Minnesota Diver Services Contract - Self-Employed

Description

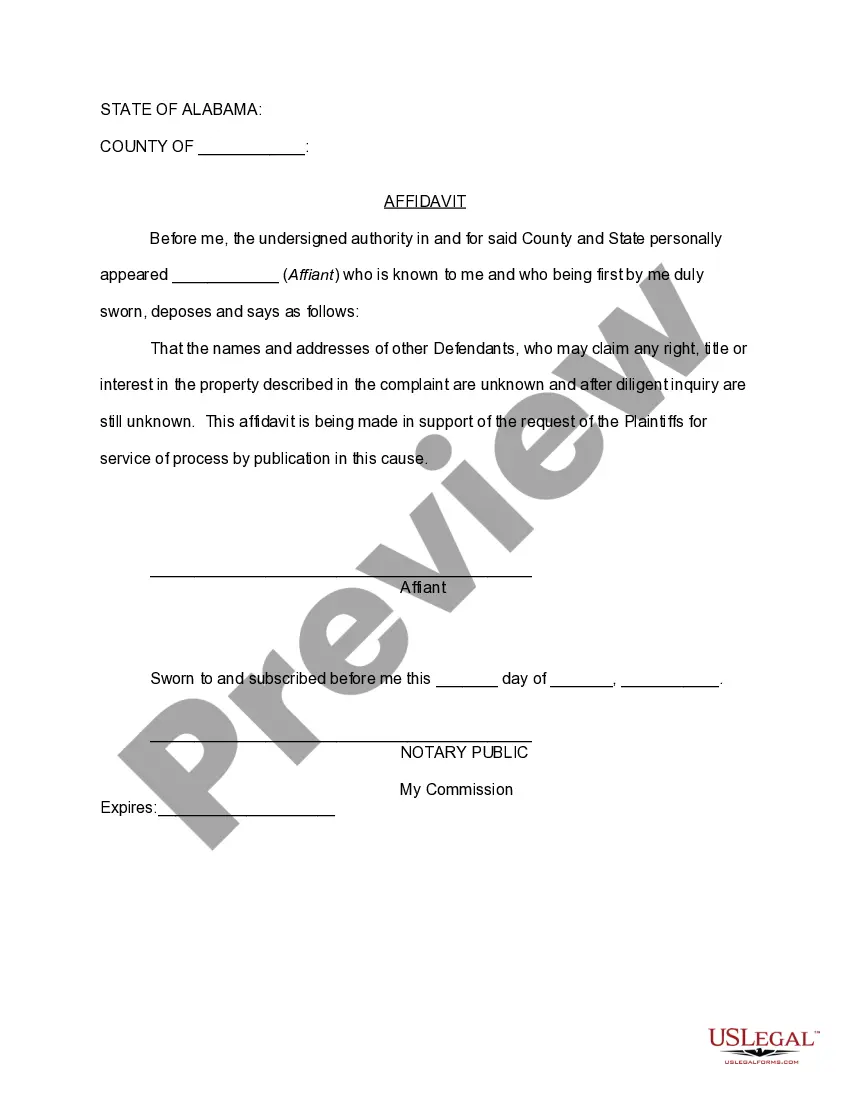

How to fill out Diver Services Contract - Self-Employed?

Are you currently in a position where you require documents for either business or personal purposes almost every day? There are numerous legitimate document templates accessible online, but finding reliable ones is not straightforward. US Legal Forms offers thousands of template documents, including the Minnesota Diver Services Contract - Self-Employed, which are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Minnesota Diver Services Contract - Self-Employed template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the document you need and ensure it is for the correct city/region. Utilize the Review button to evaluate the form. Check the description to confirm you have selected the right document. If the document is not what you are looking for, use the Search box to find the form that suits your needs and specifications. Once you find the correct document, click Get now. Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard. Select a preferred file format and download your copy. Retrieve all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Minnesota Diver Services Contract - Self-Employed at any time if necessary. Just select the desired document to download or print the template.

- Use US Legal Forms, the most comprehensive collection of legal forms, to save time and prevent errors.

- The platform offers professionally crafted legal document templates that can be utilized for a variety of purposes.

- Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

To prove your status as an independent contractor, maintain thorough documentation that includes your Minnesota Diver Services Contract - Self-Employed. Records of invoices, payments, and project details support your claim. Additionally, having an established business name, business licenses, and tax identification helps reinforce your independent status. Keep everything organized for any future needs.

Contract work indeed counts as self-employment. If you operate under a Minnesota Diver Services Contract - Self-Employed, you are classified as an independent contractor. This status allows you to manage your own schedule, client relationships, and workload. Being self-employed offers flexibility but requires you to meet certain tax responsibilities as well.

Yes, service contracts are generally taxable in Minnesota. As a self-employed contractor using a Minnesota Diver Services Contract - Self-Employed, you should be aware of your tax obligations. Income derived from these contracts is usually subject to sales tax unless exempted. Consult a tax professional for tailored advice on your specific situation.

If you earned income as a self-employed individual, you must report it, typically using a 1099 form. This includes any payments received under a Minnesota Diver Services Contract - Self-Employed. Keep in mind that the form notifies the IRS about your earnings, ensuring you meet tax obligations. It’s essential to stay organized and file accurately to avoid complications.

New rules for self-employed individuals focus on tax obligations, independent contractor classifications, and benefits access. Understanding these rules is crucial for proper compliance and maximizing benefits. The Minnesota Diver Services Contract - Self-Employed can help clarify your responsibilities and rights under these new regulations. Always consult an expert for the latest updates in self-employment law.

Certainly, a self-employed person can have a contract. In fact, using a Minnesota Diver Services Contract - Self-Employed is advisable for defining the scope of work, payment details, and deadlines. This formal document not only protects your interests but also gives clients confidence in your professionalism. It serves as a reference point in case of any disputes or questions.

Yes, you can absolutely have a contract as a self-employed individual. A Minnesota Diver Services Contract - Self-Employed clearly outlines the terms and expectations between you and the client. This contract protects your rights and ensures you receive payment for your services. Additionally, having a contract helps prevent misunderstandings and establishes a professional relationship.

The independent contractor test in Minnesota determines whether an individual is truly self-employed. It evaluates various factors, such as the level of control the contractor has over their work and whether they have the opportunity for profit or loss. Understanding this test is crucial when drafting a Minnesota Diver Services Contract - Self-Employed, as it affects tax obligations and legal protections. Consulting resources like US Legal Forms can provide clarity and ensure compliance.

Writing a Minnesota Diver Services Contract - Self-Employed involves several key steps. Start by specifying the parties involved and the services to be provided. Be sure to include payment terms, deadlines, and any necessary legal clauses. You can simplify this process by using platforms like US Legal Forms, which offer templates specifically designed for self-employed contracts.

Self-employed individuals operate their business, while contracted workers provide services under specific agreements. A Minnesota Diver Services Contract - Self-Employed clarifies this relationship, ensuring both parties understand their rights and responsibilities. By recognizing the distinction, you can better manage your business operations.