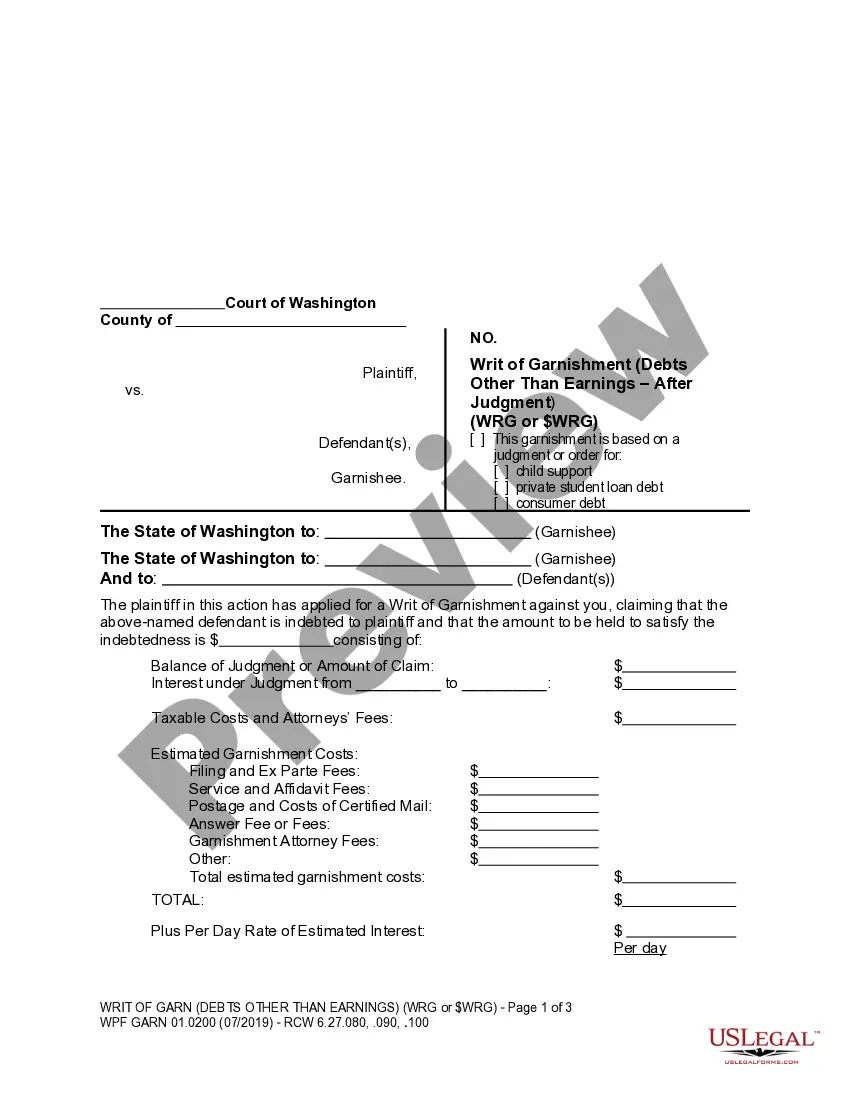

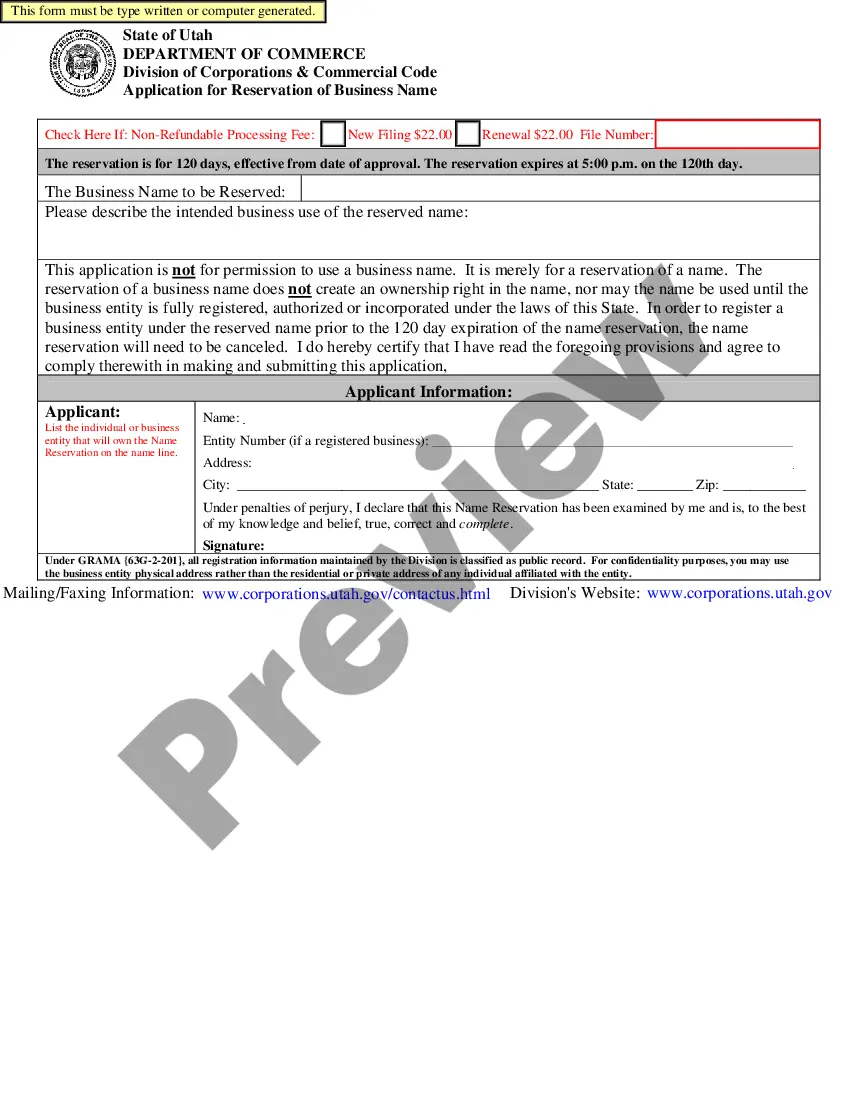

This is an official Washington court form for use in Garnishment cases, an Application for Writ of Garnishment. Available in Word or rich text format.

Washington WPF GARN 01.0100 - Application for Writ of Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington WPF GARN 01.0100 - Application For Writ Of Garnishment?

Out of the multitude of platforms that provide legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before purchasing them. Its complete library of 85,000 samples is grouped by state and use for efficiency. All of the forms on the service have already been drafted to meet individual state requirements by accredited lawyers.

If you have a US Legal Forms subscription, just log in, look for the template, hit Download and access your Form name from the My Forms; the My Forms tab keeps all your saved forms.

Keep to the guidelines below to obtain the document:

- Once you see a Form name, make certain it’s the one for the state you really need it to file in.

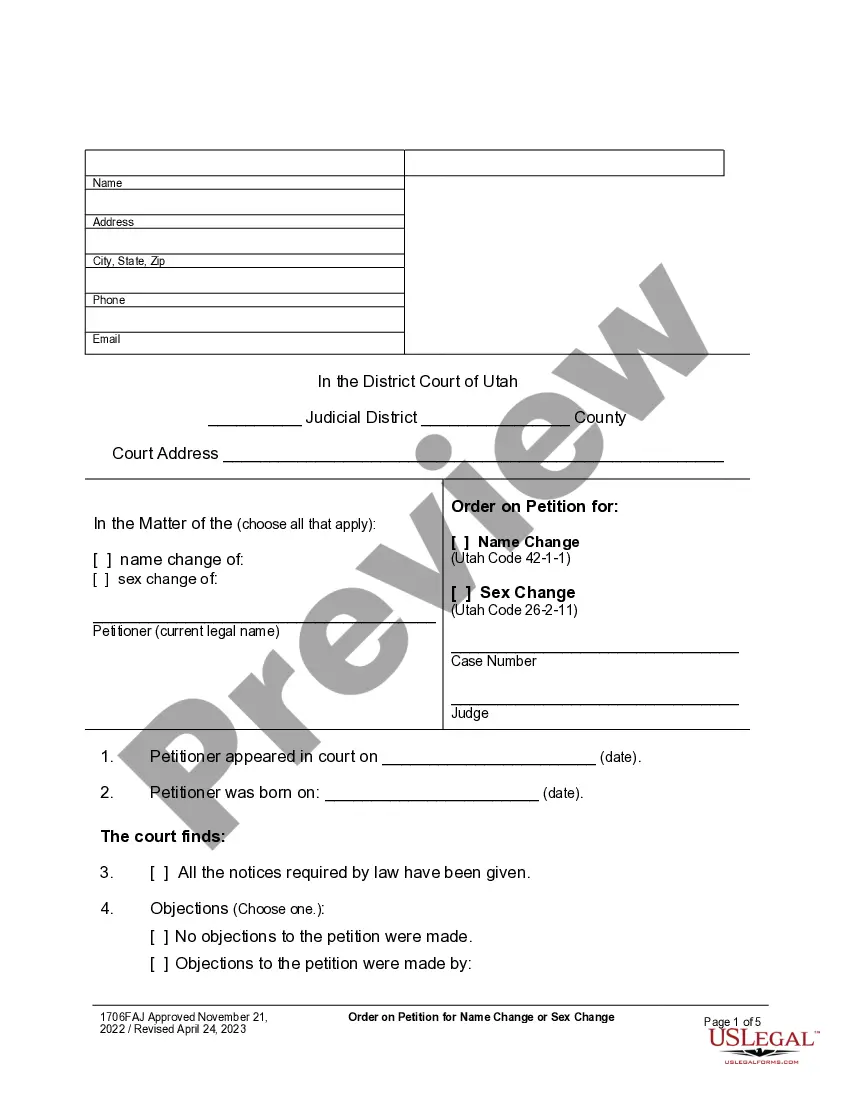

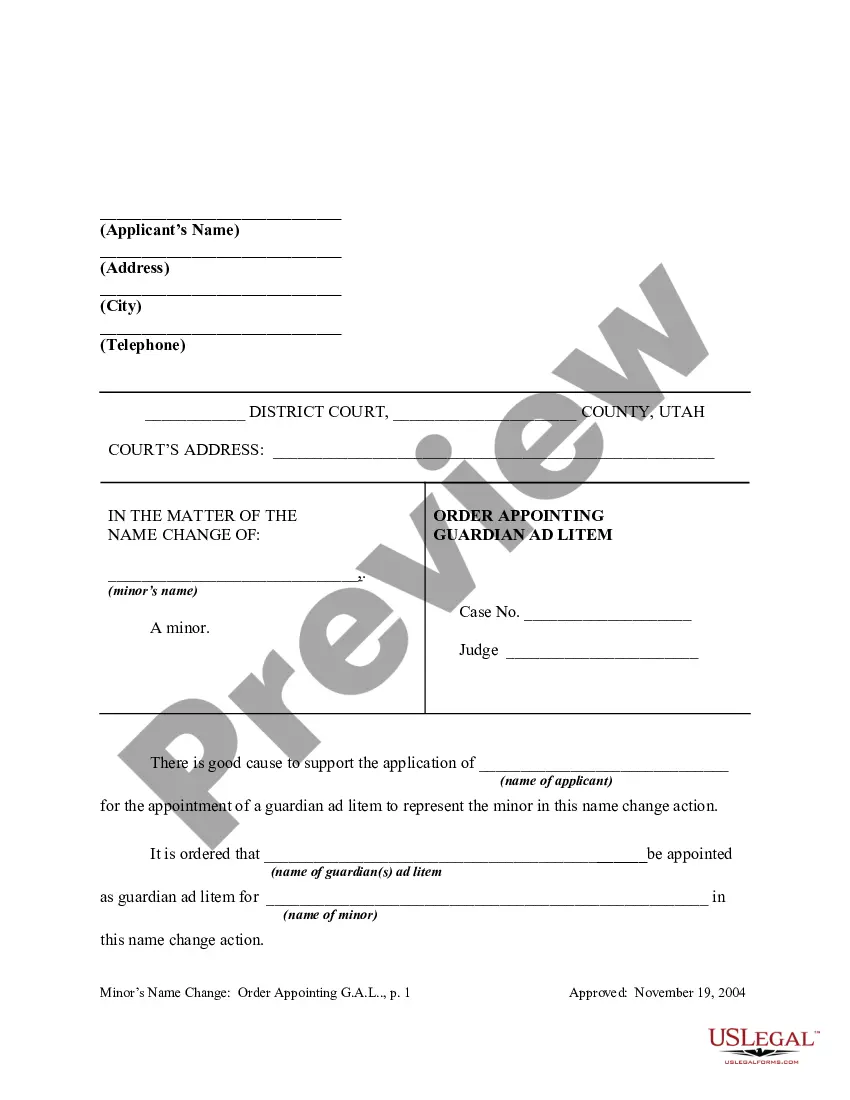

- Preview the form and read the document description before downloading the sample.

- Look for a new template via the Search field if the one you have already found isn’t appropriate.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

After you’ve downloaded your Form name, you are able to edit it, fill it out and sign it in an online editor of your choice. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains the most updated version in your state. Our platform offers quick and simple access to templates that suit both lawyers and their clients.

Form popularity

FAQ

A wage garnishment, or "continuing lien on earnings", is effective for 60 days from the date of service of the writ.

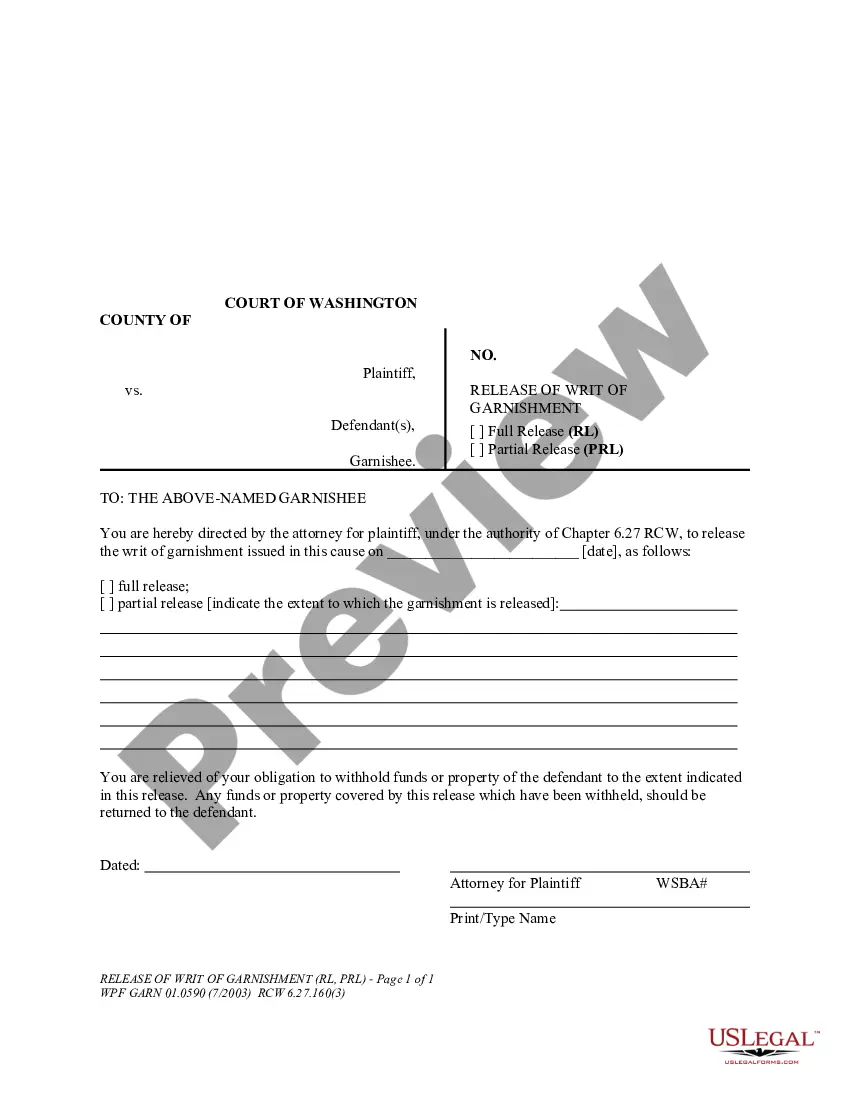

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

If your wages are being garnished or you are about to be garnished and you live in Washington State, give Symmes Law Group a call at 206-682-7975 to stop your wage garnishment immediately or use our contact form to tell us about your case.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

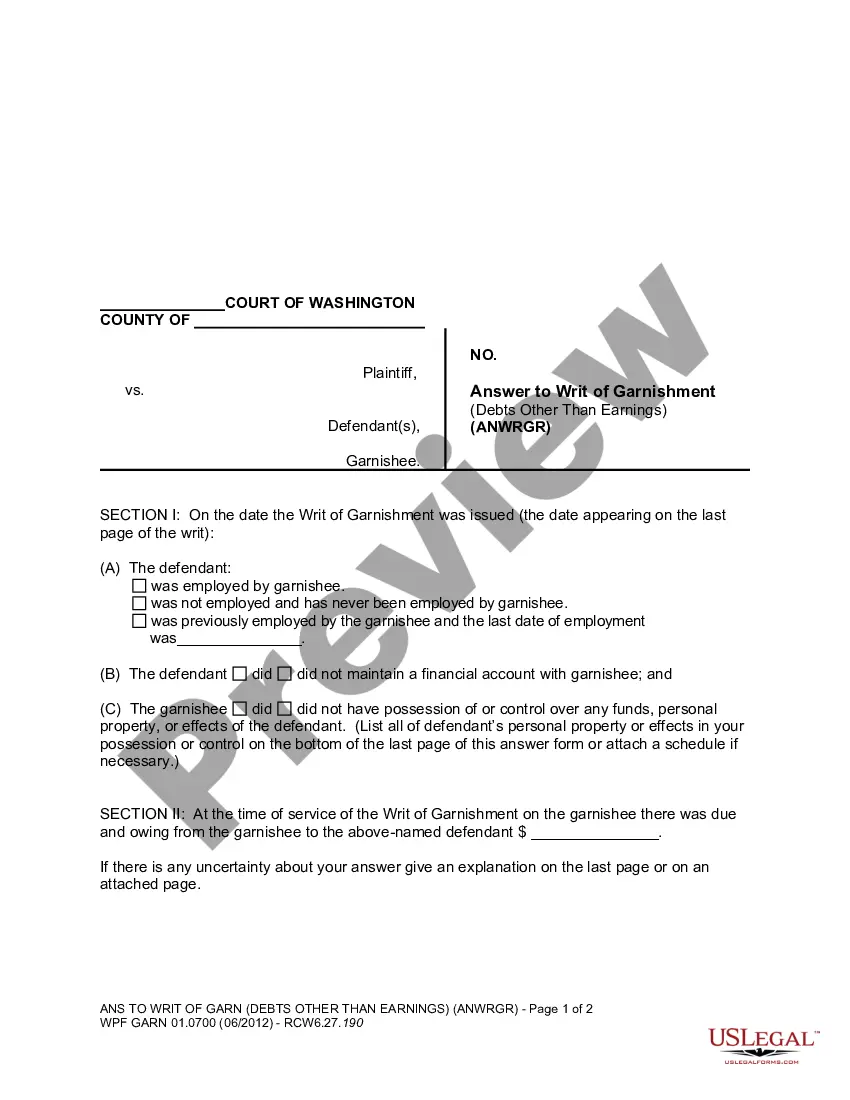

The creditor must serve the Writ of Garnishment on the garnishee via certified mail, restricted delivery, private process, or sheriff/constable. For more information on service of process see Frequently Asked Questions about Service.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.