Selecting the finest official document template can be a challenge. Clearly, there are numerous templates accessible on the internet, but how can you locate the official form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Minnesota Testamentary Trust Provision with Stock to Held in Trust for Grandchild and no Distributions to be Made until a Particular Age is Achieved, which you can utilize for both business and personal purposes. All the forms are reviewed by experts and meet federal and state standards.

If you are already a member, Log In to your account and click the Download button to obtain the Minnesota Testamentary Trust Provision with Stock to Held in Trust for Grandchild and no Distributions to be Made until a Particular Age is Achieved. Use your account to browse through the official forms you may have purchased previously. Visit the My documents section of your account and retrieve another copy of the documents you require.

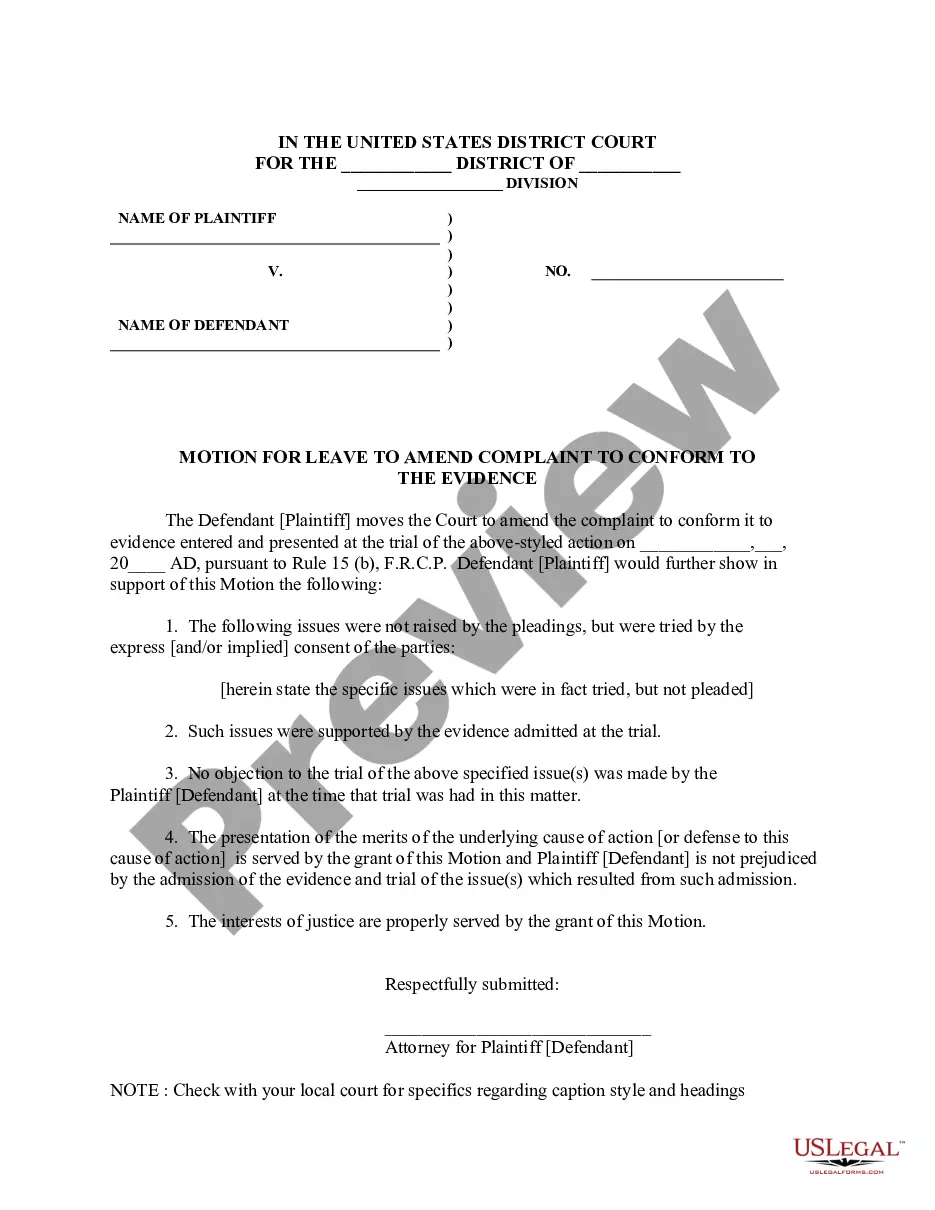

If you are a new user of US Legal Forms, here are some straightforward steps you should follow: First, ensure you have chosen the correct form for your locality. You can examine the document using the Review button and read the summary to confirm it is the appropriate one for you. If the form does not meet your needs, utilize the Search field to find the correct form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the necessary details. Create your account and pay for the order using your PayPal account or Visa or MasterCard. Select the file format and download the official document template to your device. Complete, modify, and print, and sign the obtained Minnesota Testamentary Trust Provision with Stock to Held in Trust for Grandchild and no Distributions to be Made until a Particular Age is Achieved.

US Legal Forms is the largest collection of official forms where you can find a wide range of document templates. Use the service to download accurately crafted papers that comply with state regulations.

- Ensure selection of the correct form for local area.

- Utilize the Review button to analyze the document.

- Use the Search field if the form is unsuitable.

- Click Purchase now if the form is appropriate.

- Choose a pricing plan and input details.

- Download the document template to your device.