Minnesota Direct Deposit Form for Stimulus Check

Description

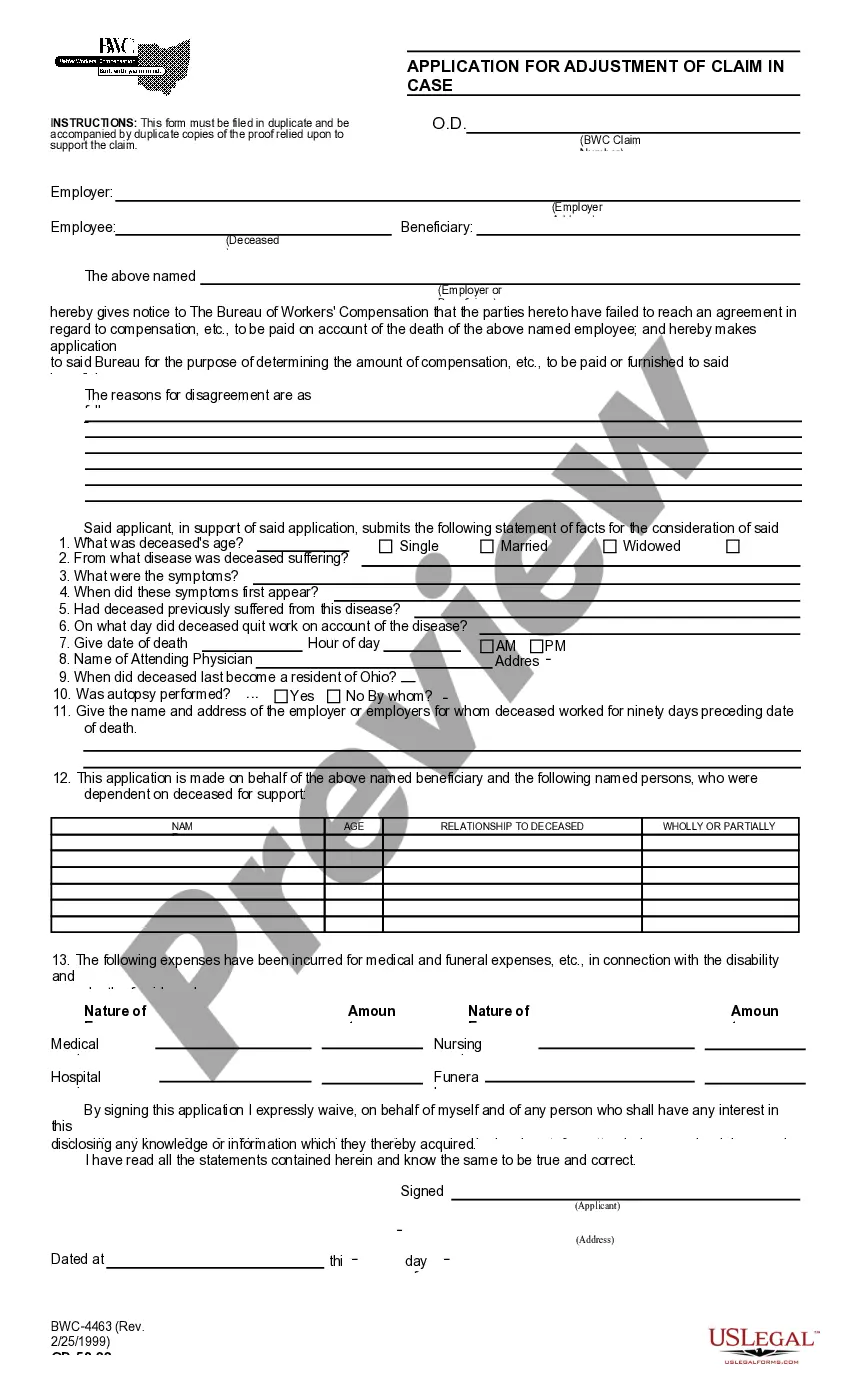

How to fill out Direct Deposit Form For Stimulus Check?

If you wish to finalize, download, or print legal documents web templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are categorized by type and state, or keywords.

Use US Legal Forms to find the Minnesota Direct Deposit Form for Stimulus Check in just a few clicks.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it onto your device. Step 7. Fill out, modify and print or sign the Minnesota Direct Deposit Form for Stimulus Check. Every legal document template you obtain is yours permanently. You have access to each form you acquired within your account. Select the My documents section and choose a form to print or download again. Compete, download, and print the Minnesota Direct Deposit Form for Stimulus Check with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your personal or business needs.

- If you are already a US Legal Forms member, Log In to your account and click the Get option to obtain the Minnesota Direct Deposit Form for Stimulus Check.

- You can also access forms you previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read through the summary.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Filling out a direct deposit request form is straightforward. Begin by providing your personal information, including your name, address, and Social Security number. Next, include your bank account details, such as your account number and routing number. Lastly, submit the Minnesota Direct Deposit Form for Stimulus Check to the appropriate agency to ensure your stimulus funds are deposited directly into your account without delays.

Yes, residents of Minnesota may qualify for stimulus checks as part of federal relief efforts. These payments aim to support individuals and families affected by economic challenges. To receive your payment, you might need to complete the Minnesota Direct Deposit Form for Stimulus Check to ensure your funds are deposited directly into your account. This process simplifies receiving your financial assistance quickly and securely.

Yes, you can track your stimulus direct deposit through your bank’s online services or mobile app. Most banks provide a way to see when deposits are made into your account. Moreover, using the Minnesota Direct Deposit Form for Stimulus Check can enhance your tracking experience, as it allows you to receive updates directly related to your stimulus payment. This way, you stay informed about the arrival of your funds.

When writing a check for direct deposit, you should include essential information such as your bank account number and the bank's routing number. Additionally, clearly indicate that the check is for direct deposit on the memo line to avoid any confusion. Using the Minnesota Direct Deposit Form for Stimulus Check simplifies this process, allowing you to submit your information accurately and securely. This step ensures your funds reach you without any delay.

The Minnesota one-time tax rebate payment is a financial relief provided by the state to help residents manage economic challenges. It is intended for eligible taxpayers and is designed to be straightforward. By using the Minnesota Direct Deposit Form for Stimulus Check, you can ensure that your rebate is deposited directly into your bank account, making the process faster and more efficient. This rebate can provide you with some much-needed financial assistance.

An example of a direct deposit is when your paycheck or government benefits, like the stimulus check, are electronically transferred into your bank account. Using the Minnesota Direct Deposit Form for Stimulus Check ensures that these funds arrive directly and securely. This method is often faster than receiving a check in the mail.

Eligibility for the Minnesota direct tax rebate generally includes individuals or families who meet specific income guidelines. If you have filed your taxes and qualify under the state’s criteria, you may receive a rebate. Always check the latest guidelines or consult resources like uslegalforms for more details.

Typically, the recipient of the stimulus check fills out the Minnesota Direct Deposit Form for Stimulus Check. This means you will provide your banking details to ensure your funds are deposited directly into your account. If you are assisting someone else, make sure you have their permission and accurate information.

Filling out a Minnesota Direct Deposit Form for Stimulus Check properly involves entering your full name, address, and Social Security number. Next, provide your bank's routing number and your account number. Double-check all entries for accuracy to avoid processing delays.

To complete a Minnesota Direct Deposit Form for Stimulus Check, first gather your banking information, including your account number and routing number. Fill out the form with your personal details, and ensure the information is accurate. Once completed, submit the form to your bank or financial institution as instructed.