Minnesota Self-Employed Independent Contractor Agreement

Description

How to fill out Self-Employed Independent Contractor Agreement?

Are you currently in a position where you require documentation for either business or personal purposes on a daily basis.

There are plenty of legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, including the Minnesota Self-Employed Independent Contractor Agreement, crafted to meet both federal and state regulations.

Once you locate the correct form, click Purchase now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for your purchase using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Minnesota Self-Employed Independent Contractor Agreement template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Acquire the form you need and ensure it corresponds to the correct state.

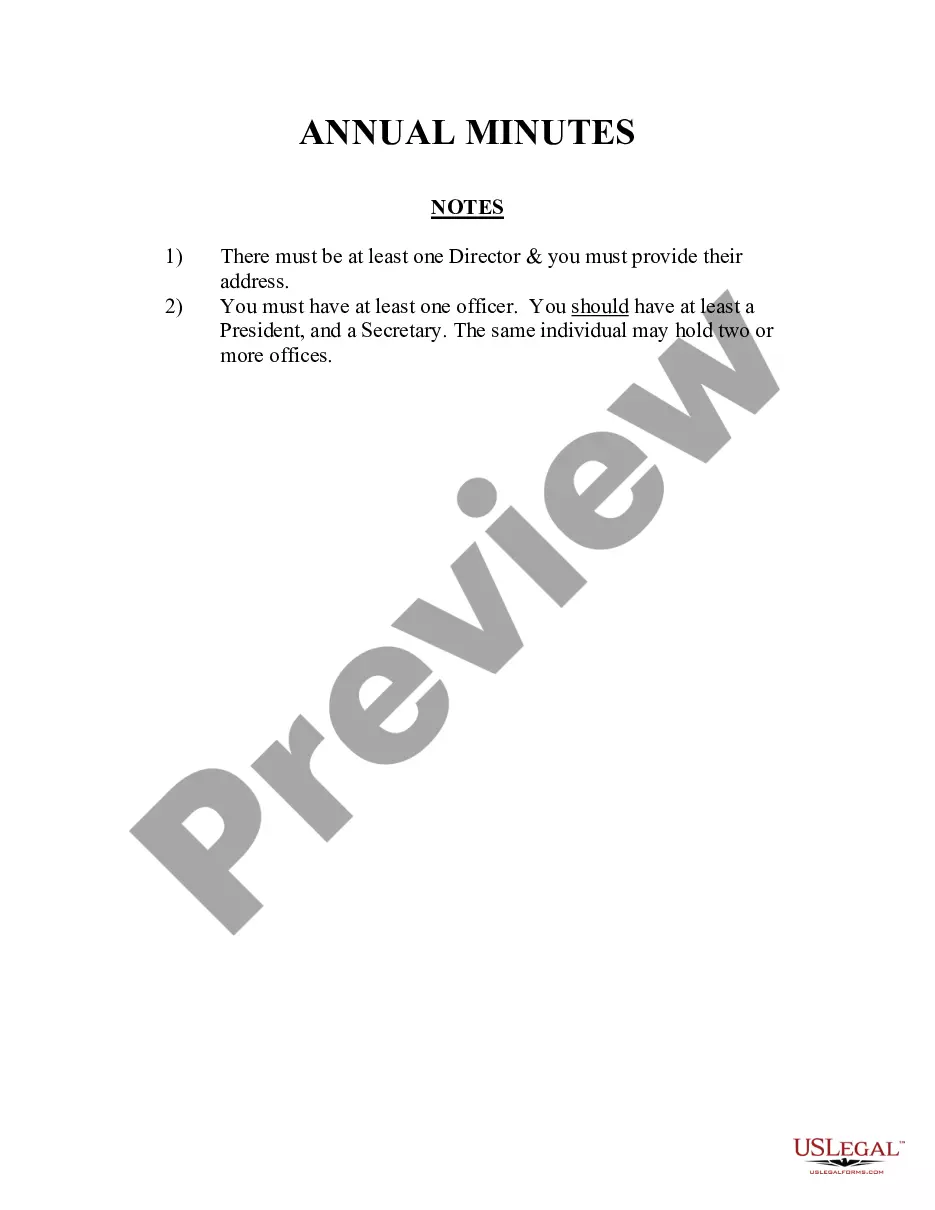

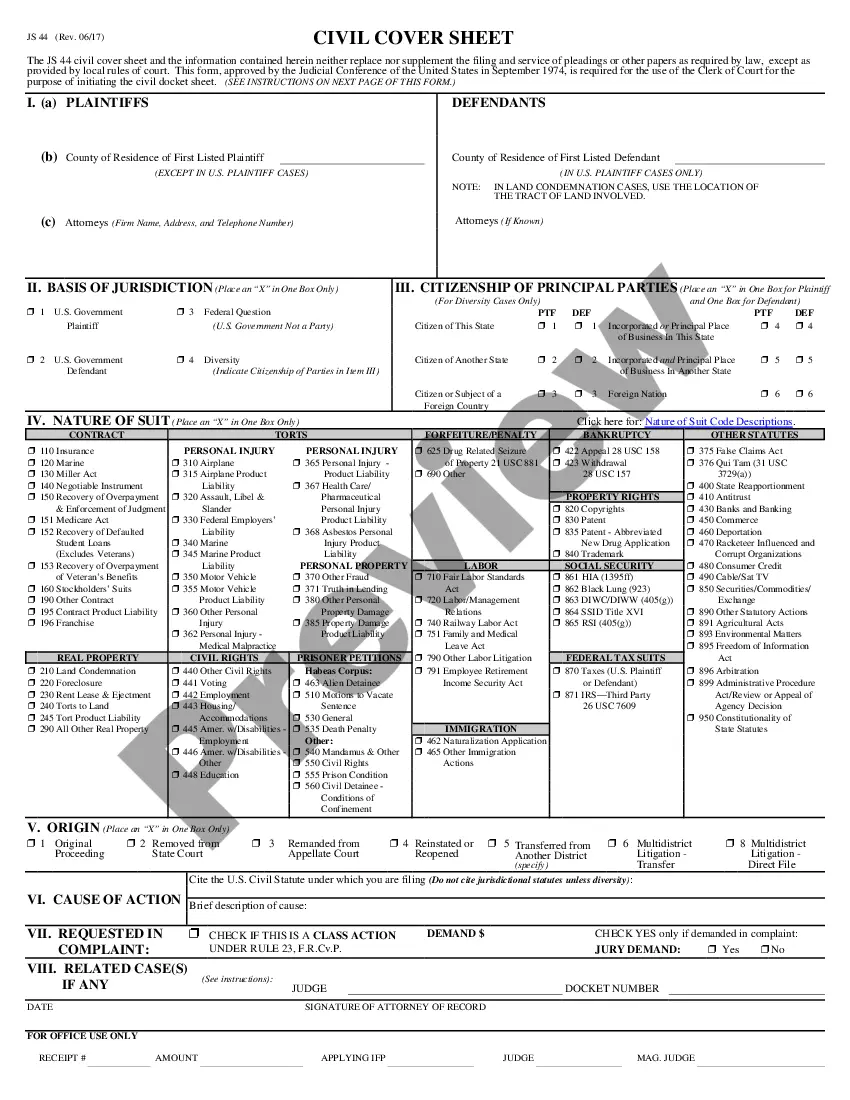

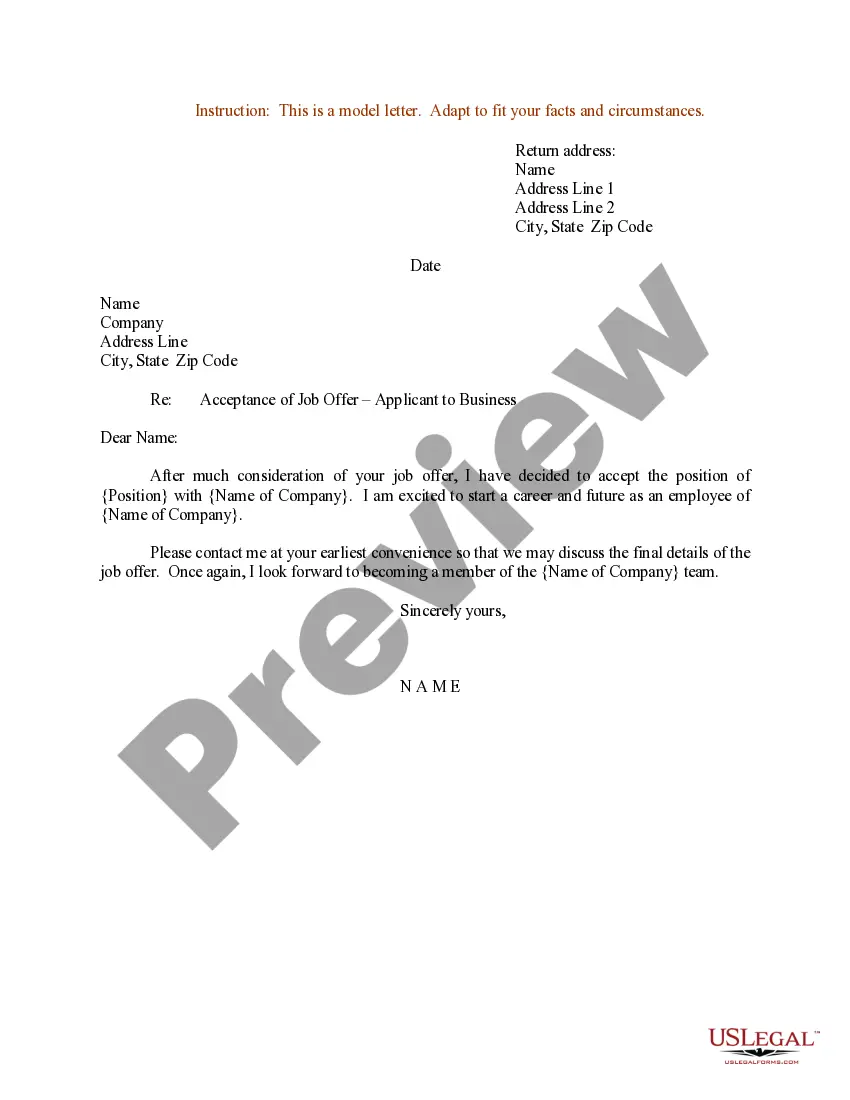

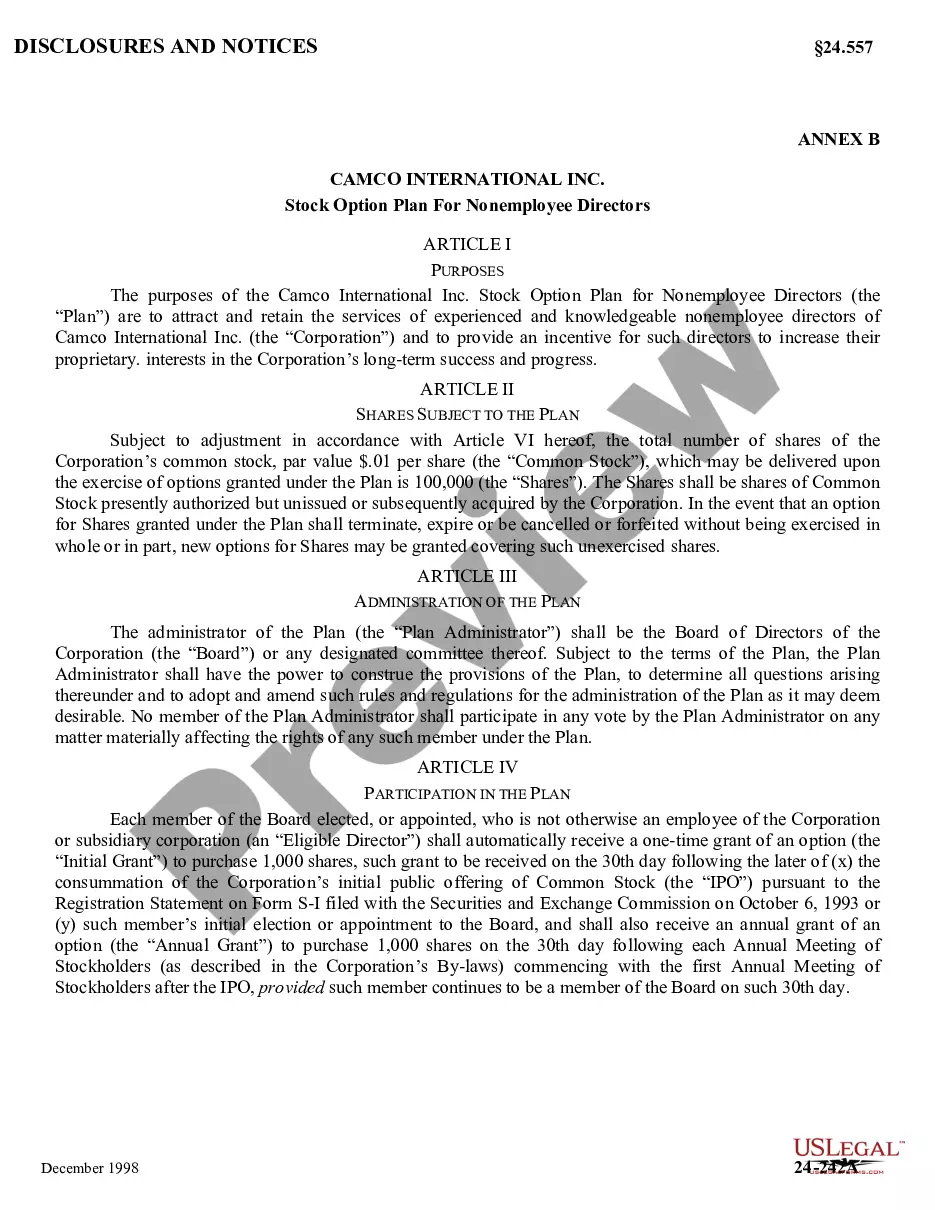

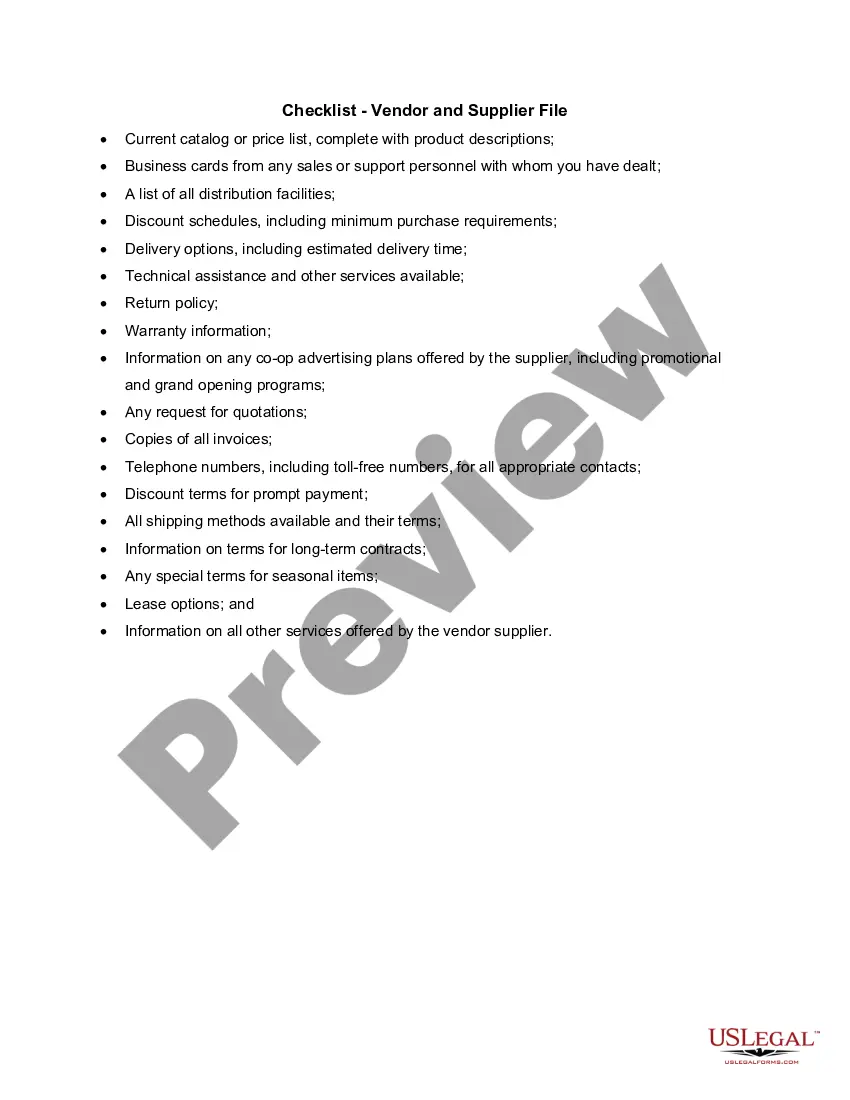

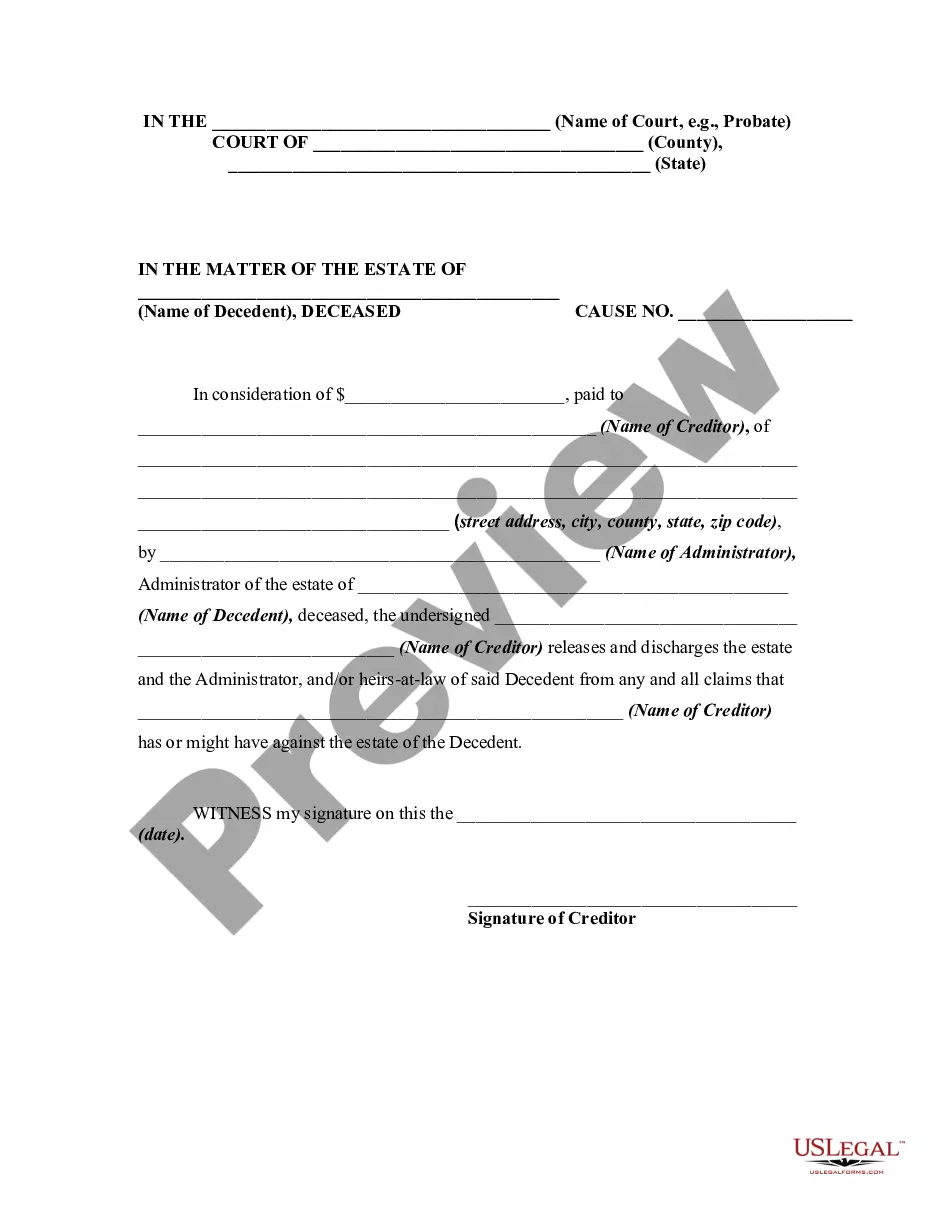

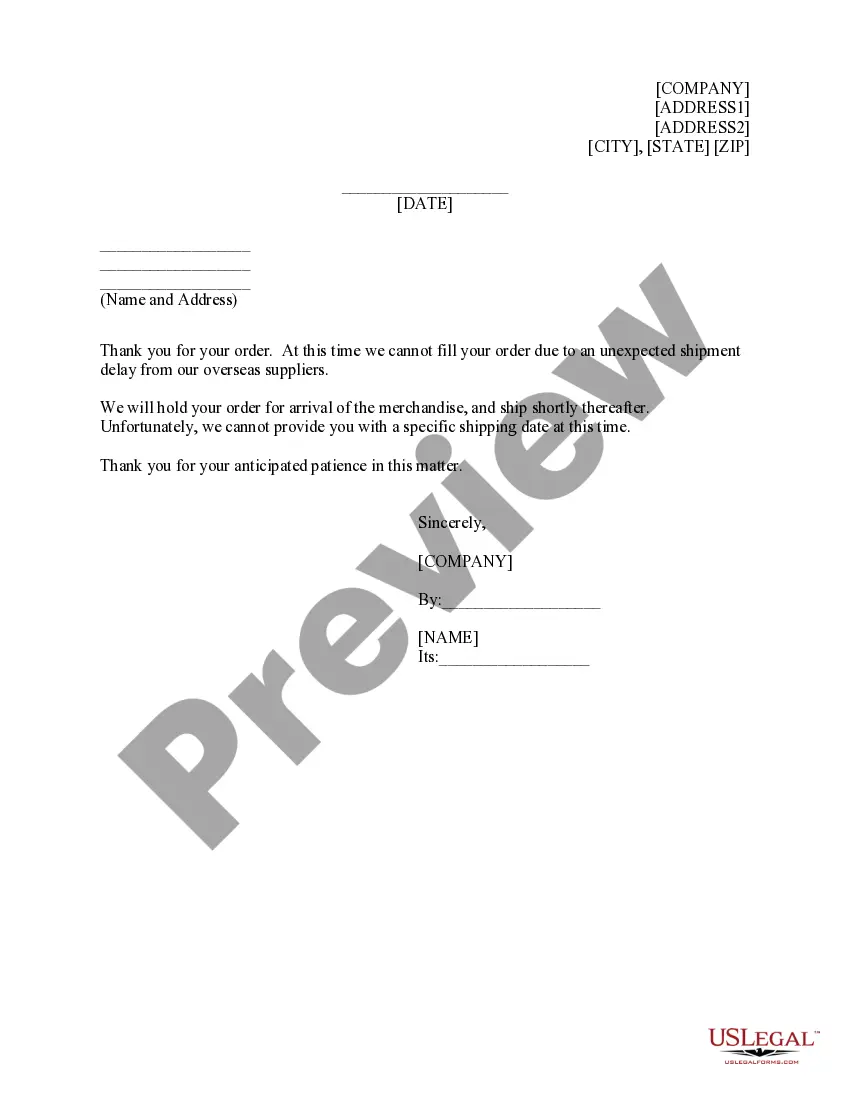

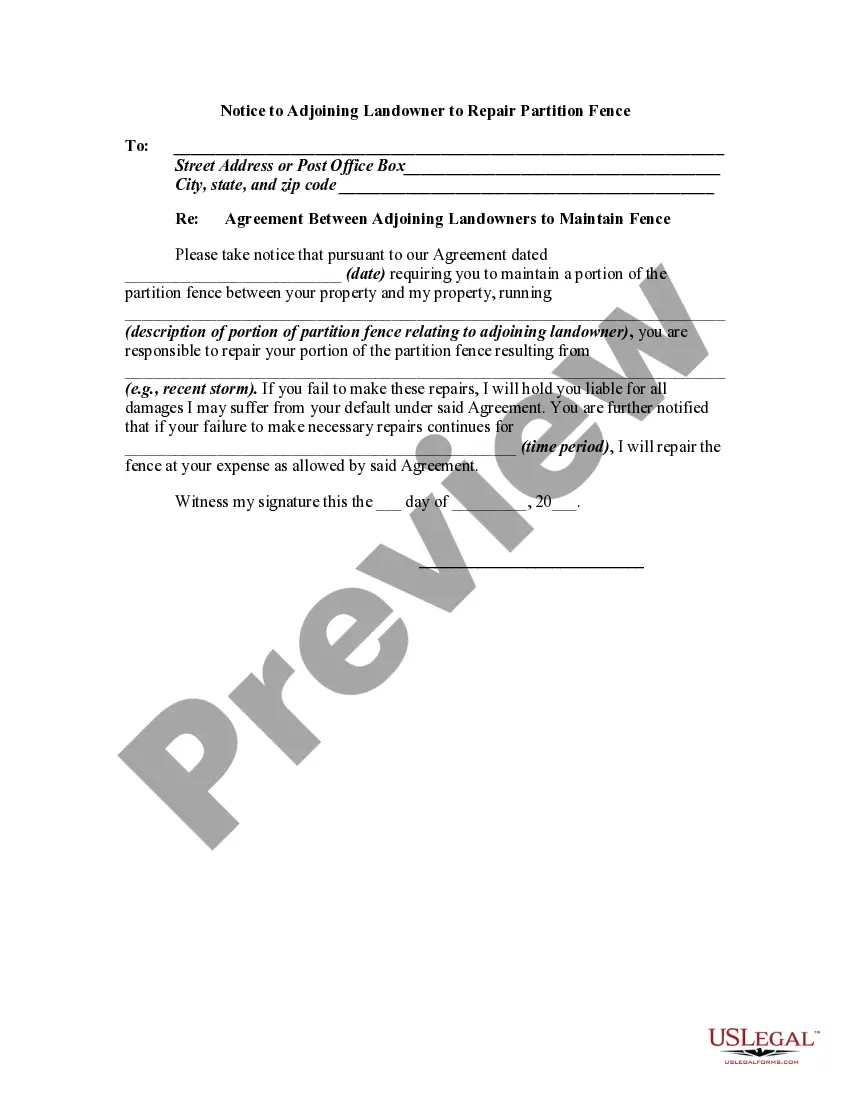

- Utilize the Preview function to review the document.

- Read the details to confirm that you've chosen the correct template.

- If the form isn't what you're looking for, use the Search section to find a template that fulfills your needs and requirements.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Have a current license, certificate or registration issued by the agency; are an employee of a business performing construction services; have a current residential building contractor or remodeler certificate of exemption; or. are excluded from registration requirements under Minnesota Statutes 326B.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Do you need to register?have a current license, certificate or registration issued by the agency;are an employee of a business performing construction services; or.have a current residential building contractor or remodeler certificate of exemption; or.are excluded from registration requirements under Minn. Stat.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.