Minnesota Designation of Rights, Privileges and Preferences of Preferred Stock

Description

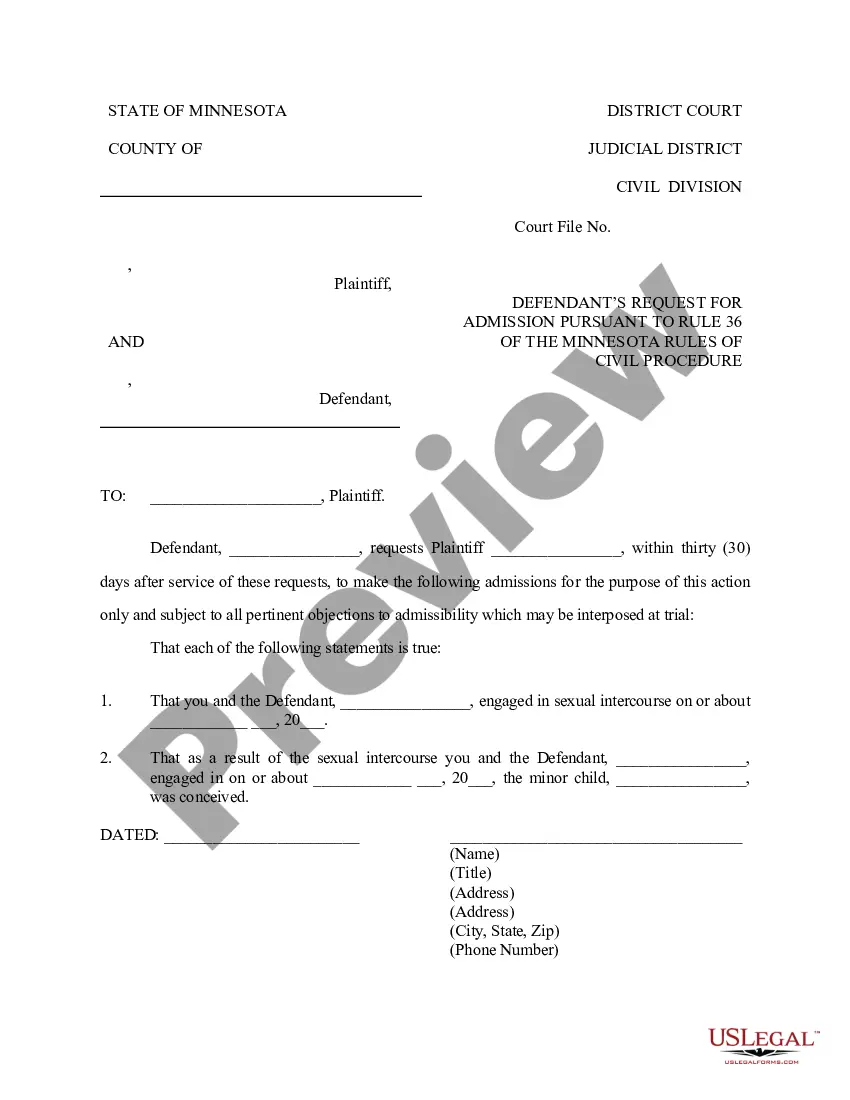

How to fill out Designation Of Rights, Privileges And Preferences Of Preferred Stock?

Are you currently inside a situation where you will need paperwork for either organization or individual uses nearly every day time? There are a variety of authorized papers templates available online, but locating ones you can rely on is not simple. US Legal Forms delivers a huge number of kind templates, like the Minnesota Designation of Rights, Privileges and Preferences of Preferred Stock, which can be composed to satisfy federal and state specifications.

If you are currently informed about US Legal Forms internet site and also have a merchant account, merely log in. Afterward, you may acquire the Minnesota Designation of Rights, Privileges and Preferences of Preferred Stock template.

Unless you offer an bank account and want to begin to use US Legal Forms, adopt these measures:

- Get the kind you need and make sure it is for your correct metropolis/region.

- Take advantage of the Preview switch to check the shape.

- Browse the information to ensure that you have selected the appropriate kind.

- In case the kind is not what you`re searching for, make use of the Research discipline to obtain the kind that meets your needs and specifications.

- If you find the correct kind, just click Acquire now.

- Select the rates strategy you desire, complete the desired details to produce your bank account, and purchase the transaction using your PayPal or bank card.

- Pick a handy paper structure and acquire your backup.

Get each of the papers templates you possess bought in the My Forms menu. You can obtain a further backup of Minnesota Designation of Rights, Privileges and Preferences of Preferred Stock at any time, if possible. Just go through the necessary kind to acquire or printing the papers template.

Use US Legal Forms, probably the most considerable collection of authorized forms, to save time as well as prevent mistakes. The assistance delivers appropriately manufactured authorized papers templates which you can use for an array of uses. Create a merchant account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

Preferred Stock Designation means the express terms of shares of any class or series of capital stock of the Corporation, whether now or hereafter issued, with rights to distributions senior to those of the Common Stock including, without limitation, any relative, participating, optional, or other special rights and ...

Ergo, preference shareholders hold preferential rights over common shareholders when it comes to sharing profits. Consequently, if a company lands into bankruptcy, preference shareholders are issued dividends first or have the first right to the company's assets before common stock investors.

Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the customarily specified rate that preferred dividends are paid to preferred shareholders, as well as an additional dividend based on some predetermined condition.

Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

In the United States there are two types of preferred stocks: straight preferreds and convertible preferreds. Straight preferreds are issued in perpetuity (although some are subject to call by the issuer, under certain conditions) and pay a stipulated dividend rate to the holder.

Preference shares, also known as preferred shares, are a type of security that offers characteristics similar to both common shares and a fixed-income security. The holders of preference shares are typically given priority when it comes to any dividends that the company pays.

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.