Minnesota Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

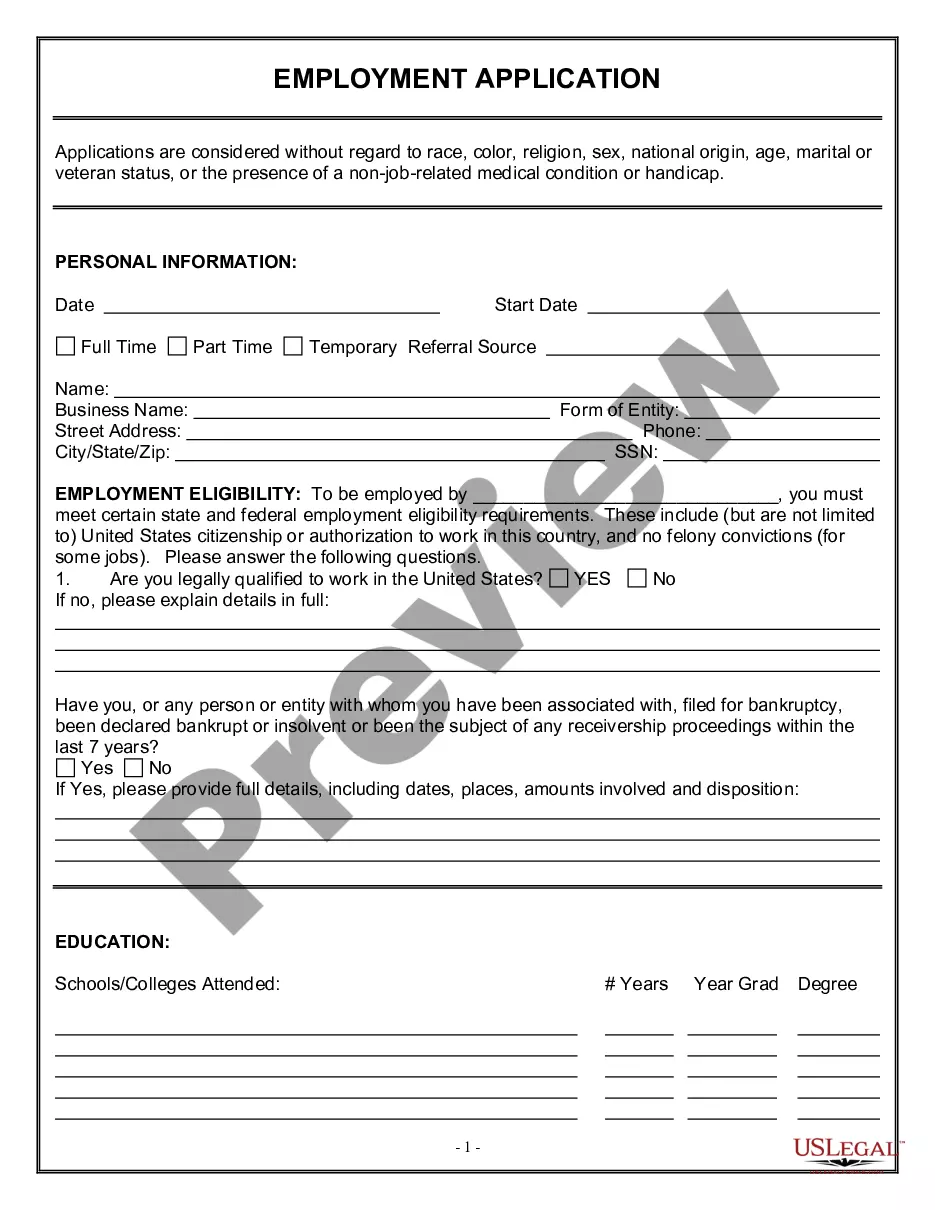

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

It is feasible to spend hours online searching for the approved document template that meets the federal and state requirements you will necessitate.

US Legal Forms offers a wide array of legal documents that are verified by professionals.

You can conveniently acquire or print the Minnesota Resolution of Meeting of LLC Members to Determine Amount of Yearly Disbursements to Members of the Company through your services.

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Obtain button.

- Afterward, you may fill out, amend, print, or sign the Minnesota Resolution of Meeting of LLC Members to Determine Amount of Yearly Disbursements to Members of the Company.

- Every legal document template you purchase is yours permanently.

- To receive another copy of the acquired form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward guidelines below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Review the form description to ensure you have chosen the right document.

Form popularity

FAQ

MCA means a Member Control Agreement adopted pursuant to Section 322B. 37 of Chapter 322B. operating agreement or bylaws means the bylaws adopted under Chapter 322B, pursuant to Section 322B. 603, which might be confusingly titled Operating Agreement.

LEGAL RECOGNITION OF ELECTRONIC. RECORDS AND SIGNATURES. 302A.015. LEGAL RECOGNITION OF ELECTRONIC RECORDS AND SIGNATURES. APPLICATION.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.

(a) Whoever unlawfully by means of fire or explosives, intentionally destroys or damages any building not included in subdivision 1, whether the property of the actor or another, commits arson in the first degree if a flammable material is used to start or accelerate the fire.

Under 322C, the ability of a member, or anyone else, to act as an agent of the LLC is to be addressed, if at all, in an operating agreement. An LLC may file statements of authority with the Office of Minnesota Secretary of State (similar to those filed by partnerships) with respect to non-members.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.