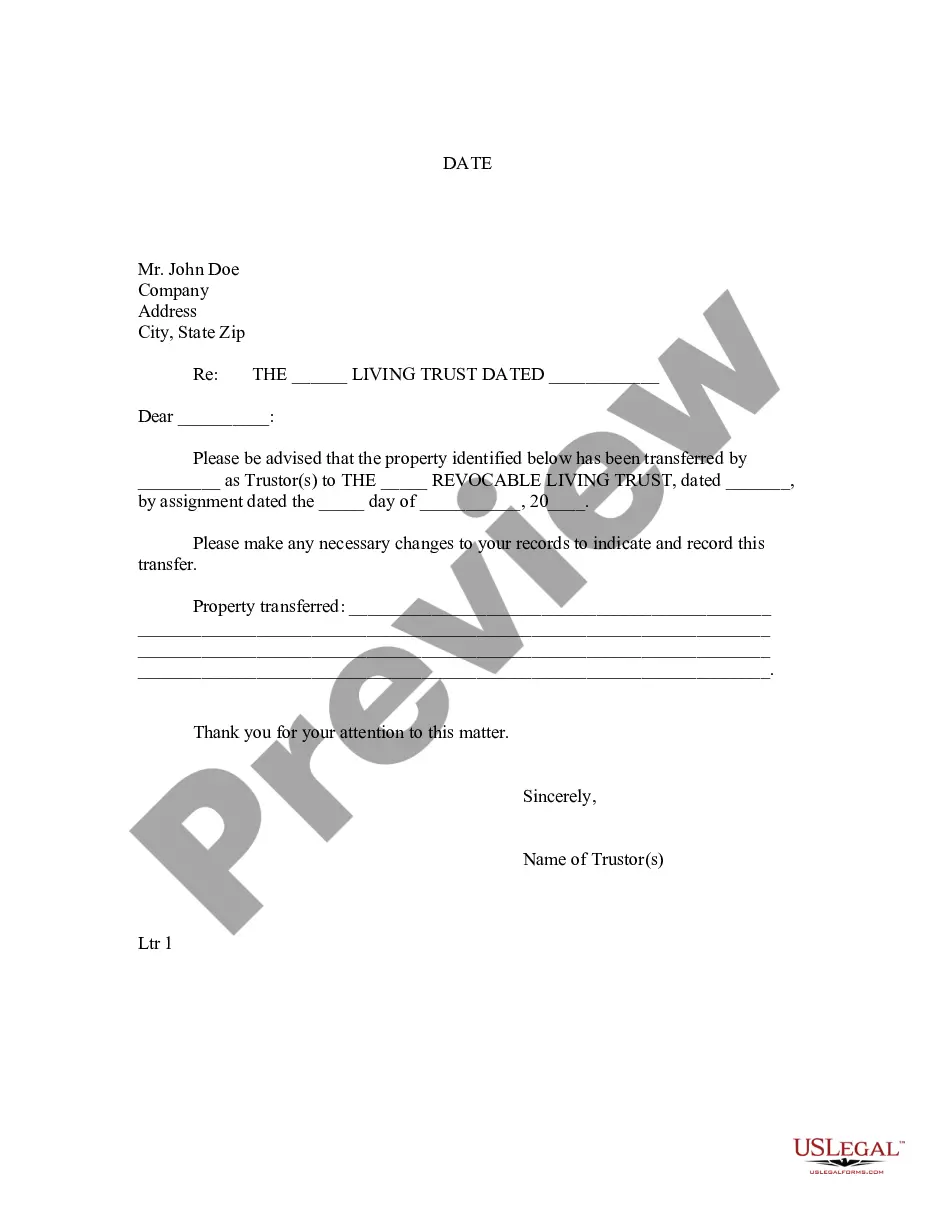

Minnesota Letter to Lienholder to Notify of Trust

Description

How to fill out Minnesota Letter To Lienholder To Notify Of Trust?

Obtain any version from 85,000 legal documents such as Minnesota Letter to Lienholder to Inform of Trust online with US Legal Forms. Every template is crafted and refreshed by state-licensed lawyers.

If you already possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the guidelines below.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable sample. The platform offers you access to forms and categorizes them to simplify your search. Use US Legal Forms to acquire your Minnesota Letter to Lienholder to Inform of Trust easily and swiftly.

- Verify the state-specific criteria for the Minnesota Letter to Lienholder to Inform of Trust you wish to utilize.

- Review the description and preview the template.

- As soon as you’re certain the sample meets your needs, simply click Buy Now.

- Select a subscription plan that fits your budget.

- Create a personal account.

- Make payment in one of two convenient ways: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

A notice of intent to lien in Minnesota is a formal notification that a creditor plans to place a lien on a property or vehicle due to unpaid debts. This notice serves as a warning to the debtor, providing them an opportunity to settle the outstanding amount before the lien is filed. Understanding this process is vital for both creditors and debtors. For creating documents like a Minnesota Letter to Lienholder to Notify of Trust, you can find helpful resources on the US Legal Forms platform.

All sellers must handprint their name and sign in the assignment area of the title. The seller must list the sales price of the vehicle in the sales tax declaration area on the back of the certificate of title. The seller must enter the date of sale and complete any disclosure statements that apply.

There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin. In the other 41 states, titles are issued to the lien holder of your vehicle until the loan is fully paid off.

Gifts. The transfer of a motor vehicle between specifically identified individuals is not charged sales tax if the transfer is a gift for no monetary or other consideration, or other expectation of consideration. The specific individuals are: spouses, parents and children, and grandparents and grandchildren.

Typical fees to transfer and title a vehicle: Title Fee: $8.25 (plus $2 for each lien recorded) Transfer Tax: $10. Public Safety Vehicle Fee: $3.50. Technology Surcharge: $2.25.

The notice must inform the homeowner of the contractor's right to lien the property, and the right to pay off any subcontractors that haven't been paid by the general contractor.

You will write in the following information on the front of the title. On the title, the seller should fill in the name and address of the purchaser, the odometer information, selling price, and the date sold in the "Transfer of Title by Seller" section.

When a contractor files a mechanics' (construction) lien on your home, the lien makes your home into what's called security for an outstanding debt, which the contractor claims is due and unpaid for services or materials.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.