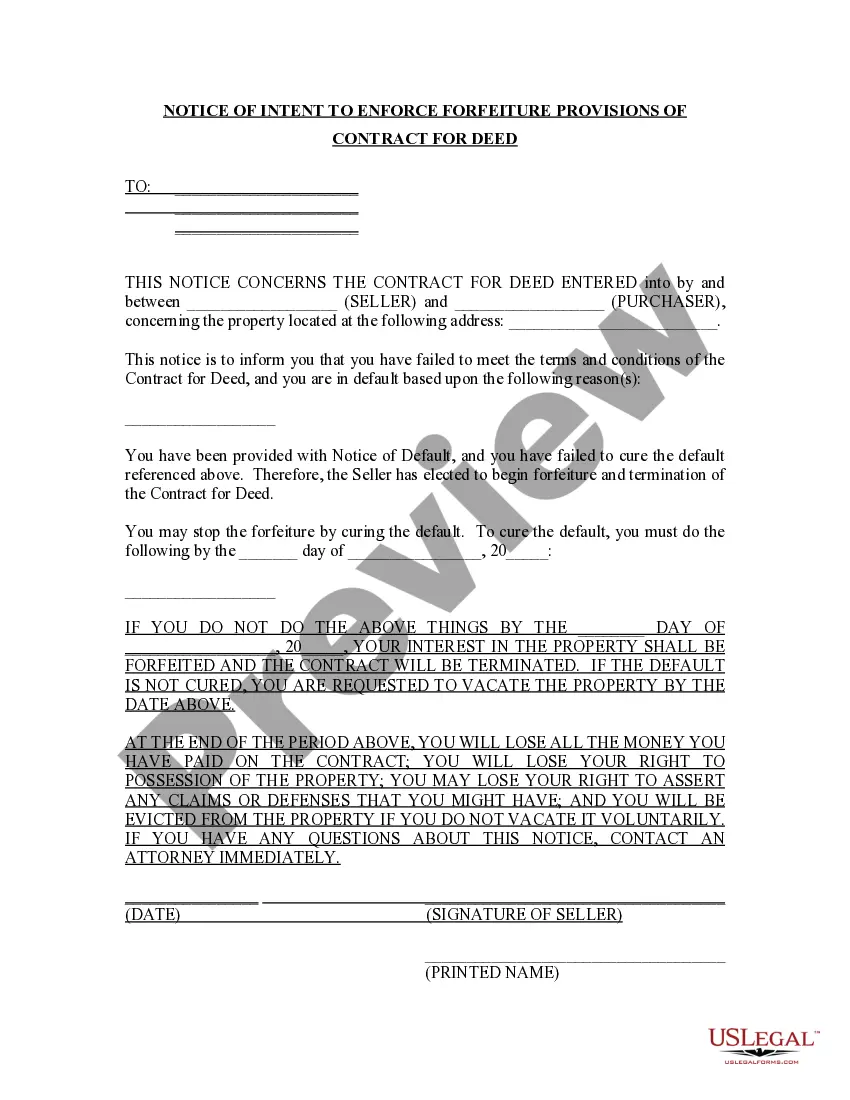

This Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed is an initial notice of Seller's intent to enforce the forfeiture remedy of contract for deed if nonpayment or other breach is not cured. It is used specifically to inform the buyer that he/she has failed to meet the terms and conditions of the Contract for Deed and as a result, are in default based upon the reasons specified.

Missouri Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed

Description

How to fill out Missouri Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed?

Utilize US Legal Forms to obtain a printable Missouri Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed. Our court-acceptable forms are created and frequently updated by experienced attorneys.

Ours is the most comprehensive Forms directory online and offers affordable and precise samples for consumers, lawyers, and small to medium-sized businesses. The documents are categorized by state, and some can be previewed before downloading.

To download templates, clients must have a subscription and Log In to their account. Click Download next to any template you require and locate it in My documents.

US Legal Forms offers a vast array of legal and tax samples and packages for business and personal requirements, including the Missouri Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed. Over three million users have already successfully utilized our platform. Choose your subscription plan and access high-quality documents in just a few clicks.

- Ensure you acquire the correct form concerning the state it’s required in.

- Examine the document by reading the description and utilizing the Preview feature.

- Click Buy Now if it’s the template you desire.

- Establish your account and pay through PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you wish to find another document template.

Form popularity

FAQ

A contract becomes legally binding in Missouri when it includes an offer, acceptance, consideration, and mutual consent. Additionally, for a contract for deed, it must comply with local laws, including the Missouri Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed. It's advisable to have written agreements and seek legal advice to ensure all elements are met, which platforms like uslegalforms can assist with.

In Missouri, contract for deed laws require specific disclosures and documentation to protect both buyers and sellers. A seller must provide clear terms and conditions, including the Missouri Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed, to ensure transparency. Understanding these laws is essential for both parties to avoid legal complications, which can be simplified by utilizing resources from uslegalforms.

To create a valid contract for deed, both parties should clearly outline all terms, such as payment amounts, deadlines, and responsibilities for property maintenance. It is crucial to include a clause regarding the Missouri Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed to protect the seller's interests. Consulting with legal professionals or using platforms like uslegalforms can help ensure compliance with local laws and safeguard both parties.

A contract for deed may lead to a lack of clear ownership until the buyer completes all payments, which can create uncertainty. Additionally, if the buyer defaults on the payments, the seller can initiate the Missouri Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed, resulting in the loss of investment without the typical foreclosure protections. This can leave buyers vulnerable, making it essential to understand the risks involved.

A land contract forfeiture occurs when a buyer fails to meet the terms of the contract, leading the seller to reclaim the property. This process often involves a Missouri Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed, which formally notifies the buyer of the seller's intention to enforce forfeiture. Understanding this process is essential for both buyers and sellers, as it outlines their rights and responsibilities. To navigate this complex situation, consider using US Legal Forms, which provides resources and documents to help you understand and manage land contract forfeitures effectively.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

But, there are 12 states that are still considered non-disclosure: Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming. In a non-disclosure state, transaction sale prices are not available to the public.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.