Minnesota Resolution of Meeting of LLC Members to Dissolve the Company

Description

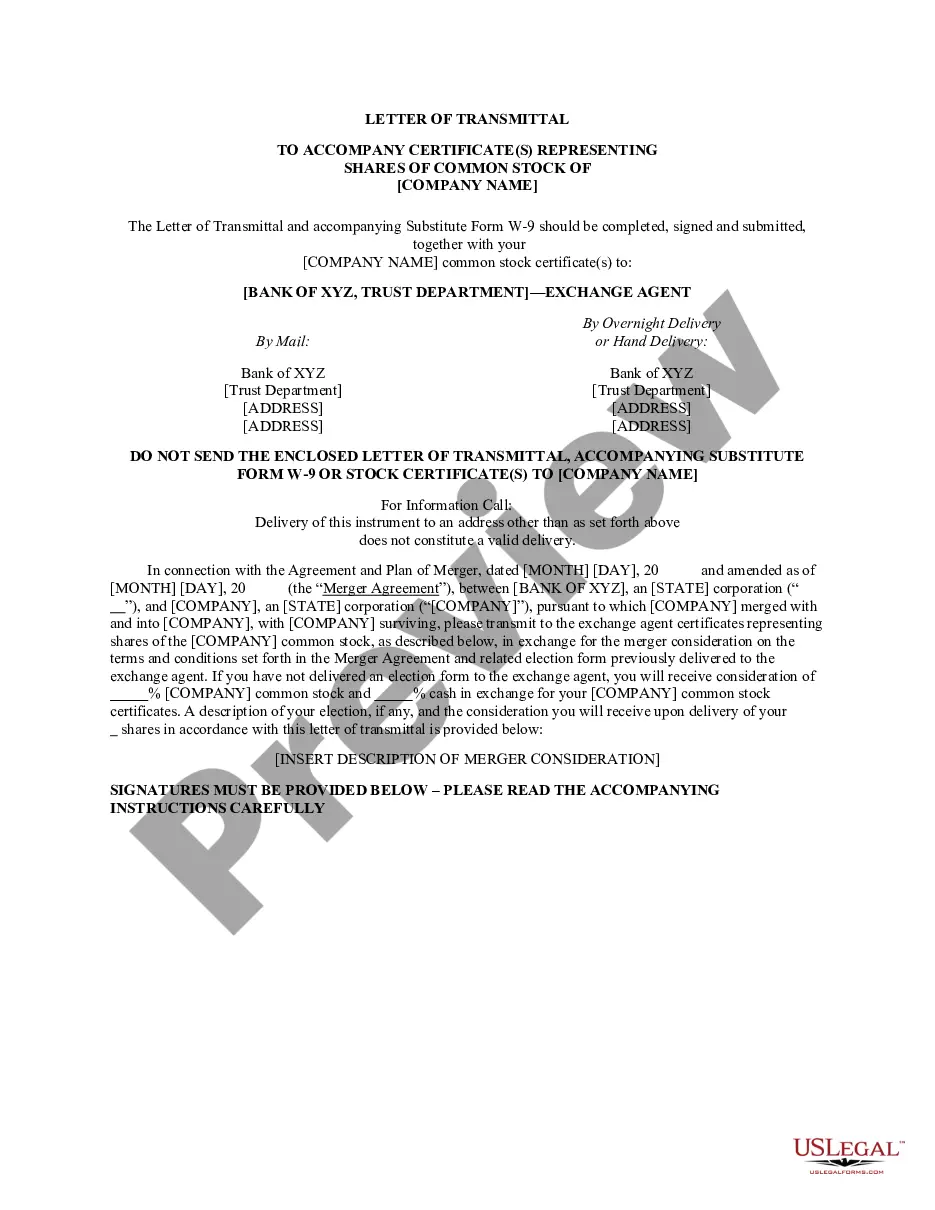

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

You can spend hours online attempting to locate the official document template that fulfills the state and federal requirements you need.

US Legal Forms offers a vast array of official forms that have been vetted by experts.

You can conveniently download or print the Minnesota Resolution of Meeting of LLC Members to Dissolve the Company from our platform.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Minnesota Resolution of Meeting of LLC Members to Dissolve the Company.

- Every official document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your region/city of interest.

- Read the form description to confirm you have chosen the correct one.

Form popularity

FAQ

6 Steps to Dissolve a Corporation#1 Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors.#2 File Articles of Dissolution.#3 Finalize Taxes.#4 Notify Creditors.#5 Liquidate and Distribute Assets.#6 Wrap Up Operations.

To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A. 7291 or 302A. 727.

In Minnesota, you must first file a Statement of Dissolution stating that you are in the process of winding up your business. Then, once you wind up your LLC, you must file the Statement of Termination. Minnesota requires business owners to submit their Statement of Termination by mail, online, or in-person.

A corporation maybe dissolved either voluntarily or involuntarily. There are three ways by which a corporation can be dissolved voluntarily. The most common method of voluntary dissolution is by shortening the corporate term through the amendment of the articles of incorporation.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

In Minnesota, you must first file a Statement of Dissolution stating that you are in the process of winding up your business. Then, once you wind up your LLC, you must file the Statement of Termination. Minnesota requires business owners to submit their Statement of Termination by mail, online, or in-person.

Closing Correctly Is ImportantOfficially dissolving an LLC is important. If you don't, you can be held personally liable for the unpaid debts and taxes of the LLC. A few additional fees you should look for; Many states also levy a fee against LLCs each year.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.