Missouri Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

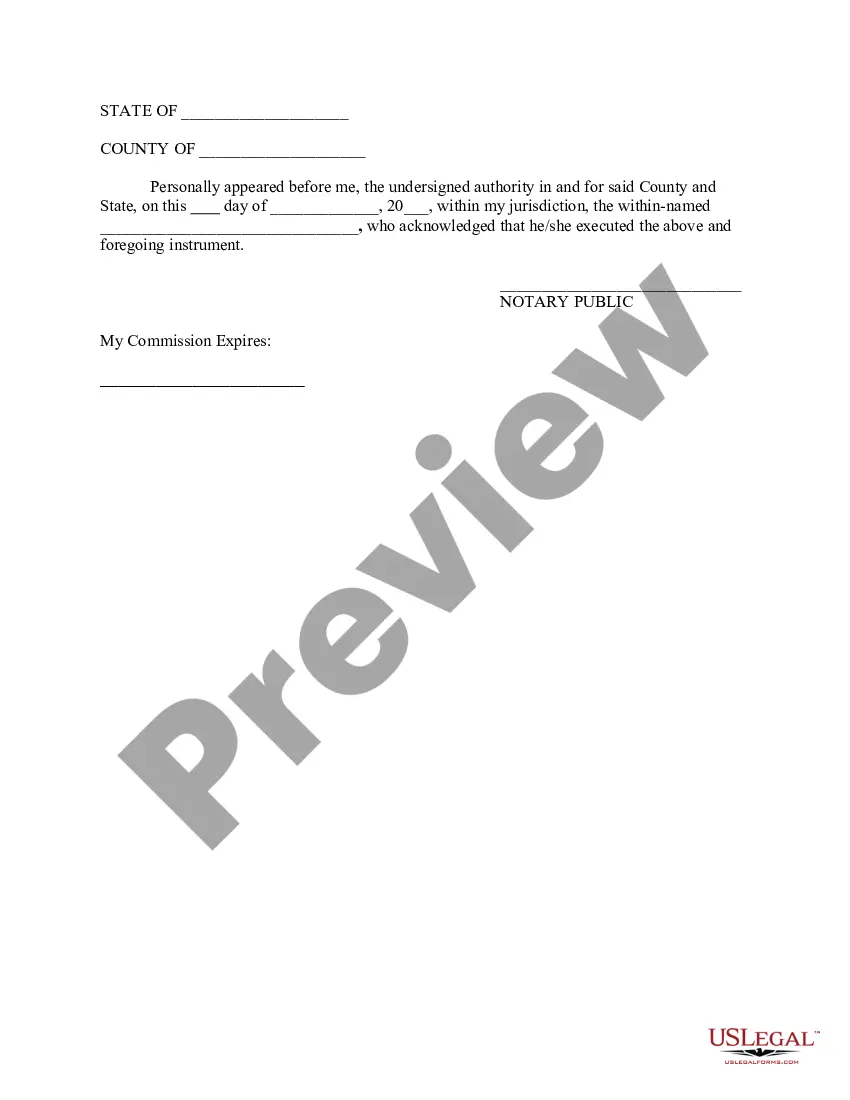

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Finding the appropriate legal document template can be challenging. Naturally, there are numerous templates accessible online, but how do you identify the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, including the Missouri Certificate of Heir for Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), which can be utilized for both business and personal purposes. All templates are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Missouri Certificate of Heir for Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Use your account to browse through the legal documents you have previously purchased. Go to the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can examine the form using the Preview feature and read the form description to confirm it is the right one for you. If the form does not fulfill your requirements, utilize the Search field to find the appropriate form. When you are confident that the form is suitable, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, and print out and sign the obtained Missouri Certificate of Heir for Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Leverage the service to acquire properly created documents that comply with state regulations.

US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Finding the appropriate legal document template can be challenging.

- The platform offers thousands of templates.

- All templates are reviewed by experts.

- If you are already registered, Log In to your account.

- Go to the My documents section of your account.

- Here are simple steps for you to follow.

Form popularity

FAQ

6 Tips to Avoid Paying Tax on Gifts Respect the annual gift tax limit. ... Take advantage of the lifetime gift tax exclusion. ... Spread a gift out between years. ... Leverage marriage in giving gifts. ... Provide a gift directly for medical expenses. ... Provide a gift directly for education expenses. ... Consider gifting appreciated assets.

While some car owners consider selling the car for a dollar instead of gifting it, the DMV gift car process is the recommended, not to mention more legitimate, way to go.

The new vehicle owner: Will not pay state or local tax on a gift transaction; and. Cannot use or transfer the license plates that were on the vehicle at the time it was gifted (if applicable).

How do I avoid paying sales tax on a car in Missouri? You already paid the tax. The title is from another state. A nonprofit organization uses the car. You received the car as a gift. Following an accident, an insurance company purchased the car.

If your state allows it, consider naming a transfer-on-death (TOD) beneficiary for your vehicles.

Missouri Sales Tax will not be assessed on a vehicle acquired by gift provided the donor or decedent has paid all sales tax. **A gift statement must be submitted. The statement must be signed by at least one of the donor(s) and include the year, make, and identification number.

Or, if the co-owner is now deceased, proof of death is required (i.e., copy of death certificate, newspaper obituary clipping, funeral home card) with the unassigned title. You may then apply and pay an $8.50 title fee and a $6 processing fee for a new title in your name alone (or you may add a different co-owner).

What You'll Need to Do to Transfer your Vehicle Title in Missouri Visit any DOS License office near you. ... Submit the required documents, your application, ID and your payment. Receive a temporary vehicle title. Receive your vehicle title via U.S. mail.