Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

What this document covers

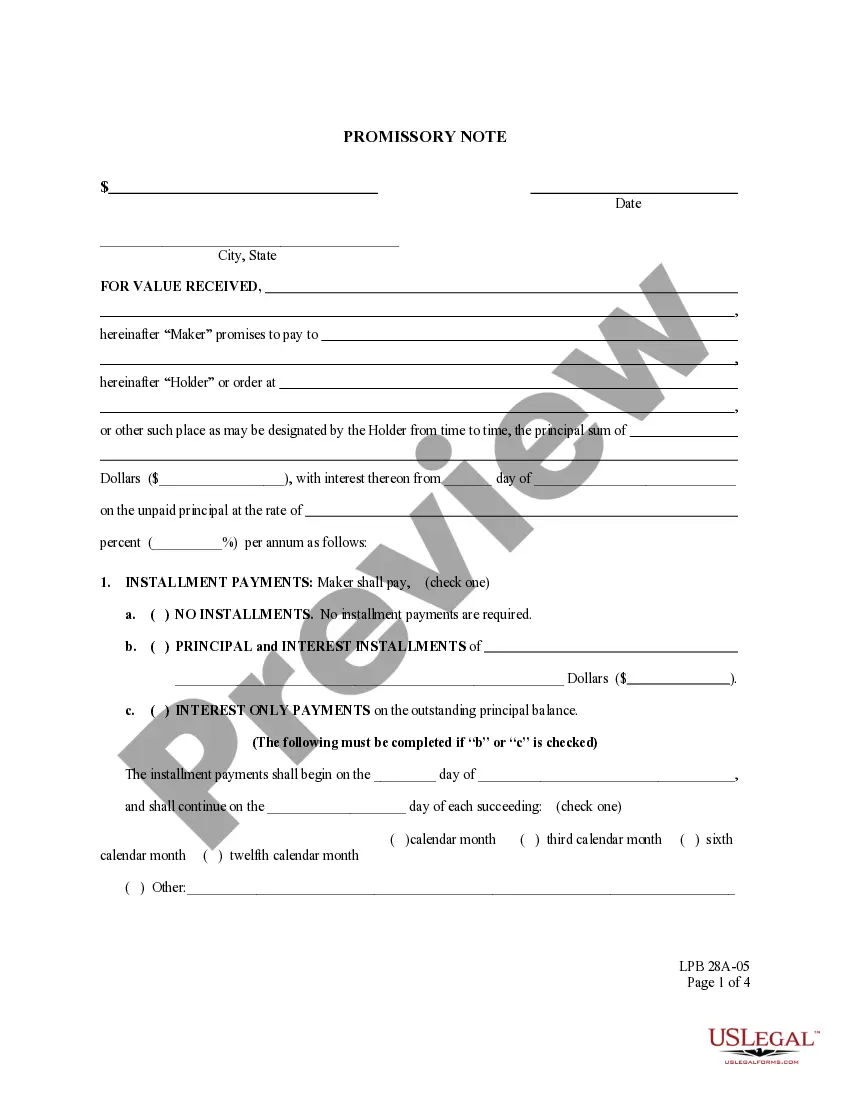

The Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document used when a borrower agrees to repay a loan with fixed-rate installments. This type of promissory note is specifically secured by commercial real estate, distinguishing it from unsecured notes. It outlines the borrowerâs promise to pay back the principal amount plus interest, detailing payment methods, due dates, and conditions of default, making it crucial for borrowers who are financing real estate investments or expansions.

Key parts of this document

- Borrower's promise to pay: Details the principal amount and payment obligations to the lender.

- Interest rate: Specifies the annual interest rate applicable to the outstanding principal.

- Payment schedule: Outlines monthly payment amounts and due dates until maturity.

- Prepayment rights: Describes circumstances under which the borrower may make early payments.

- Default conditions: Explains what constitutes a default and the lenderâs rights in such events.

Situations where this form applies

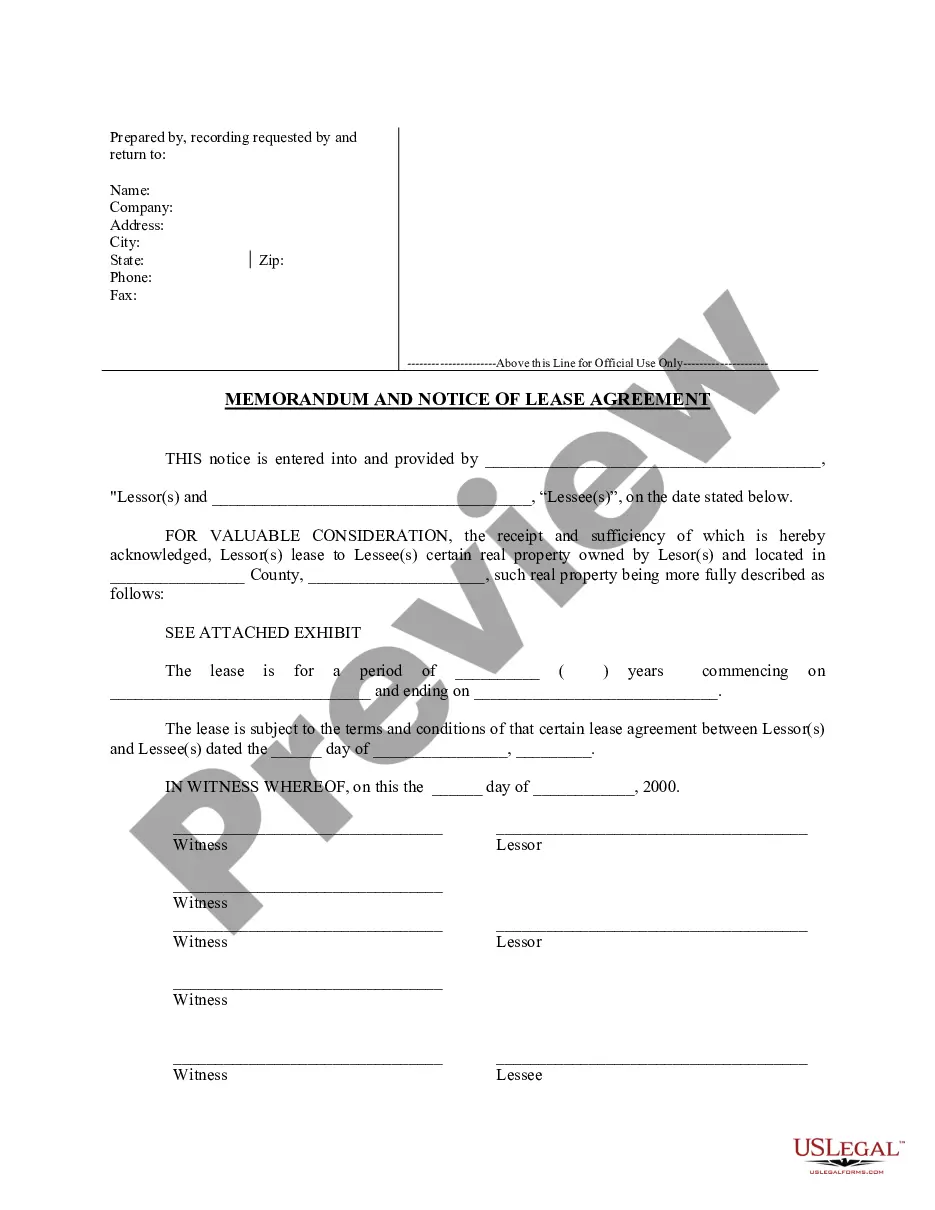

This form is used when a borrower seeks to secure a loan with commercial real estate as collateral. It is applicable in various scenarios such as purchasing commercial properties, refinancing existing loans, or securing funds for property improvements. By formally documenting the terms of the loan, both the borrower and lender have clear expectations concerning repayment, interest, and penalties for default.

Who should use this form

- Commercial property owners seeking financing.

- Real estate developers needing capital for property projects.

- Business owners using commercial real estate as collateral for loans.

- Lenders offering loans secured by commercial real estate.

How to prepare this document

- Identify the parties involved, including the borrower and lender.

- Specify the loan amount as the principal and the interest rate.

- Complete the payment schedule by entering the payment amounts and due dates.

- Include the borrower's right to prepay terms, if applicable.

- Sign and date the document where indicated.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to clearly define the loan amount and interest rate.

- Not signing the document or omitting required signatures.

- Incorrectly specifying payment terms, which can lead to confusion.

- Ignoring prepayment rights or penalties when applicable.

Why use this form online

- Easy access to legally compliant templates created by licensed attorneys.

- Convenient download and print options available anytime.

- Editability allows users to customize the form to fit specific needs.

- Clear instructions and guidelines provided, reducing the chance of errors.

Looking for another form?

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank which makes it a bearer instrument under Article 3 of the Uniform Commercial Code. So, any party that possesses the note has the legal authority to enforce it.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

What Is a Promissory Note? A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

What is the difference between a Promissory Note and a Loan Agreement? Both contracts evidence a debt owed from the Borrower to the Lender, but the Loan Agreement contains more extensive clauses than the Promissory Note. Further, only the Borrower signs the promissory note while both parties sign a loan agreement.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.