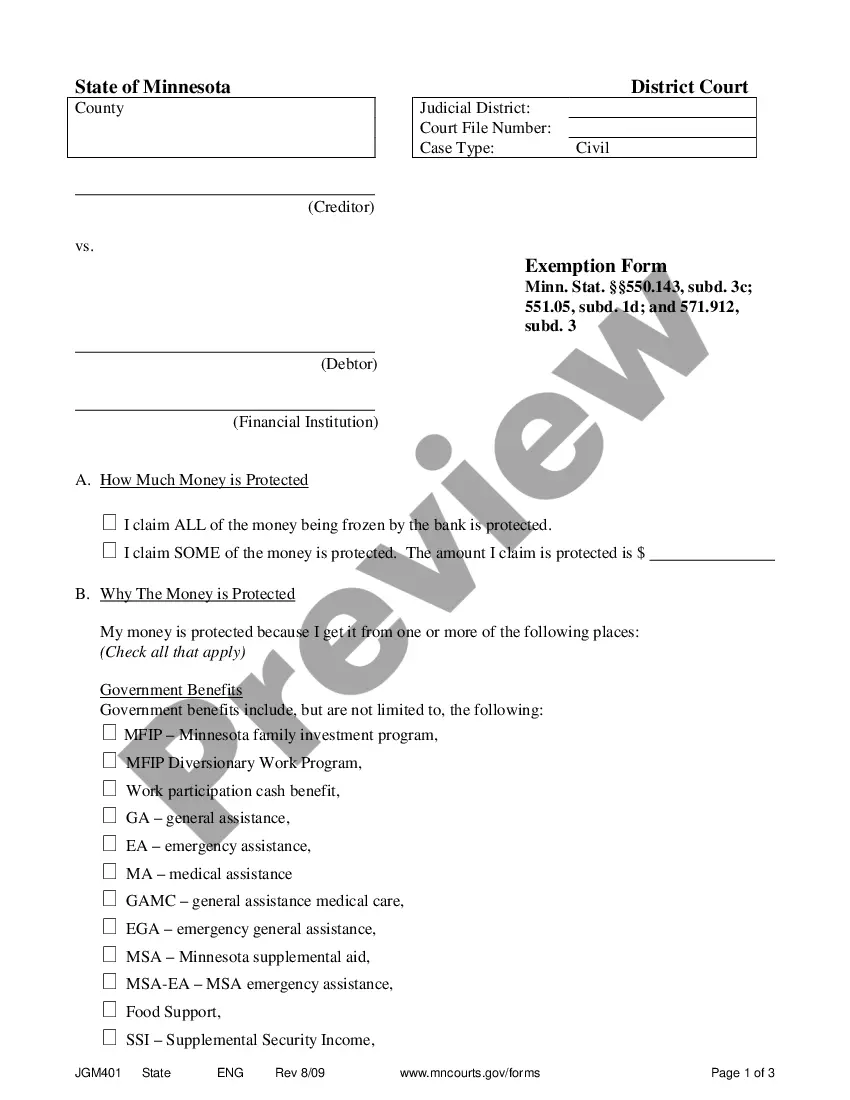

This is an official Minnesota court form for use in a civil case, a Summary of Exempt Property. USLF amends and updates these forms as is required by Minnesota Statutes and Law.

Minnesota Summary of Exempt Property

Description

How to fill out Minnesota Summary Of Exempt Property?

Obtain any version from 85,000 legal files like the Minnesota Summary of Exempt Property online with US Legal Forms. Every template is composed and refreshed by state-certified legal experts.

If you already possess a subscription, Log In. Once you reach the form’s page, click the Download button and navigate to My documents to gain access to it.

If you haven’t subscribed yet, adhere to the steps outlined below.

With US Legal Forms, you will consistently have immediate access to the relevant downloadable template. The service provides you access to documents and categorizes them to simplify your search. Use US Legal Forms to quickly and easily acquire your Minnesota Summary of Exempt Property.

- Verify the state-specific criteria for the Minnesota Summary of Exempt Property you need to utilize.

- Browse the description and preview the template.

- Once you’re confident the sample is what you require, simply click Buy Now.

- Choose a subscription plan that truly fits your budget.

- Create a personal account.

- Pay using one of two available methods: credit card or PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents tab.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Yes, you can file your M1PR Minnesota property tax refund using TurboTax. The software simplifies the process by guiding you through the necessary steps and ensuring you include all relevant details related to the Minnesota Summary of Exempt Property. Be sure to have all your documents ready, as TurboTax will prompt you for the information needed. This integration allows you to maximize your refund efficiently.

To file your CRP in Minnesota online, visit the official Minnesota Department of Revenue website. You will find a dedicated section for property tax programs, including the Minnesota Summary of Exempt Property. Follow the prompts to fill out the required information and submit your application electronically. Utilizing the online filing system ensures a smoother process and quicker response.

An example of an exempt asset in Minnesota is a primary residence, known as a homestead, which may be protected under state law. Other examples include personal property like clothing and household items. The Minnesota Summary of Exempt Property details these examples, helping you understand what you can keep during financial challenges.

Exempt property refers to assets that cannot be seized by creditors during bankruptcy or debt collection processes. This concept is designed to protect individuals from losing essential items necessary for daily living. A clear understanding of the Minnesota Summary of Exempt Property will help you identify what you can safeguard.

In Minnesota, certain assets can bypass the probate process, making it easier for heirs to inherit property. Common exempt assets include life insurance policies, retirement accounts, and jointly owned property. The Minnesota Summary of Exempt Property provides detailed insights into these exemptions and their implications for estate planning.

Properties may be exempt for various reasons, primarily to provide financial relief to qualifying individuals or groups. Exemptions serve to protect essential assets from creditors, thereby ensuring basic living standards are maintained. The Minnesota Summary of Exempt Property outlines these reasons and helps you identify applicable exemptions.

In Minnesota, certain groups may qualify for property tax exemptions. These include veterans, seniors, and individuals with disabilities, among others. By reviewing the Minnesota Summary of Exempt Property, you can learn about eligibility requirements and how to apply for these exemptions effectively.

In Minnesota, seniors may qualify for property tax deferral or exemption programs, but they do not automatically stop paying property taxes. Typically, seniors aged 65 and older can apply for these benefits, which can significantly reduce their property tax burden. To explore your options, review the Minnesota Summary of Exempt Property and consult your local assessor’s office. Additionally, US Legal Forms can provide helpful resources to guide you through the application process.

To obtain a copy of your property tax statement in Minnesota, visit your local county assessor’s website or office. Many counties provide online access to property tax statements, which can simplify the process for you. If you prefer a physical copy, you can request one directly from the assessor’s office. For easy access to forms and information, check out US Legal Forms, which offers resources related to property tax statements.

To get your property tax exempt in Minnesota, you should first review the Minnesota Summary of Exempt Property to determine if your property qualifies. You will need to complete an application and submit it to your local assessor’s office. Be sure to provide all required documentation to support your exemption claim. If you need assistance, consider using US Legal Forms to access the necessary forms and guidance.