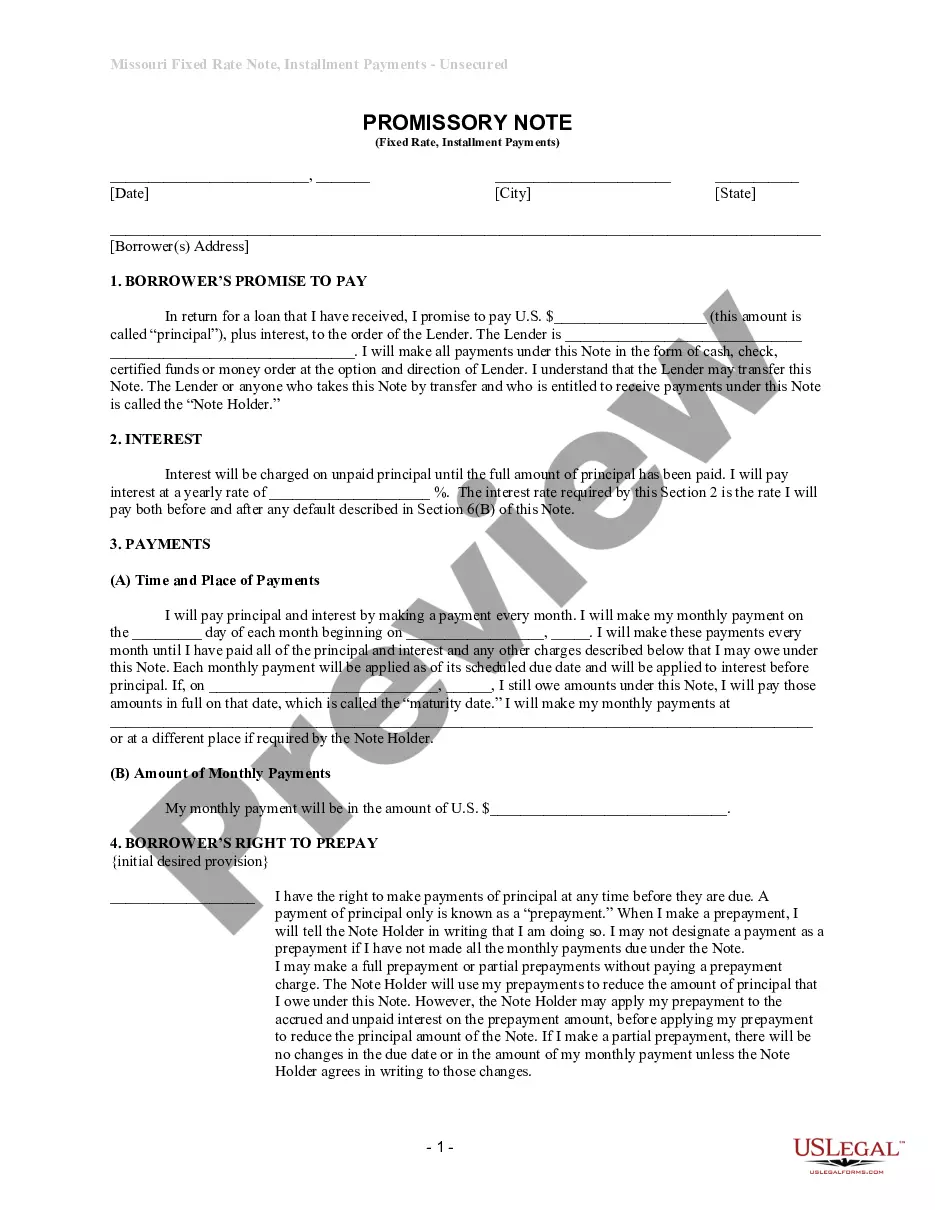

Missouri Unsecured Installment Payment Promissory Note for Fixed Rate

What is this form?

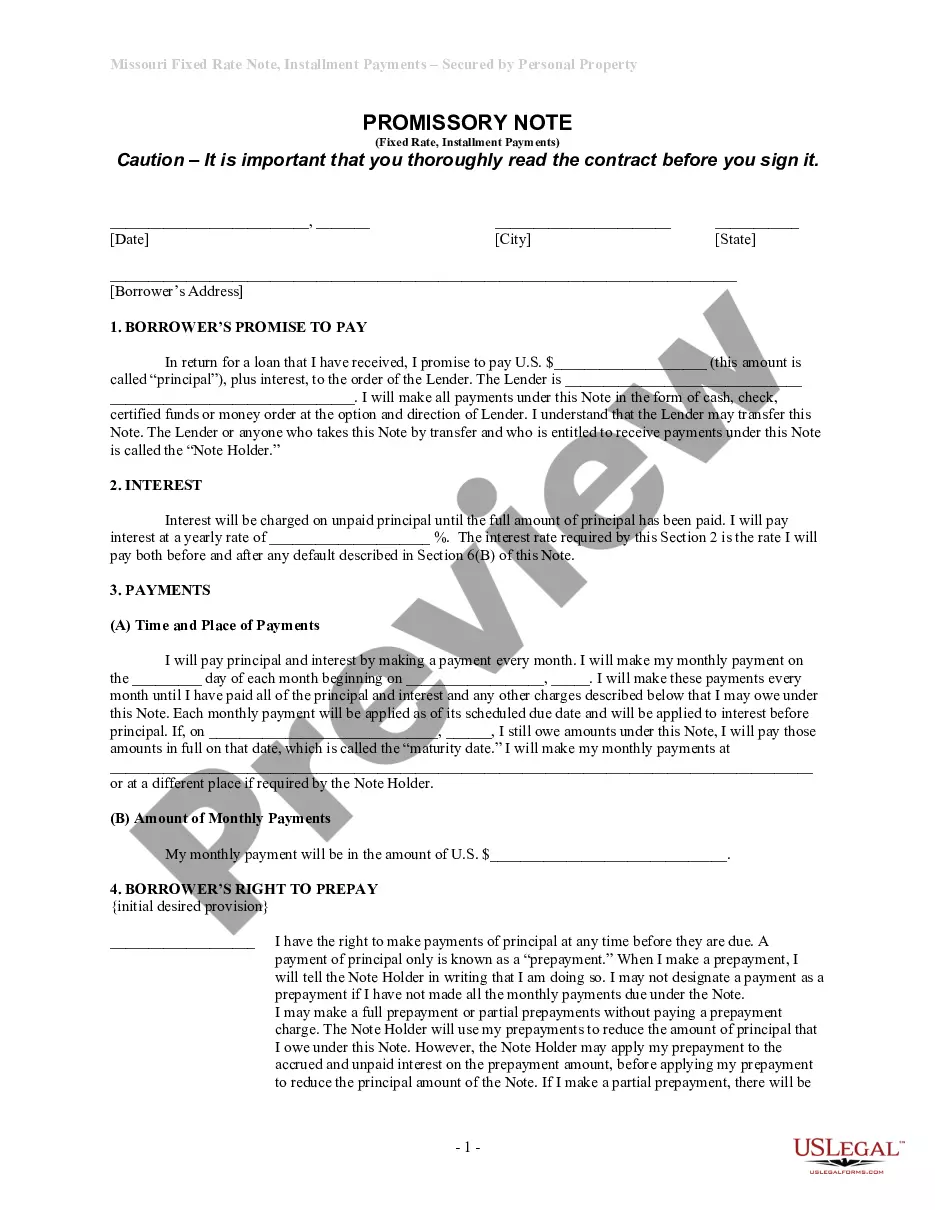

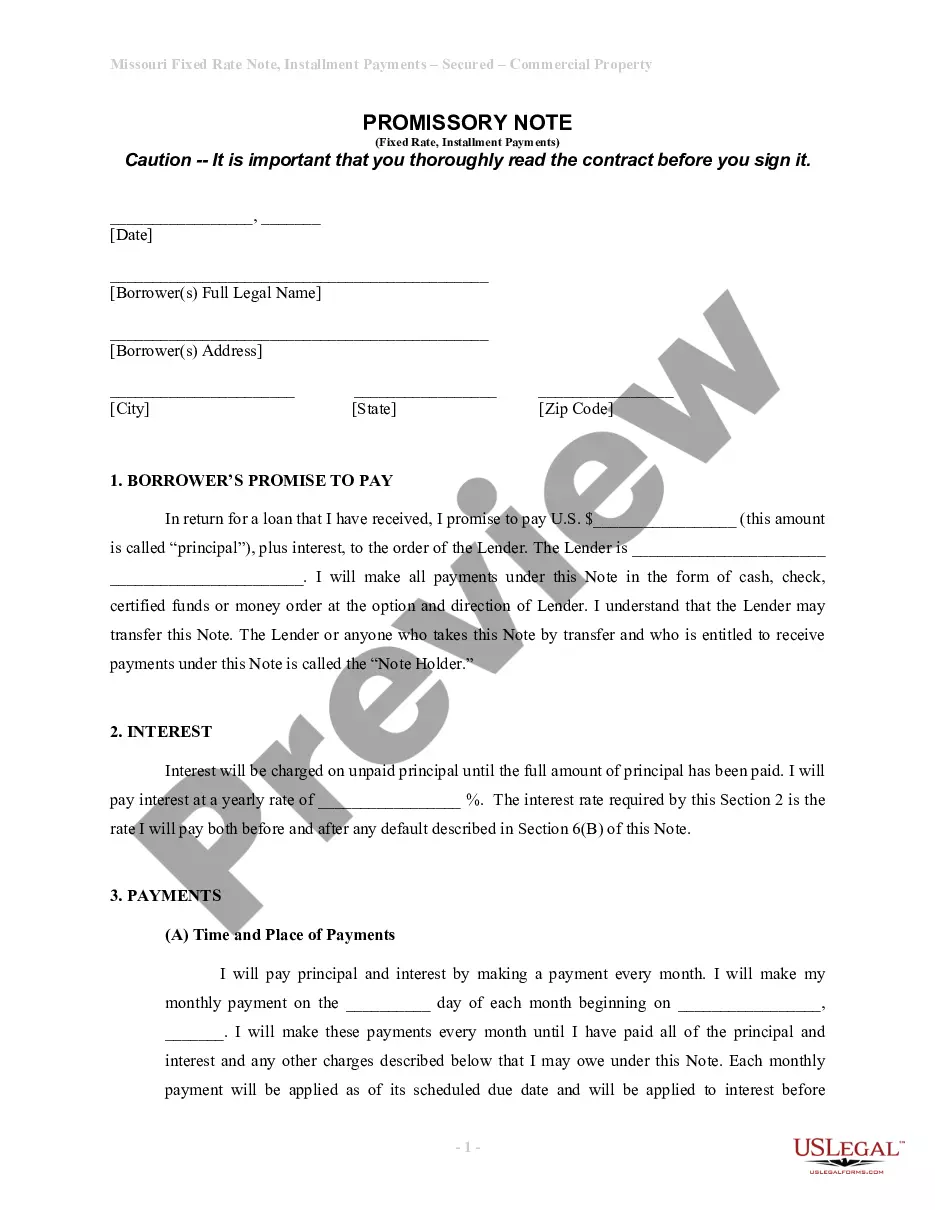

The Missouri Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document whereby a borrower promises to repay a loan amount, or principal, to a lender with a fixed interest rate over a specified period in installment payments. As an unsecured note, it does not require collateral, making it ideal for personal loans without risk to the borrowerâs property. This form is distinct from secured notes, which are backed by collateral, providing flexibility and convenience for borrowers seeking financing without putting assets at risk.

Key parts of this document

- Borrower and lender identification, including addresses.

- Loan amount (principal) and agreed interest rate.

- Payment schedule detailing monthly payment amounts and maturity date.

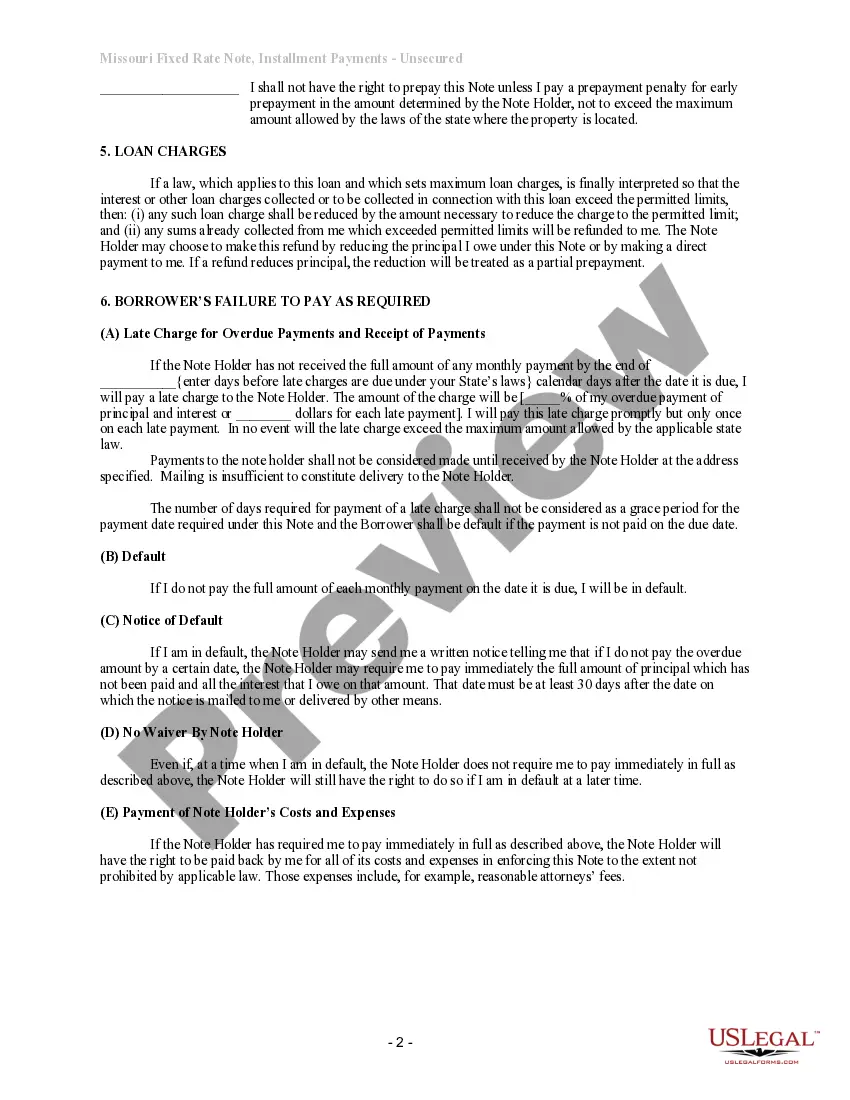

- Provision for prepayment of principal without penalties.

- Clauses addressing late payments, defaults, and their consequences.

- Notice requirements for both the borrower and lender.

When this form is needed

This promissory note is useful in various situations, such as when an individual or business borrows money without pledging assets as collateral. You may need this form when borrowing from family, friends, or private lenders. It is also applicable for personal loans offered by lenders that do not secure the debt against property, allowing for more flexibility in repayment terms.

Intended users of this form

- Individuals seeking to borrow money from a private lender.

- Businesses looking for unsecured financing options.

- Borrowers wanting clear repayment terms and conditions.

- Anyone needing an easily customizable loan agreement.

How to complete this form

- Identify the borrower and lender by entering their names and addresses.

- Specify the loan amount (principal) and fixed interest rate.

- Detail the payment schedule, including the start date and amount of monthly payments.

- Include any terms related to prepayment and potential penalties.

- Review clauses regarding late payments or defaults to understand implications.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to enter the correct loan amount or interest rate.

- Not specifying the payment due dates accurately.

- Overlooking the implications of the default clauses.

- Not notifying the lender of any prepayments in writing.

Advantages of online completion

- Offers immediate access to a legally sound document.

- Allows for easy customization to fit individual borrowing needs.

- Provides a clear structure to ensure all key terms are addressed.

- Ensures compliance with Missouri state laws.

Legal use & context

- The document is legally enforceable in Missouri as a contractual agreement.

- It outlines borrower obligations, including timely repayments and consequences for default.

- Clearly defined terms help prevent disputes between borrowers and lenders.

Looking for another form?

Form popularity

FAQ

To fill out a promissory note, start with the basic information such as the date, names, and amounts involved. Next, detail the repayment schedule and terms, including any interest rates. For a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate, ensure that all entries are accurate to uphold the agreement’s validity.

Yes, a promissory note typically includes an interest rate to outline how much the borrower will repay in addition to the principal amount. This rate can be fixed or variable, depending on the agreement. When creating a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate, clearly state the interest rate to avoid misunderstandings.

No, not all promissory notes must be secured. A Missouri Unsecured Installment Payment Promissory Note for Fixed Rate is an example of an unsecured note, meaning it does not require collateral. However, it's important to understand that unsecured notes typically carry a higher risk for lenders. If you're considering creating or using such a note, platforms like US Legal Forms provide valuable resources to help you navigate the details.

A Missouri Unsecured Installment Payment Promissory Note for Fixed Rate can be considered a fixed income investment. This is because the borrower agrees to make regular, predetermined payments over a specified period. As an investor, you can expect consistent returns, which makes it attractive for those seeking stability. It's essential to review the terms of the note to ensure it meets your financial goals.

To enforce a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate, you typically need to provide proof of the note and the borrower's failure to repay as agreed. Begin by sending a formal demand letter requesting payment. If the borrower does not respond, you may consider filing a lawsuit in court. Utilizing platforms like US Legal Forms can help you access the necessary legal documents and guidance for this process.

To collect on an unsecured promissory note, first attempt to communicate directly with the borrower to arrange payment. If informal efforts fail, you may need to send a formal notice or pursue legal action. Using a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate can streamline this process, ensuring that you have a legally binding document for reference.

Yes, a promissory note can be unsecured. This means that it does not require collateral to back it. A Missouri Unsecured Installment Payment Promissory Note for Fixed Rate allows borrowers to access funds without putting up assets, making it a flexible option for many individuals.

In Missouri, it is not a strict requirement for a promissory note to be notarized. However, notarization can provide additional security and validity to your Missouri Unsecured Installment Payment Promissory Note for Fixed Rate. It is advisable to consult with a legal professional or use US Legal Forms to ensure your document meets all legal requirements.

To obtain a legal promissory note, you can start by visiting a reputable platform like US Legal Forms. They offer customizable templates for a Missouri Unsecured Installment Payment Promissory Note for Fixed Rate. Simply choose the template that fits your needs, fill in the required information, and follow the instructions to complete your document.