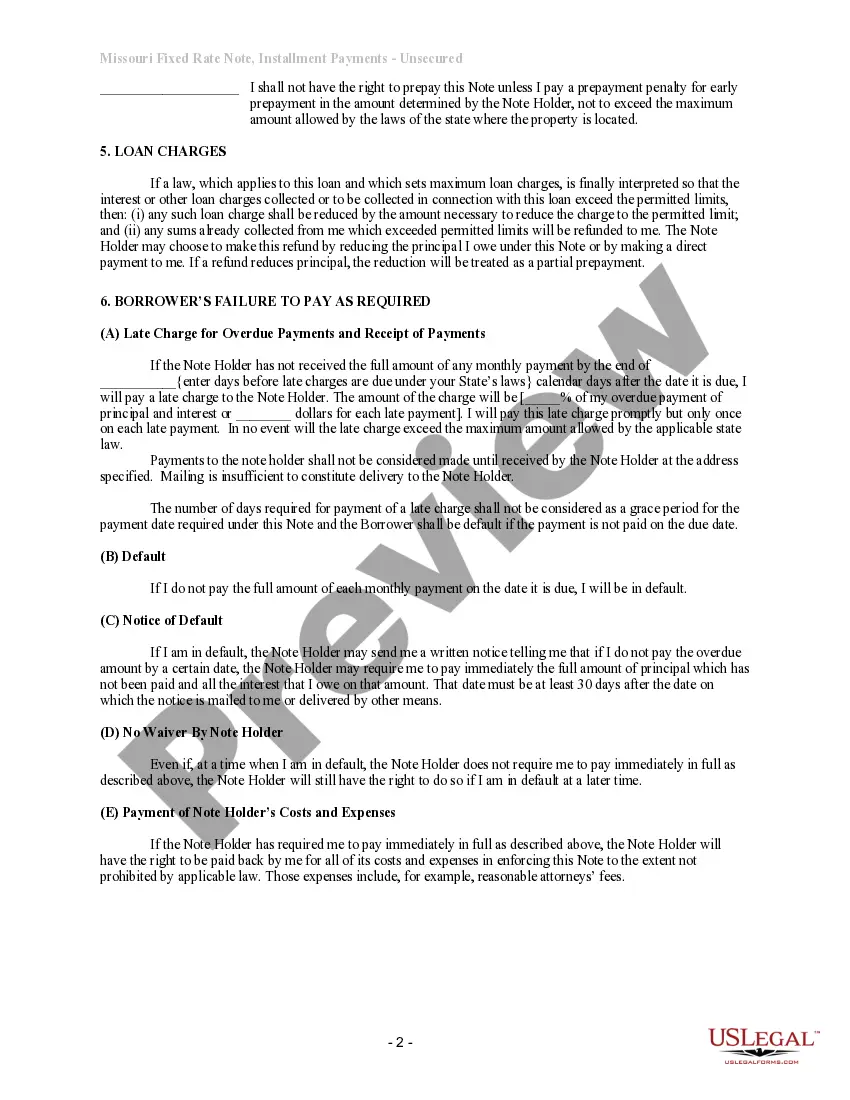

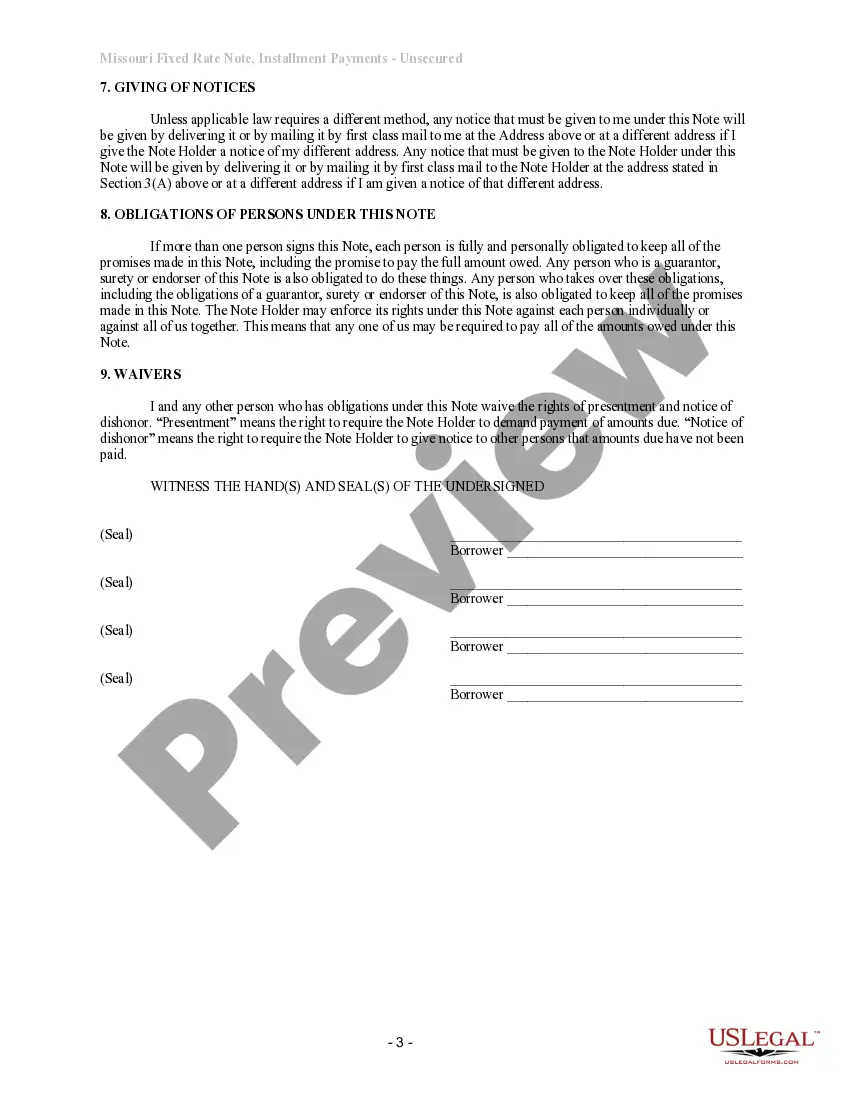

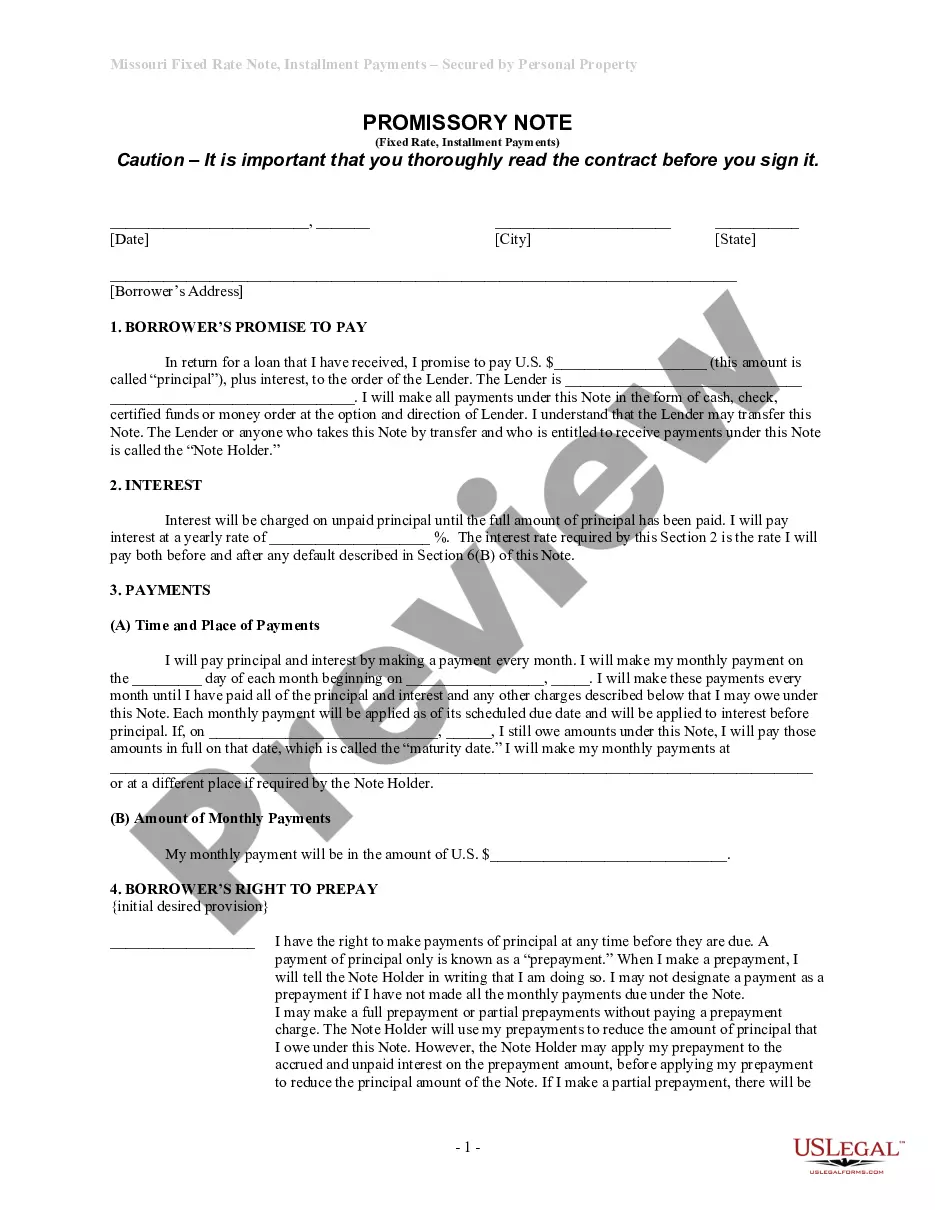

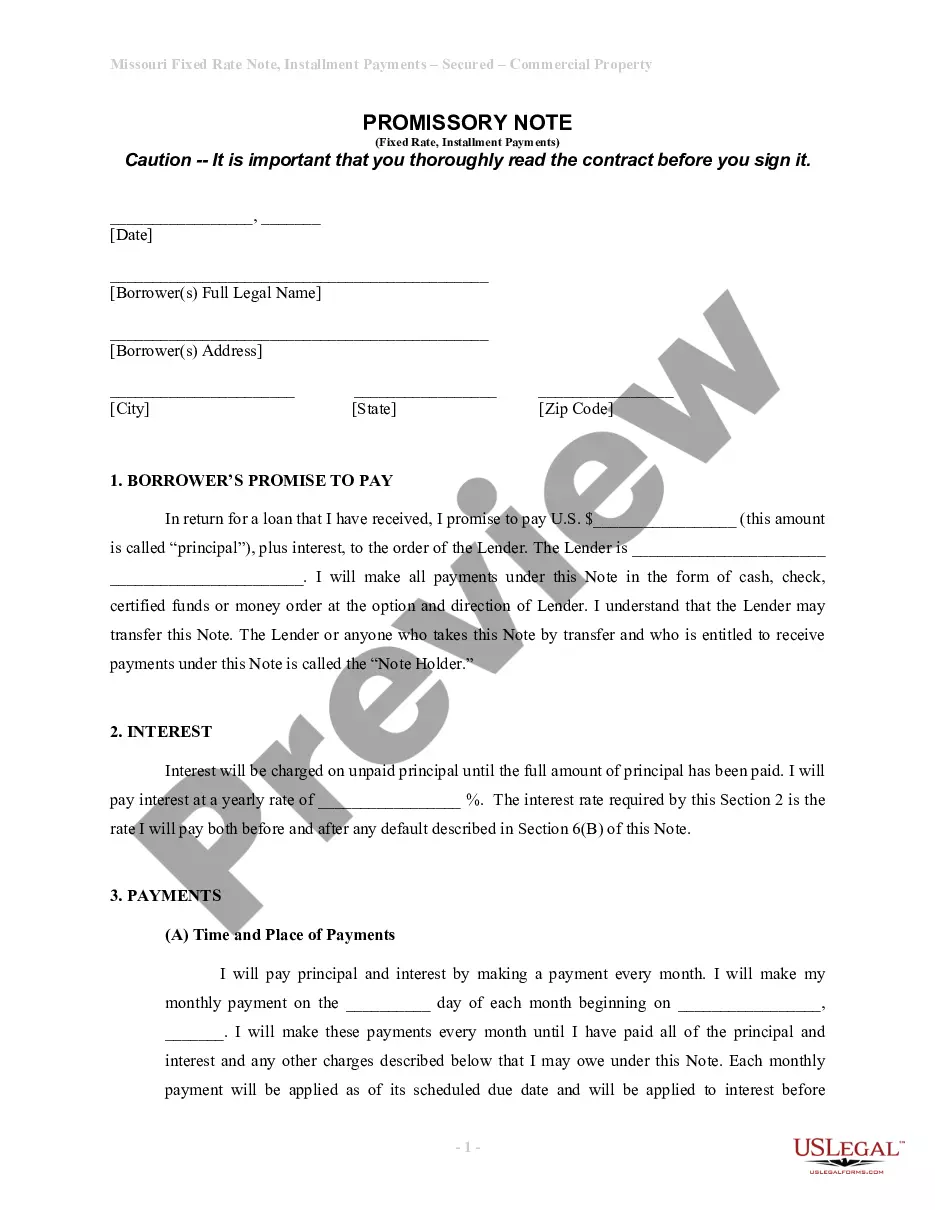

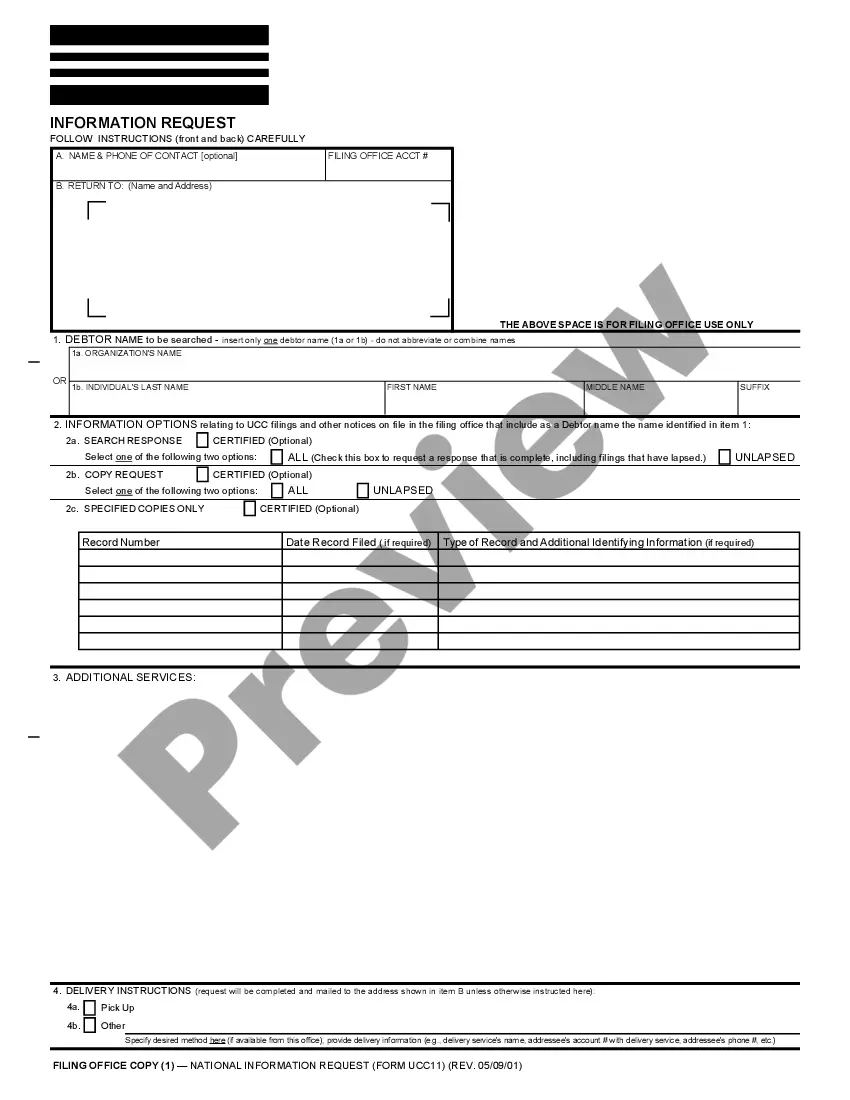

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Missouri Unsecured Installment Payment Promissory Note for Fixed Rate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Unsecured Installment Payment Promissory Note For Fixed Rate?

Obtain any version from 85,000 legal documents including Missouri Unsecured Installment Payment Promissory Note for Fixed Rate online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. Once on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the steps outlined below.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable example. The platform grants you access to forms and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Missouri Unsecured Installment Payment Promissory Note for Fixed Rate swiftly and conveniently.

- Review the state-specific criteria for the Missouri Unsecured Installment Payment Promissory Note for Fixed Rate you need to utilize.

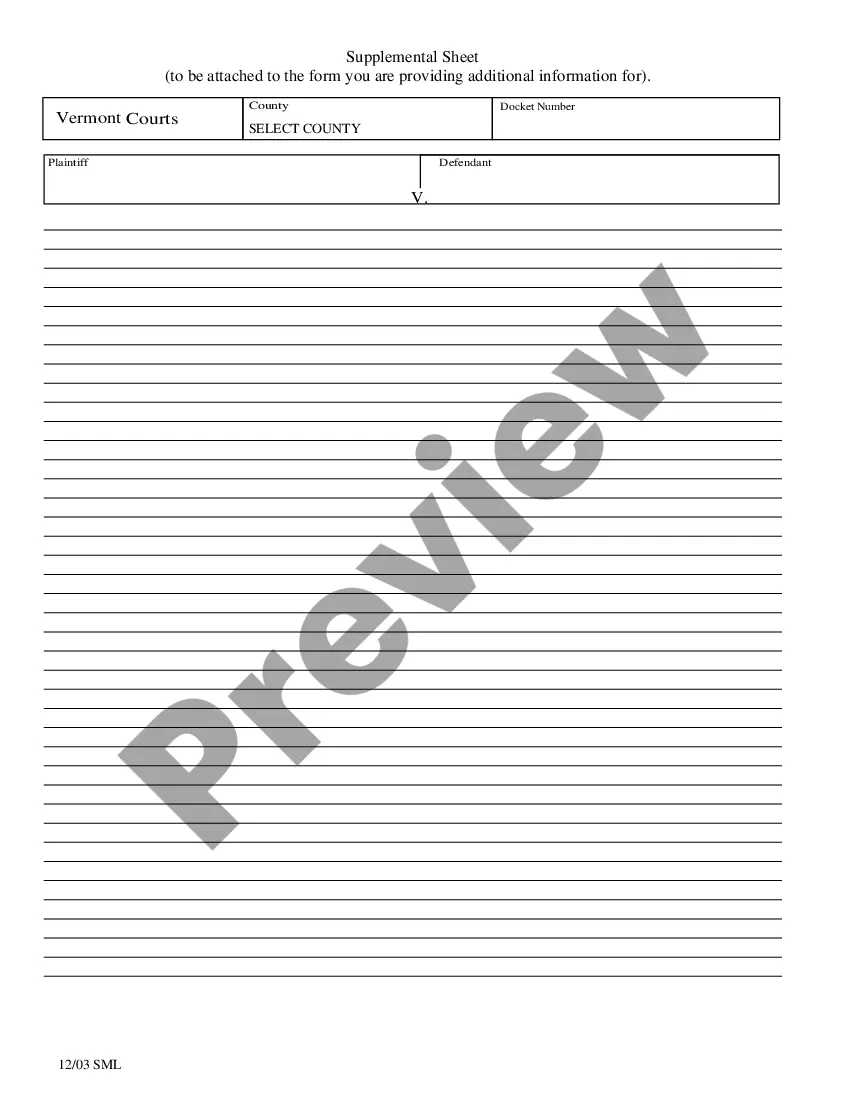

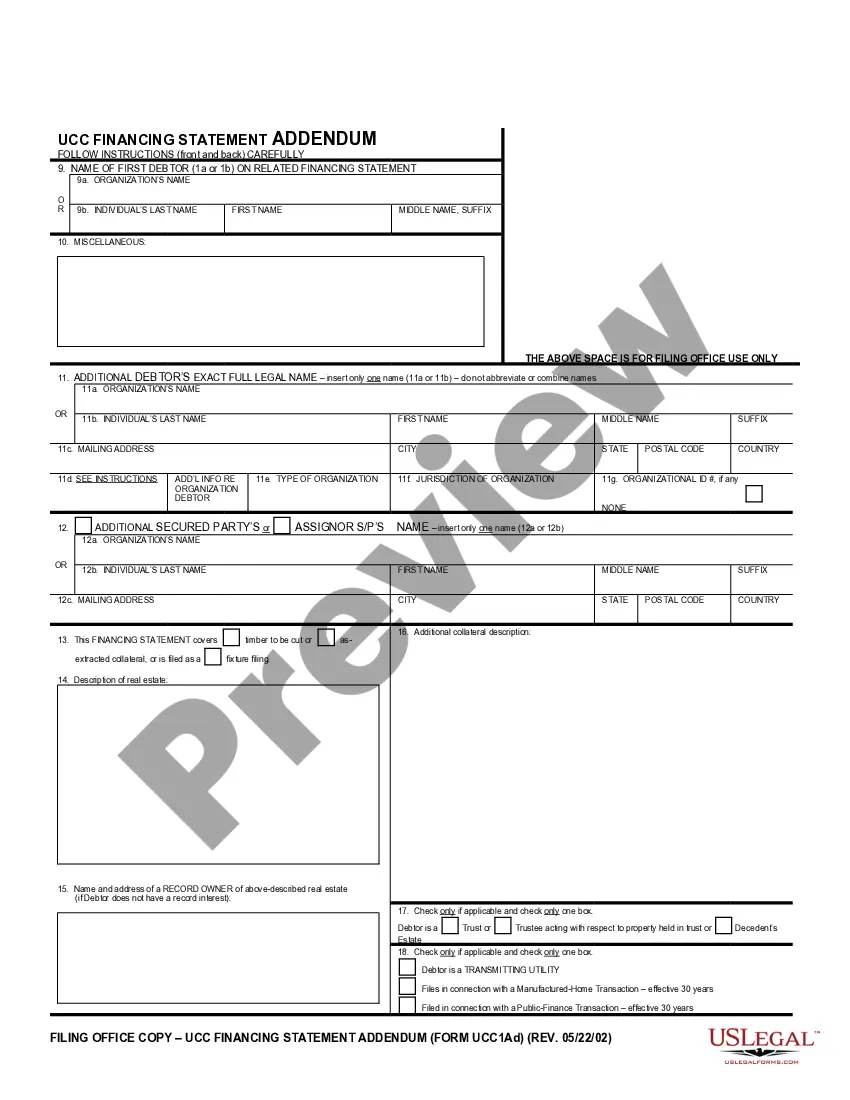

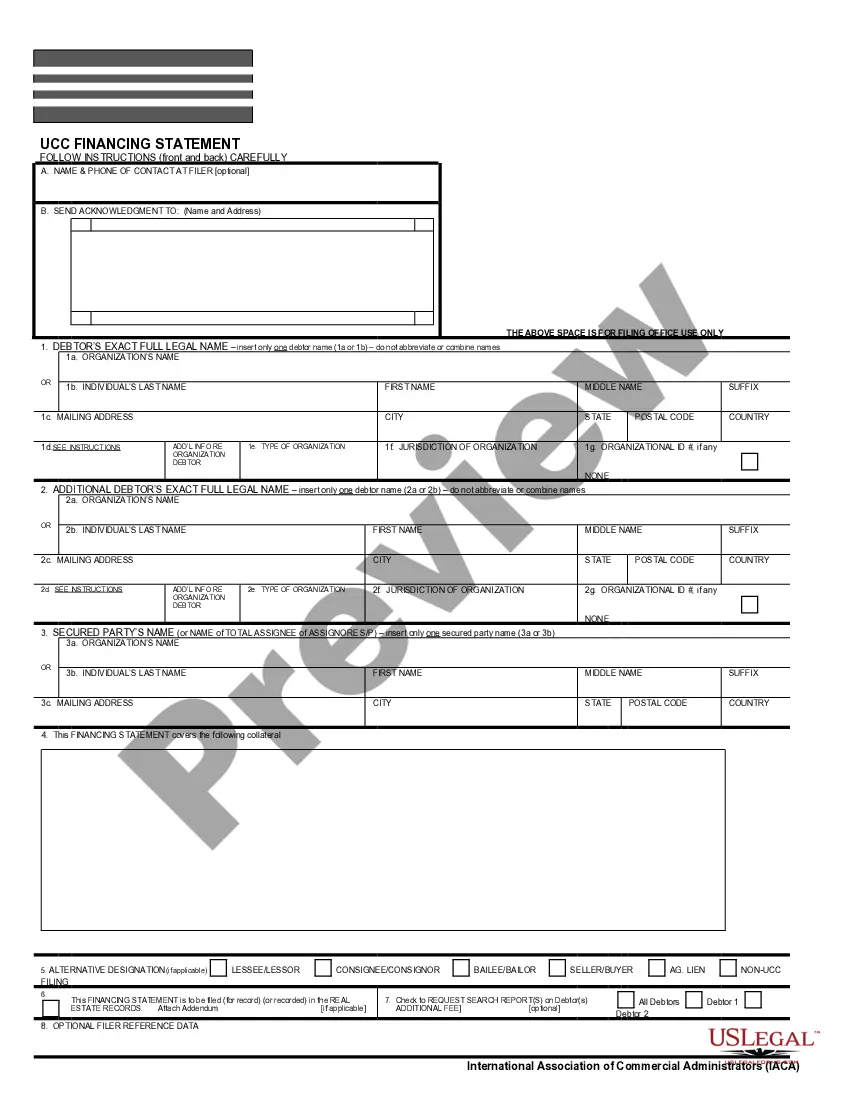

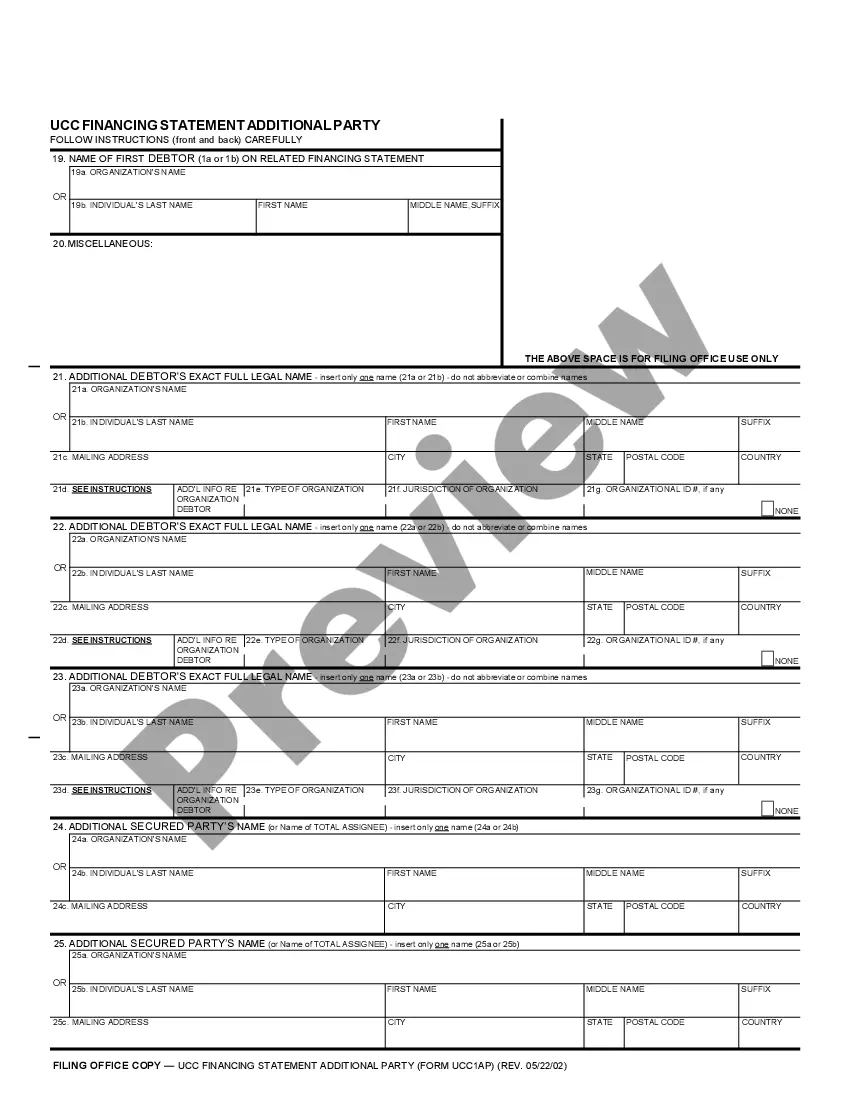

- Examine the description and preview the example.

- Once you are confident the example meets your needs, click on Buy Now.

- Choose a subscription plan that fits your budget.

- Establish a personal account.

- Make a payment using one of two suitable methods: via bank card or through PayPal.

- Select a format to download the document; two options are available (PDF or Word).

- Download the document into the My documents section.

- Once your reusable template is prepared, print it or save it to your device.

Form popularity

FAQ

To fill out a promissory note, start with the basic information such as the date, names, and amounts involved. Next, detail the repayment schedule and terms, including any interest rates. For a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate, ensure that all entries are accurate to uphold the agreement’s validity.

Yes, a promissory note typically includes an interest rate to outline how much the borrower will repay in addition to the principal amount. This rate can be fixed or variable, depending on the agreement. When creating a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate, clearly state the interest rate to avoid misunderstandings.

No, not all promissory notes must be secured. A Missouri Unsecured Installment Payment Promissory Note for Fixed Rate is an example of an unsecured note, meaning it does not require collateral. However, it's important to understand that unsecured notes typically carry a higher risk for lenders. If you're considering creating or using such a note, platforms like US Legal Forms provide valuable resources to help you navigate the details.

A Missouri Unsecured Installment Payment Promissory Note for Fixed Rate can be considered a fixed income investment. This is because the borrower agrees to make regular, predetermined payments over a specified period. As an investor, you can expect consistent returns, which makes it attractive for those seeking stability. It's essential to review the terms of the note to ensure it meets your financial goals.

To enforce a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate, you typically need to provide proof of the note and the borrower's failure to repay as agreed. Begin by sending a formal demand letter requesting payment. If the borrower does not respond, you may consider filing a lawsuit in court. Utilizing platforms like US Legal Forms can help you access the necessary legal documents and guidance for this process.

To collect on an unsecured promissory note, first attempt to communicate directly with the borrower to arrange payment. If informal efforts fail, you may need to send a formal notice or pursue legal action. Using a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate can streamline this process, ensuring that you have a legally binding document for reference.

Yes, a promissory note can be unsecured. This means that it does not require collateral to back it. A Missouri Unsecured Installment Payment Promissory Note for Fixed Rate allows borrowers to access funds without putting up assets, making it a flexible option for many individuals.

In Missouri, it is not a strict requirement for a promissory note to be notarized. However, notarization can provide additional security and validity to your Missouri Unsecured Installment Payment Promissory Note for Fixed Rate. It is advisable to consult with a legal professional or use US Legal Forms to ensure your document meets all legal requirements.

To obtain a legal promissory note, you can start by visiting a reputable platform like US Legal Forms. They offer customizable templates for a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate. Simply choose the template that fits your needs, fill in the required information, and follow the instructions to complete your document.