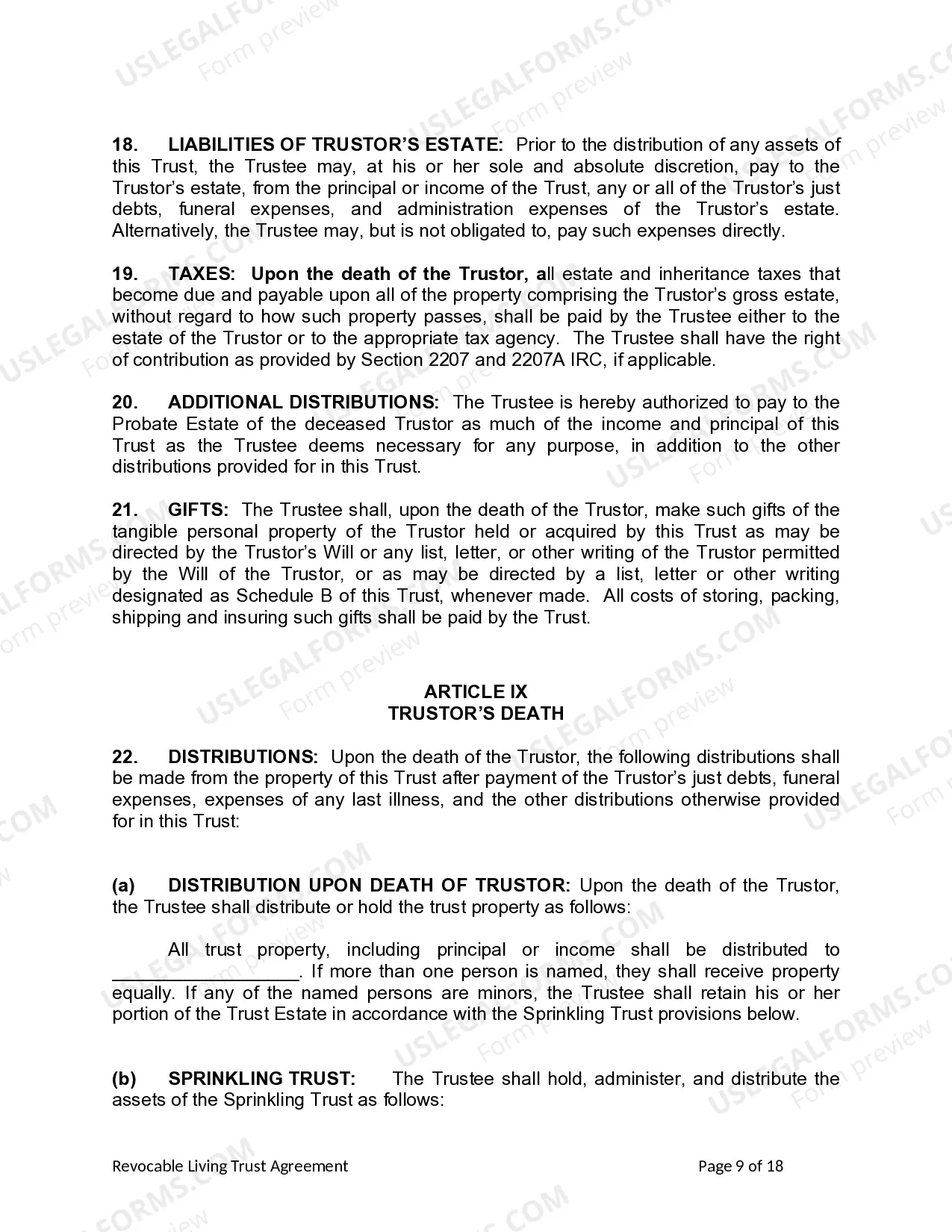

This Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Obtain any document from 85,000 legal records such as Missouri Living Trust for Individuals Who Are Single, Divorced, or Widowed (or Widower) Without Children online with US Legal Forms. Each template is crafted and updated by state-licensed legal experts.

If you already possess a subscription, Log In. Once you reach the form’s page, click the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the instructions outlined below.

With US Legal Forms, you will consistently have quick access to the suitable downloadable sample. The platform provides you access to documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Missouri Living Trust for Individuals Who Are Single, Divorced, or Widowed (or Widower) Without Children swiftly and effortlessly.

- Verify the state-specific criteria for the Missouri Living Trust for Individuals Who Are Single, Divorced, or Widowed (or Widower) Without Children that you need to utilize.

- Review the description and preview the template.

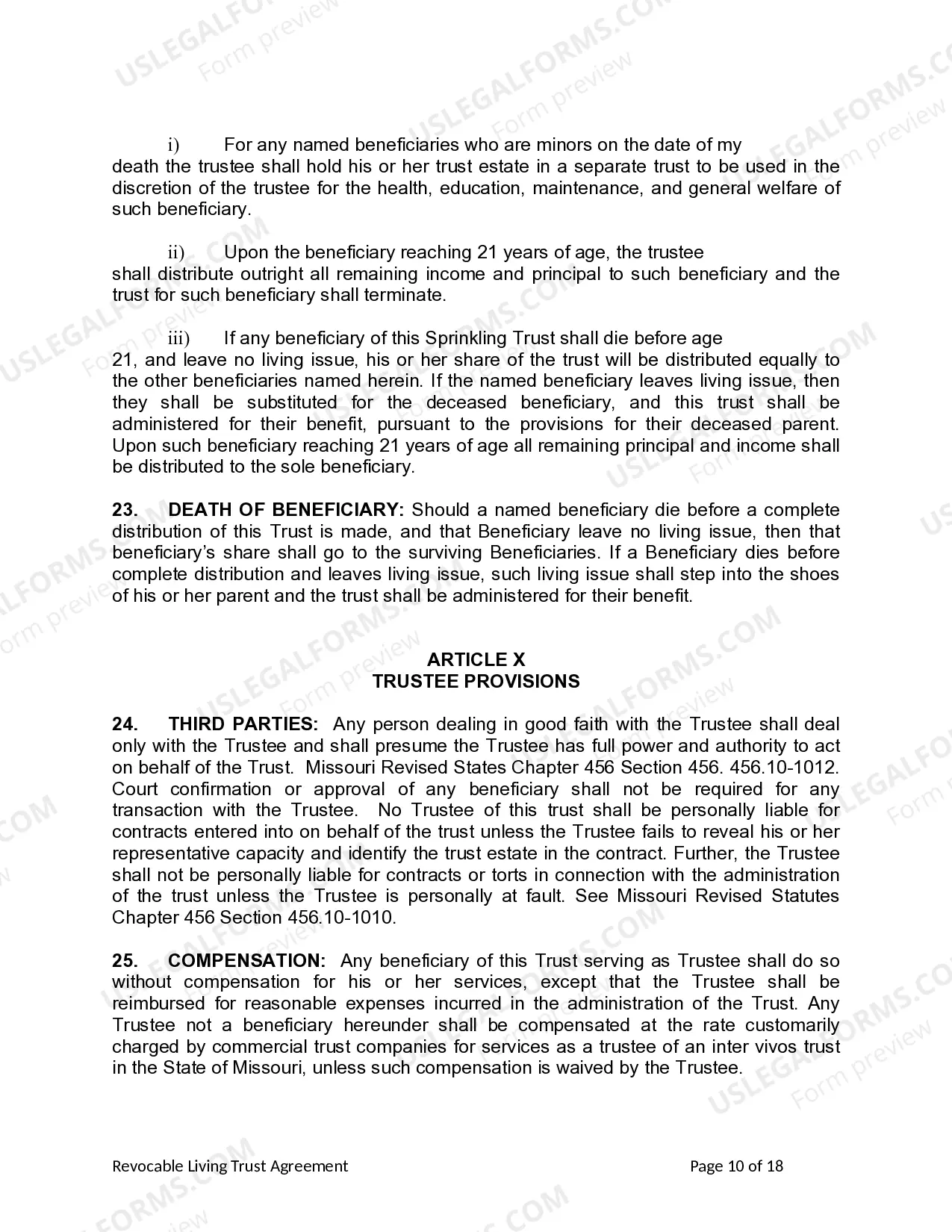

- When you are confident that the template meets your requirements, simply click Buy Now.

- Select a subscription plan that truly fits your financial situation.

- Establish a personal account.

- Make a payment in one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the document in; two choices are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

In the case of a revocable living trust, when one spouse dies, the trust typically becomes irrevocable. This means that the trust's terms cannot be changed, and it continues to manage the assets for the surviving spouse or designated beneficiaries. This arrangement is beneficial as it can help avoid probate and ensure a smooth transfer of assets. If you are considering a Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, consult US Legal Forms for tailored guidance.

Yes, you can create a Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children without involving a spouse. This legal instrument allows you to manage your assets according to your wishes, independent of a partner. It provides a straightforward way to ensure your estate is handled as you desire. Using platforms like US Legal Forms can simplify this process and guide you through the necessary steps.

While a trust offers many benefits, there are some downsides to consider. Setting up a Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children can involve initial costs and require ongoing management. Additionally, if assets are not properly transferred into the trust, they may still be subject to probate. However, with proper guidance and resources like UsLegalForms, you can effectively navigate these challenges.

Even without children, establishing a Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children is a wise decision. A trust allows you to specify how your assets should be handled upon your death, providing clarity and reducing potential conflicts among relatives or friends. Furthermore, a trust can help manage your affairs if you become incapacitated. This proactive approach ensures your wishes are respected.

When one spouse passes away, the living trust typically continues to operate, provided it is established as a joint trust. The surviving spouse retains control over the trust assets and can manage them as before. If the trust was created solely for a single individual, the assets would be distributed according to the trust terms after the individual's death. This flexibility makes a Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children a valuable estate planning tool.

In Missouri, a living trust operates by allowing you to transfer ownership of your assets into the trust while you are alive. You maintain control over the assets and can make changes as needed. Upon your death, the assets are distributed according to the terms of the trust without going through probate. This streamlined process makes a Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children an efficient choice for managing your estate.

Yes, a single person with no children can benefit from establishing a Missouri Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children. A trust allows you to manage your assets during your lifetime and dictate how they are distributed after your passing. This can provide peace of mind, knowing your wishes are clearly outlined. Additionally, a trust can help avoid the lengthy probate process.

Yes, you can establish a trust without your spouse, especially if you are single, divorced, or a widow (or widower) with no children. A Missouri Living Trust for Individuals Who are Single, Divorced, or Widows (or Widowers) with No Children allows you to maintain control over your assets and how they will be distributed. It empowers you to make decisions that align with your personal goals. Utilizing a service like US Legal Forms can provide you with the necessary resources to set up your trust efficiently.

Assets held in a living trust may offer some protection from division during a divorce, but this largely depends on how the trust is structured and your individual circumstances. For a Missouri Living Trust for Individuals Who are Single, Divorced, or Widows (or Widowers) with No Children, it is crucial to understand that marital assets are typically subject to division. Properly setting up your trust with clear terms can help clarify ownership, but consulting with a legal expert is advisable to navigate these complexities.

To obtain a Missouri Living Trust for Individuals Who are Single, Divorced, or Widows (or Widowers) with No Children, start by outlining your assets and your wishes for their distribution. You can use platforms like US Legal Forms for reliable templates and guidance specific to Missouri laws. After preparing the trust document, you will need to fund the trust by transferring your assets into it. Finally, consider consulting with an attorney to ensure everything is in order and compliant with state regulations.