Minnesota Supplemental Retirement Plan

Description

How to fill out Supplemental Retirement Plan?

If you wish to full, down load, or printing legitimate document layouts, use US Legal Forms, the largest variety of legitimate types, that can be found on the web. Utilize the site`s easy and convenient look for to find the paperwork you will need. A variety of layouts for company and person uses are sorted by groups and claims, or keywords. Use US Legal Forms to find the Minnesota Supplemental Retirement Plan within a few mouse clicks.

If you are currently a US Legal Forms consumer, log in in your account and then click the Download key to find the Minnesota Supplemental Retirement Plan. You may also gain access to types you earlier downloaded from the My Forms tab of your own account.

If you are using US Legal Forms the very first time, follow the instructions under:

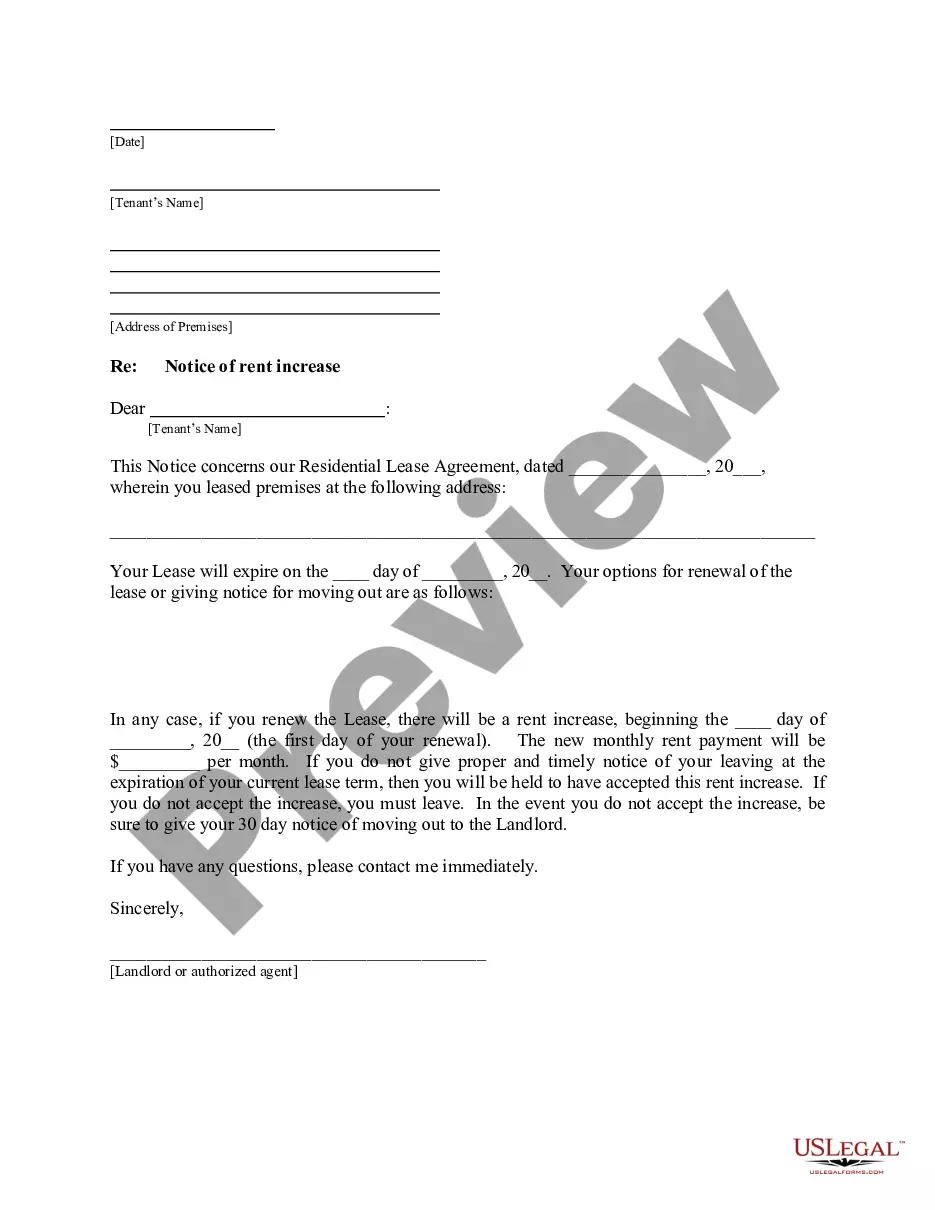

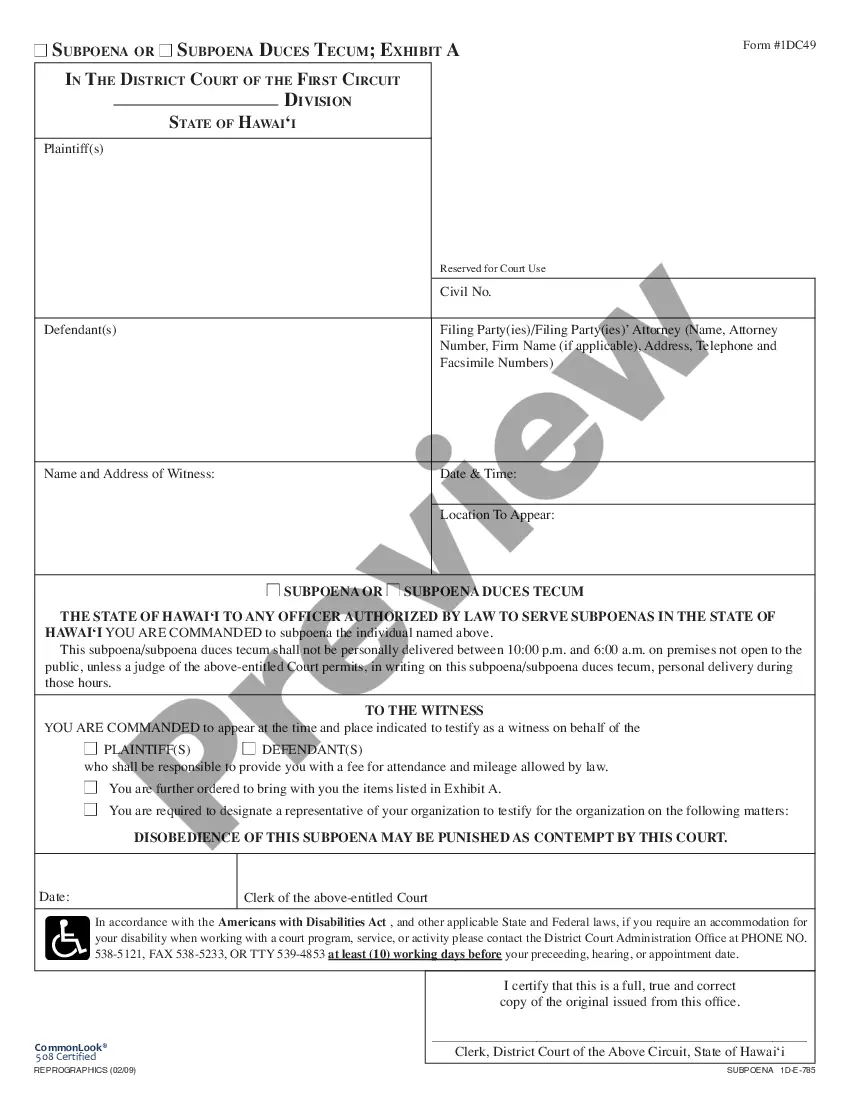

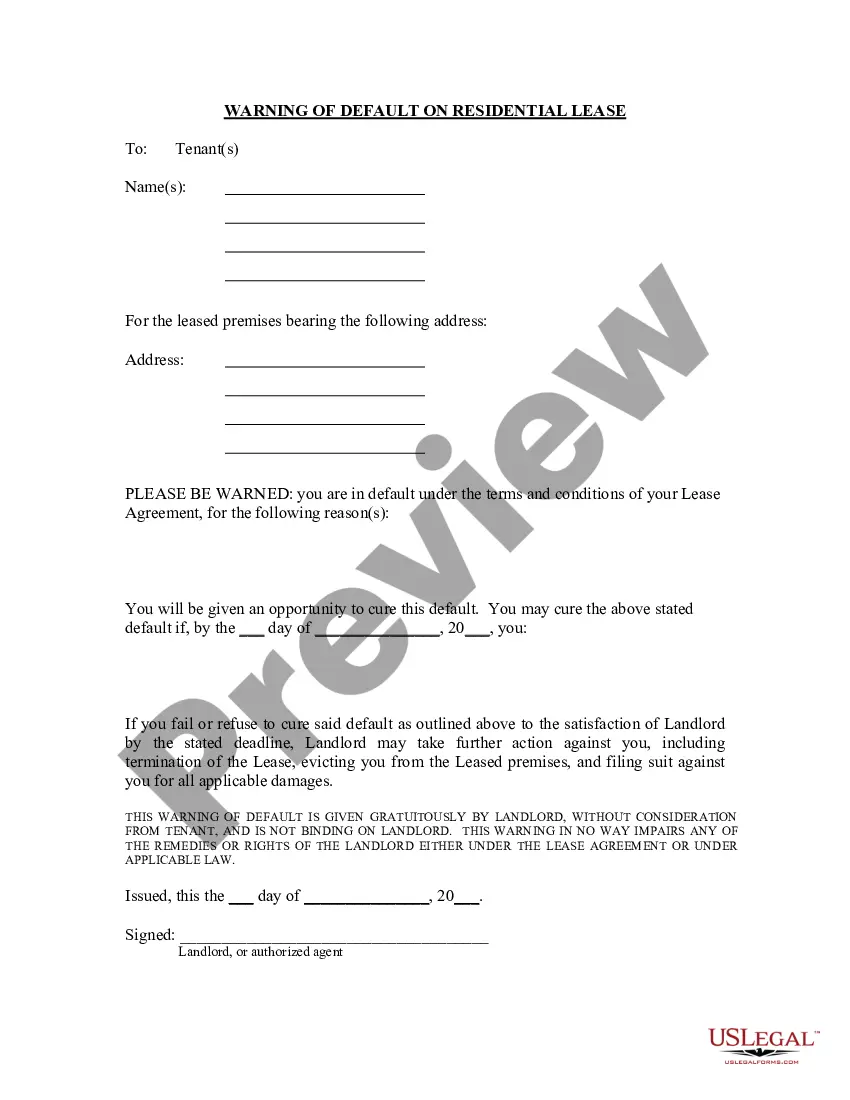

- Step 1. Be sure you have selected the form to the appropriate metropolis/nation.

- Step 2. Use the Review solution to examine the form`s content. Do not overlook to see the explanation.

- Step 3. If you are not happy using the develop, take advantage of the Lookup industry on top of the monitor to locate other models of the legitimate develop template.

- Step 4. After you have identified the form you will need, click on the Purchase now key. Select the pricing prepare you favor and add your accreditations to sign up for an account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal account to accomplish the purchase.

- Step 6. Find the file format of the legitimate develop and down load it in your gadget.

- Step 7. Comprehensive, change and printing or indicator the Minnesota Supplemental Retirement Plan.

Each and every legitimate document template you acquire is your own for a long time. You possess acces to every develop you downloaded within your acccount. Go through the My Forms section and select a develop to printing or down load again.

Be competitive and down load, and printing the Minnesota Supplemental Retirement Plan with US Legal Forms. There are millions of professional and status-specific types you can use for your company or person requirements.

Form popularity

FAQ

The employer buys the insurance policy, pays the premiums, and has access to its cash value. The employee receives supplemental retirement income paid for through the insurance policy. Once the employee receives income in retirement, that benefit is taxable. At that point, the employer receives a tax deduction.

It's a lump-sum cash award, designed to offset the effects of your reduced pension contributions due to your service-related disability.

The employee's total elective deferrals to all of these plans combined cannot exceed the annual deferral limit ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and 2021). See How Much Salary Can You Defer if You're Eligible for More Than One Retirement Plan.

Key Takeaways. A SERP is a non-qualified retirement plan offered to executives as a long term incentive. Unlike in a 401(k) or other qualified plan, SERPs offer no immediate tax advantages to the company or the executive. When the benefits are paid, the company deducts them as a business expense.

SERPs are paid out as either one lump sum or as a series of set payments from an annuity, with different tax implications for each method, so choose carefully.

Supplemental contributions Type of limit2023403b under age 50$22,500403b age 50 and over$30,000Compensation limit (employer's matched retirement contributions are limited to matches made on this amount of salary)$330,000

All these programs are qualified retirement plans under Section 401(a) of the Internal Revenue Code. Benefits are funded by investment earnings, the employer, and its employees. Contributions over a member's career are made by both the member and employer, and invested and managed by the State Board of Investment.