Minnesota Sample Letter for Notice of Objection to Secure Claim

Description

How to fill out Sample Letter For Notice Of Objection To Secure Claim?

US Legal Forms - among the largest libraries of legal forms in America - offers a wide range of legal papers web templates you may obtain or print out. While using internet site, you may get a huge number of forms for organization and personal functions, sorted by groups, claims, or search phrases.You will find the most up-to-date types of forms much like the Minnesota Sample Letter for Notice of Objection to Secure Claim within minutes.

If you currently have a monthly subscription, log in and obtain Minnesota Sample Letter for Notice of Objection to Secure Claim through the US Legal Forms local library. The Down load option can look on each and every type you view. You gain access to all formerly saved forms inside the My Forms tab of your respective bank account.

In order to use US Legal Forms initially, listed below are basic guidelines to obtain started out:

- Make sure you have chosen the right type for your city/county. Click on the Review option to examine the form`s articles. See the type information to actually have selected the correct type.

- In the event the type doesn`t suit your needs, use the Look for discipline towards the top of the monitor to discover the one that does.

- When you are pleased with the form, affirm your selection by clicking on the Buy now option. Then, select the prices program you prefer and offer your credentials to sign up on an bank account.

- Method the deal. Utilize your Visa or Mastercard or PayPal bank account to perform the deal.

- Find the format and obtain the form on your product.

- Make changes. Fill up, change and print out and sign the saved Minnesota Sample Letter for Notice of Objection to Secure Claim.

Every single template you included with your account lacks an expiration particular date which is your own property for a long time. So, if you wish to obtain or print out another version, just visit the My Forms area and click on on the type you need.

Gain access to the Minnesota Sample Letter for Notice of Objection to Secure Claim with US Legal Forms, the most comprehensive local library of legal papers web templates. Use a huge number of specialist and status-particular web templates that meet your company or personal demands and needs.

Form popularity

FAQ

An affidavit of non-prosecution serves as a formal declaration by the alleged victim that they do not wish to participate in the prosecution process. This document can be submitted to the prosecutor's office or the court as evidence of the victim's intentions not to cooperate. It must be notarized.

Start by identifying yourself in the letter. You can express to the Court the impact that the crime has had on you and your family (financial, social, psychological, emotional, and physical). Express your feelings about an appropriate sentence, e.g. jail time, probation, fine, probation conditions, counseling, etc.

The Myth of Getting Criminal Charges Dropped in Your Case This is largely a myth. Under the Georgia Criminal Code, once criminal charges are filed in a case, it must go to trial, and it is up to the prosecutor alone to decide how to proceed.

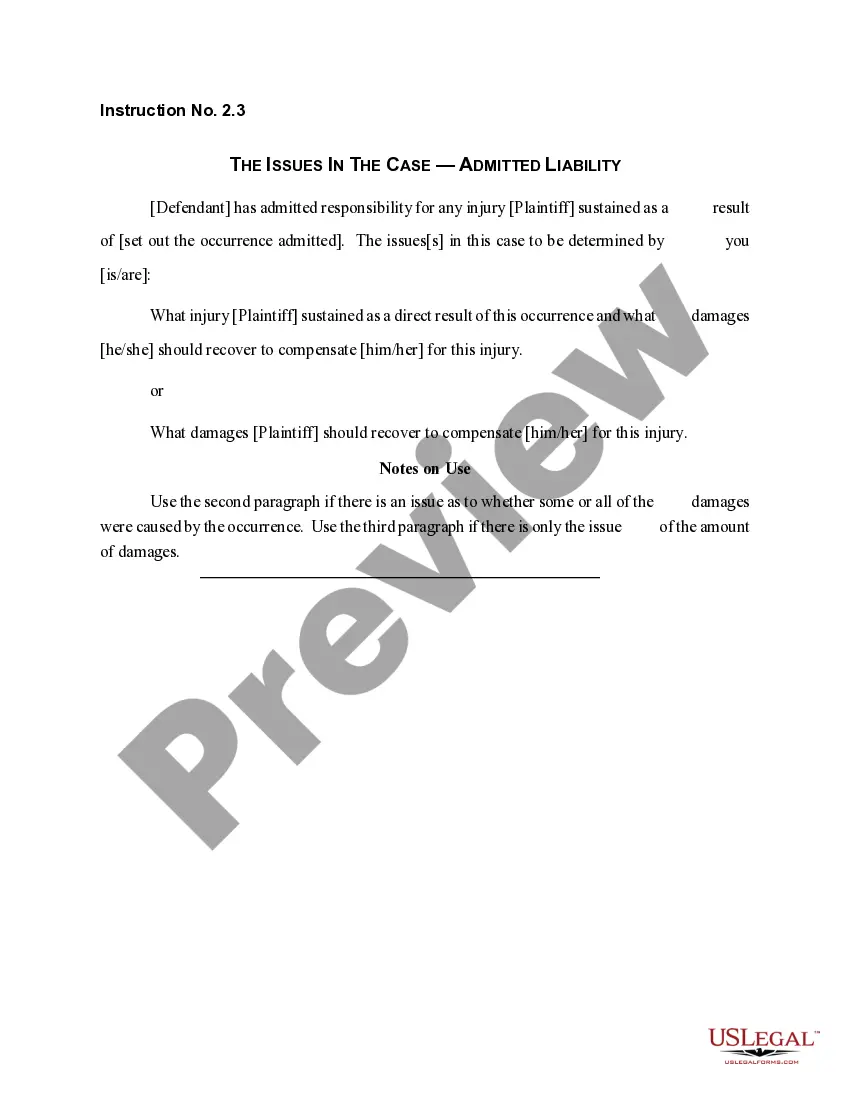

This bankruptcy form Notice of Objecton to Proof of Claim and Notice of Hearing and Objection to Claim can be used in Chapter 13 bankruptcy by a debtor's attorney to object to the proof of claim of a creditor who has overstated the amount due.

Introduce yourself and the case: Start by identifying yourself, how you're related to the case, and which case you're referring to (include the case number if applicable). State your request: Communicate your desire to have the charges dropped. This should be a simple, straightforward statement.

Organize your thoughts prior to writing your letter. Be brief. Explain your situation in as few words as possible, addressing the issue and the solution you would like to see. ... Be professional in your language and positive in your approach. ... Keep your tone formal and respectful.