Missouri Bond of Distributes With Corporate Surety is a type of surety bond that provides financial protection for the distributes of a deceased person’s estate. The bond guarantees that thdistributeses will receive their rightful portion of the estate and that the executor or administrator of the estate will handle the assets as instructed by the court. There are two types of Missouri Bond of Distributes With Corporate Surety: a standard bond and a special bond. The standard bond is a blanket bond that covers all the distributes of an estate, while the special bond covers only the individual listed on the bond. The bond is issued by a surety company and is backed by the financial strength of the surety. The surety company is responsible for fulfilling the bond’s obligations if the executor or administrator of the estate fails to do so.

Missouri Bond of Distributees With Corporate Surety

Description

How to fill out Missouri Bond Of Distributees With Corporate Surety?

If you're looking for a method to suitably finalize the Missouri Bond of Distributees With Corporate Surety without engaging a lawyer, then you're in the perfect spot.

US Legal Forms has established itself as the most comprehensive and esteemed repository of official templates for every personal and commercial situation. Each document you discover on our online platform is crafted in accordance with national and state laws, ensuring that your paperwork is properly organized.

Another fantastic feature of US Legal Forms is that you will never lose the documents you purchased - you can access any of your downloaded templates in the My documents tab of your profile whenever you need them.

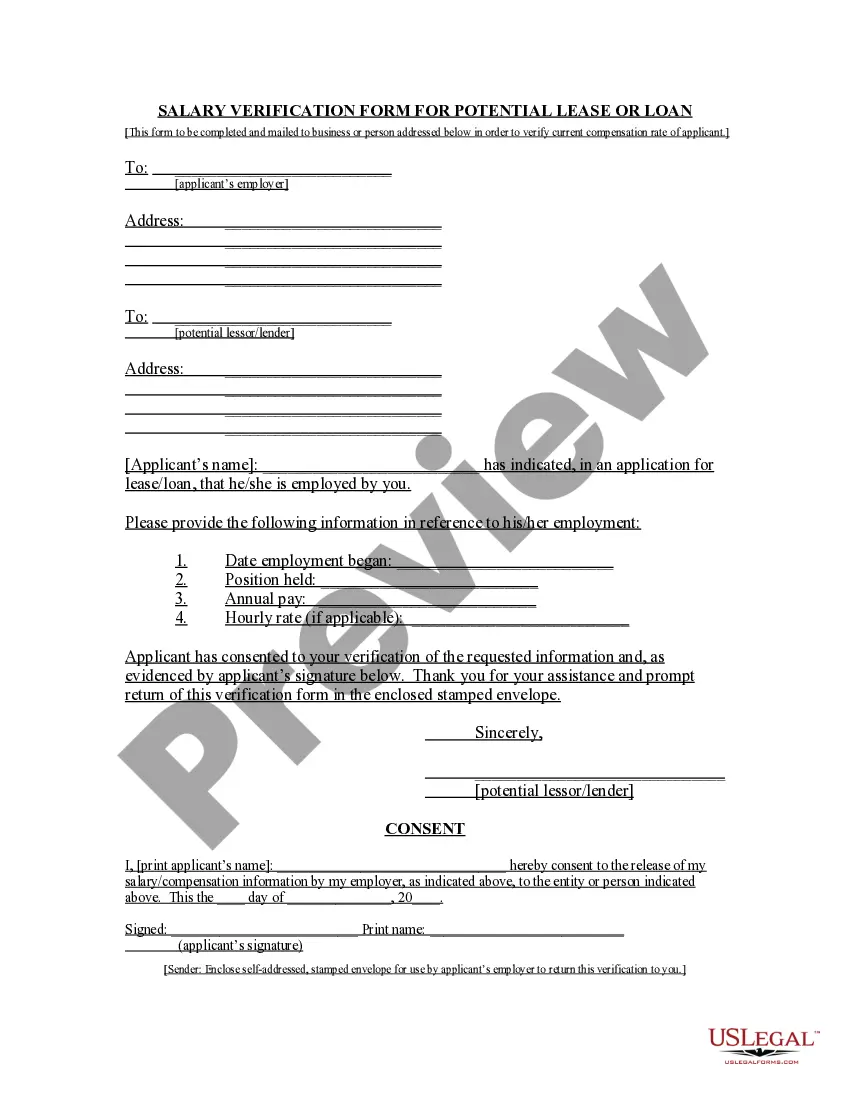

- Confirm that the document displayed on the page aligns with your legal circumstances and state laws by reviewing its text description or navigating through the Preview mode.

- Enter the form title in the Search tab at the top of the page and select your state from the dropdown to locate an alternative template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are confident that the paperwork meets all the necessary requirements.

- Log in to your account and click Download. Sign up for the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The form will be available for download immediately after.

- Select the format in which you wish to receive your Missouri Bond of Distributees With Corporate Surety and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it swiftly or print it out to prepare your physical copy manually.

Form popularity

FAQ

A corporate surety bond is a type of bond issued by a corporation that provides a guarantee on behalf of the principal. In the context of a Missouri Bond of Distributees With Corporate Surety, this bond ensures that the distributees will adhere to legal responsibilities related to estate management. By choosing a corporate surety, you benefit from the financial backing and credibility of a well-established company. This enhances trust and security in financial transactions.

A surety bond in Missouri acts as a legal contract that ensures obligations are fulfilled. It often involves three parties: the principal, the obligee, and the surety. When you require a Missouri Bond of Distributees With Corporate Surety, you guarantee that the distributees will manage the estate responsibly and in accordance with the law. If they fail to do so, the surety company compensates the affected parties.

Missouri Revised Statutes section 486.235 requires individuals file a $10,000 surety bond as part of the notary public commission application process. Missouri notary bonds protect the public and state from a notary public's errors or wrongdoings, which can include the following.

But surety bonds are also an important regulatory tool that are good for all. In fact, there are even benefits for the people who must pay for bonds and pay for claims. So yes, surety bonds are worth it.

How to Get a Surety Bond Find the bond requirements in your state for your specific business or industry. Confirm the bond coverage amount needed. Contact a surety company that's licensed to sell bonds in your state. Provide the business details and financial information needed for your quote. Receive your bond quote.

In other words, the cost of your Missouri surety bond will be between 1% and 4% of the amount of the bond. There are further factors that contribute to and influence the cost of your bond. Our surety bond cost guide can provide you with plenty of additional information on the topic.

How much does a Missouri notary bond cost? Missouri notary bonds cost $50 for the state-required 4-year term and include $10,000 of errors and omissions insurance coverage.

Surety bond premiums (the amount you pay) are often calculated as a percentage of the total bond amount, usually between 0.5% and 5% of the bond amount for applicants with good credit, and between 5% up to as much as 20% of the bond amount for applicants with poor credit.