Minnesota General Partnership for Business

Description

How to fill out General Partnership For Business?

Have you ever found yourself in a situation where you need to have paperwork for either professional or personal reasons daily.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of template forms, such as the Minnesota General Partnership for Business, designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal templates, to save time and prevent errors.

The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms site and possess an account, just Log In.

- Then, you can download the Minnesota General Partnership for Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it corresponds to your specific location/state.

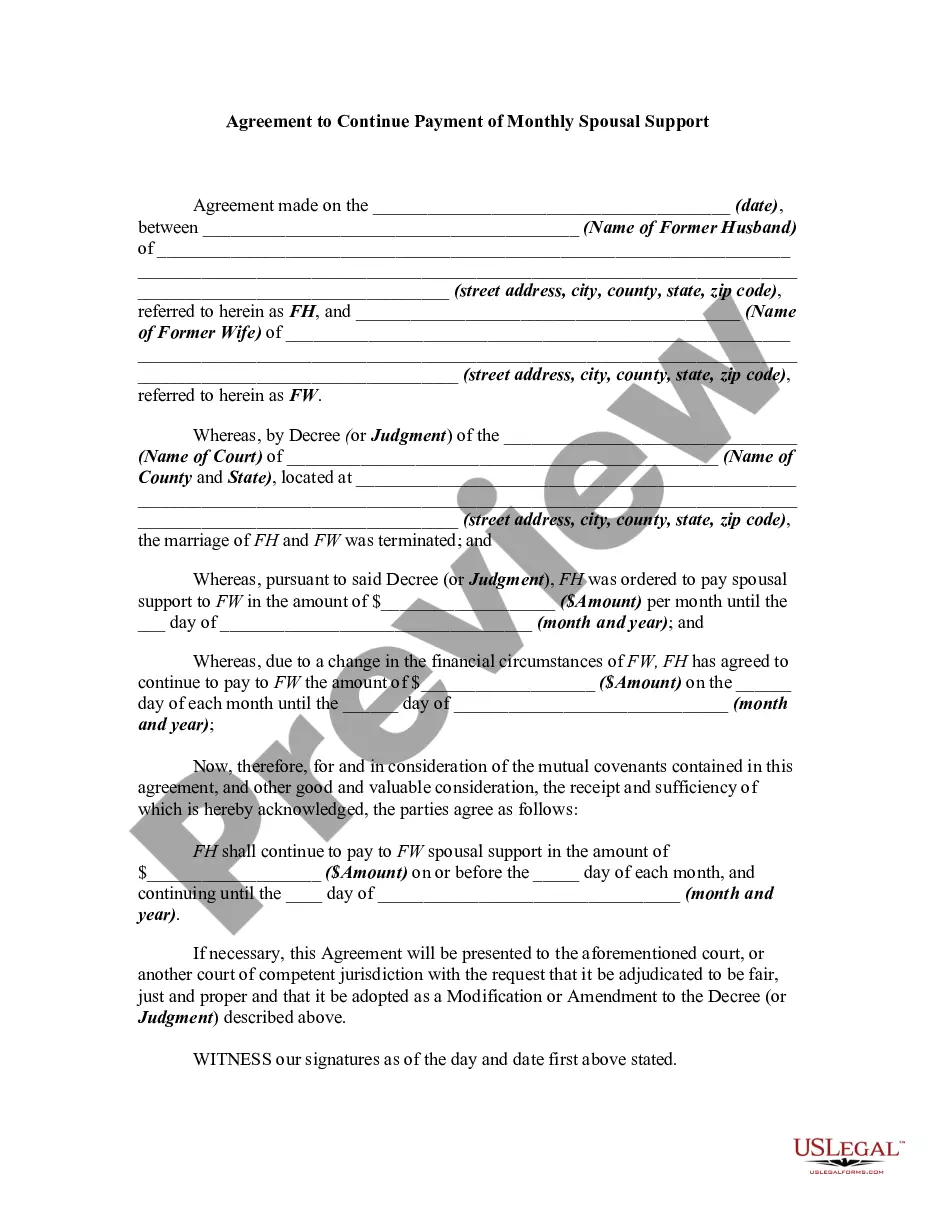

- Utilize the Review button to examine the document.

- Check the details to confirm that you've selected the correct form.

- If the form is not what you require, employ the Search field to find the template that fits your needs.

- Once you've obtained the correct form, simply click Purchase now.

- Choose the pricing plan you prefer, provide the necessary information to process your payment, and finalize your order using PayPal or Visa or Mastercard.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can retrieve a new copy of the Minnesota General Partnership for Business at any time, if needed. Just select the required form to download or print the document template.

Form popularity

FAQ

In Minnesota, partnerships usually need to register with the state, pay a filing fee, and file the required paperwork. Out of state business may be subject to filing additional forms and fees. General Partnerships (GP) GPs may file with the state if doing business under a fictitious name.

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

It's ultimately up to you and the partners to decide how to create the partnership agreement. It's a legal contract, so it should be worded as such, and signed by all parties. You can choose an online template, create one yourself or speak to an attorney to draw up the contract.

General partnership disadvantages include:General Partners are Responsible for Other Partners' Actions. In a general partnership, each partner is liable for what the other does.You'll Have to Split the Profits.Disagreements Could Arise.Your Personal Assets are Vulnerable.

Simplified taxes: The biggest advantage of a general partnership is the tax benefit. Businesses structured as partnerships do not pay income tax. Instead, all profits and losses are passed through to the individual partners.

Based on ContractsCounsel's marketplace data, the average cost of a project involving a partnership agreement is $603.89 . Partnership agreement cost depends on many variables, which includes the service requested, number of partners, and the number of custom terms needed to be included in the document.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Forming a Business Partnership? 6 Things to Consider FirstMake sure you share similar values.Set clear expectations from the start.Outline how you'll manage business finances.Decide what type of legal partnership you'll choose.Decide how you'll handle partnership dissolution.Have an attorney draw up legal documents.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

It's a partnership where all partners have responsibility for the business and unlimited liability for business debts. This means that each general partner shares both the benefits and the obligations of the business.