Minnesota Pool Services Agreement - Self-Employed

Description

How to fill out Pool Services Agreement - Self-Employed?

Selecting the appropriate legal document template can be quite challenging.

Of course, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your city/county. You can browse the form using the Review button and read the form description to confirm this is the right one for you. If the form does not meet your needs, use the Search area to find the appropriate form. Once you are confident the form is suitable, click the Buy now button to obtain the form. Choose the payment plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or Visa or MasterCard. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Minnesota Pool Services Agreement - Self-Employed. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to download professionally crafted documents that comply with state requirements.

- The service offers thousands of templates, including the Minnesota Pool Services Agreement - Self-Employed, that can be utilized for business and personal needs.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Minnesota Pool Services Agreement - Self-Employed.

- Use your account to browse through the legal forms you have purchased previously.

- Proceed to the My documents tab in your account and acquire another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

Form popularity

FAQ

While both self-employed individuals and independent contractors work for themselves, the terms differ slightly in terms of business structure. A self-employed person could run a sole proprietorship or a company, while an independent contractor typically operates on a contract basis. If you are considering entering into a Minnesota Pool Services Agreement - Self-Employed, it's essential to understand these distinctions to ensure clarity in your business operations.

To qualify as an independent contractor in Minnesota, individuals must demonstrate control over how they perform their work and often work on a contract basis rather than being employed full-time. If you’re considering a Minnesota Pool Services Agreement - Self-Employed, ensure you meet the classification criteria, which include having multiple clients and realizing the risk of profit or loss in your venture. Being aware of these qualifications can protect your business model.

Being an independent contractor has its challenges, including the lack of a steady paycheck and the absence of employer-sponsored benefits. For those operating under a Minnesota Pool Services Agreement - Self-Employed, these factors can lead to financial uncertainty. It’s important to prepare for irregular income and to seek resources, like US Legal Forms, to understand your contractual obligations and rights.

An independent contractor in Minnesota is a self-employed individual who provides services to clients without sustaining an employer-employee relationship. When working under a Minnesota Pool Services Agreement - Self-Employed, contractors manage their own taxes and benefits, giving them more control over their work life. This arrangement can be beneficial for those who desire flexibility in their schedules and project choices.

Self-employment tax in Minnesota applies to individuals who work for themselves and includes Social Security and Medicare taxes. If you operate under a Minnesota Pool Services Agreement - Self-Employed, you will need to calculate your self-employment taxes based on your earnings from your pool services business. Be aware that these taxes can significantly impact your overall income, so it's essential to plan accordingly.

In Minnesota, the independent contractor rule defines how workers are classified for employment purposes. Essentially, a worker must meet certain criteria to be considered an independent contractor, particularly under a Minnesota Pool Services Agreement - Self-Employed. This rule impacts tax responsibilities and eligibility for benefits, making it crucial for anyone engaging in pool services to understand their classification.

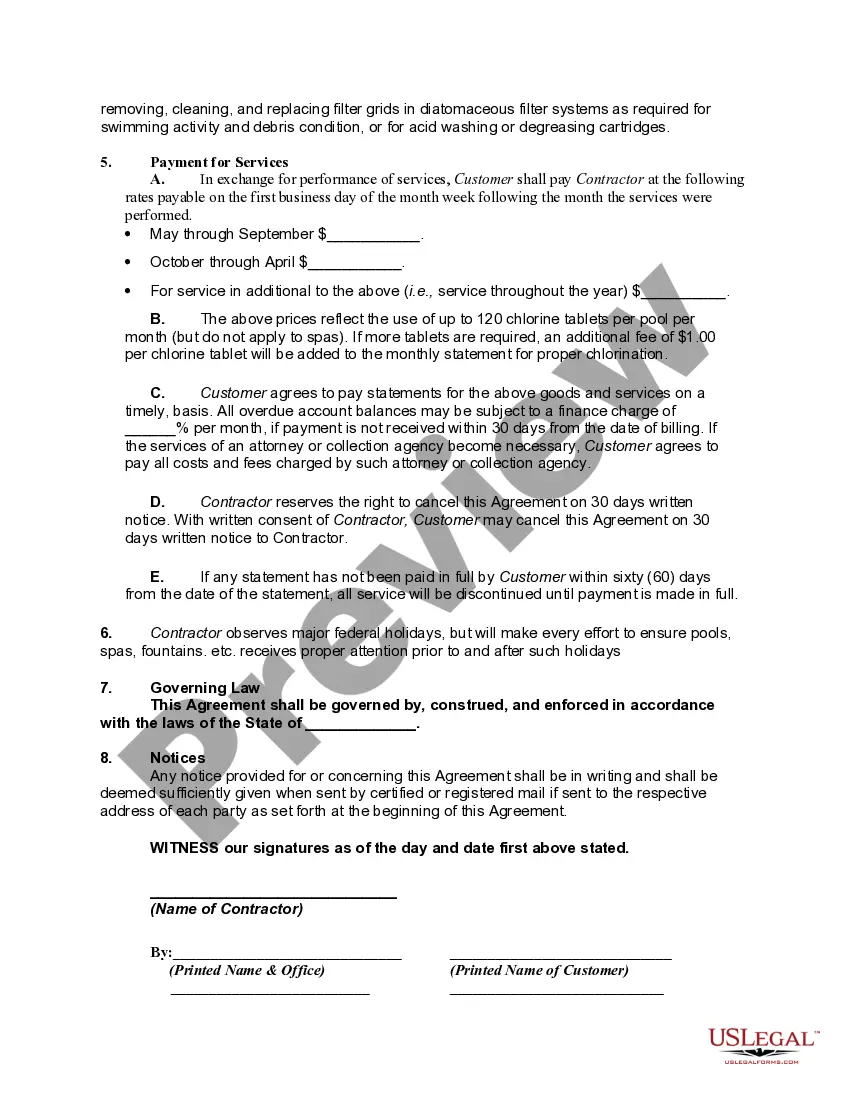

Writing a swimming pool contract involves detailing the scope of work, payment terms, and any warranties or guarantees. Be sure to include client responsibilities and policies for cancellations or changes. Leveraging a Minnesota Pool Services Agreement - Self-Employed template can streamline this process and ensure you cover all necessary aspects.

Essential equipment for a pool cleaning service includes a skimmer, vacuum, brushes, and chemical testing kits. You may also need a reliable vehicle to transport equipment. By using a Minnesota Pool Services Agreement - Self-Employed, you can ensure your clients are aware of the services covered under your agreements.

The pool service business can be quite profitable, especially in areas with a high number of residential pools. Consistent demand for maintenance and cleaning increases revenue potential. Establishing a solid contract using a Minnesota Pool Services Agreement - Self-Employed can further enhance profit margins by ensuring proper payment and service expectations.

Pool service owners' earnings can vary widely based on location, client base, and services offered. Typically, a well-managed business can yield a steady income after initial costs. A proper framework, such as the Minnesota Pool Services Agreement - Self-Employed, can help clarify fees and protect your profits.