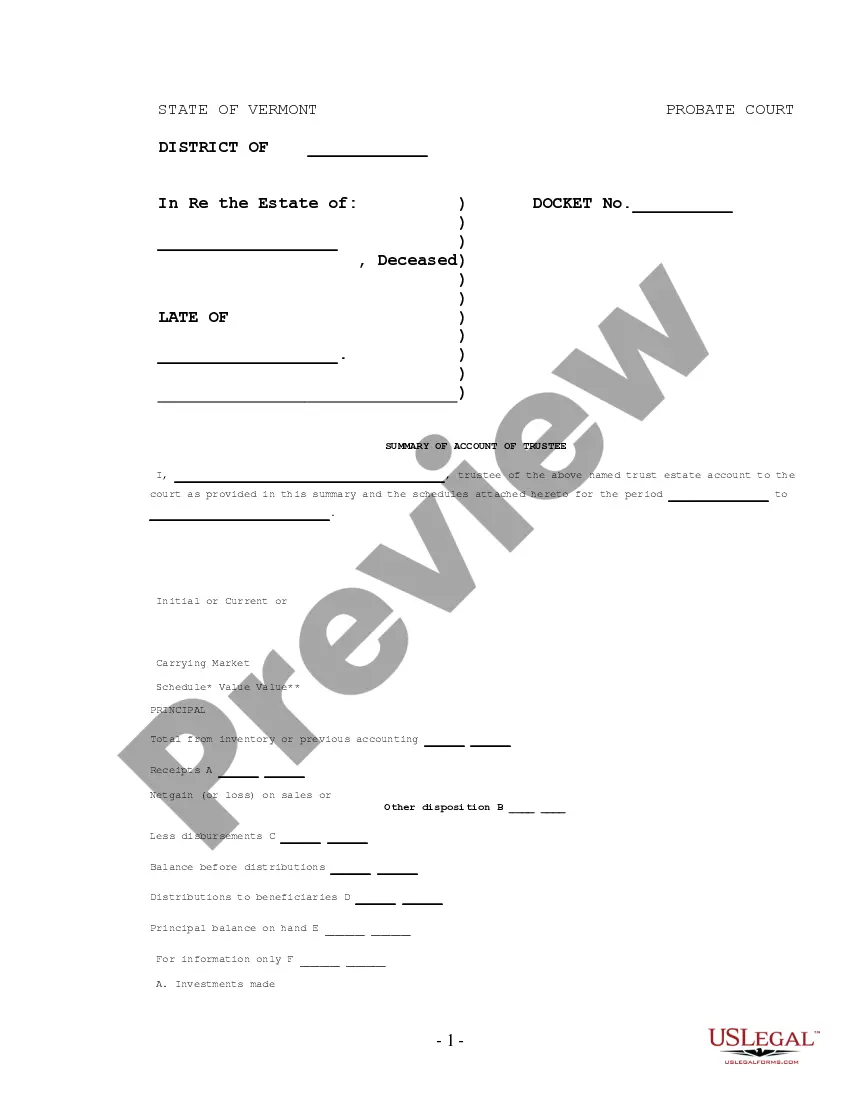

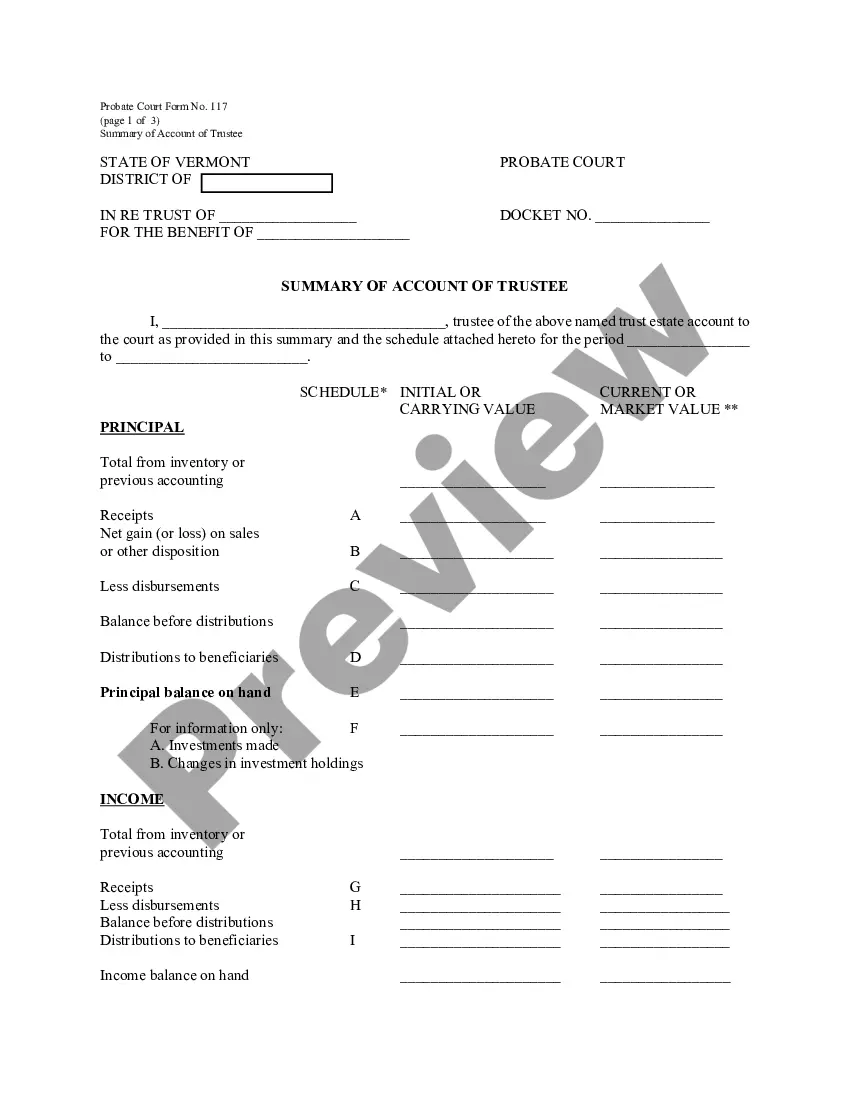

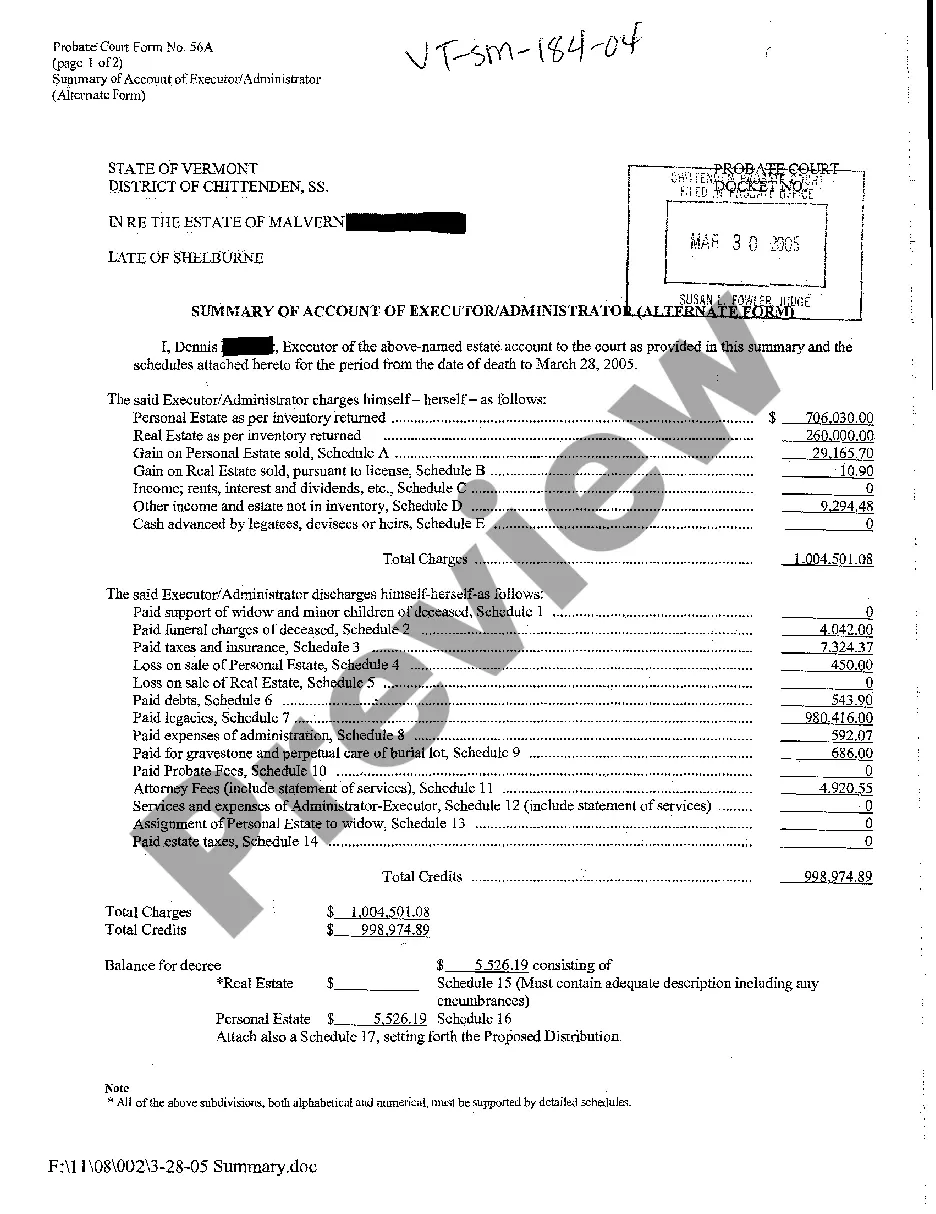

This form is used by an executor or an administrator for an estate to provide an accounting report on actions taken with regard to management and disposition of the estate. This form contains accounting schedules A-J (Forms VT-056.1-P through VT-056.10-P). For probate form 56 only without these schedules attached, see form VT-056WS-P. Form VT-056-P is one of over 150 Official Probate forms for the state of Vermont.

Vermont Summary of Account of Executor - Administrator With Schedules A-J Attached

Description

How to fill out Vermont Summary Of Account Of Executor - Administrator With Schedules A-J Attached?

- If you are an existing user, log in to your account to access your forms. Ensure your subscription is active; renew if necessary.

- For first-time users, start by checking the Preview mode and form description to make sure that you have selected the correct Vermont Summary of Account form that fits your needs.

- Use the Search tab to find alternative templates if the chosen one does not meet your requirements. Once satisfied, proceed to the next step.

- Purchase the document by selecting the Buy Now button and choose your preferred subscription plan. You will need to create an account for full access.

- Complete your transaction by entering your credit card information or using your PayPal account to pay for your subscription.

- Download the form to your device, allowing for easy completion. You can also find it anytime in the My documents section of your profile.

US Legal Forms empowers individuals and attorneys alike by providing an extensive library of over 85,000 legal forms, ensuring that you can easily find and complete the necessary documentation.

With our user-friendly interface, you can quickly access the resources you need, and if you need assistance, premium experts are available to help ensure your forms are filled out correctly. Start your journey towards legal clarity today!

Form popularity

FAQ

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

It is the executor's or the administrator's responsibility to collect and distribute the assets and to pay any death taxes and expenses of the decedent.

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.

State law typically provides for payment of the executor. By Mary Randolph, J.D. Most executors are entitled to payment for their work, either by the terms of the will or under state law.

Typically, the probate court will find executor compensation reasonable if it is in line with what people have received in the past as compensation in that area. For example, if in the last year, executor fees were typically 1.5%, then 1.5% would be considered reasonable and 3% may be unreasonable.

The laws in most areas simply stipulate that the fees must be fair and reasonable . Alberta estate law differs in this respect. Executors in this province are expected to keep their fees between 1 and 5 percent of the total value of the estate.