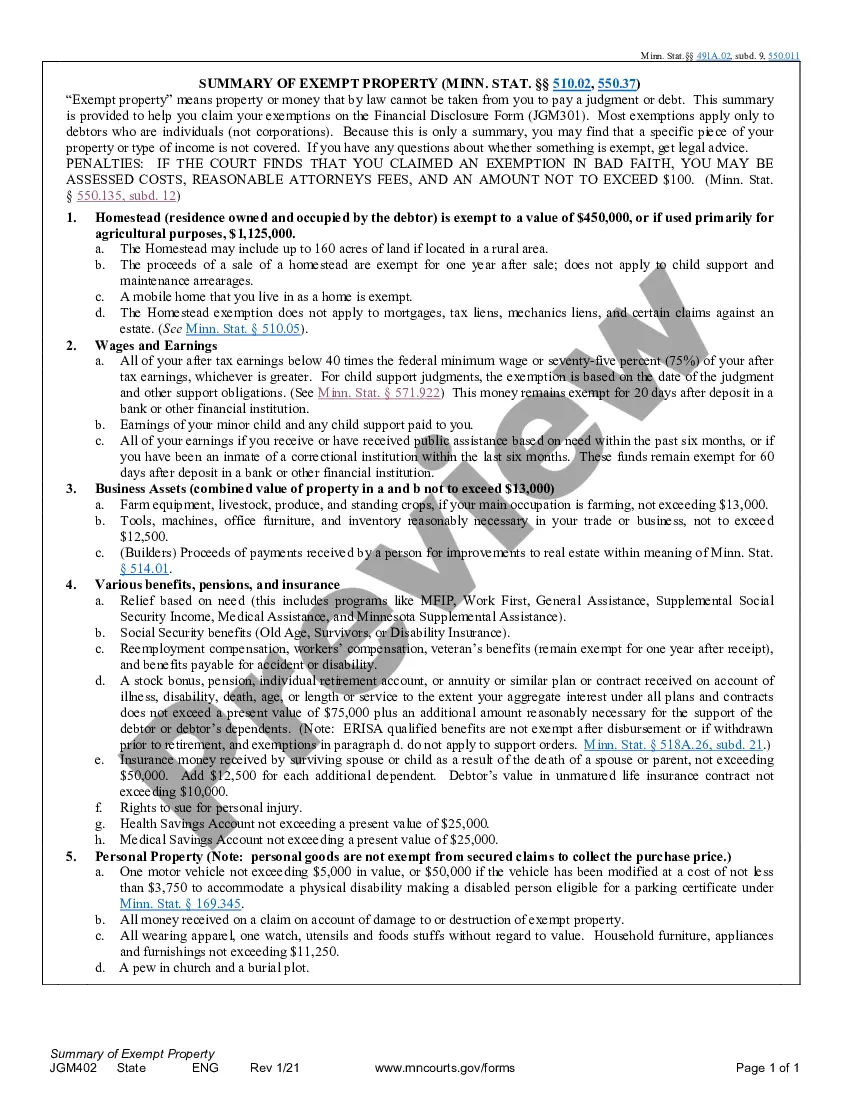

This is an official Minnesota court form for use in a civil case, an Exemption Notice. USLF amends and updates these forms as is required by Minnesota Statutes and Law.

Minnesota Exemption Notice

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Exemption Notice?

Obtain any version from 85,000 authorized documents such as the Minnesota Exemption Notice online with US Legal Forms. Each template is crafted and refreshed by state-certified lawyers.

If you possess a subscription, Log In. Once you reach the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, adhere to the following steps: Check the state-specific criteria for the Minnesota Exemption Notice you need to utilize. Browse through the description and preview the sample. Once you’re certain the sample meets your requirements, click Buy Now. Choose a subscription plan that truly fits your financial situation. Establish a personal account. Make a payment in one of two suitable methods: by card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Save the document to the My documents tab. Once your reusable form is prepared, print it out or store it on your device.

- With US Legal Forms, you’ll consistently have instant access to the appropriate downloadable sample.

- The service grants you access to forms and categorizes them to facilitate your search.

- Utilize US Legal Forms to acquire your Minnesota Exemption Notice easily and swiftly.

Form popularity

FAQ

To become tax exempt in Minnesota, you must apply through the Minnesota Department of Revenue, providing the required documentation that supports your tax-exempt status. This often includes information related to your organization’s purpose and activities. For a smooth application process, consider using US Legal Forms, which can help you find the correct forms and ensure you meet all the necessary criteria outlined in the Minnesota Exemption Notice.

Filing an exemption for wage garnishment in Minnesota involves completing a form that outlines your financial situation and submitting it to the court. You must clearly indicate why the garnishment causes undue hardship, referencing the Minnesota Exemption Notice to support your claim. Utilizing resources from US Legal Forms can simplify this process and provide you with the necessary documentation to present your case effectively.

To obtain a religious exemption for vaccines in Minnesota, you need to submit a written statement to your school or healthcare provider, expressing your religious beliefs against vaccination. It is important to ensure your statement aligns with the Minnesota Exemption Notice requirements. You may also want to consult legal resources or platforms like US Legal Forms to guide you through the process and ensure compliance with state laws.

To obtain an exemption from wage garnishment, you need to understand the Minnesota Exemption Notice. Begin by reviewing your income and expenses to determine if you qualify for an exemption based on your situation. You can then file a motion with the court to request this exemption, providing necessary documentation to support your claim. For detailed guidance and assistance, consider using the US Legal Forms platform, which offers resources tailored to help you navigate the legal process effectively.

To file a claim of exemption in Minnesota, you should start by completing the appropriate forms, which you can find through the court system or legal resources. It’s crucial to gather all necessary documentation to support your claim. You will then submit your claim to the court where the garnishment order was issued. Using the Minnesota Exemption Notice can provide guidance on the process and help ensure your claim is filed correctly.

In Minnesota, specific exemptions protect a portion of your income from garnishment. For instance, certain benefits such as Social Security, unemployment compensation, and workers' compensation are typically exempt. Furthermore, the Minnesota Exemption Notice outlines additional protections for personal property and wages. It’s essential to be aware of these exemptions to safeguard your finances effectively.

In Minnesota, certain groups are eligible for property tax exemptions. These include veterans with a disability, active duty military personnel, and certain low-income homeowners. Additionally, nonprofit organizations may qualify for exemptions under specific conditions. Understanding the Minnesota Exemption Notice can help you determine if you qualify for any exemptions.

In Minnesota, certain income and property may be considered tax exempt, meaning they are not subject to state taxation. This can include specific retirement benefits, government assistance payments, and certain types of property. Understanding what qualifies as tax exempt can help you make informed financial decisions and optimize your tax situation.

A notice of exemptions is a document that informs the court and creditors about the specific assets or income that are claimed to be exempt from garnishment. This notice is crucial in protecting your rights as a debtor and ensuring that essential resources remain available to you. Filing a notice of exemptions can help you navigate the complexities of garnishment and safeguard your financial future.

In court, exemption refers to the legal protection of certain assets from being seized by creditors. When a debtor claims an exemption, the court evaluates the validity of this claim based on Minnesota law. Understanding how exemptions work in court can empower you to effectively protect your rights and ensure that you do not lose necessary resources during financial difficulties.