Missouri Consent and Subordination Agreement

Description

accessions to collateral.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Consent And Subordination Agreement?

Obtain any type of document from 85,000 legal papers such as the Missouri Consent and Subordination Agreement online with US Legal Forms. Each template is crafted and refreshed by state-certified lawyers.

If you already possess a subscription, Log In. Once you’re on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t signed up yet, follow the steps outlined below.

With US Legal Forms, you’ll consistently have instant access to the relevant downloadable template. The service provides you with access to documents and categorizes them to simplify your search. Utilize US Legal Forms to obtain your Missouri Consent and Subordination Agreement quickly and effortlessly.

- Verify the state-specific requirements for the Missouri Consent and Subordination Agreement you intend to use.

- Browse through the description and preview the example.

- Once you’re confident the example meets your needs, click on Buy Now.

- Select a subscription plan that fits your financial plan.

- Establish a personal account.

- Make a payment in one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

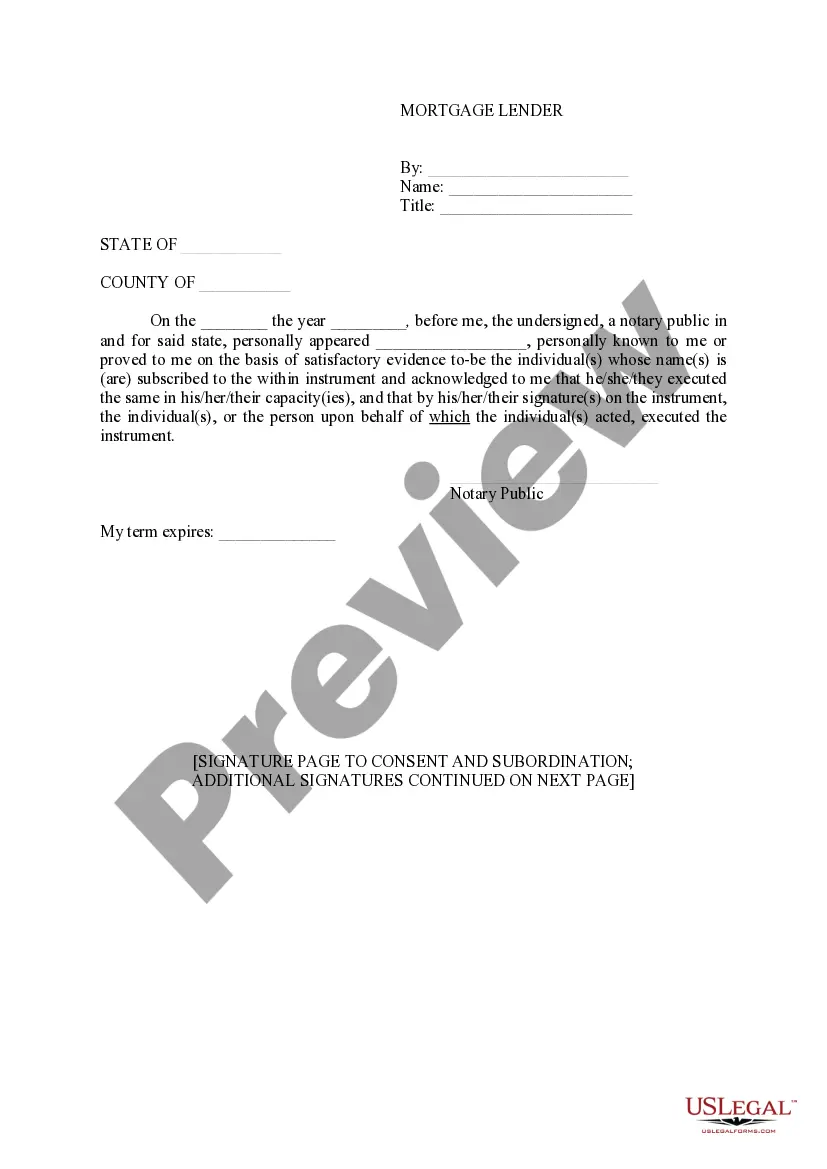

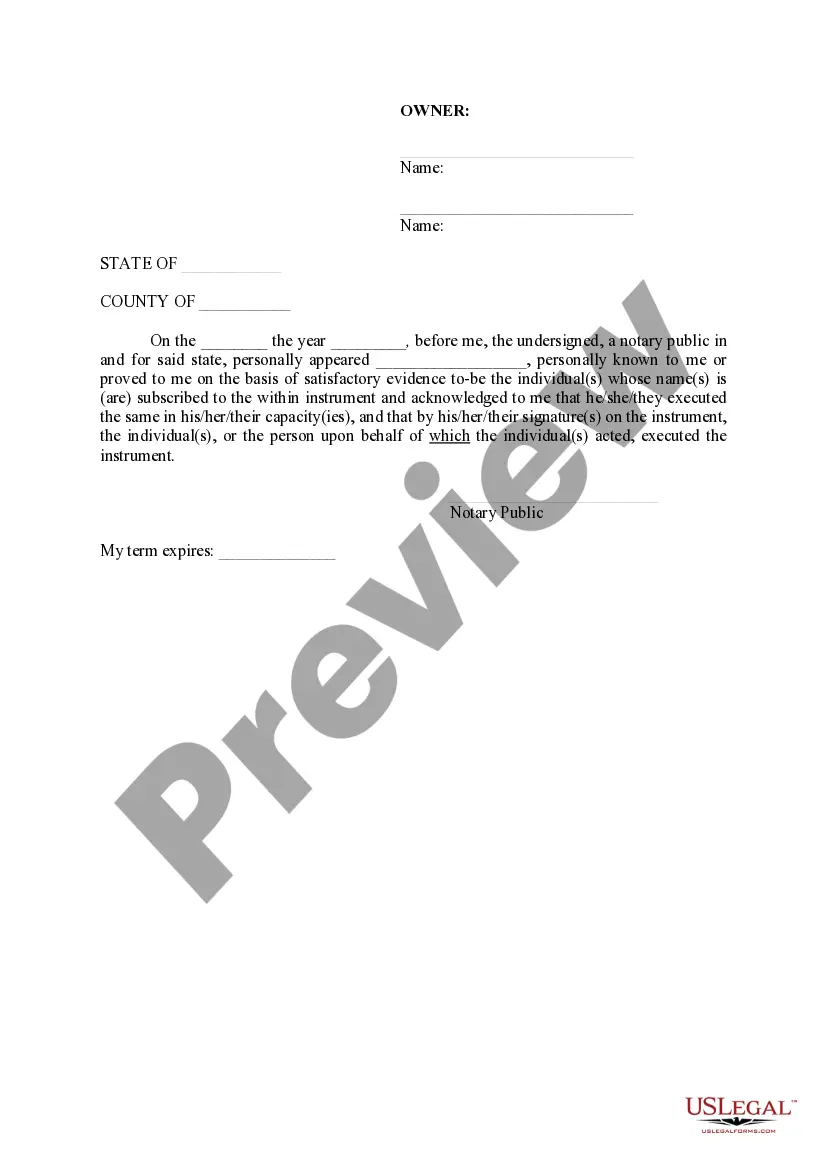

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

A subordination agreement often comes up when a home has a first and a second mortgage, and the borrower wants to refinance the first mortgage. If you have two mortgages on your home and refinance the first loan, the refinancing lender might require a subordination agreement.

What is a Subordinate Mortgage? Subordinate mortgages are loans that have a lower priority status than any other recorded liens (or debts) against a property. When you get the loan you need to purchase your home, this loan is typically recorded as the first repayment priority on your deed after closing.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

A subordination agreement acknowledges that one party's claim or interest is superior to that of another party in the event that the borrower's assets must be liquidated to repay the debts.