Washington Promissory Note with Due on Sale and Commerical Property options

Description

How to fill out Washington Promissory Note With Due On Sale And Commerical Property Options?

How much time and resources do you normally spend on drafting formal documentation? There’s a better way to get such forms than hiring legal experts or spending hours browsing the web for a suitable blank. US Legal Forms is the premier online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Washington Promissory Note with Due on Sale and Commerical Property options.

To get and prepare an appropriate Washington Promissory Note with Due on Sale and Commerical Property options blank, adhere to these simple instructions:

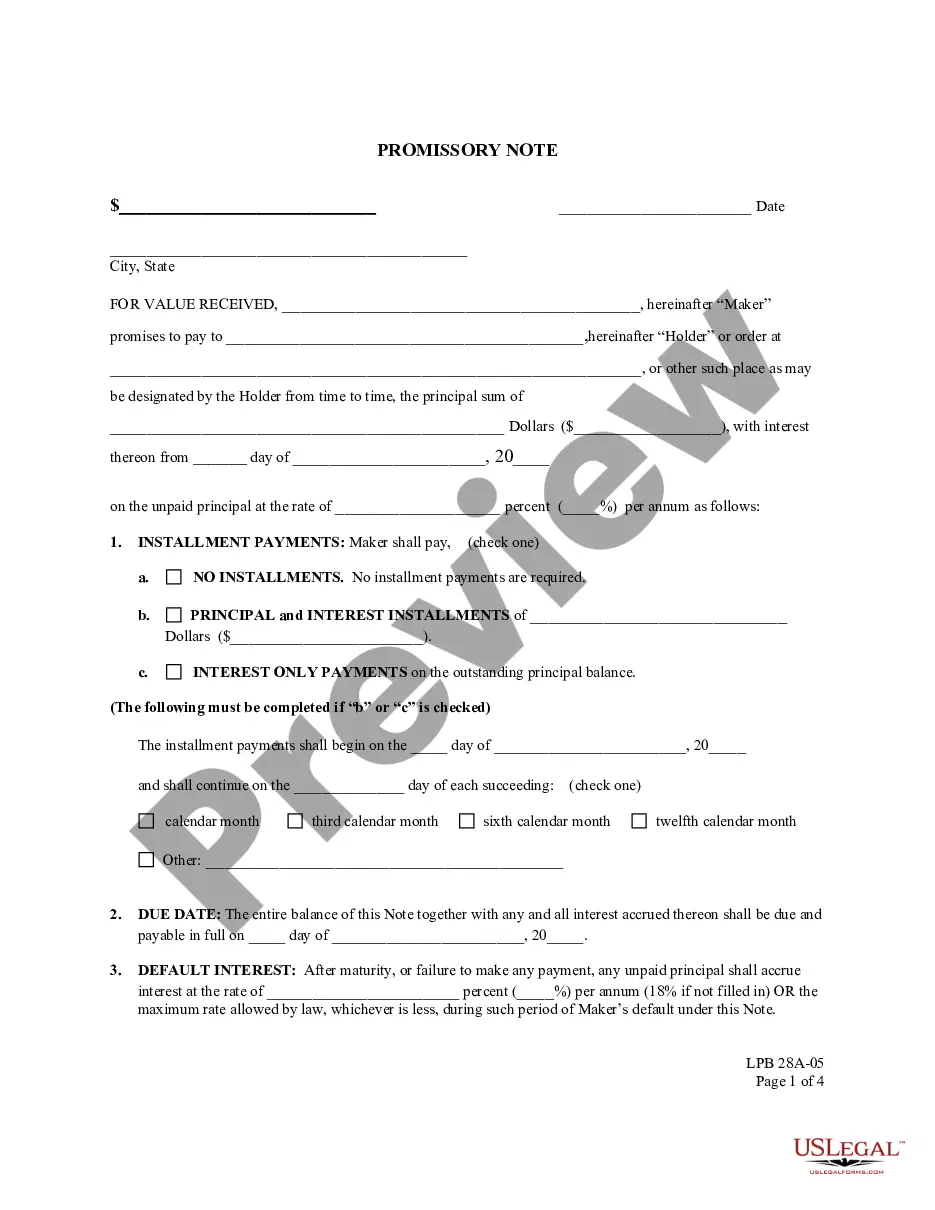

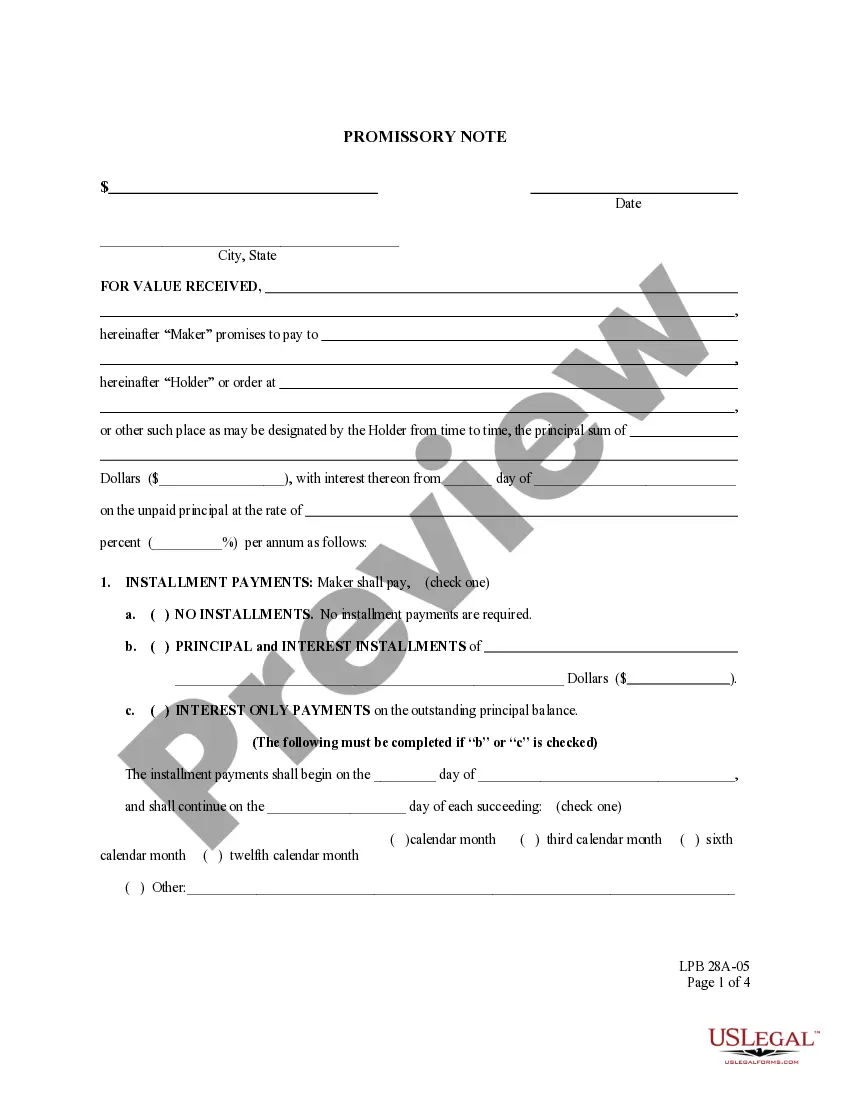

- Examine the form content to make sure it complies with your state requirements. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Washington Promissory Note with Due on Sale and Commerical Property options. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely safe for that.

- Download your Washington Promissory Note with Due on Sale and Commerical Property options on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort preparing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

The note always should set forth, at a minimum, the parties, the amount owed, the payment terms, the interest rate, and the creditor's remedies upon default. Promissory notes can operate as security agreements if the right provisions are included.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

There are two major types of promissory notes, secured and unsecured. Secured promissory notes have collateral behind them to secure the loan. Unsecured notes might have a personal guarantee but no valuable collateral, which carries a higher degree of risk of financial loss.

Promissory notes are legally binding, but if a note becomes invalid, it may not be enforceable. A promissory note could become invalid if: It isn't signed by both parties.

1. Commercial promissory notes: A commercial promissory note is a formal type of promissory note that institutions like credit unions or banks typically issue to borrowers. Commercial lenders might use these for auto loans, personal loans, or business loans to private individuals.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

But specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

The key difference between commercial paper and promissory notes is who they are typically issued to. Commercial paper is usually issued by businesses to other businesses, while promissory notes are usually issued by businesses to individuals.