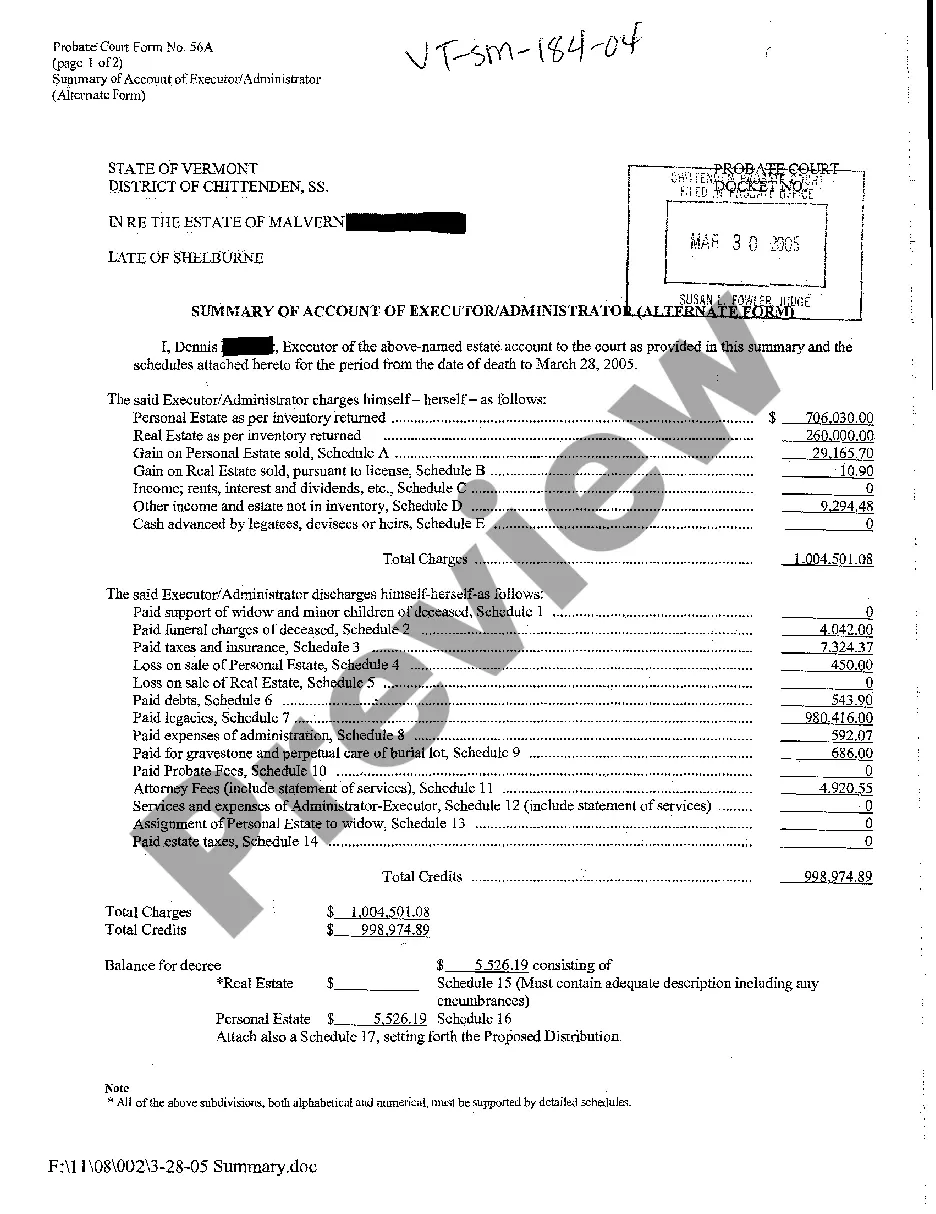

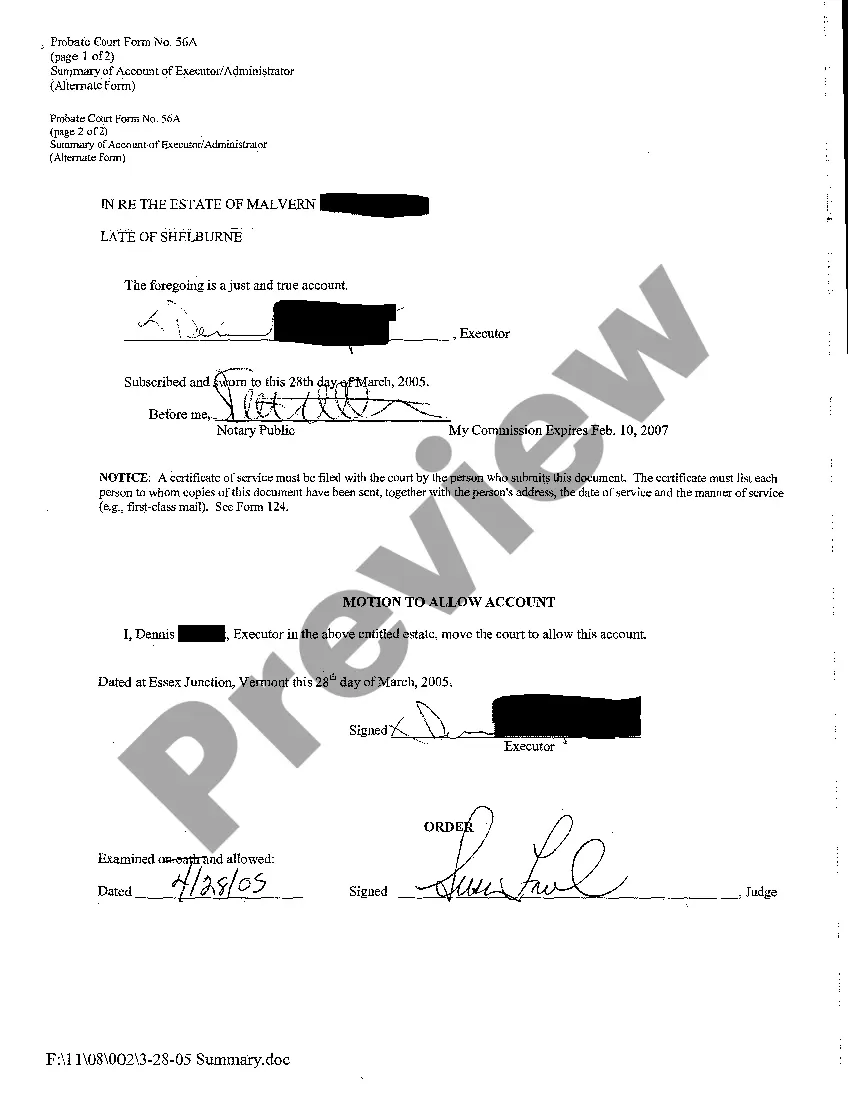

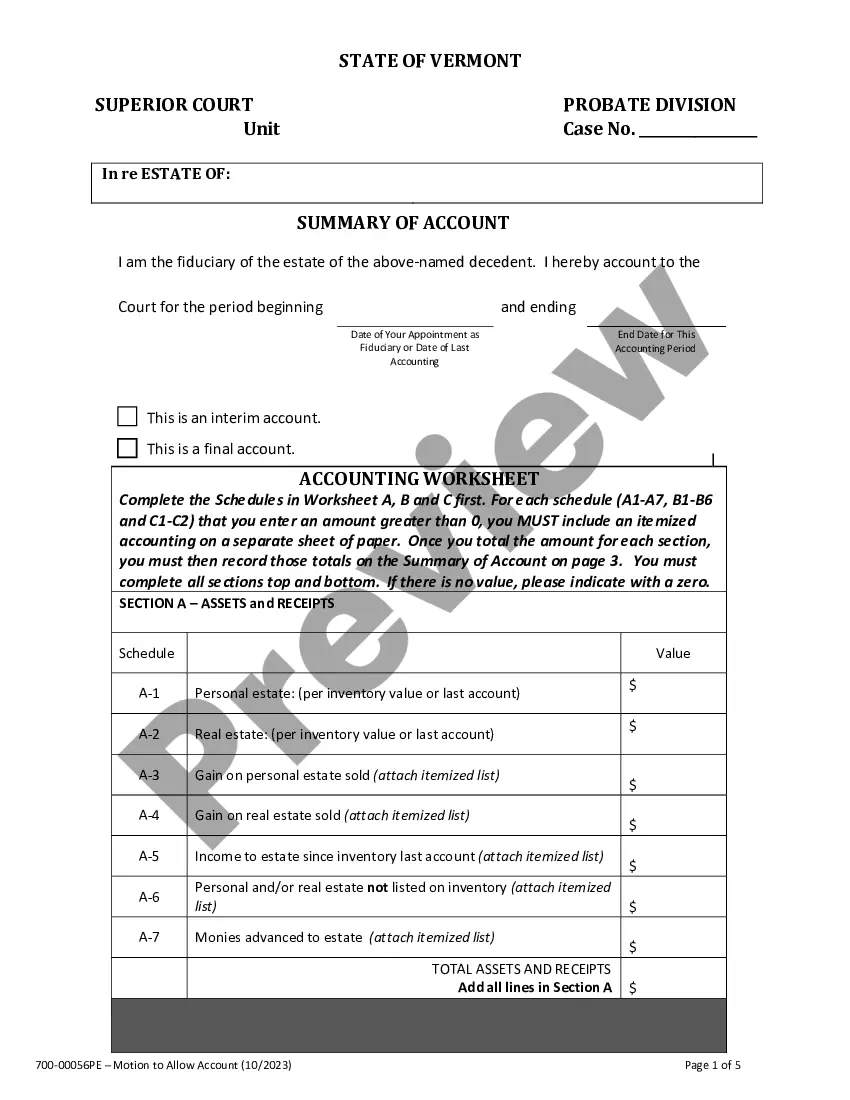

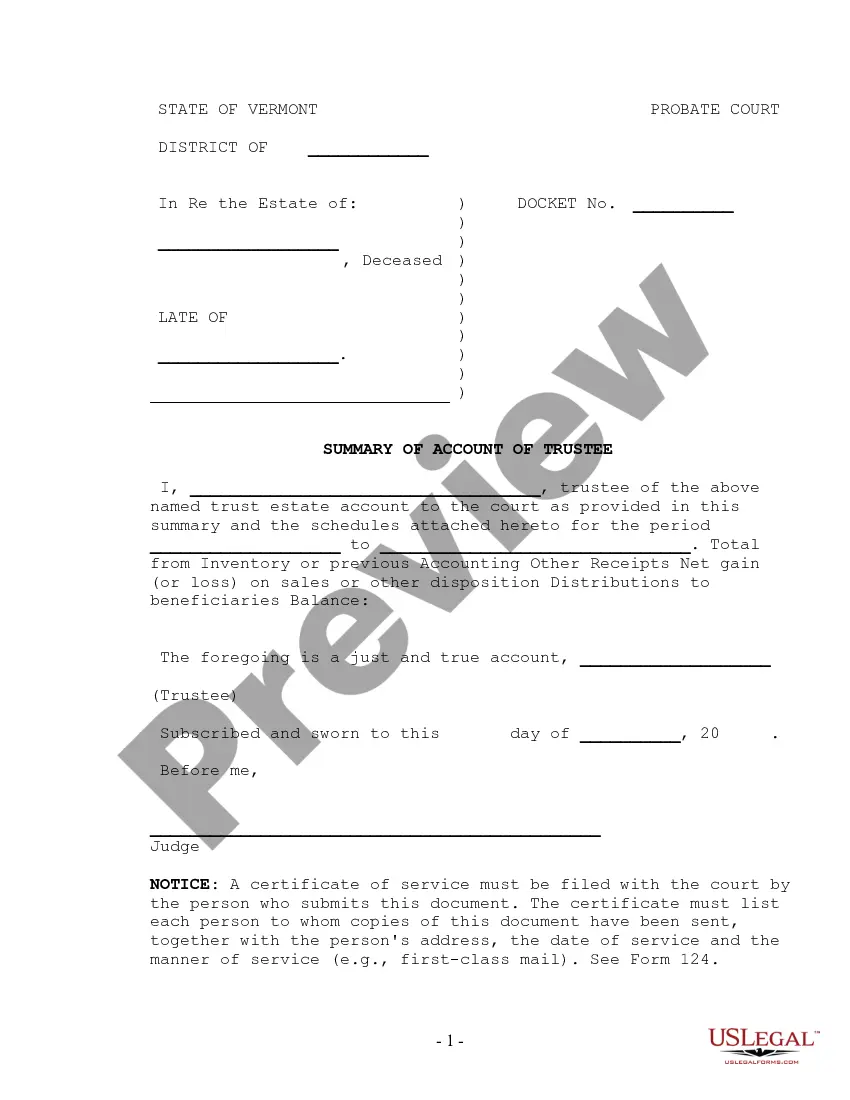

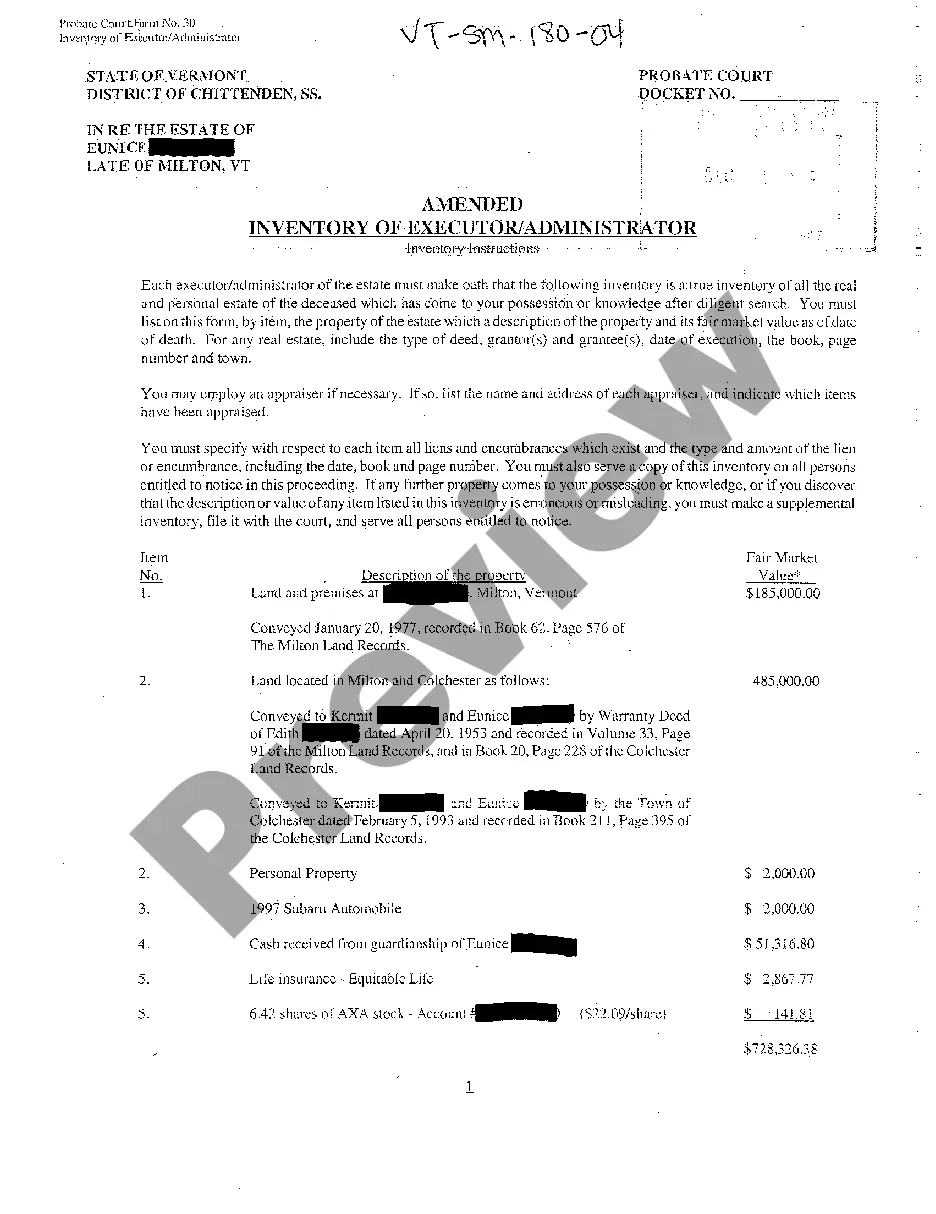

Vermont Summary of Account of Executor Administrator Alternate Form

Description

How to fill out Vermont Summary Of Account Of Executor Administrator Alternate Form?

Searching for a Vermont Summary of Account of Executor Administrator Alternate Form on the internet might be stressful. All too often, you find papers which you believe are alright to use, but find out later they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any form you are searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be added in your My Forms section. In case you do not have an account, you must sign up and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Summary of Account of Executor Administrator Alternate Form from our website:

- See the document description and click Preview (if available) to check whether the form suits your expectations or not.

- If the document is not what you need, get others with the help of Search field or the listed recommendations.

- If it is right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted templates, users will also be supported with step-by-step instructions regarding how to get, download, and fill out templates.

Form popularity

FAQ

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

Yes an estate can have 2 administrators but it is not likely. If a names co-executors the Court may allow this, but if two people want to serve as co-administrators most Courts say "No" to the future conflicts between adminsitrators.

CO-ADMINISTRATOR. One of several administrators. In general, they have, like executors, the power to act singly to the personal estate of the intestate.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

In most situations, it's not a good idea to name co-executors. When you're making your will, a big decision is who you choose to be your executorthe person who will oversee the probate of your estate. Many people name their spouse or adult child. You can, however, name more than one person to serve as executor.

). The administrator usually is the spouse, domestic partner, or close relative of the dead person. ). The case must be filed in the county where the person who died lived (or if the person lived outside of California, in the California county where that person owned property).

Do you always need probate or letters of administrationYou usually need probate or letters of administration to deal with an estate if it includes property such as a flat or a house.you discover that the estate is insolvent, that is, there is not enough money in the estate to pay all the debts, taxes and expenses.