Minnesota Simple Partnership Agreement

Description

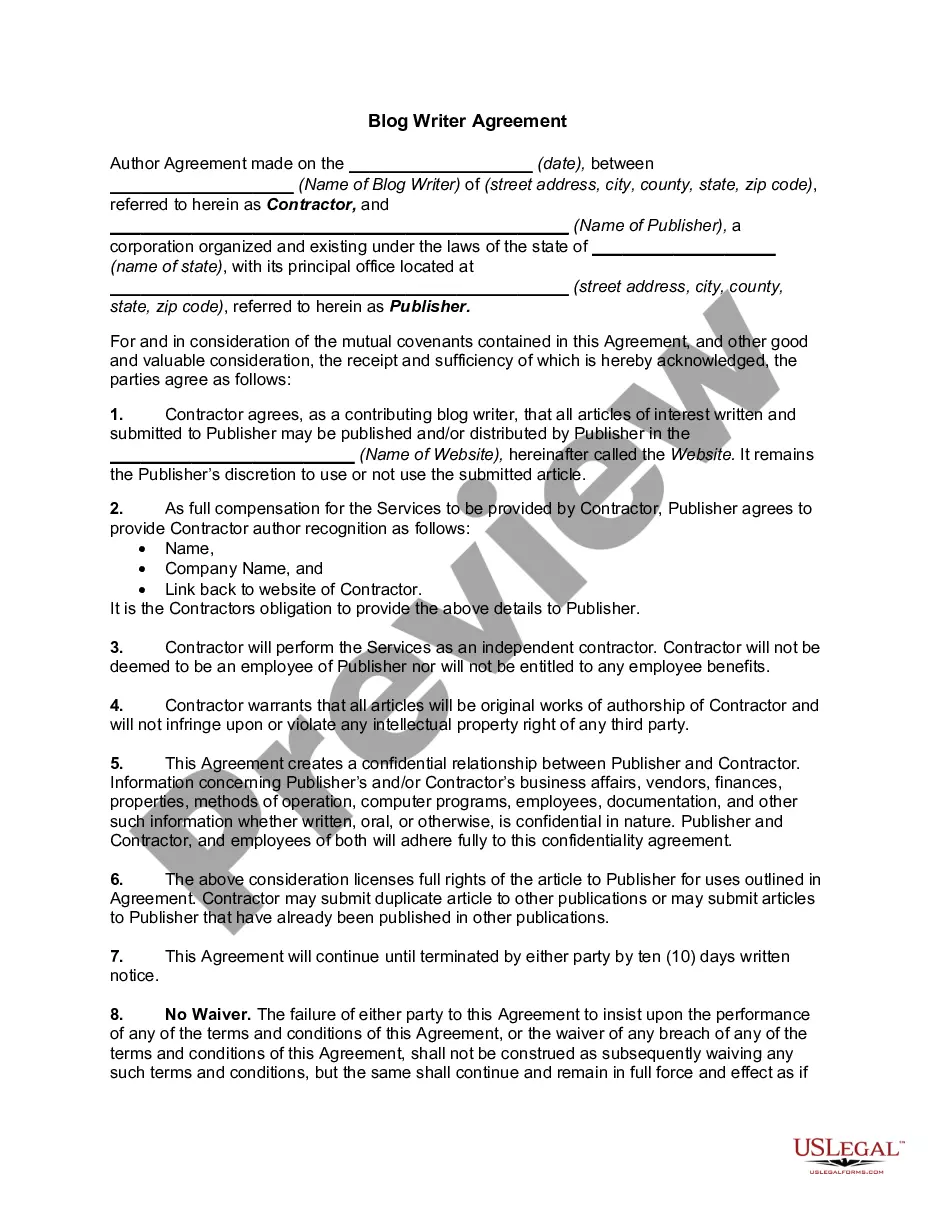

How to fill out Simple Partnership Agreement?

If you wish to total, obtain, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal forms, which are accessible online.

Employ the site's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to each form you saved in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, and print the Minnesota Simple Partnership Agreement with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Minnesota Simple Partnership Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the Minnesota Simple Partnership Agreement.

- You can also view forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, consult the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Remember to read through the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find more forms in the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Minnesota Simple Partnership Agreement.

Form popularity

FAQ

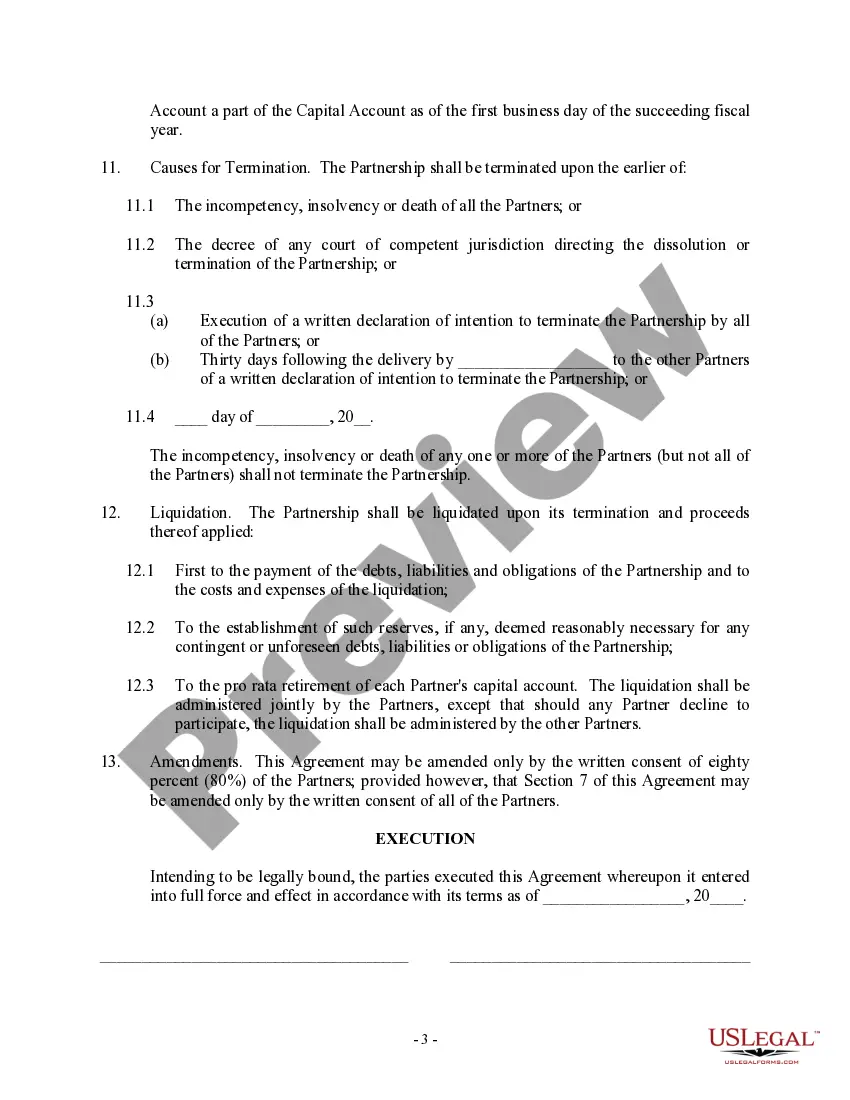

Minnesota requires partnerships to withhold tax on the income earned by nonresident partners. This nonresident withholding applies to distributions made to partners who do not reside in Minnesota. If your partnership operates under a Minnesota Simple Partnership Agreement, understanding these withholding rules will help you comply with state requirements and avoid potential issues.

Certain groups may be exempt from Minnesota income tax, including some tax-exempt organizations and nonprofits. Additionally, some individuals and partnerships formed under a Minnesota Simple Partnership Agreement may qualify for specific exemptions. It's essential to review eligibility criteria to determine your tax responsibilities.

Individuals, partnerships, and corporations doing business in Minnesota must file a Minnesota tax return. If you are a partner in a partnership under a Minnesota Simple Partnership Agreement, you may also need to file an individual return based on your share of the partnership's income. Understanding these requirements can help ensure you fulfill your tax obligations.

Any partnership doing business or earning income in Minnesota must file a Minnesota partnership return. This includes partnerships that operate under a Minnesota Simple Partnership Agreement. It is crucial to report all income, deductions, and distributions, as this return helps determine partners' share of income.

A partnership must file its return by the 15th day of the fourth month after the end of its tax year. For most partnerships, this means April 15th if following a calendar year. If you have formed a Minnesota Simple Partnership Agreement, timely filing is essential to avoid penalties and ensure compliance with state tax regulations.

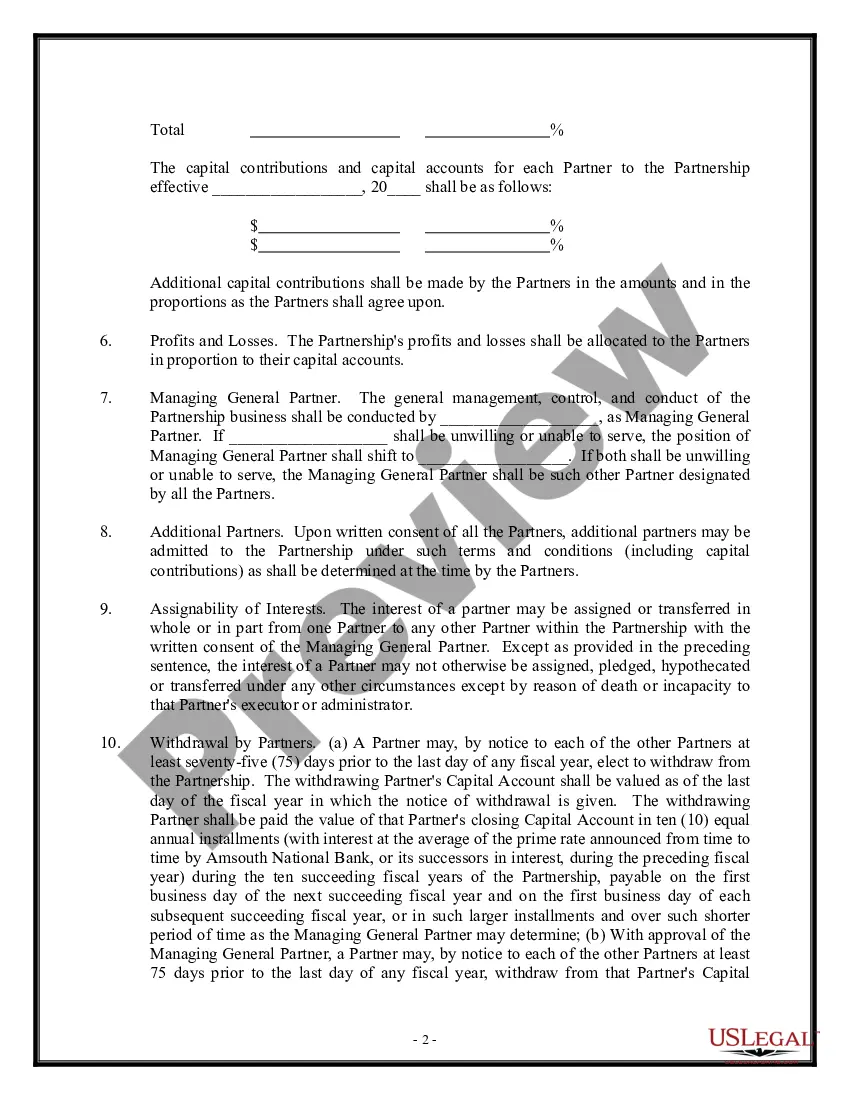

The key difference lies in the roles of the partners. In a simple partnership, all partners have equal management rights and responsibilities, whereas a limited partnership includes both general partners who manage the business and limited partners who invest but do not participate in daily operations. When creating a Minnesota Simple Partnership Agreement, knowing these roles can help you choose the best structure for your business needs.

Minnesota partnership tax refers to the tax obligations that partnerships must follow within the state. Partnerships themselves are not taxed; instead, earnings are passed through to partners who report them on their income tax returns. When you establish a Minnesota Simple Partnership Agreement, it's essential to understand these tax implications to ensure compliance and effective financial planning.

A simple partnership is a business arrangement between two or more individuals who agree to share profits and responsibilities. This type of partnership is characterized by its straightforward structure and flexible management. With a Minnesota Simple Partnership Agreement, partners can define their roles, contributions, and profit-sharing methods, ensuring clarity from the start.

A simple partnership generally refers to a straightforward arrangement between partners without complex structures, while a general partnership includes partners who share management duties and liabilities. In both forms, each partner is liable for business debts, but the simple partnership implies a more informal setup. If you’re considering the Minnesota Simple Partnership Agreement, it typically falls under the simpler category, which is easy to manage.

A simple partnership consists of two or more partners who share profits and responsibilities equally, with flexible management structures. In contrast, a compound partnership involves multiple tiers of partners, often including silent or limited partners. Understanding these distinctions is important when forming a Minnesota Simple Partnership Agreement, as it impacts decision-making and liability.