Missouri Request for Property Information from Contractor - Business Entity Subcontractor

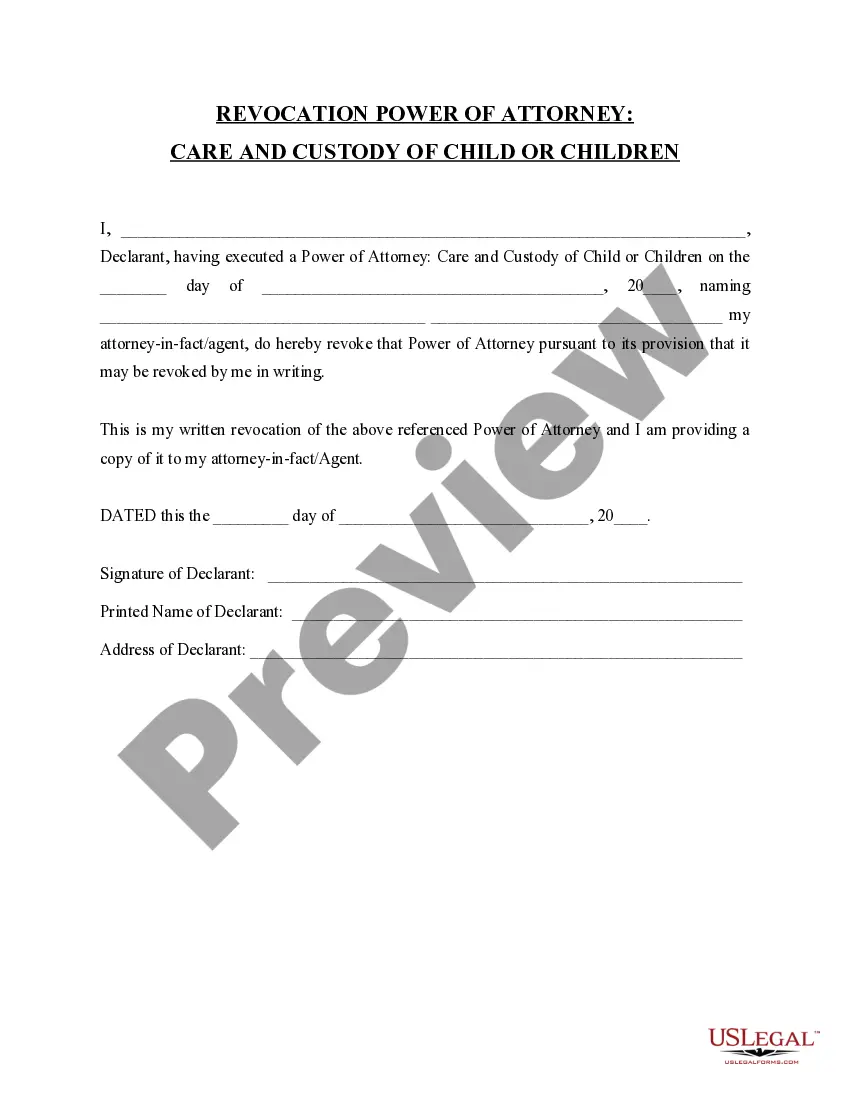

Overview of this form

The Request for Property Information from Contractor - Business Entity Subcontractor is designed for business entity subcontractors, such as corporations or limited liability companies, to formally request property information, including legal descriptions, from the contractor. This form differentiates itself from other contractor-related forms by catering specifically to business entities involved in subcontracting agreements.

Key components of this form

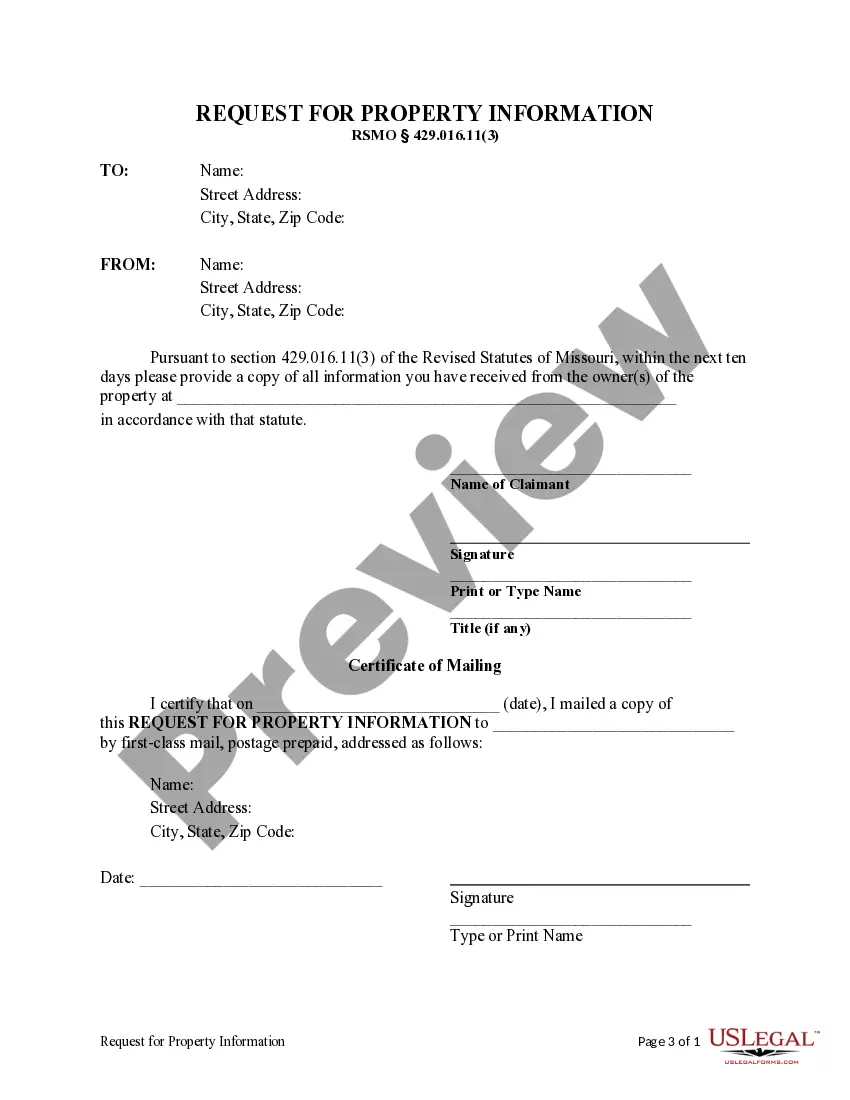

- Requestor's information: Includes fields for the business entity's name, address, and contact details.

- Contractor's information: Fields to specify the contractor's name and contact information.

- Property details: Sections to provide the property's legal description and any identification numbers.

- Signature area: A designated space for the requestor to sign and date the form.

When this form is needed

This form is used when a business entity subcontractor needs to obtain specific property information from a contractor. It may be required for various scenarios, such as providing details for project planning, ensuring compliance with legal requirements, or clarifying property boundaries and descriptions for contractual agreements.

Intended users of this form

- Business entity subcontractors (Corporations, LLCs, etc.) involved in construction projects.

- Contractors who require formal requests for property information from subcontractors.

- Individuals or organizations seeking clarity on property details related to a subcontracting agreement.

Instructions for completing this form

- Identify the requestor: Fill in the business entity's name and contact information at the top of the form.

- Provide contractor details: Enter the contractorâs name and contact information in the designated fields.

- Specify property information: Input the legal description and any relevant property identification numbers.

- Sign the form: Ensure the requestor signs and dates the form before submission.

Notarization requirements for this form

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete contact information for both the requestor and contractor.

- Omitting important property details, such as the legal description or identification numbers.

- Not signing or dating the form, which can invalidate the request.

Why use this form online

- Convenience of accessing the form anytime and from anywhere.

- Editable fillable fields allow for quick and accurate completion.

- Reliability of utilizing a form drafted by licensed attorneys to meet legal standards.

Looking for another form?

Form popularity

FAQ

To obtain a copy of articles of incorporation in Missouri, you can visit the Secretary of State's website or contact their office directly. They provide an online database where you can search for business entity information, including articles of incorporation. Utilizing a Missouri Request for Property Information from Contractor - Business Entity Subcontractor can further assist you in accessing necessary documents and confirming a contractor's legal standing.

In Missouri, many types of contractors need a license to operate legally. This requirement varies by city and county, so it's essential to check local regulations. If you are unsure about your status or need to verify a contractor's credentials, consider a Missouri Request for Property Information from Contractor - Business Entity Subcontractor. This request can provide clarity on licensing and help ensure you are working with qualified professionals.

Business personal property tax is levied on tangible assets used in your business operations, such as equipment and furniture. This tax helps fund local services and infrastructure. Understanding the implications of this tax is vital, especially when managing your Missouri Request for Property Information from Contractor - Business Entity Subcontractor, as it can affect your financial planning.

The primary difference between an independent contractor and an employee in Missouri lies in the level of control and independence. Employees work under the direction of their employers, while independent contractors operate with more autonomy. Knowing this difference is essential when preparing your Missouri Request for Property Information from Contractor - Business Entity Subcontractor, as it affects tax liability and legal responsibilities.

In Missouri, a contractor typically has six months from the completion of a project to file a lien. This timeframe is crucial for ensuring your rights are protected regarding payments. If you are unsure about the process or need to understand your rights better, refer to your Missouri Request for Property Information from Contractor - Business Entity Subcontractor for clarity.

Yes, Missouri does have a business personal property tax that applies to tangible personal property owned by businesses. This tax is assessed annually and can impact your overall operational costs. If you need guidance on how to navigate this tax system, consider using uslegalforms to simplify your Missouri Request for Property Information from Contractor - Business Entity Subcontractor.

To speak with someone at the Missouri Department of Revenue, you can call their customer service line or visit their official website for additional resources. They provide various ways to connect, including email and in-person visits. If you require specific information related to your Missouri Request for Property Information from Contractor - Business Entity Subcontractor, having your documents ready will expedite the process.

Several states in the U.S. do not impose a business personal property tax, including Delaware, Nevada, and New Hampshire. If you're operating in Missouri, you should be aware that it does have a business personal property tax. Understanding these differences can help you make informed decisions when filing your Missouri Request for Property Information from Contractor - Business Entity Subcontractor.