Minnesota UCC3 Financing Statement Amendment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota UCC3 Financing Statement Amendment?

Obtain any type from 85,000 legal files including Minnesota UCC3 Financing Statement Amendment online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to access it.

If you have yet to subscribe, follow the steps outlined below.

With US Legal Forms, you’ll consistently have immediate access to the relevant downloadable template. The platform offers you access to documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Minnesota UCC3 Financing Statement Amendment effortlessly and swiftly.

- Verify the state-specific prerequisites for the Minnesota UCC3 Financing Statement Amendment you wish to utilize.

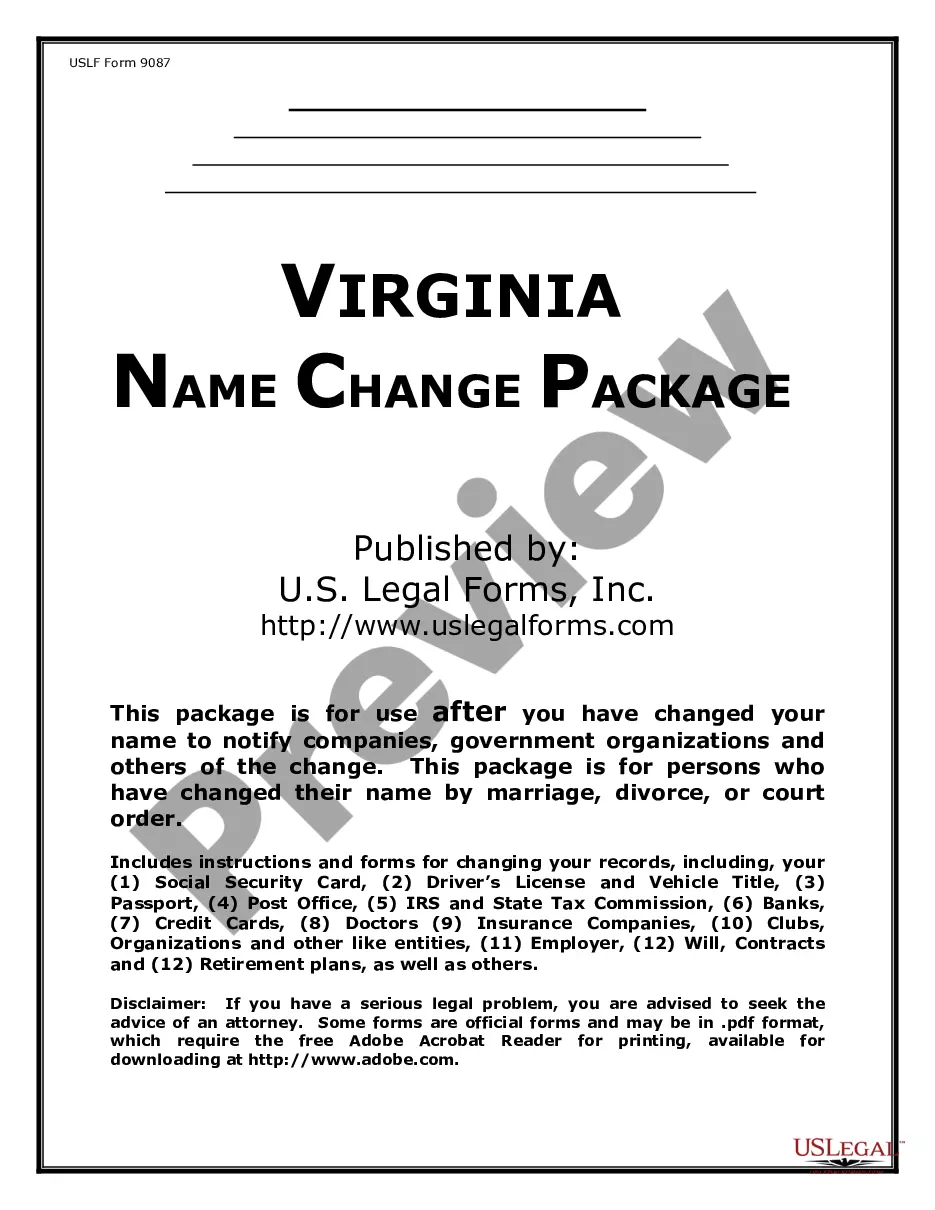

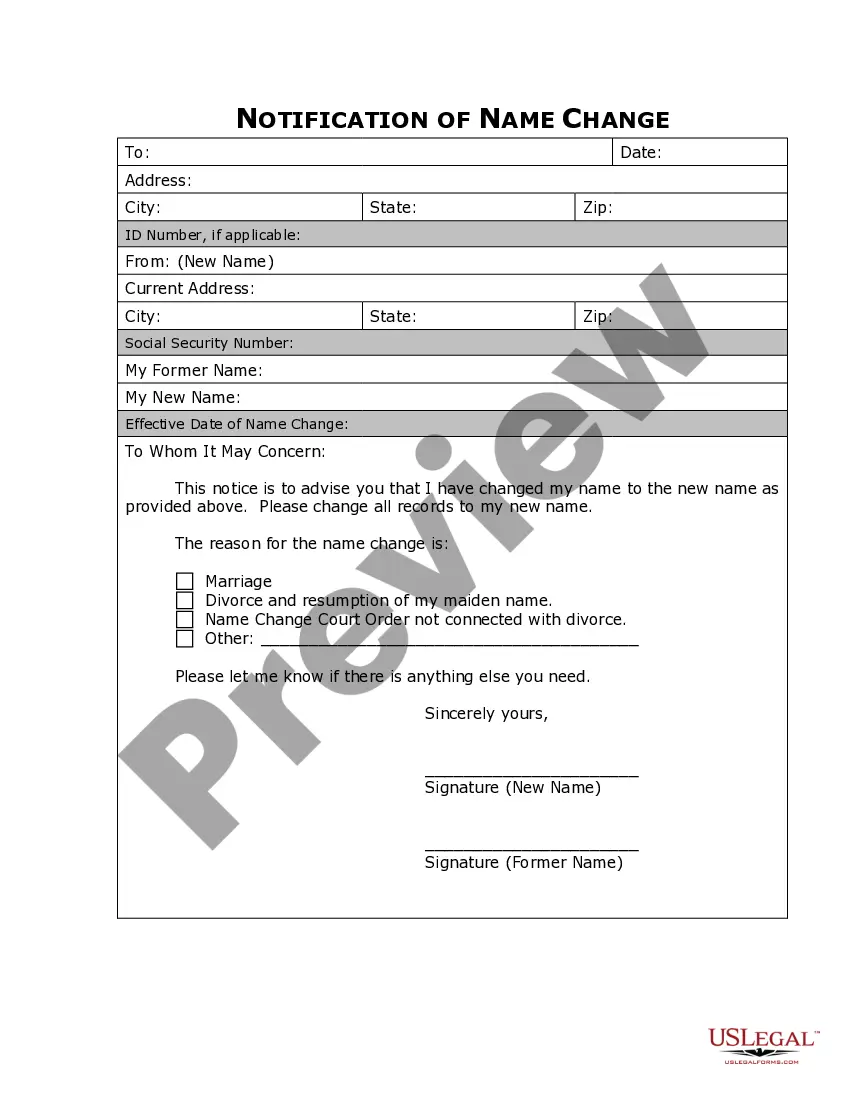

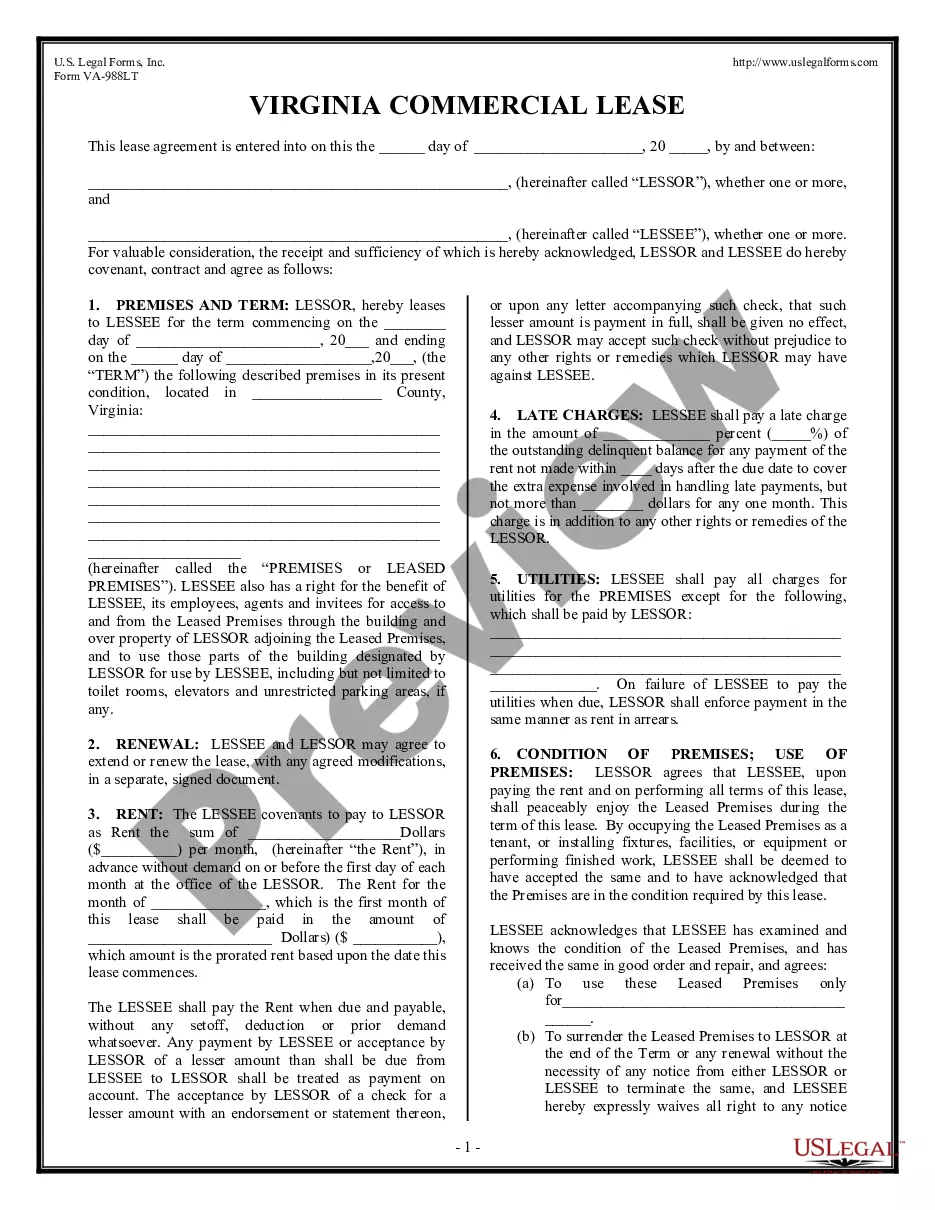

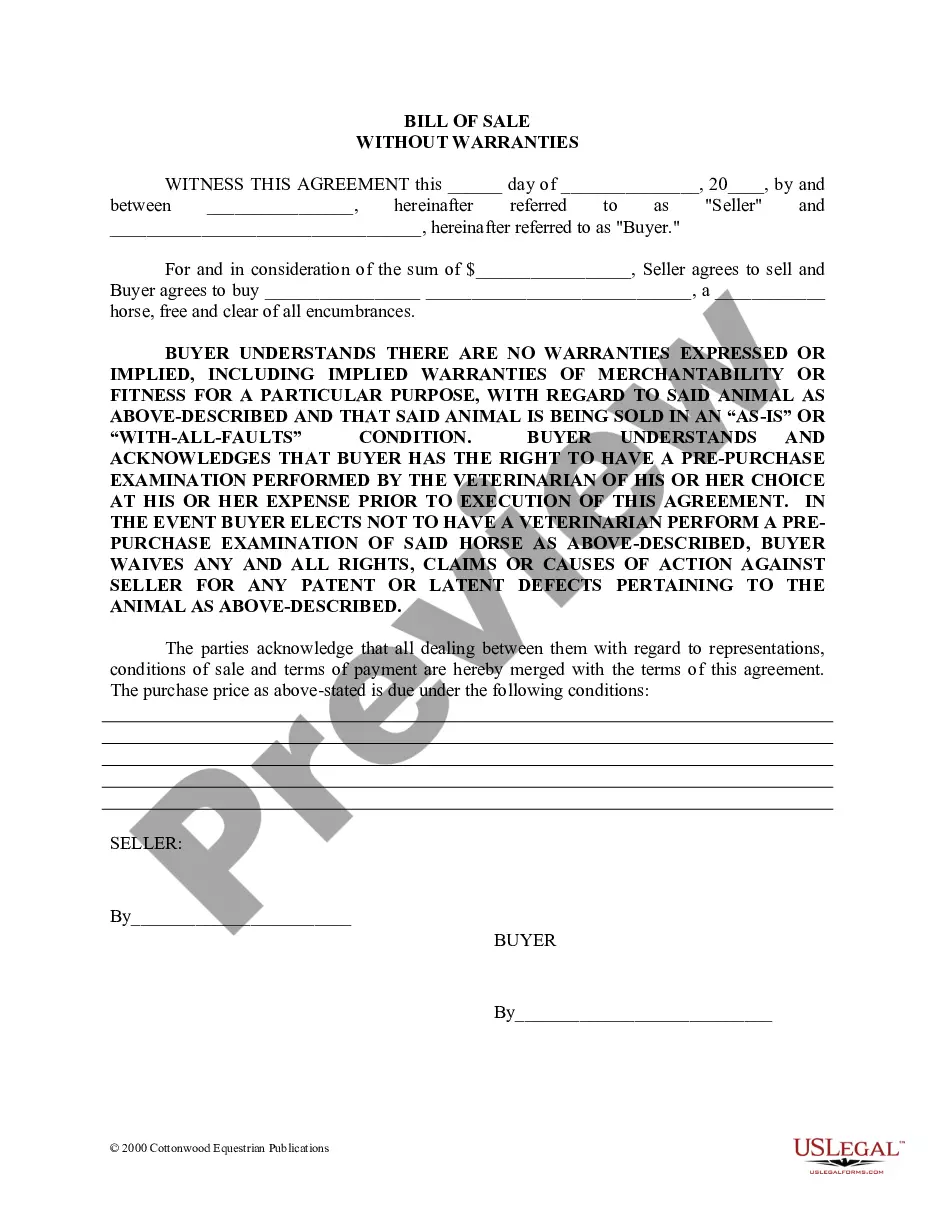

- Review the description and preview the template.

- When you are certain the sample meets your requirements, click on Buy Now.

- Select a subscription plan that aligns with your budget.

- Establish a personal account.

- Complete payment in one of two convenient methods: by card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents tab.

- Once your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

To terminate a UCC Financing Statement, you must complete a Minnesota UCC3 Financing Statement Amendment, which serves to release the lien. You will need to include the original filing details and any required signatures. After preparing the amendment, submit it to the relevant state authority to ensure the termination is officially recorded. The US Legal Forms platform offers easy access to the necessary forms and instructions, making the process straightforward.

To cancel a UCC, you need to file a Minnesota UCC3 Financing Statement Amendment. This form officially indicates that you are terminating the secured party's interest in the collateral. You must provide the necessary details such as the original UCC filing information and submit the amendment to the appropriate state office. Using the US Legal Forms platform can simplify this process, ensuring you have the correct forms and guidance.

To terminate a UCC financing statement, you need to file a UCC3 Financing Statement Amendment with the proper state authority. This amendment notifies the public that the secured obligation has been fulfilled, thereby releasing the lien. Ensure that you provide accurate information related to the original statement in your filing. U.S. Legal Forms can assist you in completing this process correctly and efficiently.

Yes, a UCC financing statement can be assigned to another party through an assignment process. This involves filing a UCC3 Financing Statement Amendment to reflect the new secured party. It's important to include all relevant details about the original statement and the assignee. U.S. Legal Forms offers templates and guidance to help you complete this process smoothly.

Yes, an UCC lien can be removed through the filing of a UCC3 Financing Statement Amendment. This amendment acts as a termination statement when the underlying obligation has been satisfied. It is crucial to ensure that all required information is correct and that the amendment is filed with the appropriate state office. Utilizing resources like U.S. Legal Forms can help you navigate this process efficiently.

To remove a UCC financing statement, you must file a UCC3 Financing Statement Amendment with the appropriate state office. This document serves as a formal request to terminate or amend the existing UCC filing. Be sure to include all necessary information, such as the original UCC statement details and the specific changes you want to make. Using U.S. Legal Forms can streamline this process, ensuring that all paperwork is completed accurately.

A UCC filing amendment is a legal document that modifies an existing UCC financing statement. This amendment can change various aspects, such as the debtor's name, the secured party's details, or the collateral description. Filing an amendment is crucial to maintain accurate records and protect your interests. For assistance, uslegalforms offers comprehensive resources to help you prepare and file your amendment correctly.

To remove a UCC Financing Statement, you must file a UCC-3 termination statement with the state. This statement officially cancels the financing statement and prevents any claims against the secured party. Make sure to include all necessary details to avoid any delays. Uslegalforms can assist you with the correct forms and filing instructions to ensure a smooth removal process.

Yes, you can amend an UCC filing by submitting a UCC-3 amendment statement. This document allows you to change specific details in the original financing statement, such as the debtor or secured party information. It’s important to follow the proper procedures to ensure that the amendment is valid. Consider using uslegalforms for clear guidelines and templates that simplify the amendment process.

Yes, an UCC filing can be removed through a termination statement. This statement must be filed with the appropriate state authority to officially remove the financing statement from the public record. It’s essential to ensure that all details are accurate to avoid complications. Uslegalforms provides tools to help you navigate this process smoothly.