Minnesota UCC3 Financing Statement Amendment Addendum

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota UCC3 Financing Statement Amendment Addendum?

Access any template from 85,000 legal documents including Minnesota UCC3 Financing Statement Amendment Addendum online with US Legal Forms. Each template is crafted and revised by state-certified attorneys.

If you already possess a subscription, Log In. After navigating to the form’s page, click on the Download button and go to My documents to obtain access to it.

If you haven’t subscribed yet, adhere to the steps outlined below: Check the state-specific requirements for the Minnesota UCC3 Financing Statement Amendment Addendum you wish to utilize. Review the description and preview the example. Once you’re assured the template meets your needs, simply click Buy Now. Select a subscription plan that truly suits your budget. Create a personal account. Make payment using either of the two suitable methods: credit card or PayPal. Choose a format for downloading the document; two options are available (PDF or Word). Download the file to the My documents tab. After your reusable template is downloaded, print it out or save it to your device. With US Legal Forms, you will always have swift access to the correct downloadable template. The service provides you with access to forms and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Minnesota UCC3 Financing Statement Amendment Addendum quickly and effortlessly.

After your reusable template is downloaded, print it out or save it to your device. With US Legal Forms, you will always have swift access to the correct downloadable template. The service provides you with access to forms and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Minnesota UCC3 Financing Statement Amendment Addendum quickly and effortlessly.

- Access any template from 85,000 legal documents including Minnesota UCC3 Financing Statement Amendment Addendum online with US Legal Forms. Each template is crafted and revised by state-certified attorneys.

- If you already possess a subscription, Log In. After navigating to the form’s page, click on the Download button and go to My documents to obtain access to it.

- If you haven’t subscribed yet, adhere to the steps outlined below: Check the state-specific requirements for the Minnesota UCC3 Financing Statement Amendment Addendum you wish to utilize.

- Review the description and preview the example.

- Once you’re assured the template meets your needs, simply click Buy Now.

- Select a subscription plan that truly suits your budget.

- Create a personal account.

- Make payment using either of the two suitable methods: credit card or PayPal.

- Choose a format for downloading the document; two options are available (PDF or Word).

Form popularity

FAQ

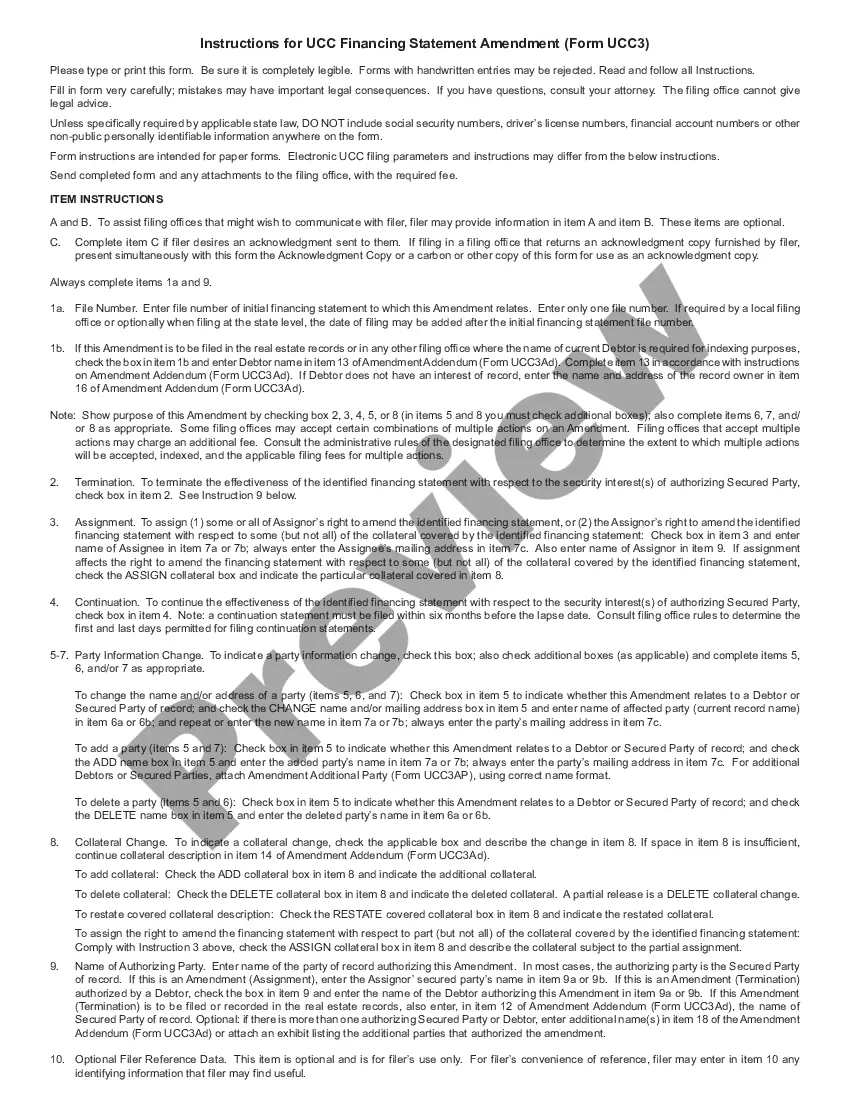

Yes, you can amend a UCC filing by submitting a UCC3 Financing Statement Amendment Addendum. This allows you to update information such as the debtor's name or the collateral description. Amending your UCC filing ensures that all parties have the most current information. For streamlined access to the amendment process, uslegalforms offers a user-friendly platform to assist you.

To remove a UCC Financing Statement, you must file a UCC3 Financing Statement Amendment Addendum indicating the termination of the financing statement. This document must be submitted to the appropriate filing office. It's important to follow the correct procedures to ensure that the removal is properly recorded. Consider using uslegalforms for easy access to the necessary forms and guidance.

In Minnesota, UCC financing statements are filed with the Secretary of State's office. This can be done online, by mail, or in person. Filing your UCC3 Financing Statement Amendment Addendum through the proper channels ensures that your records are accurate and accessible. Utilizing platforms like uslegalforms can simplify the filing process for you.

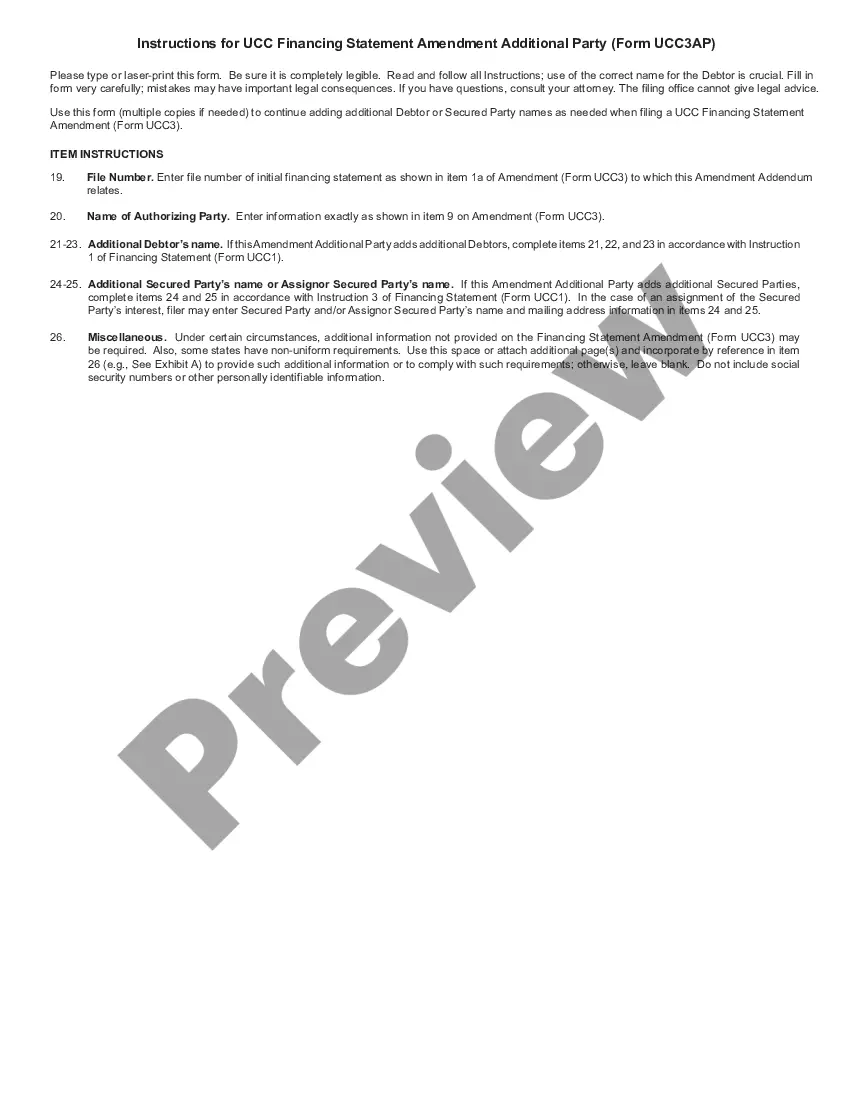

Yes, a UCC Financing Statement can be assigned to another party. This process typically involves completing a UCC3 Financing Statement Amendment Addendum to reflect the new party. By doing this, you ensure that the secured party's rights are transferred correctly. It's crucial to file this amendment in accordance with Minnesota law to maintain the validity of the security interest.

To terminate an UCC fixture filing, you must file a termination statement that specifies the original fixture filing. This process is similar to terminating other UCC filings, ensuring that the secured interest is officially removed. Using the Minnesota UCC3 Financing Statement Amendment Addendum streamlines this process and helps maintain accurate records in your transactions.

The Uniform Commercial Code (UCC) has undergone several amendments over the years, with the most recent significant updates occurring in 2010. It's important to stay informed about these changes, as they can impact UCC filings, including the Minnesota UCC3 Financing Statement Amendment Addendum. Regularly checking official sources will help you remain compliant with current UCC regulations.

To terminate a UCC-3 in Minnesota, you must submit a UCC termination statement that identifies the original filing. This is done using the appropriate forms, which you can easily obtain through the Minnesota Secretary of State’s website or platforms like uslegalforms. By accurately completing the Minnesota UCC3 Financing Statement Amendment Addendum, you can ensure that your termination is processed efficiently.

Yes, an UCC filing can be removed by filing a termination statement, which officially ends the secured interest. This process is essential for clearing any financial obligations related to the UCC financing statement. Utilizing the Minnesota UCC3 Financing Statement Amendment Addendum simplifies this procedure, ensuring all necessary changes are documented correctly.

To remove a UCC financing statement, you need to file a termination statement with the appropriate state office. In Minnesota, this involves submitting a UCC-3 form specifically designed for termination. After filing your Minnesota UCC3 Financing Statement Amendment Addendum, it's important to verify that the financing statement is officially removed from the records to protect your interests.

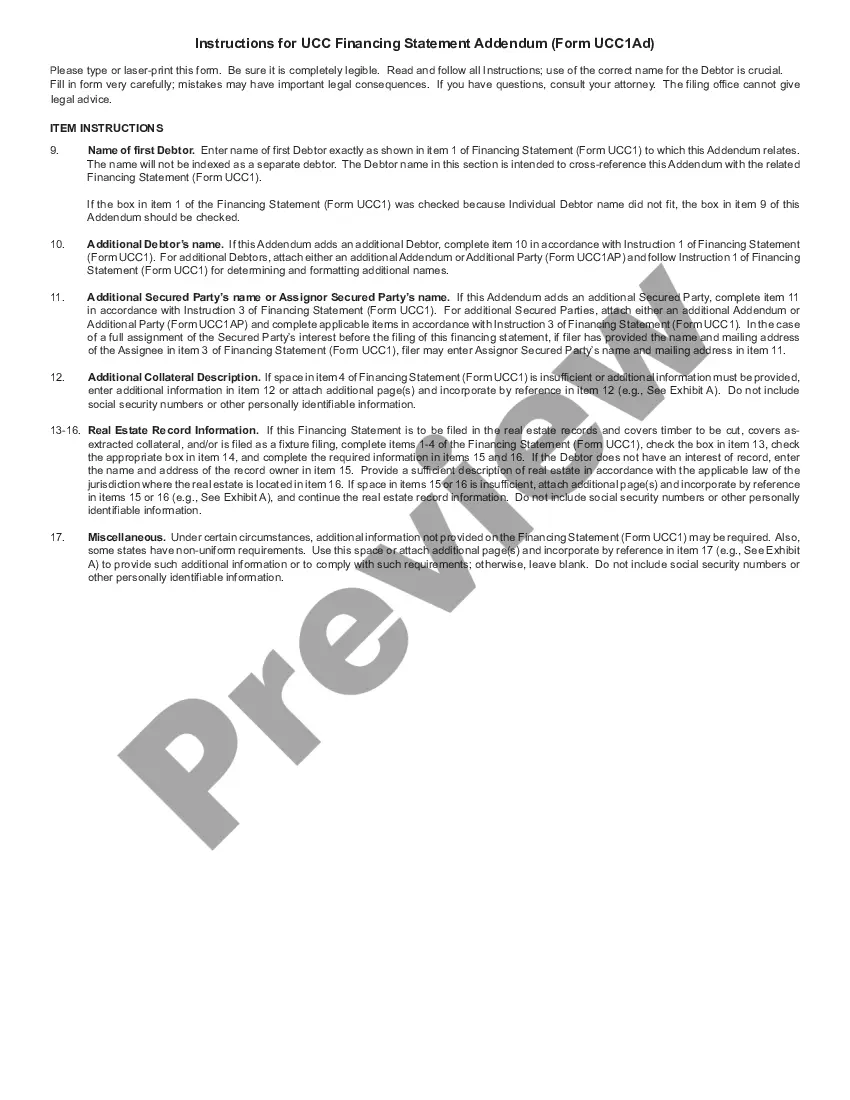

A UCC filing amendment is a formal change made to an existing UCC financing statement. This process allows you to update information, such as the debtor's name or the collateral described in the original filing. By submitting a Minnesota UCC3 Financing Statement Amendment Addendum, you can ensure that all parties are aware of the most current information regarding the secured transaction.