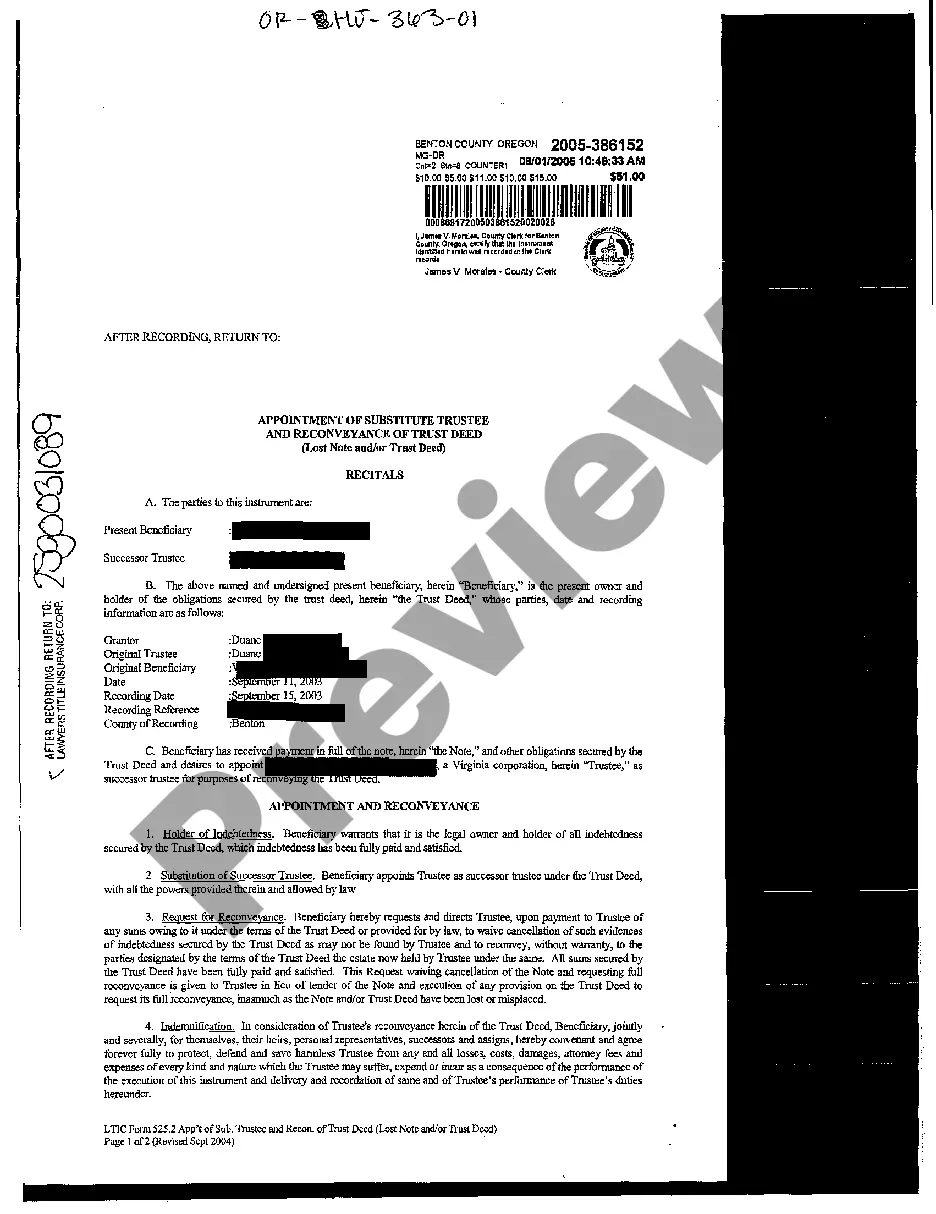

A well drafted trust instrument will generally prescribe the method and manner of substitution, succession, and selection of successor trustees. Such provisions must be carefully followed. A trustee may be given the power to appoint his or her own successor. Also, a trustor may reserve, or a beneficiary may be given, the power to change trustees. This form is a sample of a resignation by the trustee prior to the appointment of a new trustee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.