Missouri Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

Are you currently in a situation where you need documents for either business or personal purposes regularly.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Missouri Sample Letter for Tax Deeds, which can be tailored to meet federal and state requirements.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Missouri Sample Letter for Tax Deeds anytime if needed. Just select the necessary form to download or print the document template.

Use US Legal Forms, which has the most extensive collection of legal forms, to save time and prevent errors. The service offers professionally created legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Missouri Sample Letter for Tax Deeds template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

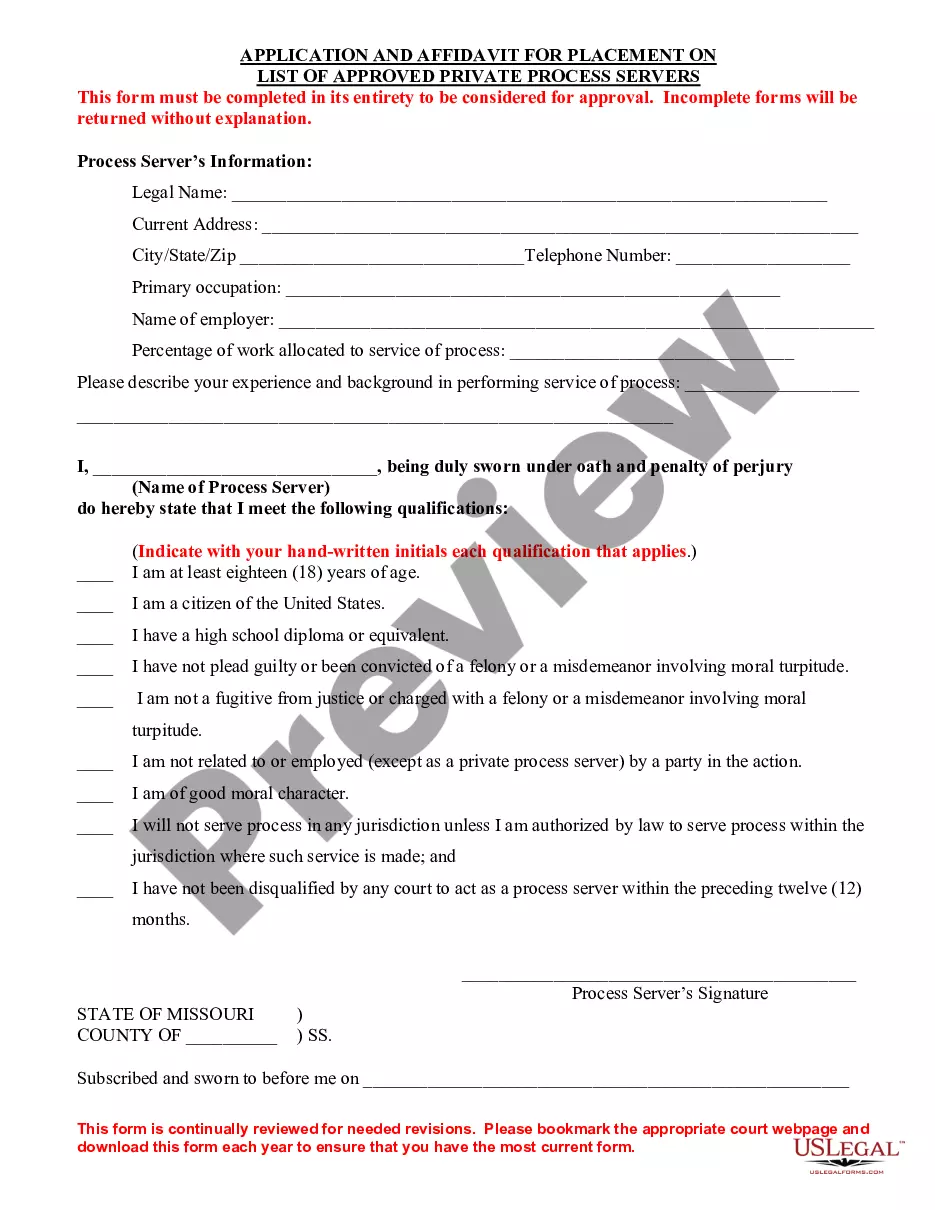

- Utilize the Review button to examine the form.

- Check the details to confirm that you have selected the appropriate form.

- If the form isn’t what you’re searching for, use the Research field to find the template that meets your needs.

- Once you find the right form, click Get now.

- Choose the pricing plan you prefer, enter the required information to create your account, and pay for your order using PayPal or a credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Per Missouri Statutes, real estate properties with three or more years of delinquent property taxes are offered at the Collector of Revenue's annual tax sale on the fourth Monday in August. The 2023 tax sale has ended, and the auction books will be posted on this page after all processing has concluded.

Almost all Missouri counties, other than Jackson County and St. Louis City, sell tax liens. This means that when you bid at a Missouri tax auction, you are not buying a deed to the property, instead you a buying the right to collect the tax amount from the property owner.

In Missouri, you can ordinarily redeem your home within one year after the tax sale and up until the purchaser gets the deed to your home?if the property sells on the collector's first or second sale attempt. (Mo. Ann. Stat.

Enacted by legislation drafted by Senator Chuck Gross, the Missouri Homestead Preservation Act allows qualified senior citizens and disabled individuals a credit on their real estate property tax if those taxes increase at least 2.5 percent in a non- reassessment (even-numbered ) year or at least 5 percent in a ...

Remember, you don't actually own the property! You only own the tax lien. After the auction, the county will give you a Certificate of Purchase, which you can exchange for a deed one year later if you follow certain procedures.

Notices for Unpaid Taxes in Missouri If you have unpaid taxes in Missouri, the state will send the following notices: Balance Due, Adjustment, or Non-Filer Notice ? You will receive one of these three notices depending on if you owe a balance, had your return adjusted, or failed to file.

If you are delinquent on your personal property taxes, the Collector of Revenue may file suit. Court costs and attorney's fees are assessed against the account as dictated by Missouri Statute.