Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

Selecting the optimal legal document web template can be a significant challenge.

Naturally, there are numerous themes accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor, which can be utilized for both business and personal needs.

You can review the form with the Preview button and read the form description to confirm it is suitable for your needs.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log Into your account and click on the Download button to access the Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor.

- Use your account to search for the legal forms you have previously bought.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple guidelines for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

To fill out a declaration of independent contractor status form, outline your business structure and confirm that you operate independently. Usually, you'll include your business name, address, and nature of work in this declaration. Consider utilizing resources from uslegalforms to ensure that your declaration aligns with the requirements needed for a Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor.

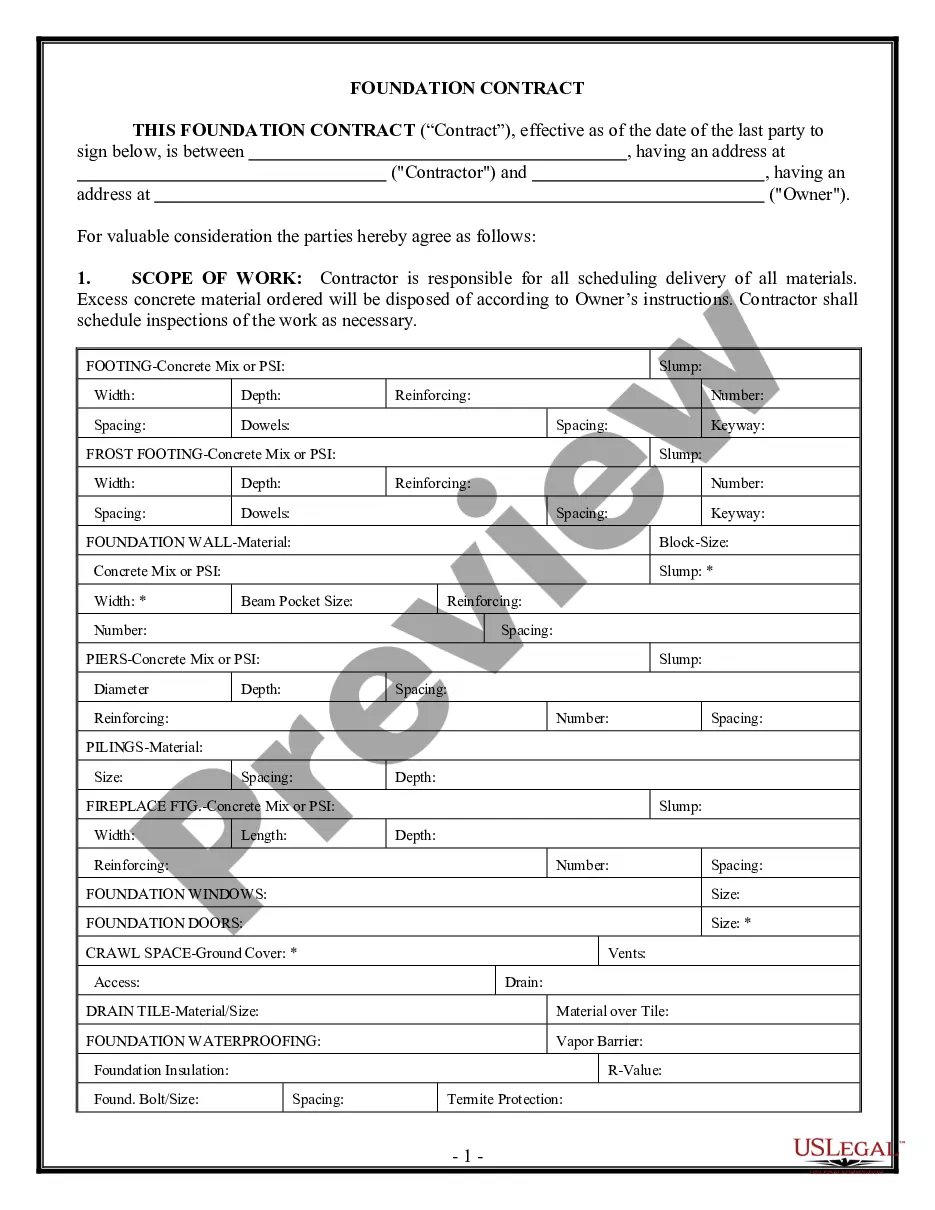

When filling out an independent contractor agreement, begin by providing basic information for both the contractor and the client, including names and contact details. Next, outline the services to be provided and specify payment arrangements. Finally, ensure that both parties sign and date the Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor to formalize the agreement.

To write an independent contractor agreement, start by clearly detailing the scope of work and expectations for both parties. Include payment terms, timelines, and any necessary legal clauses. You may want to consider using a template like the Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor for easily accessible and structured guidance.

An independent contractor typically fills out a W-9 form to provide their taxpayer information. Additionally, when entering into a working relationship, the contractor will need to complete a Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor. This agreement outlines the terms of the project, payment details, and other important conditions.

The new federal rule on independent contractors, established by the Department of Labor, aims to clarify the classification of workers in various employment situations. It emphasizes a more rigid standard for determining who qualifies as an independent contractor versus an employee. Understanding these changes is crucial, and using a Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor can help you navigate this evolving landscape with confidence.

A basic independent contractor agreement typically includes essential elements such as the scope of work, payment terms, confidentiality clauses, and termination conditions. This document serves as a foundation for outlining the expectations between the parties, protecting both sides legally. For professionals, a Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor provides a robust framework for engaging in work without complications.

In Minnesota, independent contractors must adhere to specific legal requirements to ensure compliance with state law. These include obtaining the necessary licenses and permits, paying taxes as a self-employed individual, and maintaining proper insurance coverage. A Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor can guide you in fulfilling these obligations effectively.

The independent contractor agreement in Minnesota is a contract that outlines the terms of work between a hiring party and a self-employed independent contractor. This agreement defines the roles, responsibilities, payment terms, and expectations, ensuring clarity for both parties. Using a Minnesota Outside Project Manager Agreement - Self-Employed Independent Contractor, you can avoid misunderstandings and promote a productive working relationship.