Missouri Personal Financial Information Organizer

Description

How to fill out Personal Financial Information Organizer?

Locating the appropriate legal document template could pose a challenge.

Indeed, there are numerous templates accessible online, but how can you find the legal template you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Missouri Personal Financial Information Organizer, suitable for both business and personal use.

If the form does not meet your requirements, utilize the Search field to find the correct document. When you are confident that the form is appropriate, click on the Get now button to obtain the form. Choose your preferred pricing plan and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Missouri Personal Financial Information Organizer. US Legal Forms is the largest collection of legal documents where you can find various file templates. Take advantage of the service to download professionally crafted documents that meet state regulations.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the Missouri Personal Financial Information Organizer.

- Use your account to browse through the legal documents you have previously acquired.

- Visit the My documents section in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have chosen the correct form for your city/state. You can view the form using the Preview button and read the form description to confirm it is suitable for your needs.

Form popularity

FAQ

There are many things you can use a budget binder for but these are just some of the few that we'll share:Goal setting and tracking.Paycheck tracking.Debt pay off tracking.Planning purposes.A Binder.Fun colored pens.Whiteout & paper clips.Plastic pocket dividers.More items...?

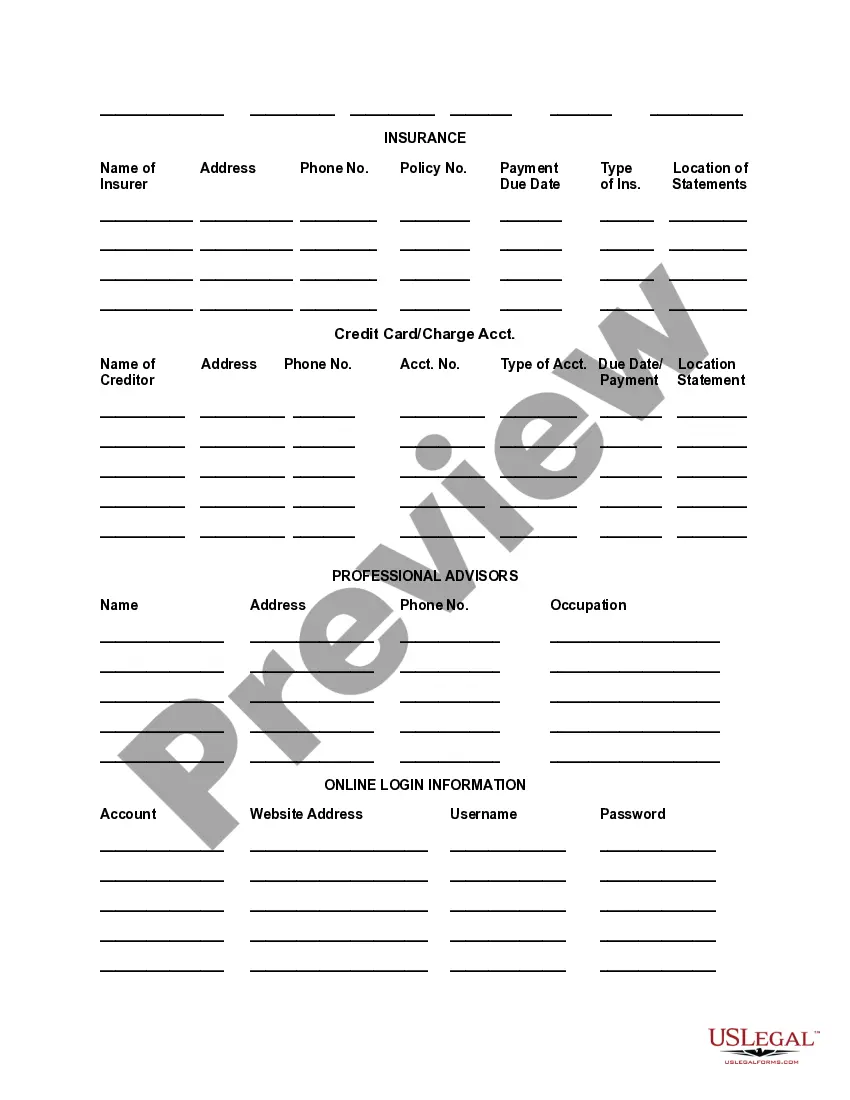

Organize regular bills and financial statements by the month or by the account (your preference). It is usually easiest to stick with either hanging files or an expanding file. When organizing by account, be sure to arrange documents in chronological order within each file so they are easier to find later on.

What exactly does personal financial planning mean? It is a comprehensive plan, projecting many years into the future. It isn't just for those with a lot of money. A financial plan safeguards you against life's surprises. It includes details about your income, savings, investments, expenditures, debt and insurance.

Like a financial planner, a money coach is someone who can help you with the big picture of your finances. The main difference is that money coaches look at your finances as just one part of your overall life.

Let's get started:Step 1: Ditch the Shoebox Method.Step 2: Track Your Expenses.Step 3: Establish a Bill-Paying System.Step 4: Read Your Bills and Account Statements.Step 5: Shred Old Financial Records.Step 6: Stop the Clutter at the Source.

Your Personal Financial Organizer is a take-action booklet intended to help you put your finances and budget in order as a first step to preparing an effective savings strategy. The sooner you start saving, the more time your money will have to work for you. Page 4. 2 YOUR PERSONAL FINANCIAL ORGANIZER.

Tips for Organizing Your FinancesStep 1: Ditch the Shoebox Method.Step 2: Track Your Expenses.Step 3: Establish a Bill-Paying System.Step 4: Read Your Bills and Account Statements.Step 5: Shred Old Financial Records.Step 6: Stop the Clutter at the Source.

You could go the traditional route and use a simple set of labeled folders in a file drawer. More important documents should be kept in a fire-resistant file cabinet, safe, or safe-deposit box. If space is tight and you need to reduce clutter, you might consider electronic storage for some of your financial records.

Financial planning in 7 stepsStart by setting financial goals.Track your money, and redirect it toward your goals.Get your employer match.Make sure emergencies don't become disasters.Tackle high-interest debt.Invest to build your savings.Build a moat to protect and grow your financial well-being.

An example of personal finance is knowing how to budget, balance a checkbook, obtain funds for major purchases, save for retirement, plan for taxes, purchase insurance and make investments.