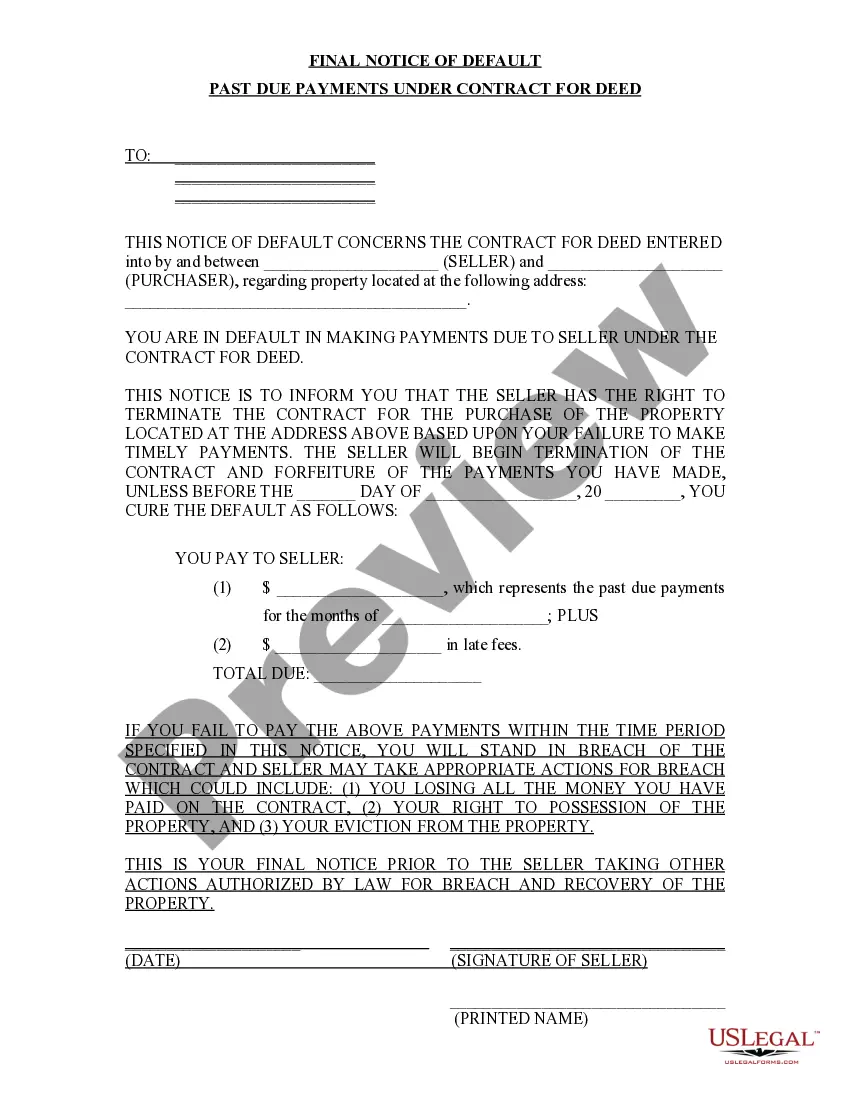

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Missouri Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Missouri Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to acquire a printable Missouri Final Notice of Default for Overdue Payments related to Contract for Deed. Our court-acceptable forms are crafted and frequently updated by proficient attorneys.

Ours is the most comprehensive Forms catalog available online and offers cost-effective and precise templates for clients, legal professionals, and small to medium businesses. The templates are organized into state-specific categories, and some can be viewed before being downloaded.

To download samples, clients must possess a subscription and Log In to their account. Click Download next to any form you require and locate it in My documents.

US Legal Forms offers a vast array of legal and tax documents and packages for both business and personal requirements, including Missouri Final Notice of Default for Overdue Payments related to Contract for Deed. Over three million users have successfully employed our platform. Select your subscription plan and access high-quality forms in just a few clicks.

- Verify that you have the correct template pertaining to the state it is intended for.

- Examine the document by reading the description and utilizing the Preview option.

- Click Buy Now if it’s the document you seek.

- Establish your account and make payment via PayPal or credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you need to locate another document template.

Form popularity

FAQ

The 407.675 law in Missouri addresses consumer protection in real estate transactions, particularly focusing on contracts for deed. This law outlines the rights of buyers and sellers, ensuring transparency and fairness throughout the process. Understanding this law is vital, especially when dealing with a Missouri Final Notice of Default for Past Due Payments in connection with Contract for Deed. For assistance with navigating these legal requirements, the US Legal Forms platform offers a wealth of resources and forms that can help you stay informed and compliant.

A notice of default in real estate indicates that a borrower has failed to meet their mortgage obligations. This official document informs the borrower of their delinquency and outlines the potential consequences if the situation remains unresolved. It is important to understand that receiving a Missouri Final Notice of Default for Past Due Payments in connection with Contract for Deed can lead to foreclosure proceedings. Therefore, addressing the notice promptly can significantly impact the borrower's future choices.

In Missouri, the right to cure notice serves as a formal notification to a borrower regarding their default status. This notice provides the borrower with a specific timeframe to address the overdue payments before further legal action is taken. Essentially, it acts as a final opportunity for the borrower to rectify the situation, thus avoiding a Missouri Final Notice of Default for Past Due Payments in connection with Contract for Deed. Understanding this notice is crucial for both borrowers and lenders to navigate the complexities of real estate transactions.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

What Is A Deed Of Termination? A Deed of Termination is a document signed by parties to confirm that a legally binding contract previously entered into is to be terminated. This typically relates to the ending of a commercial relationship between two parties prior to the natural expiration of the contract between them.

Generally, the seller will look for a down payment anywhere from 10% to 20% of the purchase price. The interest on a contract for deed could be anywhere from 1% to 2.5% higher than the current market rate.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.