Minnesota Self-Employed Business Development Executive Agreement

Description

How to fill out Self-Employed Business Development Executive Agreement?

If you want to be thorough, acquire, or print licensed document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Minnesota Self-Employed Business Development Executive Agreement with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Minnesota Self-Employed Business Development Executive Agreement.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

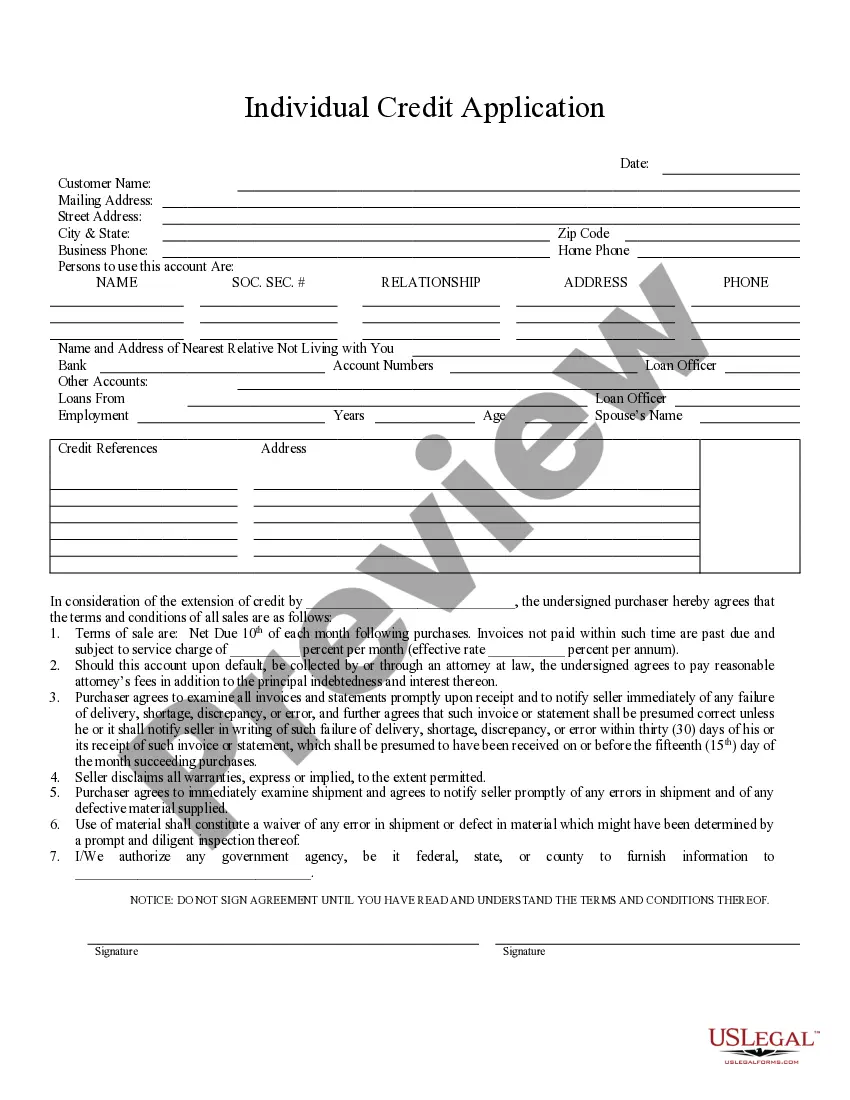

- Step 2. Use the Preview feature to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A business development agreement is a contract that outlines the collaboration between parties in a business venture. This document details objectives, responsibilities, and the financial terms of the partnership. In the case of a Minnesota Self-Employed Business Development Executive Agreement, it specifically defines the relationship between a self-employed business development executive and their clients. This agreement fosters mutual understanding and establishes clear expectations.

While Minnesota law does not mandate an operating agreement for LLCs, having one can significantly benefit your business. An operating agreement, although not required, helps clarify the management structure, member roles, and operational procedures of your LLC. Using this alongside your Minnesota Self-Employed Business Development Executive Agreement can strengthen your overall business framework.

Creating a development agreement involves outlining the specific roles and responsibilities of the parties involved. Start by identifying the key components, such as duties, compensation, and duration, within your Minnesota Self-Employed Business Development Executive Agreement. Next, ensure you include any relevant terms that protect both parties’ interests. By structuring it correctly, you enhance clarity and reduce misunderstandings.

Yes, you can draft your own Minnesota Self-Employed Business Development Executive Agreement. However, it is important to ensure that the agreement covers all necessary terms and complies with Minnesota laws. Consider using templates or resources that outline essential elements to guide you. Alternatively, you might find it beneficial to consult with a legal professional.

Not all states require LLCs to have an operating agreement, but a few do mandate it, such as California and New York. However, regardless of the state regulations, having an operating agreement is still a best practice for any LLC, including those based in Minnesota. Creating a Minnesota Self-Employed Business Development Executive Agreement not only aligns with best practices but also strengthens the foundation of your business. It helps in navigating various state laws and can enhance your LLC's credibility.

While an operating agreement (OA) is not mandatory for LLCs in Minnesota, it is highly beneficial. An OA creates a formal structure that outlines members' rights and obligations, thus reducing potential conflicts. By establishing a Minnesota Self-Employed Business Development Executive Agreement, you can provide clarity for all involved parties. It ensures everyone understands their roles and responsibilities, fostering a more organized operation.

Yes, Minnesota imposes self-employment tax on individuals who earn income from self-employment. This tax covers Social Security and Medicare contributions, which are crucial for personal retirement benefits. If you're considering a Minnesota Self-Employed Business Development Executive Agreement, it's important to factor in these taxes when planning your financial structure. Understanding this can help you manage your business finances effectively.

Minnesota does not legally require LLCs to have an operating agreement. However, having an operating agreement is strongly recommended to outline the management structure and operational processes of the LLC. This document can serve as a Minnesota Self-Employed Business Development Executive Agreement, ensuring all members are aligned on expectations and responsibilities. It protects members and enhances the legitimacy of the business.

Yes, an LLC can technically exist without an operating agreement in Minnesota. However, operating without one can lead to misunderstandings among members regarding their roles and profit distribution. Having a clearly defined Minnesota Self-Employed Business Development Executive Agreement helps in establishing governance rules and facilitates smoother operations. It is advisable to create one for clarity and protection.

The Minnesota employment contract is a formal agreement that details the relationship between an employer and an employee or contractor. This document outlines job responsibilities, compensation, benefits, and other essential conditions. It's vital for protecting both parties and ensuring clarity on expectations. Using a Minnesota Self-Employed Business Development Executive Agreement can be a smart choice for self-employed individuals looking to establish clear terms with their clients.