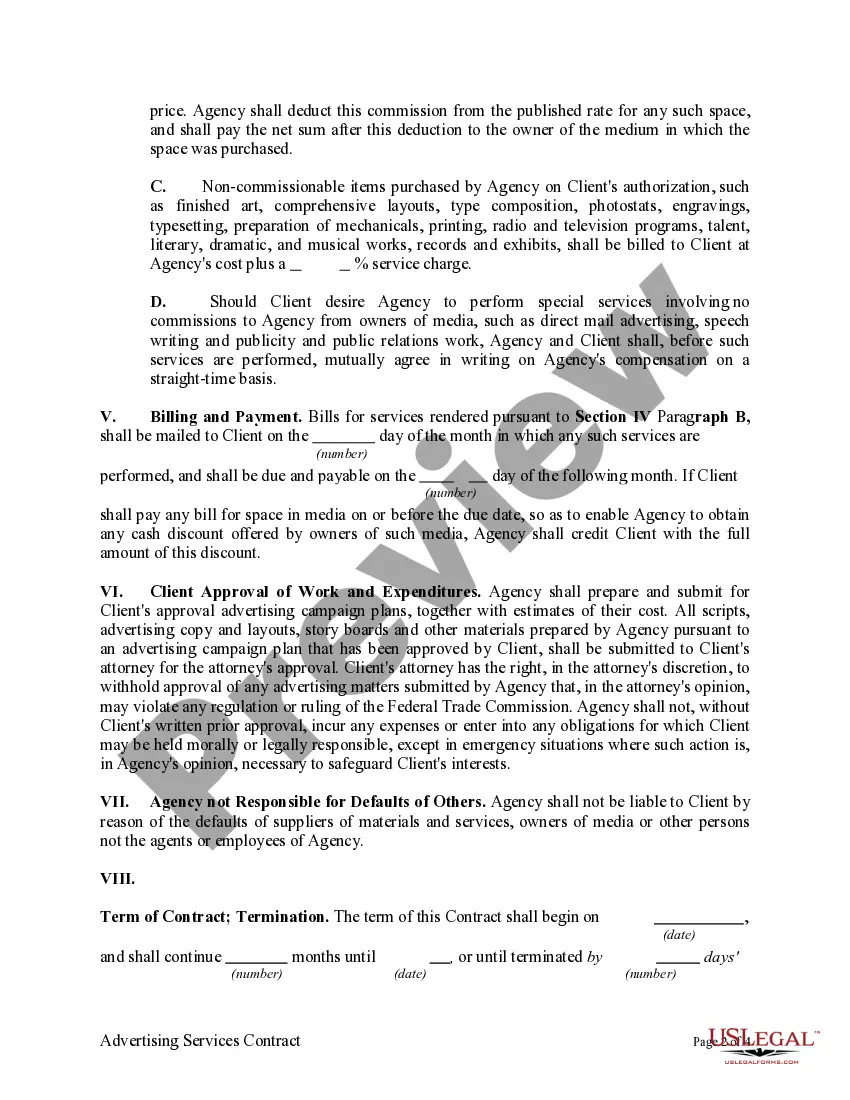

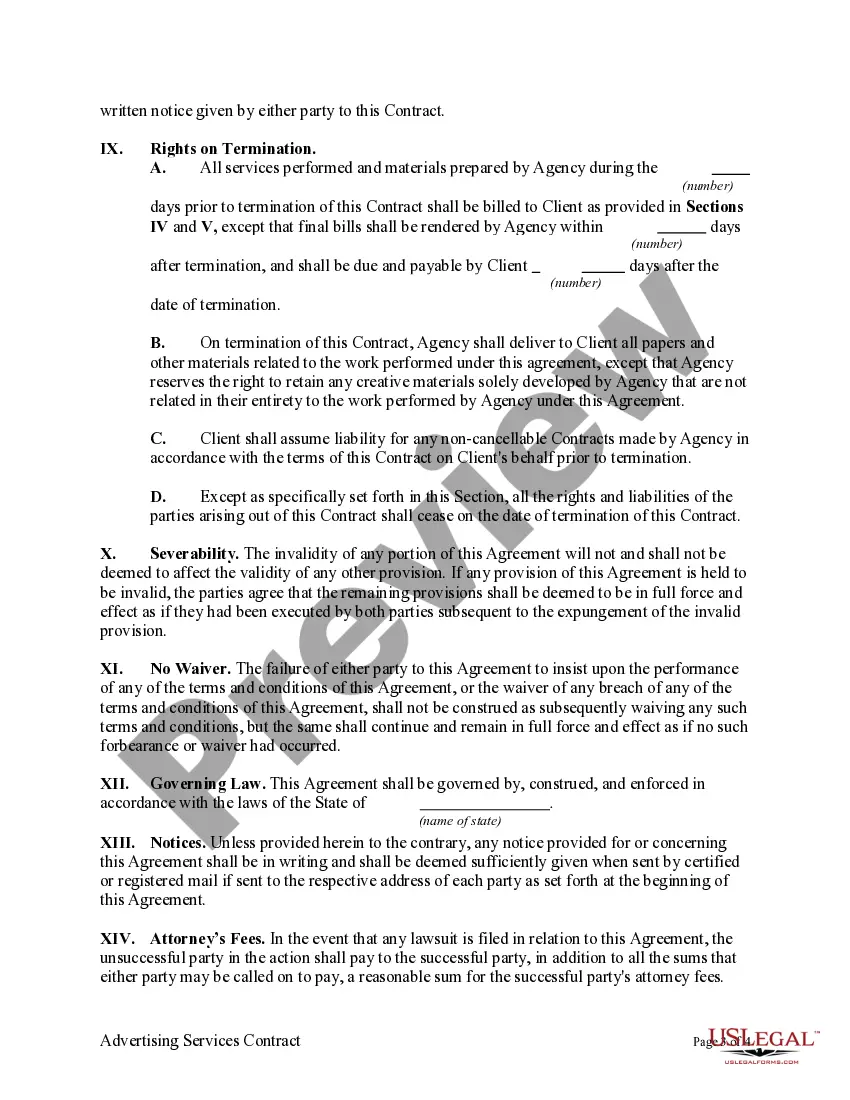

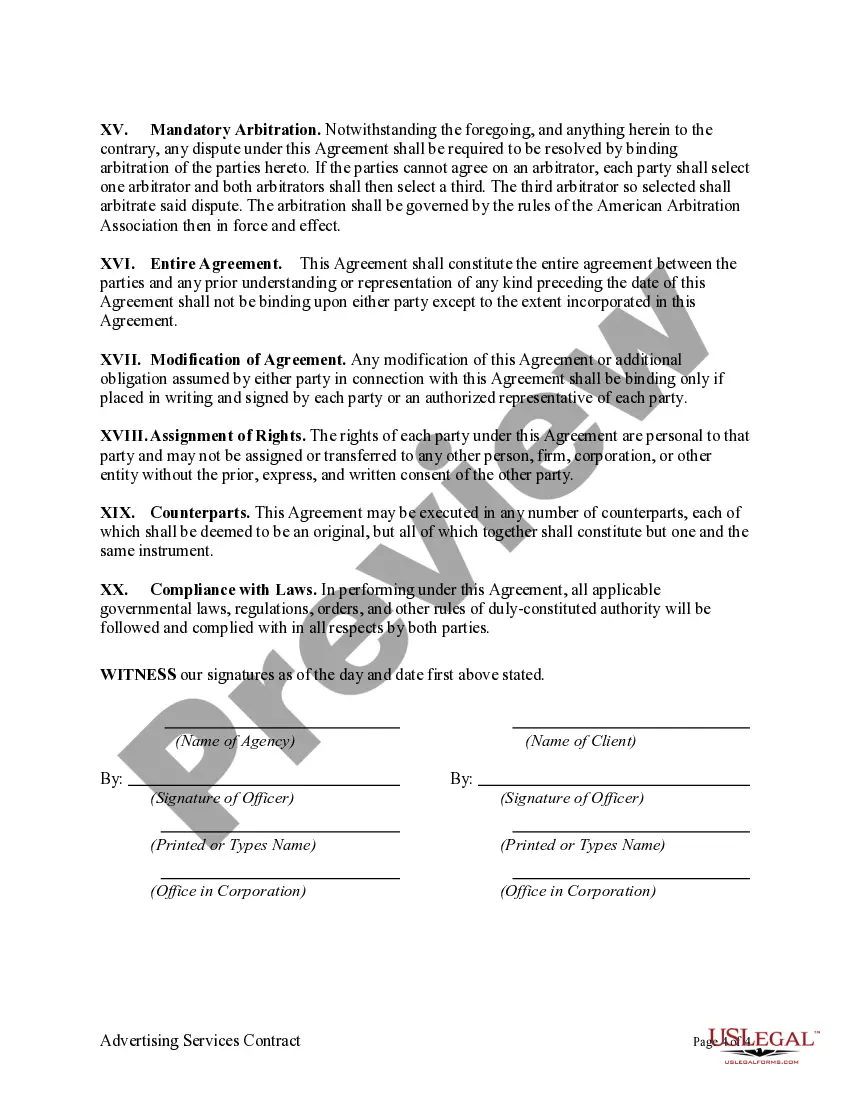

This form is an example of an advertising services contract by which the maker of goods or provider of services arranges with a second party to promote the first parties services or goods.

Missouri Advertising Services Contract

Description

How to fill out Advertising Services Contract?

Have you ever been in a situation where you require documents for potential business or personal reasons nearly all the time.

There are numerous official document templates accessible online, but locating trustworthy types isn’t straightforward.

US Legal Forms offers thousands of document templates, such as the Missouri Advertising Services Agreement, which can be formulated to comply with federal and state regulations.

Once you find the appropriate form, simply click Buy now.

Choose the payment plan you want, provide the necessary details to make your payment, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Missouri Advertising Services Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

- Use the Review option to inspect the document.

- Read the description to confirm that you have chosen the right form.

- If the form isn’t what you’re looking for, use the Search field to find the document that meets your needs and requirements.

Form popularity

FAQ

To report sales tax in Missouri, businesses need to submit the completed Form 53 along with any required payments. This form captures sales data and calculates the tax owed. If you are managing a Missouri Advertising Services Contract, you can streamline this reporting process by using platforms like uslegalforms, which provide guidance on compliance.

To file for sales tax in Missouri, you will generally use Form 53. This form is specifically designed for reporting sales tax collected from customers. If your business involves a Missouri Advertising Services Contract, timely filing using Form 53 can help maintain good standing with tax authorities.

To fill out Form 53/1 in Missouri, first ensure you have the correct business information readily available. You will need to provide details about your sales, tax collected, and other required figures. Utilizing resources like the uslegalforms platform can simplify the process of completing this form correctly, ensuring your Missouri Advertising Services Contract complies with state regulations.

In Missouri, the time frame to back out of a contract typically depends on the specific circumstances of the agreement. Generally, if a consumer enters into a contract with a cooling-off period, they may have up to three days to cancel. However, for a Missouri Advertising Services Contract, it’s wise to review the terms thoroughly before committing, as specific provisions may apply.

Yes, remote sellers must register with the Missouri Secretary of State if they meet certain sales thresholds. This registration process allows them to collect and remit sales tax on goods sold to customers in Missouri. Ensuring compliance is crucial for businesses involved in a Missouri Advertising Services Contract.

To file your Missouri state taxes, you typically need Form MO-1040 for individual income tax. Additionally, if you operate a business, you might need other specific forms relevant to your Missouri Advertising Services Contract. Gathering all required documents before filing can help you avoid delays or penalties.

In Missouri, the sales tax return form is called Form 53. This form is essential for businesses that collect sales tax from customers. Completing Form 53 accurately ensures compliance with Missouri laws and may help streamline operations related to your Missouri Advertising Services Contract.

An advertisement contract is a formal agreement that specifies the terms under which advertising services are provided. This contract includes details such as the scope of work, budget, and duration of the advertising campaign. By using a Missouri Advertising Services Contract, you can clearly define the needs of your business and ensure that the advertising agency meets those requirements. This reduces misunderstandings and enhances collaboration throughout the advertising process.

A typical marketing contract outlines the roles and responsibilities of each party involved in advertising services. It details deliverables, timelines, and payment terms, ensuring clarity in the business relationship. When you engage in a Missouri Advertising Services Contract, you create a framework for effective marketing efforts and accountability. This type of contract helps protect your rights and sets expectations between you and the service provider.

An advertising agreement is a legally binding document that details the partnership between a business and an advertising agency. It lays out the scope of work, payment terms, and duration of the partnership. Utilizing a Missouri Advertising Services Contract can streamline this process, ensuring clarity and professionalism in your advertising campaigns.