Minnesota Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

You can spend hrs on the Internet trying to find the legal document template that meets the federal and state demands you want. US Legal Forms gives a huge number of legal varieties which can be evaluated by professionals. It is possible to obtain or produce the Minnesota Direct Deposit Form for IRS from my services.

If you already possess a US Legal Forms profile, you may log in and click the Down load key. Next, you may comprehensive, revise, produce, or indication the Minnesota Direct Deposit Form for IRS. Each and every legal document template you acquire is yours eternally. To have yet another duplicate of any purchased type, visit the My Forms tab and click the related key.

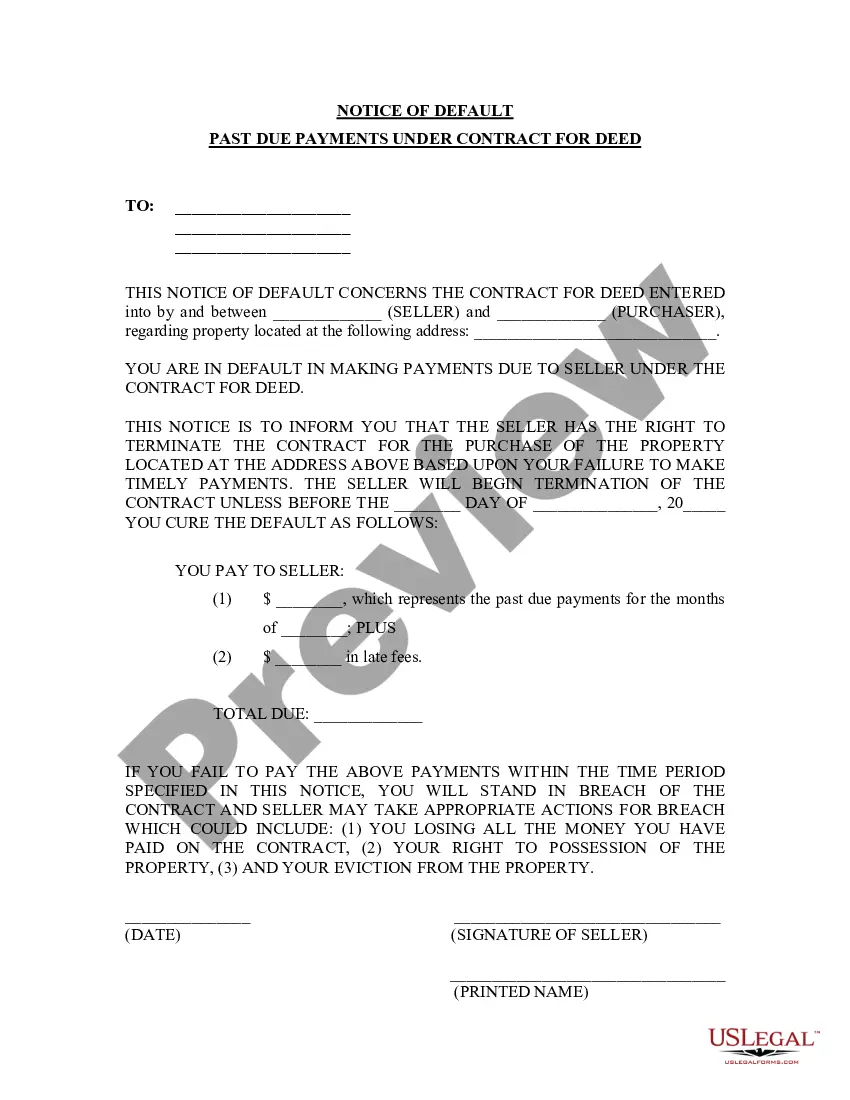

If you use the US Legal Forms internet site the first time, keep to the basic instructions beneath:

- Initially, be sure that you have selected the proper document template for your state/city that you pick. Look at the type information to make sure you have chosen the correct type. If readily available, make use of the Preview key to check throughout the document template as well.

- If you would like locate yet another variation of your type, make use of the Search area to obtain the template that suits you and demands.

- Upon having found the template you desire, click Acquire now to move forward.

- Find the costs program you desire, type in your references, and sign up for a merchant account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal profile to fund the legal type.

- Find the formatting of your document and obtain it in your device.

- Make changes in your document if needed. You can comprehensive, revise and indication and produce Minnesota Direct Deposit Form for IRS.

Down load and produce a huge number of document templates making use of the US Legal Forms website, that provides the biggest variety of legal varieties. Use specialist and condition-particular templates to handle your small business or personal needs.

Form popularity

FAQ

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040.

Form M-60 (Certificate of Record for Vision Screen and/or Eye Examination)

And, you can choose to have your refund deposited into one, two or even three of your own bank accounts For more information go to IRS.gov/directdeposit. Whether you file electronically or on paper, direct deposit gives you access to your refund faster than a paper check.

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

People who need to update their bank account information should go directly to the IRS.gov site and not click on links received by email, text or phone.