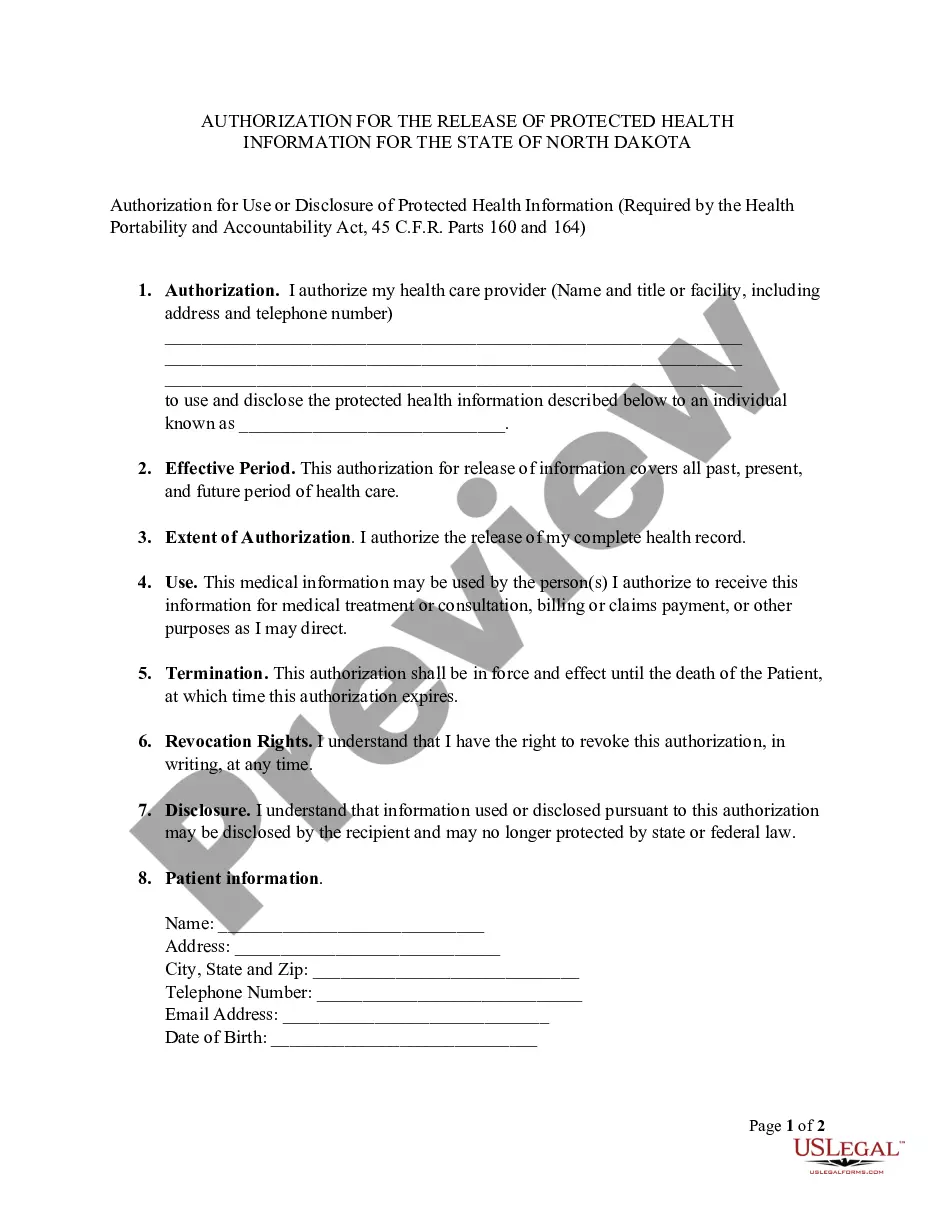

In a general sense, a cash flow plan allows a company to plan its incoming and outgoing cash to ensure it can meet expenses. Cash flow activities include operating activities, investing activities, and financing activities.

Do one month at a time.Enter Your Beginning Balance. For the first month, start your projection with the actual amount of cash your business will have in your bank account.Estimate Cash Coming In. Fill in all amounts you expect to take in during the month.Estimate Cash Going Out.Subtract Outlays From Income.

Your Monthly Cash Flow Plan. (BUDGET) A monthly cash flow plan or budget gives you more control over your money and sets you up to achieve short-term and long-term financial goals and dreams. It is important to have a zero based cash flow plan which means your monthly income minus your expenses should equal ZERO.

Do one month at a time.Enter Your Beginning Balance. For the first month, start your projection with the actual amount of cash your business will have in your bank account.Estimate Cash Coming In. Fill in all amounts you expect to take in during the month.Estimate Cash Going Out.Subtract Outlays From Income.

Preparing a cash flow budget involves four steps:Preparing a sales forecast.Projecting your anticipated cash inflows.Projecting your anticipated cash outflows.Putting the projections together to come up with your cash flow bottom line.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

Monthly Cash Flow reports are considered essential month-end financial statements and are often used by CFOs and Analysts to review the cash inflows and outflows of the business. Key functionality in this type of report is parameter driven so the figures are presented automatically when the user runs the report.

A cash flow statement shows how money flows in and out of a business....How to Write a Cash Flow StatementStart with the Opening Balance.Calculate the Cash Coming in (Sources of Cash)Determine the Cash Going Out (Uses of Cash)Subtract Uses of Cash (Step 3) from your Cash Balance (sum of Steps 1 and 2)

How to Create a Personal Cash Flow StatementNote your income. Find out when you are paid. This is about more than just recognizing your monthly income.Track your expenses. Next, you should know where your money is going, and when it needs to get there.