Minnesota Assignment of Bank Account

Description

How to fill out Assignment Of Bank Account?

Choosing the right legal file format might be a have a problem. Naturally, there are a lot of themes available on the net, but how can you discover the legal develop you want? Use the US Legal Forms site. The support delivers a huge number of themes, including the Minnesota Assignment of Bank Account, that you can use for business and private requirements. Each of the varieties are checked out by specialists and meet federal and state demands.

When you are already listed, log in to the account and click on the Obtain option to find the Minnesota Assignment of Bank Account. Make use of your account to appear through the legal varieties you may have purchased previously. Go to the My Forms tab of your account and get one more copy from the file you want.

When you are a whole new customer of US Legal Forms, here are straightforward recommendations so that you can adhere to:

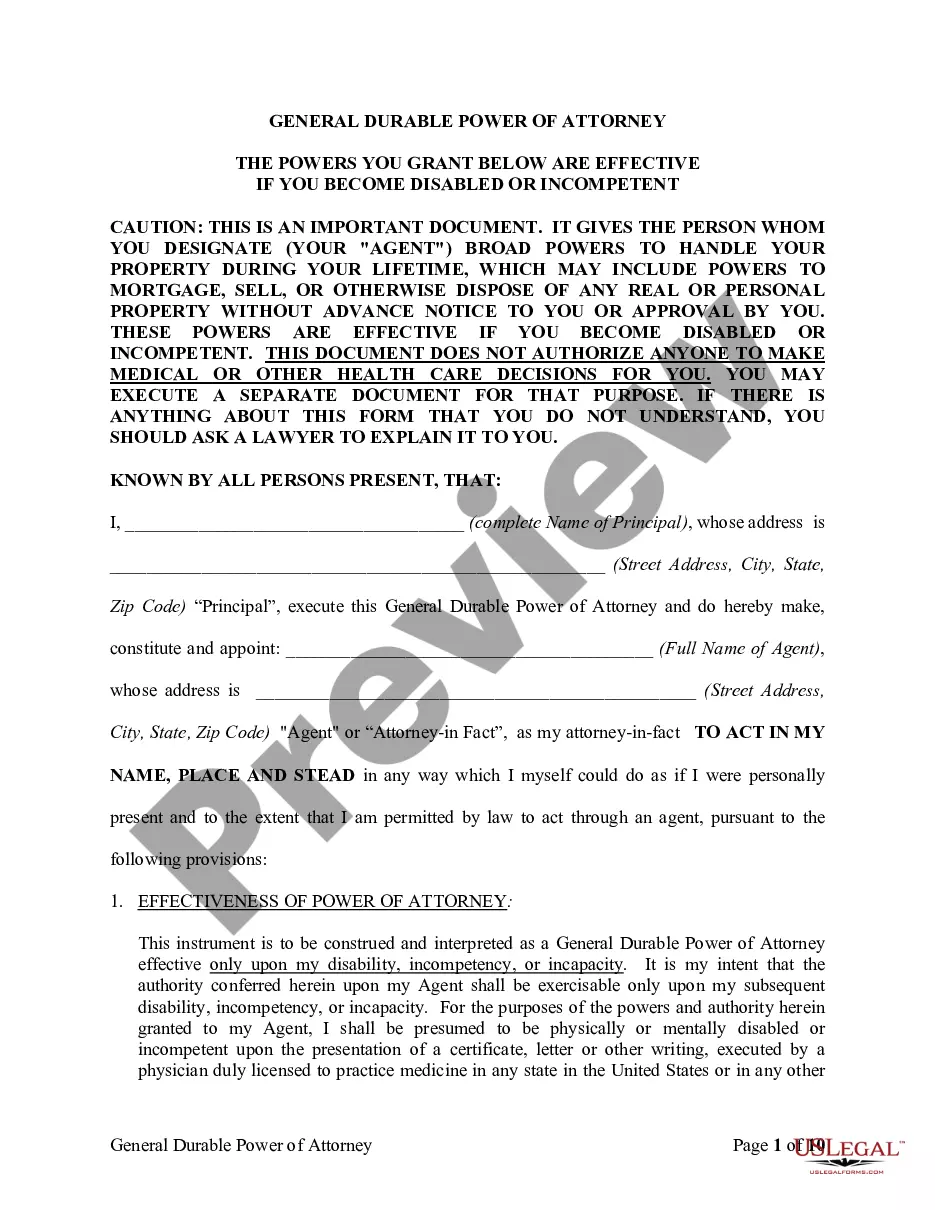

- Initially, make sure you have chosen the correct develop to your city/county. It is possible to look over the form while using Review option and read the form outline to make certain it will be the best for you.

- In case the develop fails to meet your expectations, use the Seach field to discover the correct develop.

- When you are certain the form would work, go through the Get now option to find the develop.

- Choose the pricing plan you desire and enter the required information and facts. Build your account and pay for the order using your PayPal account or bank card.

- Opt for the file file format and download the legal file format to the product.

- Complete, change and print and sign the obtained Minnesota Assignment of Bank Account.

US Legal Forms is the biggest library of legal varieties for which you can find numerous file themes. Use the service to download professionally-made files that adhere to express demands.

Form popularity

FAQ

Either visit your bank in person to speak to an agent, or visit your bank's website to obtain a power of attorney form online. Fill out and submit the form ing to your bank's instructions.

Automated Clearing House (ACH) credit is when you request a bill payment through your bank. Some banks charge a fee for this service. If your bank offers ACH credit services, they will need: Your 7-digit Minnesota Tax ID number.

345.75 ABANDONED TANGIBLE PERSONAL PROPERTY. If property has not been removed within six months after it comes into the possession of a person, it is abandoned and shall become the property of the person in possession, after notice to the prior owner.

169.305 CONTROLLED-ACCESS RULES AND PENALTIES. (a) No person shall drive a vehicle onto or from any controlled-access highway except at such entrances and exits as are established by public authority.

Banks allow you to designate someone to be a ?signor? on your account. That means that this person can write checks and make withdrawals from your bank account while you are living ? without the need of having a signed Power of Attorney for Property Document.

Except for a driver of an authorized emergency vehicle in the course of performing duties, no driver of a vehicle shall back the same upon the roadway or shoulder of any controlled-access highway.