Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates

Description

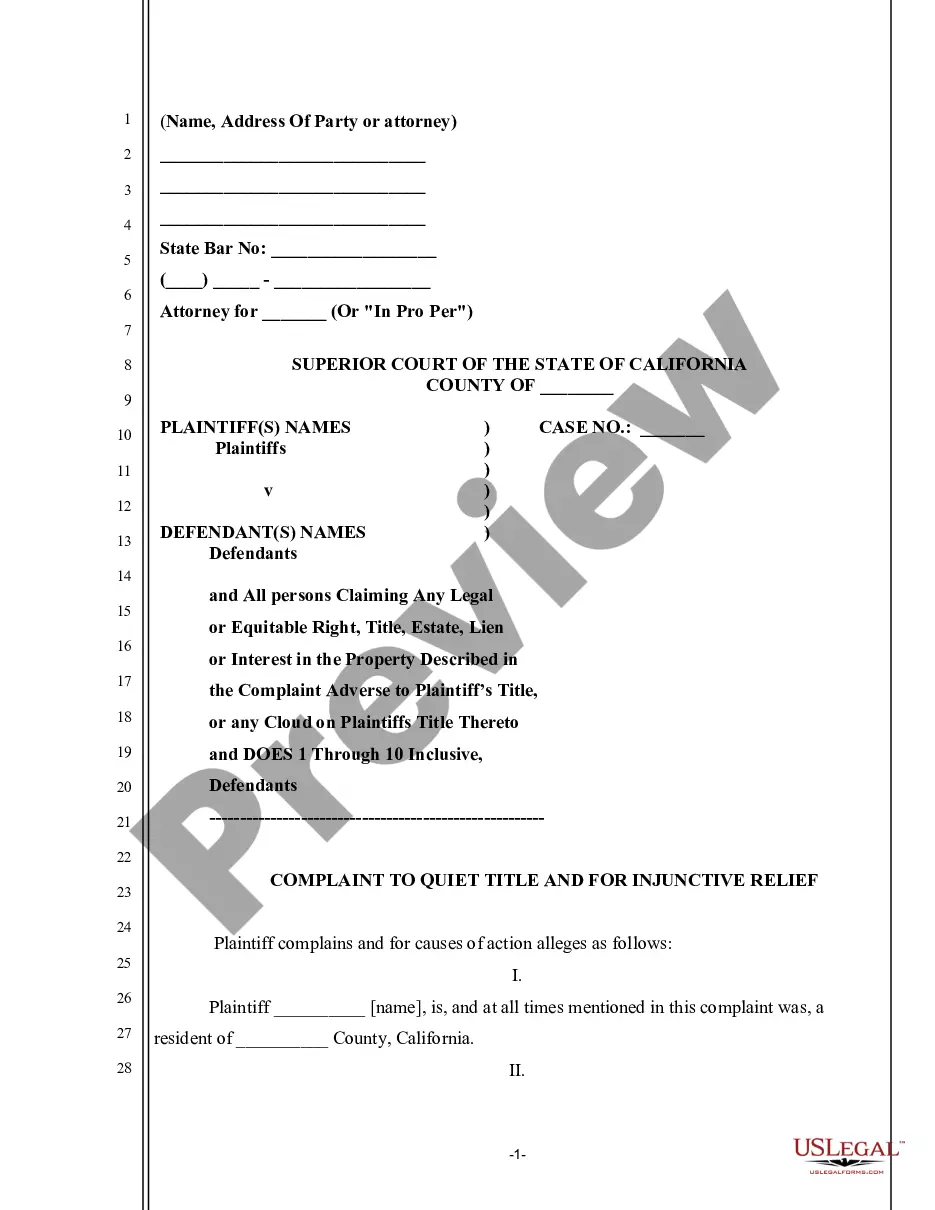

How to fill out Minnesota Complex Will With Credit Shelter Marital Trust For Large Estates?

Obtain any type from 85,000 legal records such as Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates online with US Legal Forms.

Each template is crafted and refreshed by state-certified attorneys.

If you possess a subscription, Log In. Once you’re on the form’s page, click the Download button and navigate to My documents to access it.

With US Legal Forms, you will consistently have immediate access to the correct downloadable template. The platform provides you access to documents and categorizes them to facilitate your search. Utilize US Legal Forms to acquire your Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates swiftly and efficiently.

- Verify the state-specific prerequisites for the Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates you wish to utilize.

- Examine the description and preview the example.

- When you’re confident the template meets your requirements, simply click Buy Now.

- Choose a subscription plan that genuinely fits your budget.

- Establish a personal account.

- Make payment in one of two convenient methods: by card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- Once your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

Yes, a properly established trust can help avoid probate in Minnesota. This is particularly advantageous for individuals using a Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates, as it allows for a smoother transfer of assets to beneficiaries without the lengthy probate process. Utilizing platforms like uslegalforms can simplify the creation of such trusts, ensuring compliance with state laws.

A credit shelter trust can indeed be considered a complex trust, as it often retains income and does not distribute it to beneficiaries immediately. This type of trust is beneficial in a Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates, as it helps to minimize estate taxes while preserving wealth for future generations. Understanding its functions is key to effective estate planning.

Yes, marital trust assets are typically included in the estate of the deceased spouse. However, the specific implications can vary based on the structure of the trust and the provisions outlined in a Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates. It's essential to consult legal experts to understand how these assets will affect estate taxes.

A marital trust can be classified as a complex trust, especially when it generates income that is not distributed to beneficiaries. In the context of a Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates, this structure allows for effective management of assets while providing tax benefits. Understanding the differences between marital and complex trusts is crucial for estate planning.

The taxes on a credit shelter trust typically depend on the income generated by the trust's assets. Generally, the trust is responsible for any tax obligations, but the beneficiaries may also be liable for taxes on distributions they receive. Understanding the tax implications within a Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates can help you plan effectively and minimize tax burdens.

In many cases, a trust may be better than a will in Minnesota, especially for larger estates. Trusts often avoid probate, ensuring a quicker and more private distribution of assets. A Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates can further enhance your estate planning by combining the benefits of both wills and trusts.

Upon the death of the surviving spouse, the assets held in the credit shelter trust are typically distributed according to the terms established in the trust document. This distribution can help avoid additional estate taxes, preserving wealth for heirs. Therefore, having a well-structured Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates is crucial for ensuring that your wishes are honored.

Yes, a credit shelter trust can be sued, as it is a legal entity that holds assets. However, the trust provides a layer of protection for the beneficiaries' assets, shielding them from personal liabilities of the grantor or the beneficiaries. When structured properly within a Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates, it can offer strategic advantages in asset protection.

Using a credit shelter trust allows you to protect and manage your assets more effectively while minimizing estate taxes. This trust can hold assets up to the exemption limit, ensuring that your surviving spouse can benefit without triggering additional taxes. A Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates can optimize this strategy, providing you peace of mind regarding your estate's future.

The best trust for your house often depends on your specific situation, but a revocable living trust is commonly recommended for its flexibility. However, if you are dealing with large estates, a Minnesota Complex Will with Credit Shelter Marital Trust for Large Estates may provide tax benefits and better estate planning options. Consulting a legal expert can ensure you choose the right trust for your needs.