No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Minnesota Rejection of Claim and Report of Experience with Debtor

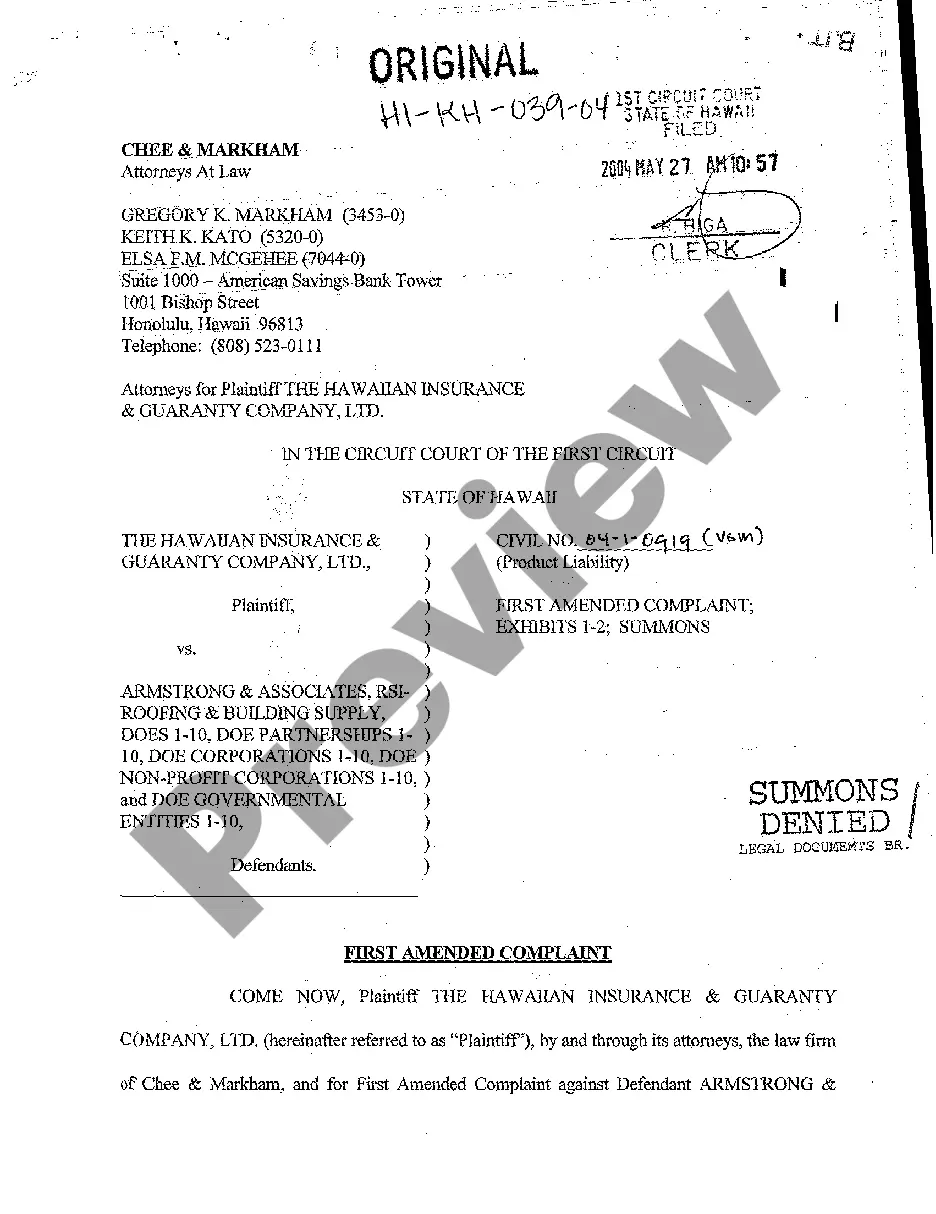

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a selection of legal template options you can download or create.

By utilizing the website, you can discover thousands of forms for commercial and personal needs, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Minnesota Rejection of Claim and Report of Experience with Debtor in just minutes.

Refer to the description of the form to ensure you have chosen the correct one.

If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you already possess a membership, Log In and download the Minnesota Rejection of Claim and Report of Experience with Debtor from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms from the My documents tab in your account.

- If you wish to use US Legal Forms for the first time, here are simple guidelines to help you get started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

An assignment for the benefit of creditors under Minnesota statute 577 allows a debtor to transfer their assets to a trustee, who then pays creditors. This legal process provides a structured way to settle debts, which may relate to situations like the Minnesota Rejection of Claim and Report of Experience with Debtor. Understanding this option can help you make informed decisions about debt resolution.

In Minnesota, you generally have six years to file a lawsuit regarding most breaches of contract or debt issues. This timeline is essential when considering a Minnesota Rejection of Claim and Report of Experience with Debtor, as it affects your ability to seek redress. Being aware of this timeframe can empower you to take timely legal action.

The statute of conciliation court in Minnesota governs the small claims process and the rules that apply to these courts. It is crucial to understand this statute when participating in the process, especially regarding the Minnesota Rejection of Claim and Report of Experience with Debtor. Familiarity with these regulations can improve your chances of a favorable outcome.

The maximum amount for claims in conciliation court in Minnesota is $15,000. This limit makes conciliation court an effective venue for resolving smaller debt-related disputes, such as those considered in the Minnesota Rejection of Claim and Report of Experience with Debtor. Knowing this can aid in deciding where to file your claim.

In Minnesota, debt collectors typically have six years to pursue a debt after the last payment was made or the debt was acknowledged. This time frame is crucial when dealing with the Minnesota Rejection of Claim and Report of Experience with Debtor. Knowing this can help you understand your rights and how long you may be liable for debts.

A conciliation hearing aims to resolve disputes quickly and affordably without going through a lengthy trial. This hearing is particularly useful for debt-related issues, such as those found in the Minnesota Rejection of Claim and Report of Experience with Debtor. It offers an opportunity for both parties to present their case and potentially reach an agreement.

Statute 491a 02 focuses on the legal procedures for conciliation courts in Minnesota. This statute can impact how you handle disputes related to debts as part of the Minnesota Rejection of Claim and Report of Experience with Debtor. Understanding this statute helps you navigate the legal landscape effectively.

Rule of Practice 521 in Minnesota outlines the process for disputing a claim in court. This rule is especially relevant in the context of the Minnesota Rejection of Claim and Report of Experience with Debtor. It sets clear guidelines for how claims can be challenged and addressed within the conciliation court system.

A Rule 14 motion to sever requests the court to separate claims or defendants into different trials. This motion can help clarify issues and prevent confusion in cases with multiple parties. Filing this motion appropriately can lead to more focused and manageable trials. If you're involved in a case affected by a Minnesota Rejection of Claim and Report of Experience with Debtor, this motion might help streamline your legal proceedings.

The term 'Rule 14' can vary depending on the jurisdiction, but it generally refers to rules regarding third-party actions in litigation. It outlines how a defendant can bring in additional parties who may share liability. Understanding this rule is essential for managing complex cases effectively. In cases involving a Minnesota Rejection of Claim and Report of Experience with Debtor, this rule may play a significant role.