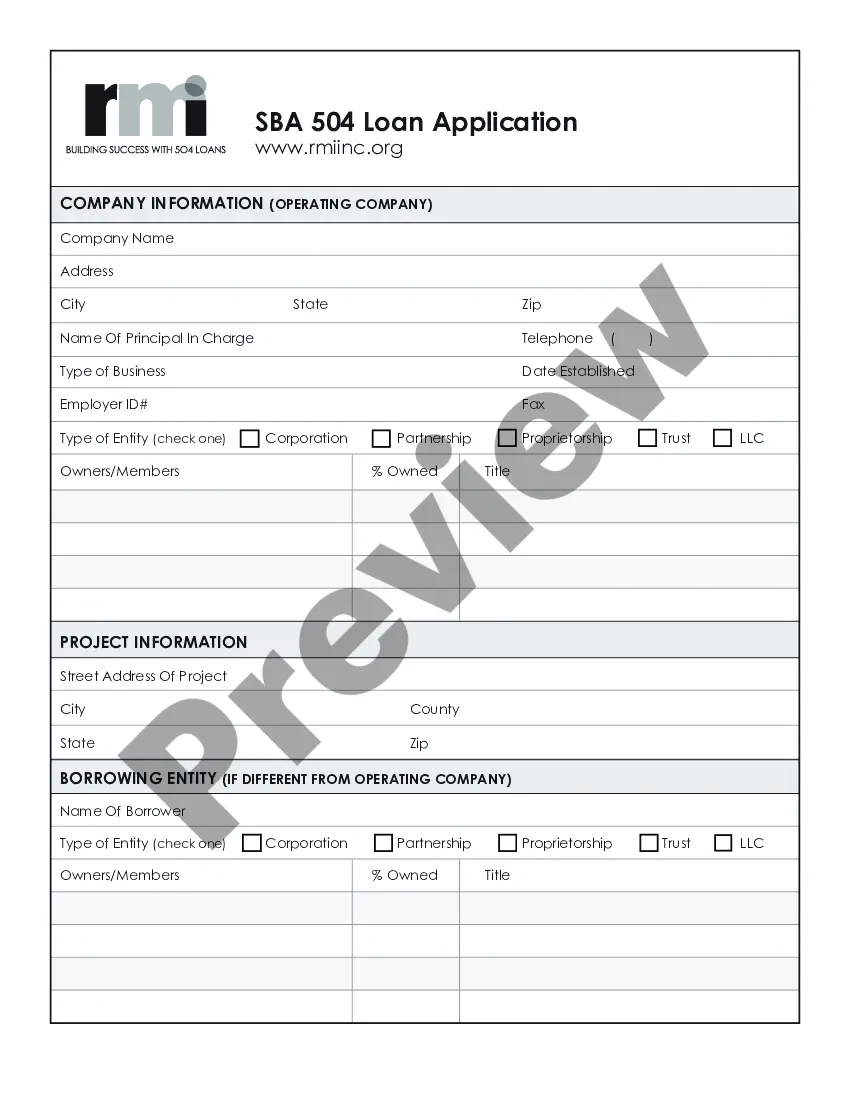

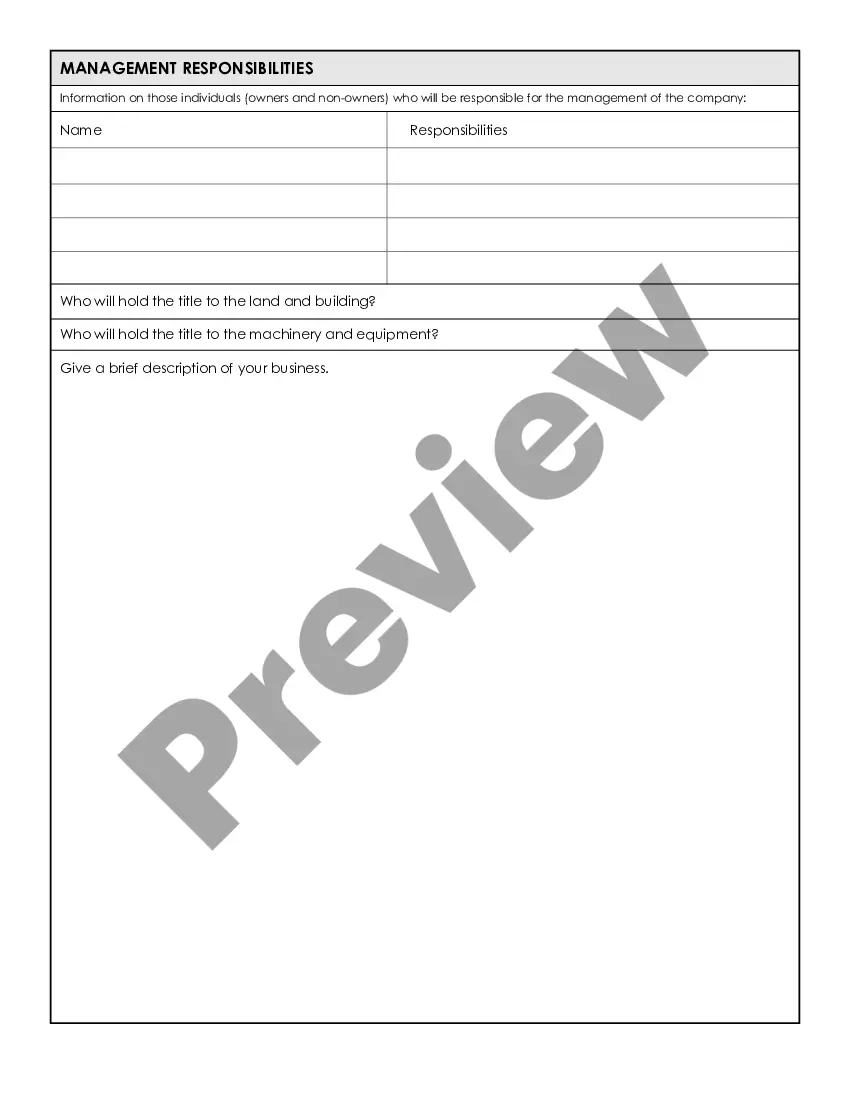

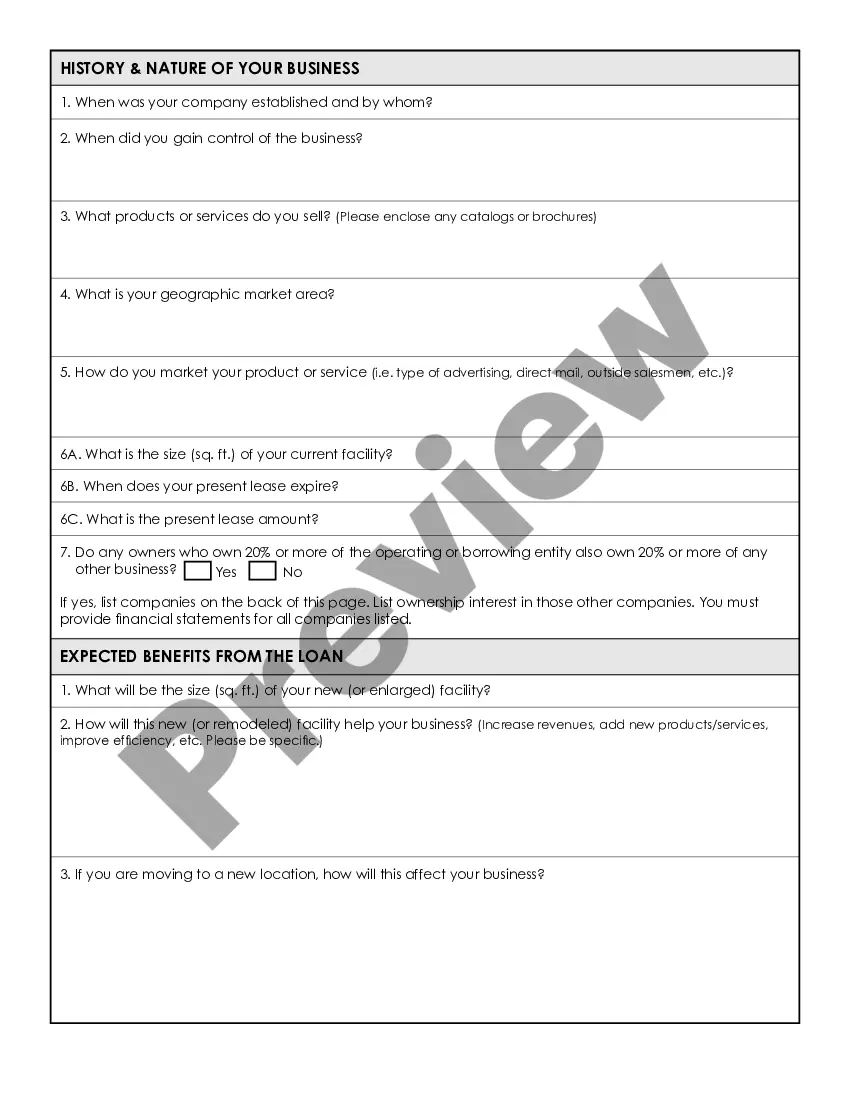

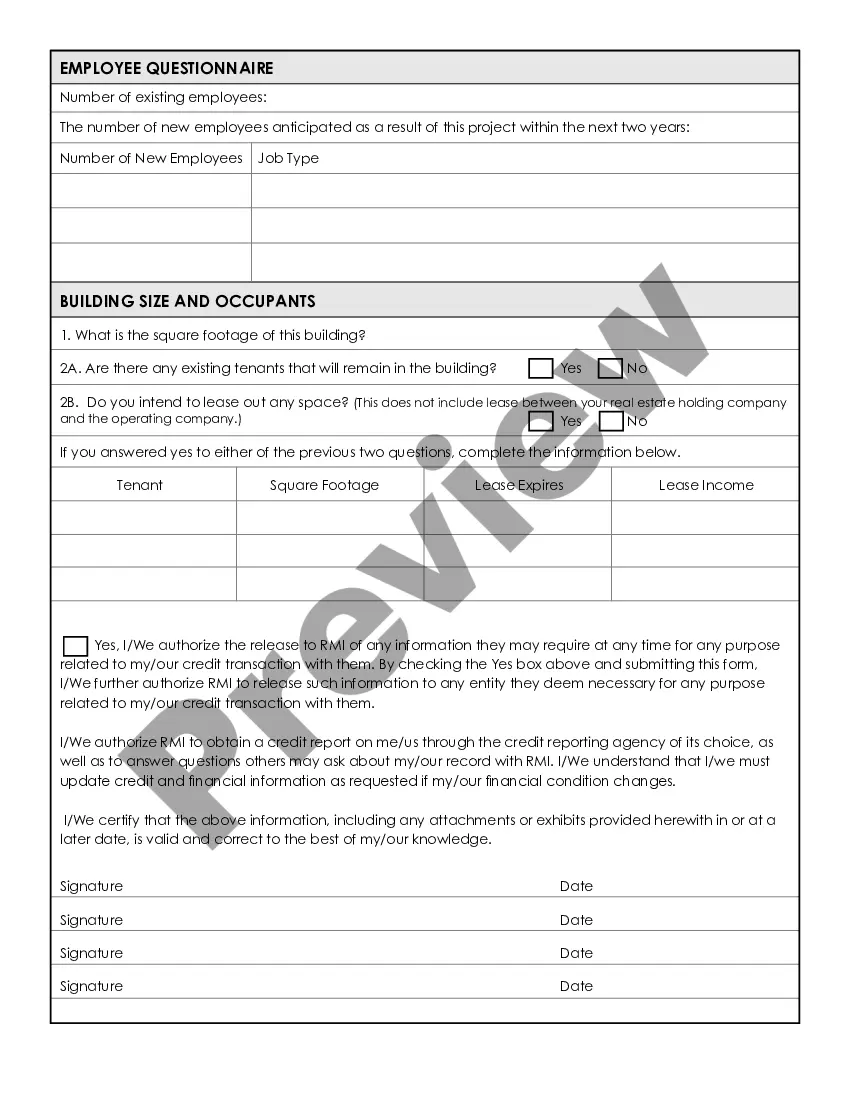

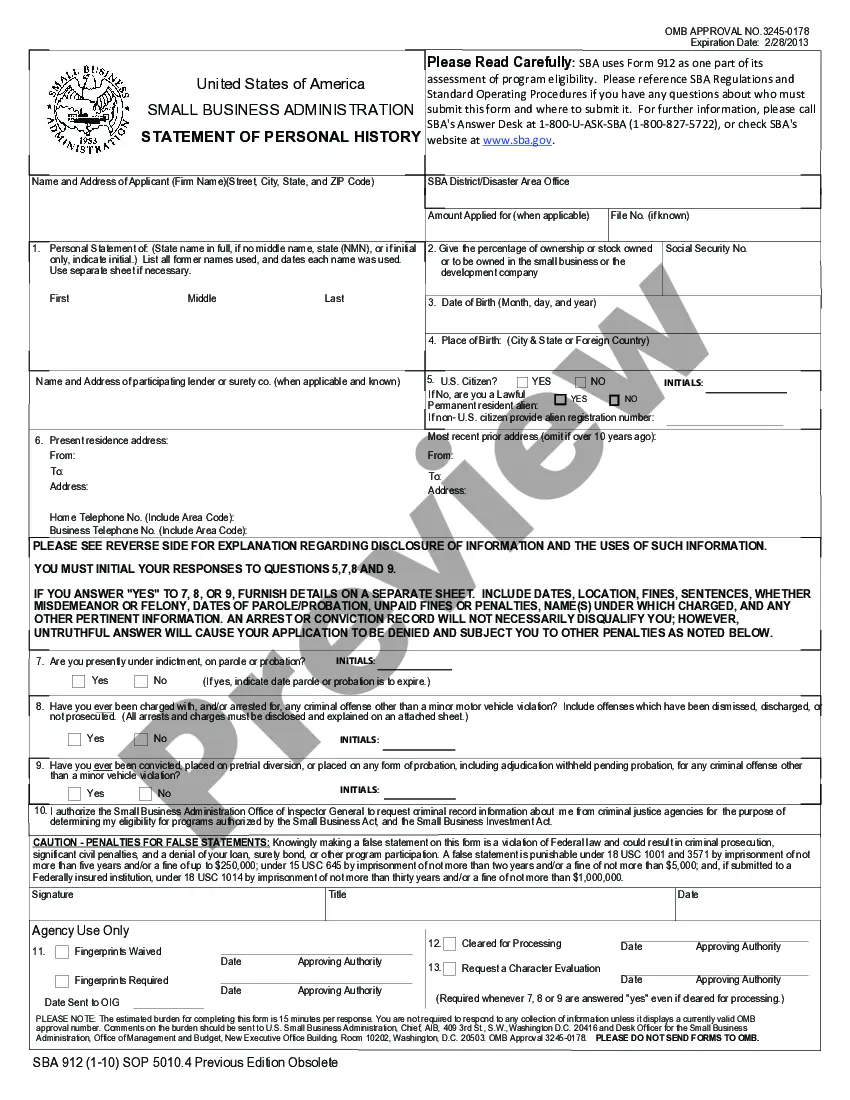

Small Business Administration Loan Application Form and Checklist

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Small Business Administration Loan Application Form And Checklist?

Make use of the most extensive legal library of forms. US Legal Forms is the perfect place for getting up-to-date Small Business Administration Loan Application Form and Checklist templates. Our platform offers thousands of legal forms drafted by certified lawyers and sorted by state.

To obtain a template from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our platform, log in and select the template you are looking for and purchase it. Right after buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the template features a Preview option, use it to check the sample.

- If the sample does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample meets your requirements.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the sample.

- When it is downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and complete the Form name. Join thousands of delighted customers who’re already using US Legal Forms!

Form popularity

FAQ

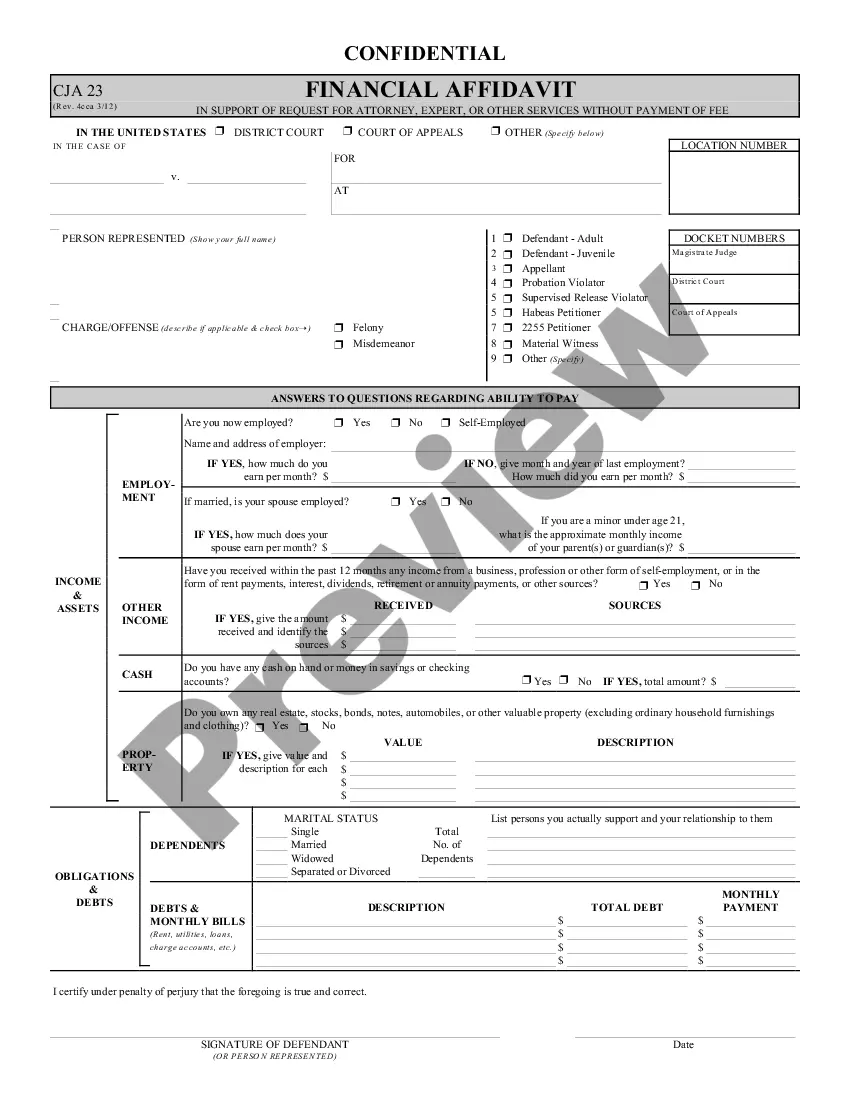

Personal Background Statement. Professional Resume. Personal Credit Report & Score. Business Credit Report. Personal Tax Returns. Legal Documents. Business Plan. Use of Loan.

Yes, as long as your bank allows it, you can have multiple SBA loans outstanding at the same time, but the total amount borrowed can't exceed SBA program limits.Small business owners often apply for multiple SBA loans because these loans are affordable and have favorable repayment terms.

Step 1: Visit the SBA disaster loan website. Here is the direct link to begin the loan application process: https://covid19relief.sba.gov/#/. Step 2: Verify eligibility. Step 3: Provide business information.

Step 1: Access your PPP Application. Step 2: Add or Confirm Existing Business Information. Step 3: Add New Requirements for Business Information. Step 4: Enter or Confirm Ownership. Step 5: Enter or Confirm Additional Owner Info. Step 6: Upload or Confirm Documents.

Lenders are more likely to approve a loan application when you can show consistent, positive cash flow; ideally over several years. Every small business owner must start somewhere, but being unable to show the bank revenue history makes it hard to qualify for an SBA loan.

Paper loan applications at disasterloan.sba.gov/ela/Information/PaperForms U.S. Small Business Administration Processing and Disbursement Center 14925 Kingsport Road Fort Worth, TX 76155.

Step 1: Visit the SBA disaster loan website. Here is the direct link to begin the loan application process: https://covid19relief.sba.gov/#/. Step 2: Verify eligibility. Step 3: Provide business information.

Find a lender. Only lenders who partner with the SBA can offer SBA loans. Choose your loan type. When people say SBA loans, they're typically referring to 7(a) loans, which are the SBA's primary loan program. Gather your documents. Apply for your loan.

Color copy of government issued ID (front and back) 2019 1040 Schedule C 2019 IRS Form W-3. 2019 IRS Form 940. W2s for any employees earning more than $100,000. Payroll statement covering 2/15/2020.