Minnesota Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

Finding the right legal file web template might be a have a problem. Needless to say, there are tons of web templates accessible on the Internet, but how will you find the legal form you will need? Make use of the US Legal Forms internet site. The assistance gives a huge number of web templates, including the Minnesota Acknowledgment by Debtor of Correctness of Account Stated, which can be used for organization and personal needs. Every one of the forms are examined by specialists and satisfy federal and state demands.

Should you be previously listed, log in in your bank account and click the Download option to find the Minnesota Acknowledgment by Debtor of Correctness of Account Stated. Make use of bank account to look through the legal forms you may have ordered previously. Visit the My Forms tab of your respective bank account and obtain one more backup in the file you will need.

Should you be a new customer of US Legal Forms, here are straightforward directions for you to comply with:

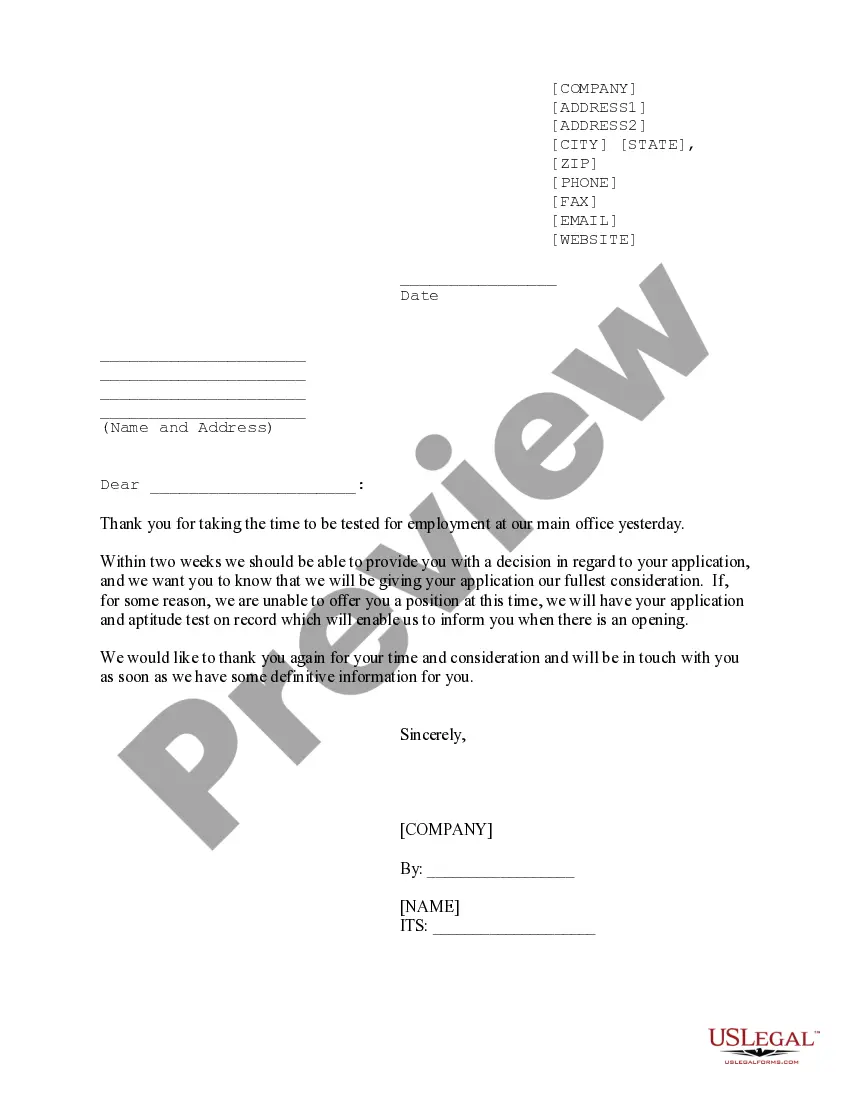

- Initially, ensure you have chosen the appropriate form to your city/state. You can look through the form while using Review option and study the form description to guarantee it is the best for you.

- In the event the form will not satisfy your expectations, take advantage of the Seach field to obtain the appropriate form.

- When you are certain the form is suitable, go through the Buy now option to find the form.

- Opt for the prices prepare you desire and enter in the needed details. Make your bank account and pay for your order using your PayPal bank account or charge card.

- Opt for the data file formatting and obtain the legal file web template in your system.

- Complete, edit and printing and indicator the acquired Minnesota Acknowledgment by Debtor of Correctness of Account Stated.

US Legal Forms will be the greatest local library of legal forms for which you can see numerous file web templates. Make use of the company to obtain appropriately-produced paperwork that comply with condition demands.

Form popularity

FAQ

An Account Stated establishes an implied contract, whereas a breach of contract traditionally refers to an expressly written contract. Account Stated is used when no contract exists or when the plaintiff cannot prove the existence of the contract.

Collections actions involving the sale of goods often include two varieties of ?account? claims in addition to traditional breach of contract theories: ?account stated? and ?open account.? Generally, an account stated claim alleges the failure to pay an agreed-upon balance, while an open account claim alleges an ...

The elements of account stated are: (1) prior transactions between the parties which establish a debtor-creditor relationship; (2)an express or implied agreement between the parties as to the amount due; and (3) an express or implied promise from the debtor to pay the amount due.

?Account stated? is a legal theory used in a Minnesota civil lawsuit to recover money from another person. Credit card companies and banks often use account-stated claims against consumers in court. The doctrine of account stated is an alternative to a breach-of-contract claim for establishing liability on a debt.

An account stated cause of action is based on an account stated in writing at a specified time and place between the creditor and the debtor of a specified and agreed on amount due. See, e.g., Tringali v. Vest (1951) 106 Cal. App. 2d 720.