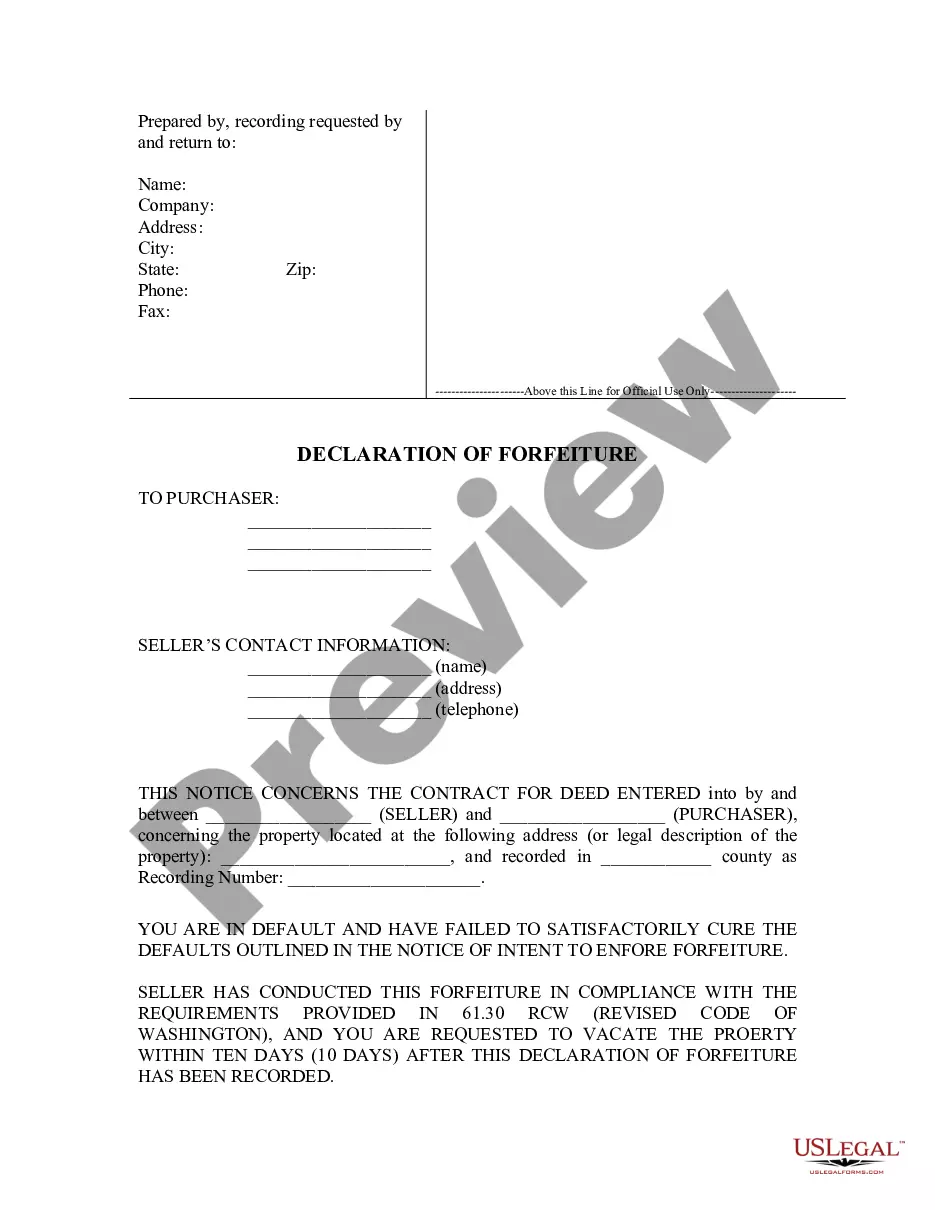

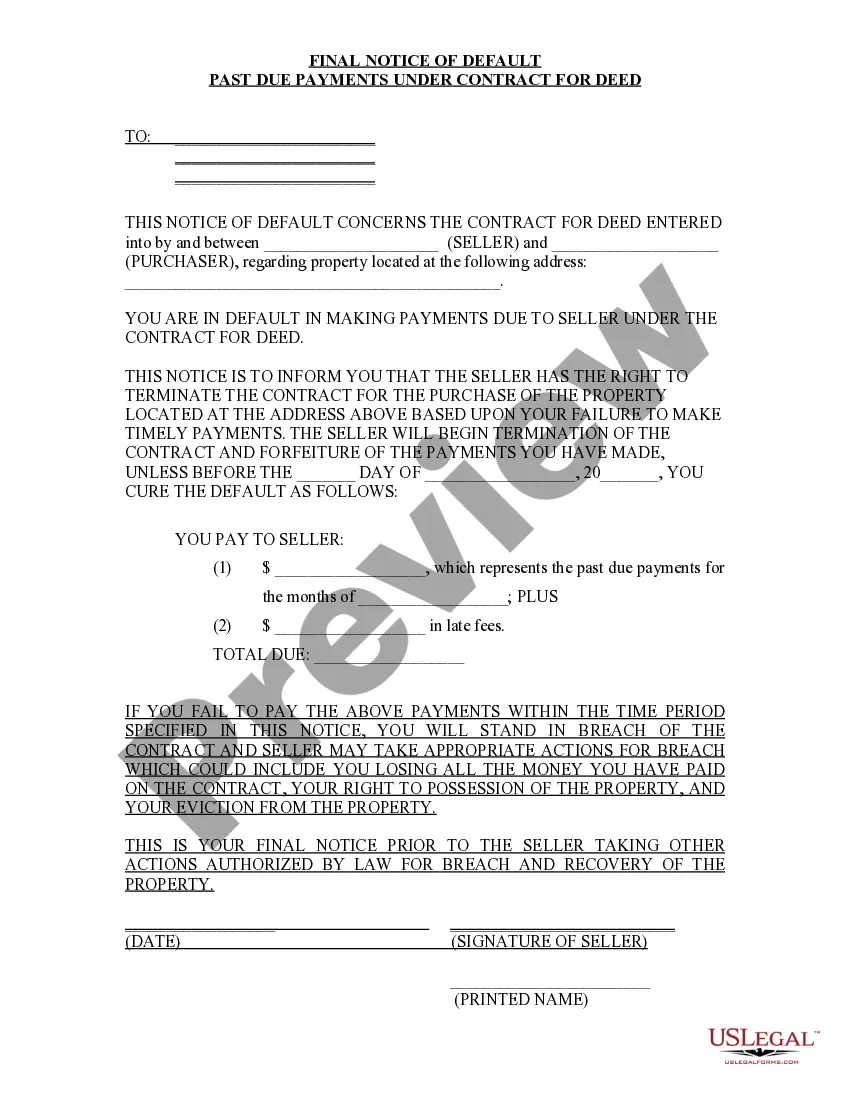

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Missouri Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Installments Fixed Rate Promissory Note Secured By Personal Property?

Obtain any version from 85,000 lawful documents including Missouri Installments Fixed Rate Promissory Note Secured by Personal Property online with US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you already possess a subscription, Log In. When you arrive on the form’s page, click on the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the steps outlined below.

After your reusable template is prepared, print it out or save it to your device. With US Legal Forms, you will consistently have prompt access to the appropriate downloadable template. The platform provides access to documents and organizes them into categories to enhance your search experience. Use US Legal Forms to acquire your Missouri Installments Fixed Rate Promissory Note Secured by Personal Property quickly and effortlessly.

- Verify the state-specific criteria for the Missouri Installments Fixed Rate Promissory Note Secured by Personal Property you wish to utilize.

- Examine the description and preview the example.

- Once you are confident that the template meets your requirements, click on Buy Now.

- Select a subscription plan that aligns with your financial plan.

- Establish a personal account.

- Make a payment using one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents tab.

Form popularity

FAQ

To collect on an unsecured promissory note, you should first communicate directly with the borrower. Establish a clear understanding of the payment terms outlined in your Missouri Installments Fixed Rate Promissory Note Secured by Personal Property. If the borrower fails to respond or adhere to the agreement, consider sending a formal demand letter. If necessary, you may need to pursue legal action, which could involve filing a lawsuit to recover the owed amount.

In Missouri, a promissory note does not need to be notarized to be legally binding. However, for a Missouri Installments Fixed Rate Promissory Note Secured by Personal Property, notarization can enhance the document’s credibility. Notarizing the note can help prevent future legal complications by providing proof of the parties' agreement. To make the process easier, consider using uslegalforms, which offers templates and guidance for notarization.

A promissory note can still be valid even if it is not notarized. In the context of a Missouri Installments Fixed Rate Promissory Note Secured by Personal Property, the essential elements include clear terms and the signatures of the involved parties. However, notarization adds a layer of authenticity and can prevent disputes about the signer's identity. Therefore, while notarization is not strictly required, it is often recommended to strengthen the document's validity.

A promissory note can hold up in court if it is properly executed and meets the legal requirements. This includes having clear terms regarding repayment and sufficient identification of the parties involved. A well-drafted Missouri Installments Fixed Rate Promissory Note Secured by Personal Property increases the likelihood of enforceability in legal disputes.

In Missouri, the statute of limitations for enforcing a promissory note is typically five years. This means that a lender has five years from the date of default to take legal action. Understanding these timeframes is crucial when dealing with a Missouri Installments Fixed Rate Promissory Note Secured by Personal Property.

Using a promissory note involves certain risks for both borrowers and lenders. For borrowers, failing to repay can lead to losing the personal property used as collateral. For lenders, there is a risk that the borrower may default, requiring legal action to recover the owed amount, especially in the context of a Missouri Installments Fixed Rate Promissory Note Secured by Personal Property.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Personal Promissory Notes This is a particular loan taken from family or friends. Commercial Here, the note is made when dealing with commercial lenders such as banks. Real Estate This is similar to commercial notes in terms of nonpayment consequences.

What is the difference between a Promissory Note and a Loan Agreement? Both contracts evidence a debt owed from the Borrower to the Lender, but the Loan Agreement contains more extensive clauses than the Promissory Note. Further, only the Borrower signs the promissory note while both parties sign a loan agreement.